Navigating the Intricacies of Tax Reporting with Printable Form 1041

Navigating the complexities of tax reporting can be a daunting task, but with the availability of Printable Form 1041, individuals and businesses can streamline the process and ensure compliance with tax regulations. This comprehensive form serves as a valuable tool for reporting the income, deductions, and credits of estates and trusts, making it an essential resource for fiduciaries and tax professionals alike.

In this guide, we will delve into the intricacies of Printable Form 1041, exploring its purpose, accessibility, and proper completion. We will also shed light on related forms and resources, filing options and deadlines, and the benefits of utilizing this form for tax reporting purposes.

Define Printable Form 1041

Form 1041, also known as the U.S. Income Tax Return for Estates and Trusts, is a document that must be filed annually with the Internal Revenue Service (IRS) by the personal representative of an estate or the trustee of a trust. The form is used to report the income, deductions, and credits of the estate or trust for the tax year.

Purpose and Nature of Form 1041

The primary purpose of Form 1041 is to calculate the taxable income of an estate or trust and to determine the amount of income tax that is owed. The form also provides information about the distributions made to beneficiaries during the tax year.

Target Audience for Form 1041

Form 1041 is intended for use by personal representatives of estates and trustees of trusts. These individuals are responsible for filing the form on behalf of the estate or trust and for ensuring that the correct amount of tax is paid.

Content and Structure of Form 1041

Form 1041 is a complex document that consists of several pages. The form includes sections for reporting the following information:

- Income

- Deductions

- Credits

- Distributions to beneficiaries

Accessibility and Availability

Printable Form 1041 is readily available through various channels, ensuring accessibility for those who need it.

Online Platforms

The official website of the Internal Revenue Service (IRS) provides a user-friendly online portal to download Printable Form 1041. Individuals can navigate to the IRS website, locate the form, and print it directly from their devices.

Official Websites

In addition to the IRS website, other government and non-profit organizations offer Printable Form 1041 for download. These websites often provide additional resources, such as instructions and guidance on completing the form.

Physical Locations

Individuals who prefer physical copies can visit local IRS offices or public libraries. These locations typically have a supply of Printable Form 1041 available for pickup.

There are no specific restrictions or requirements for accessing Printable Form 1041. Individuals are free to obtain the form through any of the available channels.

Completing and Filing s

Filing Printable Form 1041 is essential for UK trusts and estates to comply with tax obligations. Here’s a step-by-step guide to help you navigate the process efficiently.

It’s crucial to gather all necessary information and documentation, such as financial statements, tax records, and identification numbers, before you start completing the form.

Step 1: Gather Necessary Information

- Trust or estate financial statements

- Tax identification numbers (UTR or NINO)

- Income and expense records

- Details of beneficiaries and distributions

Step 2: Calculate Tax Liability

Determine the taxable income of the trust or estate and calculate the tax liability using the appropriate tax rates and allowances.

Step 3: Complete Form 1041

Fill in the form accurately, ensuring all sections are completed and the information provided is correct and up-to-date.

Step 4: Attach Supporting Documents

Include copies of relevant supporting documents, such as financial statements and tax calculations, with the form.

Step 5: File Form 1041

Submit the completed Form 1041 along with supporting documents to HMRC by the filing deadline.

Common Errors to Avoid

- Incomplete or inaccurate information

- Missing supporting documents

- Incorrect tax calculations

- Filing after the deadline

Best Practices

- Keep accurate records throughout the year

- Seek professional advice if needed

- File on time to avoid penalties

- Retain a copy of the filed form for your records

Related Forms and Resources

When working with Form 1041, it’s essential to be aware of other forms and resources that can assist in the completion and filing process. These include:

Instructions for Form 1041

The IRS provides detailed instructions for Form 1041, which offer guidance on completing each section of the form. These instructions can be found on the IRS website or by calling the IRS directly.

Form 1041-ES

Form 1041-ES is used to make estimated tax payments for estates or trusts. Estimated tax payments are required if the estate or trust expects to owe more than $1,000 in taxes for the year.

Form 1041-A

Form 1041-A is used to report the sale or exchange of property by an estate or trust. This form is required if the property was sold or exchanged for a gain or loss.

Form 1041-B

Form 1041-B is used to report the distribution of income or principal from an estate or trust to its beneficiaries. This form is required if the estate or trust distributed more than $600 to any one beneficiary.

Form 1041-C

Form 1041-C is used to report the generation-skipping transfer tax (GST). This tax is imposed on certain transfers of property from a person to a person who is two or more generations below the person making the transfer.

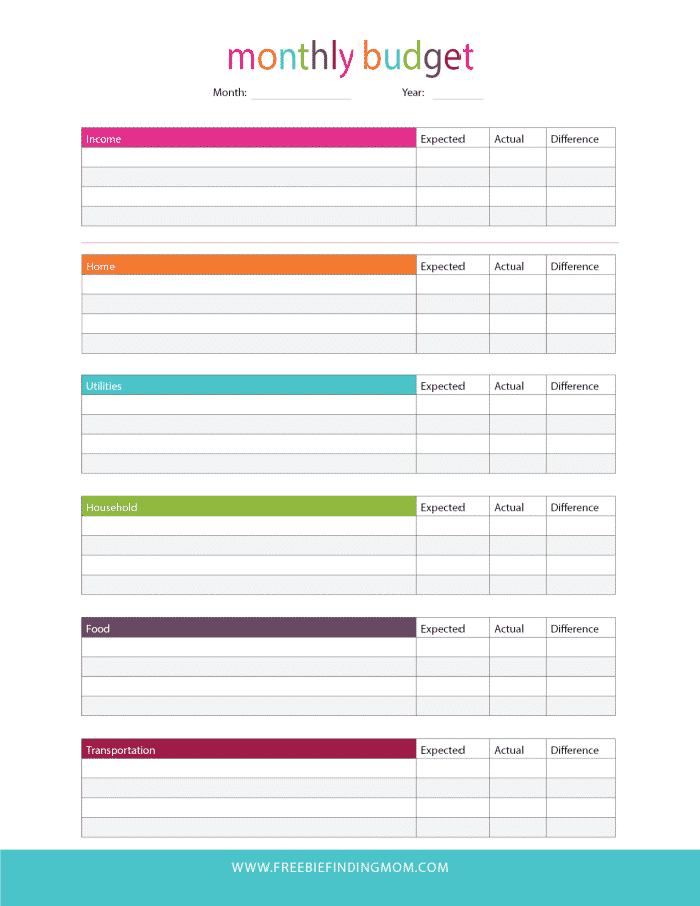

Filing Options and Deadlines

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png?w=700)

Filing Form 1041 is a crucial step for trusts and estates. Here’s a breakdown of the options available to you, along with the deadlines and potential consequences of late filing.

Filing Electronically

Filing electronically is the quickest and most convenient option. It’s secure, allows for quick processing, and provides confirmation of receipt. You’ll need to use an authorized e-file provider to submit your return electronically.

Filing by Mail

You can also file Form 1041 by mail. Send the completed form to the address provided on the instructions. Make sure to include all required attachments and supporting documents.

Deadlines

The deadline for filing Form 1041 is April 15th. If the 15th falls on a weekend or holiday, the deadline is extended to the next business day. Late filing can result in penalties and interest charges.

Consequences of Late Filing

Filing your return late can lead to penalties and interest charges. The penalty for late filing is 5% of the unpaid tax for each month or part of a month that the return is late, up to a maximum of 25%. Interest is also charged on the unpaid tax from the due date until the date the tax is paid.

Benefits and Importance

Printable Form 1041 offers several advantages for tax purposes, simplifying the process and ensuring compliance.

It streamlines tax preparation by providing a structured format that guides users through the necessary information, reducing the risk of errors and omissions.

Compliance and Penalties

Filing Form 1041 is crucial for meeting tax obligations and avoiding penalties. Failure to file can result in substantial fines and interest charges, as well as potential legal consequences.

Q&A

What is the purpose of Printable Form 1041?

Printable Form 1041 is designed for reporting the income, deductions, and credits of estates and trusts. It is used by fiduciaries, such as executors and trustees, to fulfill their tax reporting responsibilities.

How can I obtain Printable Form 1041?

Printable Form 1041 can be easily accessed online through the official website of the Internal Revenue Service (IRS) or downloaded from various tax software programs.

What are some common errors to avoid when completing Form 1041?

Common errors to avoid include incorrect calculations, missing or incomplete information, and failing to attach necessary schedules and supporting documentation.

What are the filing options available for Form 1041?

Form 1041 can be filed electronically or by mail. Electronic filing is encouraged for its speed, accuracy, and convenience.

What are the consequences of late filing Form 1041?

Late filing of Form 1041 may result in penalties and interest charges, as well as potential legal consequences in severe cases.