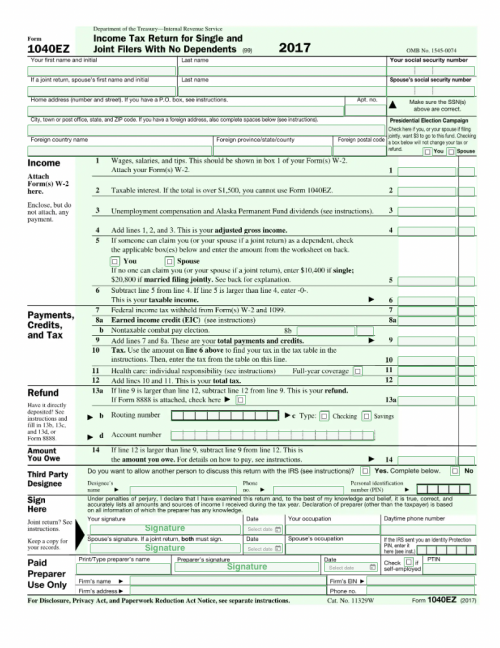

Effortlessly File Your Taxes with the Printable Form 1040 Ez

Navigating the complexities of tax filing can be daunting, but the Printable Form 1040 Ez streamlines the process, making it accessible and convenient for taxpayers with simple tax situations. Designed for individuals with straightforward income and deductions, this form offers a user-friendly interface and clear instructions, empowering you to file your taxes with confidence.

Whether you’re a first-time filer or seeking a hassle-free tax preparation experience, the Printable Form 1040 Ez is your ideal companion. Its simplicity and accessibility empower you to understand your tax obligations, ensuring accuracy and minimizing the stress associated with tax season.

Introduction

Filing taxes can be a daunting task, but it doesn’t have to be. The IRS Form 1040 EZ is a simplified tax form designed to make filing your taxes easier if you have a simple tax situation. It’s perfect for people with straightforward income and deductions, such as wages, salaries, and interest.

Using a printable Form 1040 EZ offers several benefits. First, it’s free to download from the IRS website, so you don’t have to pay for tax preparation software or an accountant. Second, it’s easy to fill out, with clear instructions and straightforward questions. And third, it’s the fastest way to file your taxes, as you can simply mail it in or file it electronically.

Benefits of Using a Printable Form 1040 EZ

- Free to download

- Easy to fill out

- Fastest way to file your taxes

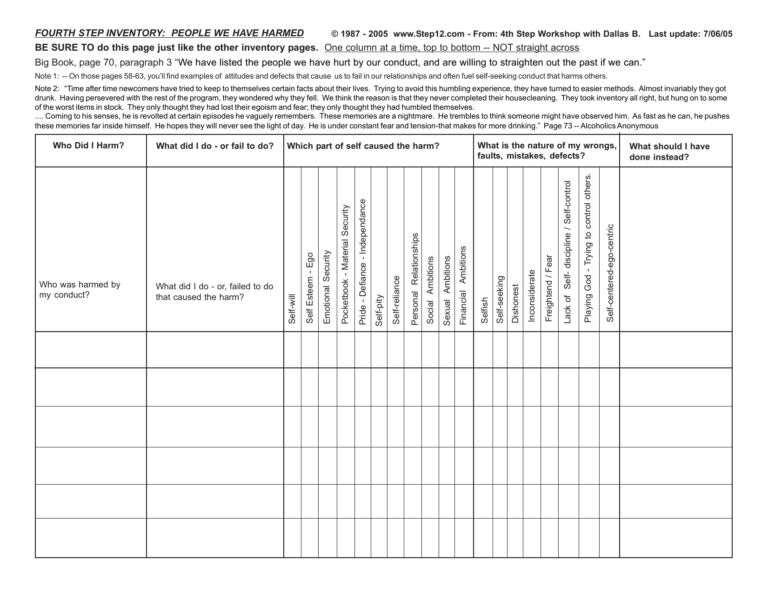

Understanding the Form

Yo, Form 1040 EZ is a simplified tax return for UK blokes and birds who have a basic income and tax situation. It’s a breeze to fill out, but let’s break it down, bruv.

Sections Included in Form 1040 EZ

The form has three main sections:

- Personal Info: Name, address, and Social Security number.

- Income: Wages, salaries, tips, and other income.

- Tax and Credits: Standard deduction, personal exemption, and any tax credits.

Steps for Completing Each Section

To complete each section, follow these steps:

- Personal Info: Fill in your personal details as they appear on your Social Security card.

- Income: Report your total income from all sources, including wages, salaries, and any other taxable income.

- Tax and Credits: Calculate your standard deduction, personal exemption, and any tax credits you qualify for. These amounts reduce your taxable income and the amount of tax you owe.

Eligibility Requirements

Bruv, Form 1040 EZ is not for everyone. You gotta meet certain criteria to use it. Let’s spill the beans, shall we?

First off, you can only file Form 1040 EZ if you:

- Are single or married filing jointly and both spouses meet the other requirements.

- Don’t have any dependents.

- Don’t itemize deductions (meaning you take the standard deduction).

- Don’t claim any tax credits other than the Earned Income Tax Credit.

- Don’t owe any household employment taxes.

- Don’t have any income from self-employment.

- Don’t have any income from farming.

Limitations and Restrictions

Even if you meet the criteria, there are still some limitations to using Form 1040 EZ. You can’t file Form 1040 EZ if you:

- Had over $100,000 in taxable income (or $50,000 if married filing separately).

- Made estimated tax payments.

- Owe any taxes for the previous year.

- Received advance payments of the Premium Tax Credit or additional Child Tax Credit.

- Are claiming the American Opportunity Tax Credit.

So, there you have it. If you meet all these criteria, Form 1040 EZ is your ticket to a simpler tax return. But if you don’t, you’ll need to use the more complicated Form 1040.

Completing the Form

Completing the Form 1040 EZ is a breeze, mate! Let’s break it down step by step to make it a doddle.

Before you get started, gather all the necessary documents, like your wage slips, tax forms, and any other bits and bobs that might be relevant. Then, grab a pen or type away on your computer – it’s time to get this show on the road!

Step 1: Personal Information

Kick off by filling in your personal deets – name, address, Social Security number, and all that jazz. Make sure it’s all correct, or else the taxman might get confused and start asking awkward questions.

Step 2: Filing Status

Next up, choose your filing status. Are you single, married, or something else? Circle the option that best describes your relationship status. This will determine how your income is taxed.

Step 3: Income

Time to add up your earnings! Pop in your wages, salaries, tips, and any other income you might have had. Don’t forget to include any unemployment benefits or Social Security payments you received.

Step 4: Adjustments to Income

Now, let’s see if you can reduce your taxable income. Check if you qualify for any adjustments, like student loan interest or educator expenses. If you do, enter the amount on the appropriate line.

Step 5: Taxable Income

Subtract your adjustments from your income to get your taxable income. This is the amount the taxman is most interested in!

Step 6: Tax

Using the tax table provided, find the amount of tax you owe based on your taxable income and filing status. This is the meat and potatoes of the form, so make sure you get it right.

Step 7: Credits

Time for some good news! If you qualify for any tax credits, like the earned income credit or the child tax credit, enter the amounts on the appropriate lines. These credits can reduce your tax bill, so don’t miss out!

Step 8: Payments and Refund

Have you already paid any taxes throughout the year? If so, enter the amounts on the appropriate lines. This includes any federal income tax withheld from your paychecks or estimated tax payments you made.

Once you’ve entered all your payments, compare them to the tax you owe. If you’ve paid more than you owe, you’ll get a refund! If you owe more, you’ll need to pay the difference.

Step 9: Sign and Date

Last but not least, don’t forget to sign and date the form. This shows that you’re the one who filled it out and that you’re responsible for the information provided. Once you’ve done that, you’re all set!

Remember, if you get stuck or have any questions, don’t hesitate to reach out for help. The IRS website has plenty of resources, or you can always chat with a tax professional.

Filing the Form

Filing your Form 1040 EZ is easy, bruv. You can either do it online or by post.

Electronically

- Head over to the IRS website and click on “File Online”.

- Follow the instructions to create an account and upload your form.

- Once you’ve double-checked everything, hit “Submit”.

By Mail

- Print out your completed Form 1040 EZ and sign it.

- Pop it in an envelope and send it to the address on the form.

- Make sure you use the right envelope and postage, or your form might go astray.

Resources and Support

Navigating tax forms can be a bit of a headache, but fear not, mate! Here are some ace resources to help you get your head around Form 1040 EZ and file it like a pro.

If you’re still feeling a bit lost, don’t hesitate to reach out to the IRS for support. They’re the experts in all things tax, and they’re there to help you every step of the way.

Helpful Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-1040ez

- IRS Publication 501: https://www.irs.gov/pub/irs-pdf/p501.pdf

- Free File Alliance: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free

Contact Information

- IRS Helpline: 1-800-829-1040

- IRS website: https://www.irs.gov/help/contact-your-local-irs-office

Q&A

Is Form 1040 Ez suitable for everyone?

No, Form 1040 Ez is designed for taxpayers with simple tax situations. If you have complex income sources, deductions, or credits, you may need to use a different tax form.

Can I file Form 1040 Ez electronically?

Yes, you can file Form 1040 Ez electronically using tax software or the IRS Free File program.

Where can I find instructions for completing Form 1040 Ez?

The IRS website provides detailed instructions for completing Form 1040 Ez. You can also consult with a tax professional for guidance.