Printable Form 1040-ES 2023: A Comprehensive Guide for Estimated Tax Payments

Navigating the complexities of estimated tax payments can be daunting, but with the Printable Form 1040-ES 2023, you can simplify the process and ensure timely and accurate filings. This guide provides a comprehensive overview of the form, empowering you to confidently manage your tax obligations throughout the year.

Whether you’re a seasoned taxpayer or a first-time filer, this printable form offers numerous advantages, including the flexibility to work at your own pace, the ability to review and make changes easily, and the convenience of having a physical copy for your records.

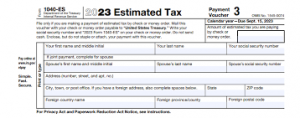

Printable Form 1040 ES 2023 Overview

Form 1040 ES is a printable tax form that individuals can use to estimate their federal income tax liability for the current year. It is particularly useful for those who are self-employed or have complex tax situations. Using a printable version of the form allows individuals to complete their tax calculations manually, providing them with greater control over the process.

The printable Form 1040 ES 2023 can be accessed from the Internal Revenue Service (IRS) website. Individuals can download the form in PDF format and print it for their use.

Steps for Completing Form 1040 ES

Filling out Form 1040 ES is essential for making estimated tax payments to the IRS. Here’s a breakdown of the steps to ensure accuracy and completeness:

1. Gather Your Info: Collect your financial records, including income statements, deductions, and credits.

2. Estimate Your Income and Deductions: Calculate your expected income and eligible deductions for the tax year. Use last year’s tax return as a reference.

3. Determine Your Estimated Tax Liability: Subtract your deductions from your income to find your taxable income. Apply the appropriate tax rates to calculate your estimated tax liability.

4. Figure Out Your Quarterly Payments: Divide your estimated tax liability by four to determine your quarterly payment amount.

5. Complete the Form: Fill out Form 1040 ES with your personal information, estimated income, deductions, and calculated quarterly payments.

Tips for Accuracy and Completeness

* Be Conservative: Estimate your income and deductions on the lower side to avoid underpaying taxes.

* Review Regularly: Check your estimates throughout the year and adjust your quarterly payments if necessary.

* Use the Worksheet: Utilize the provided worksheet in the form to guide your calculations.

* File on Time: Submit your Form 1040 ES on or before the due dates to avoid penalties.

Estimated Tax Calculation

Estimating your tax liability is crucial to avoid underpayment penalties and ensure timely tax payments. There are two primary methods for estimating your tax liability: using tax tables or tax software.

Tax tables are provided by the tax authorities and are based on your income, filing status, and deductions. You can find tax tables in the Form 1040-ES instructions or online. To use tax tables, simply locate your income bracket and filing status, and then read across to find your estimated tax liability.

Using Tax Software

Tax software is another option for estimating your tax liability. Tax software can guide you through the process of calculating your taxes, taking into account your income, deductions, and credits. It can also help you generate payment vouchers and file your estimated tax returns electronically.

Impact of Deductions and Credits

Deductions and credits can significantly reduce your tax liability. Deductions reduce your taxable income, while credits directly reduce your tax bill. When estimating your tax liability, it is important to consider the deductions and credits that you are eligible for.

Payment Options

The Internal Revenue Service (IRS) offers various convenient ways to pay your estimated taxes. Choose the option that best suits your needs and preferences.

You can make payments online, by mail, or through a financial institution. If you’re paying by mail, use the payment voucher included in your Form 1040-ES package. Ensure you write your Social Security number on your check or money order and include the voucher with your payment.

Online Payments

To pay online, visit the IRS website and select the “Make a Payment” option. You’ll need to have your Social Security number, the amount you want to pay, and your bank account or debit card information ready.

Mail Payments

If you prefer to pay by mail, address your payment to the Internal Revenue Service at the address provided on your Form 1040-ES package. Remember to include the payment voucher and write your Social Security number on your check or money order.

Consequences of Late or Insufficient Payments

Paying your estimated taxes on time and in full is crucial to avoid penalties. Late payments may result in a penalty of up to 5% of the unpaid tax for each month or part of a month that the payment is late, up to a maximum of 25% of the tax.

Insufficient payments can also lead to penalties. If you underpay your estimated taxes by more than 10% of your total tax liability, you may be subject to an underpayment penalty.

Filing Deadlines and Extensions

As a self-employed individual or independent contractor, you’re responsible for paying estimated taxes throughout the year. These payments are due on specific dates, known as filing deadlines.

The standard filing deadlines for Form 1040 ES are as follows:

- April 15th

- June 15th

- September 15th

- January 15th of the following year

If you can’t meet these deadlines, you can request an extension using Form 4868. This form allows you to extend your filing deadline by six months, but it doesn’t extend the payment deadline. You’ll still need to make your estimated tax payments by the original due dates.

There are penalties for late filing and late payment of estimated taxes. The penalty for late filing is 5% of the unpaid taxes for each month or part of a month that your return is late, up to a maximum of 25%. The penalty for late payment is 0.5% of the unpaid taxes for each month or part of a month that your payment is late, up to a maximum of 25%.

Common Questions and Answers

This section aims to address some frequently asked questions and provide clear answers to guide you through the process of understanding and completing Form 1040-ES. These questions cover eligibility, exceptions, and special circumstances.

By providing concise explanations, we hope to empower you with the knowledge necessary to navigate the complexities of estimated tax payments.

Eligibility

- Who is required to file Form 1040-ES?

Generally, you must file Form 1040-ES if you expect to owe more than £1,000 in taxes for the current year, after subtracting any withholding and refundable credits.

- Are there any exceptions to the eligibility criteria?

Yes, there are certain exceptions, such as if you are a farmer or a fisherman with an expected gross income of less than £2,500 from farming or fishing, or if you are a member of the Armed Forces on active duty.

Special Circumstances

- What if I have irregular income or my income fluctuates?

You can use the annualized income installment method to estimate your tax liability and make payments accordingly.

- Can I make estimated tax payments for my spouse?

Yes, you can make joint estimated tax payments if you file a joint tax return with your spouse.

Other Common Questions

- What happens if I underpay my estimated taxes?

You may be subject to penalties and interest charges on the unpaid amount.

- What if I overpay my estimated taxes?

Any overpayment will be refunded to you when you file your tax return.

FAQ Summary

What is the purpose of Form 1040-ES?

Form 1040-ES is used to make estimated tax payments if you expect to owe taxes of $1,000 or more when you file your annual tax return.

Where can I access the Printable Form 1040-ES 2023?

You can download the form from the IRS website or obtain a copy by mail by calling 1-800-TAX-FORM (1-800-829-3676).

What are the estimated tax payment deadlines?

Estimated tax payments are due April 15, June 15, September 15, and January 15 of the following year.

What are the consequences of late or insufficient estimated tax payments?

Late or insufficient payments may result in penalties and interest charges.

Can I request an extension for filing Form 1040-ES?

Yes, you can request an extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.