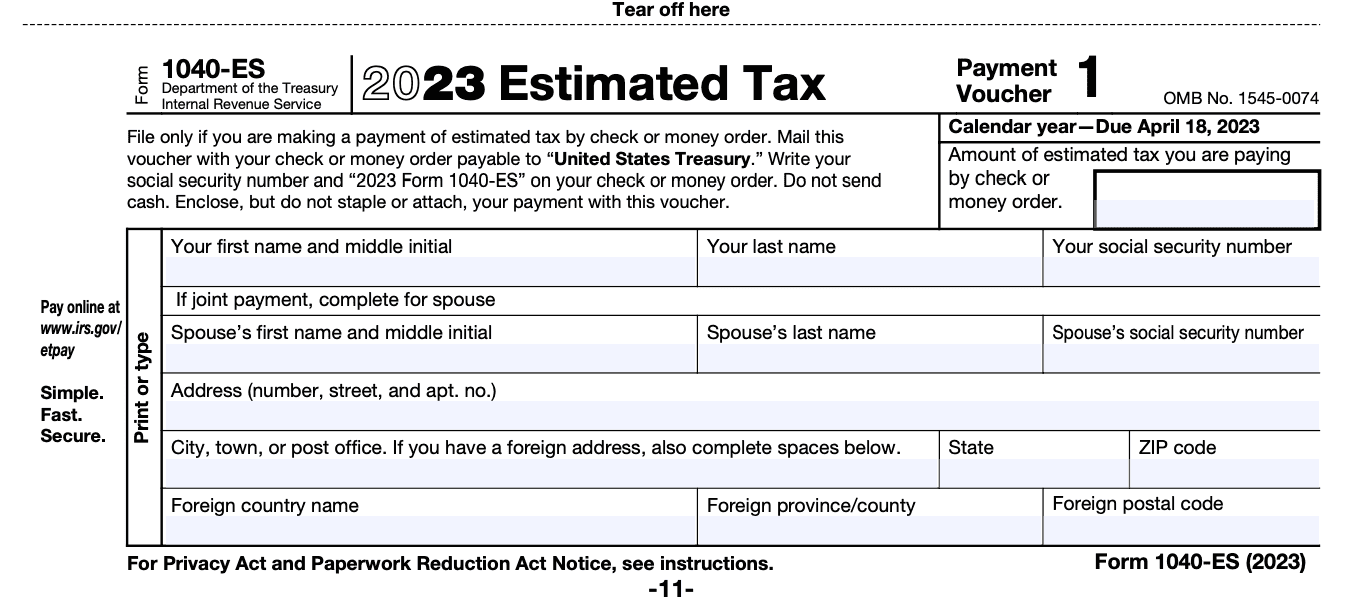

Printable Form 1040 Es: Your Guide to Estimated Tax Payments

Navigating the world of taxes can be a daunting task, but understanding and utilizing Form 1040-ES can make it a breeze. This printable form is your key to ensuring timely and accurate estimated tax payments, helping you stay compliant and avoid penalties.

Whether you’re self-employed, a freelancer, or have other sources of income not subject to withholding, Form 1040-ES empowers you to take control of your tax obligations. In this comprehensive guide, we’ll delve into the purpose, usage, and intricacies of this essential form, empowering you to file with confidence.

What is Form 1040-ES?

Yo, blud! Form 1040-ES is like a rad way to make sure you’re not getting mugged by the taxman, innit?

It’s a sweet little form that helps you spread out your estimated tax payments over the year, so you don’t have to cough up a lump sum at the end. It’s like a layaway plan for your taxes, bruv.

Who Should Use This Form?

If you’re self-employed, or you’ve got income that’s not subject to withholding, like investments or freelance work, then Form 1040-ES is your go-to.

Benefits of Using Form 1040-ES

- Avoid penalties for underpayment of taxes.

- Spread out your tax payments evenly throughout the year.

- Peace of mind knowing you’re on top of your tax responsibilities.

How to Fill Out Form 1040-ES?

Filling out Form 1040-ES is a simple process that can be completed in a few steps. Follow the instructions below to ensure you complete the form correctly.

Step-by-Step Instructions

Here are the steps on how to fill out Form 1040-ES:

| Line Number | Description | Instructions |

|---|---|---|

| 1 | Name and Address | Enter your name and address. |

| 2 | Social Security Number | Enter your Social Security number. |

| 3 | Filing Status | Indicate your filing status. |

| 4 | Exemptions | Enter the number of exemptions you claim. |

| 5 | Income | Estimate your total income for the year. |

| 6 | Deductions and Adjustments | Estimate your total deductions and adjustments for the year. |

| 7 | Taxable Income | Subtract line 6 from line 5. |

| 8 | Tax | Calculate your tax liability using the tax tables or tax software. |

| 9 | Credits | Estimate your total tax credits for the year. |

| 10 | Total Tax | Subtract line 9 from line 8. |

| 11 | Amount Paid With Return | Enter the amount of tax you paid with your return. |

| 12 | Amount Due | Subtract line 11 from line 10. |

| 13 | Refund | Subtract line 10 from line 11. |

Example:

- If you expect to earn £100,000 in income for the year and have £10,000 in deductions and adjustments, your taxable income would be £90,000.

- Using the tax tables, you would calculate your tax liability to be £20,000.

- If you claim £2,000 in tax credits, your total tax would be £18,000.

- If you paid £15,000 in estimated taxes with your return, you would owe £3,000 in additional taxes.

When to File Form 1040-ES?

Filing Form 1040-ES is crucial to avoid penalties for underpayment of estimated taxes. Here’s a breakdown of the deadlines and consequences:

Filing Deadlines

- April 15th: File Form 1040-ES for the first quarter (January-March).

- June 15th: File for the second quarter (April-May).

- September 15th: File for the third quarter (June-August).

- January 15th of the following year: File for the fourth quarter (September-December).

Consequences of Filing Late

Filing Form 1040-ES late can result in penalties and interest charges. The penalty is calculated as a percentage of the unpaid taxes, and the interest is charged on the amount of the penalty.

Where to File Form 1040-ES?

You can file Form 1040-ES using the following methods:

- Mail: Send the completed form to the Internal Revenue Service (IRS) at the address provided on the form.

- Electronic filing: File the form electronically using tax preparation software or through the IRS website.

- Tax preparer: Hire a tax preparer to file the form on your behalf.

Pros and Cons of Each Filing Method:

Mail:

- Pros: Free and easy to use.

- Cons: Can take longer to process than other methods.

Electronic filing:

- Pros: Faster processing time, can be more accurate, and often provides error-checking features.

- Cons: May require additional software or services, which can incur fees.

Tax preparer:

- Pros: Ensures accuracy and can provide professional advice.

- Cons: Can be expensive, and you may need to provide additional documentation.

Common Errors to Avoid on Form 1040-ES

Filling out Form 1040-ES can be tricky, especially if you’re not familiar with the tax code. Here are some common mistakes to watch out for:

1. Not Estimating Your Tax Liability Correctly

The most important part of Form 1040-ES is estimating your tax liability. If you underestimate, you could end up owing money when you file your taxes. If you overestimate, you’ll have to wait until you file your taxes to get a refund.

To avoid these mistakes, make sure you take into account all of your income and deductions when you’re estimating your tax liability.

2. Not Paying Your Taxes on Time

Form 1040-ES is due on April 15th, June 15th, September 15th, and January 15th. If you don’t pay your taxes on time, you could be charged a penalty.

To avoid this mistake, make sure you mark your calendar and set up a payment plan if necessary.

3. Not Filing Form 1040-ES

If you don’t file Form 1040-ES, you could be charged a penalty. Even if you don’t owe any taxes, you still need to file Form 1040-ES.

To avoid this mistake, make sure you file Form 1040-ES even if you don’t owe any taxes.

4. Not Keeping a Copy of Your Form 1040-ES

It’s important to keep a copy of your Form 1040-ES for your records. This will help you if you need to make any changes to your estimated tax payments or if you’re audited by the IRS.

To avoid this mistake, make sure you keep a copy of your Form 1040-ES in a safe place.

5. Not Getting Help if You Need It

If you’re not sure how to fill out Form 1040-ES, don’t be afraid to get help. You can contact the IRS or a tax professional for assistance.

To avoid this mistake, don’t hesitate to get help if you need it.

Additional Resources for Form 1040-ES

If you need more information about Form 1040-ES, there are a few places you can go.

The IRS website has a dedicated page for Form 1040-ES, where you can find instructions, FAQs, and other helpful resources.

Contact Information

You can also contact the IRS directly by phone or mail if you have any questions about Form 1040-ES.

- Phone: 1-800-829-1040

- Mail: Internal Revenue Service, P.O. Box 1291, Cincinnati, OH 45201

FAQs

Here are some of the most frequently asked questions about Form 1040-ES:

- Who needs to file Form 1040-ES?

- When are estimated tax payments due?

- How do I calculate my estimated tax liability?

- What happens if I don’t pay enough estimated taxes?

Common Queries

Q: Who should use Form 1040-ES?

A: Individuals who expect to owe taxes of $1,000 or more when they file their annual tax return should use Form 1040-ES to make estimated tax payments.

Q: How often should I file Form 1040-ES?

A: Estimated tax payments are typically made quarterly, with deadlines falling on April 15, June 15, September 15, and January 15 of the following year.

Q: What happens if I don’t file Form 1040-ES or underpay my estimated taxes?

A: Failure to file Form 1040-ES or underpaying estimated taxes may result in penalties and interest charges.

Q: Can I make estimated tax payments online?

A: Yes, you can make estimated tax payments online through the IRS website or through authorized tax software.