Streamlining Expense Management with Printable Expense Forms

Navigating the complexities of expense management can be a daunting task, but with the advent of printable expense forms, businesses have a powerful tool at their disposal. These forms offer an array of benefits, from enhanced convenience to streamlined record-keeping, making expense tracking a breeze.

In this comprehensive guide, we will delve into the essential elements, customization options, and security considerations associated with printable expense forms. We will also explore how they can be seamlessly integrated with accounting systems for automated processing, ensuring data accuracy and efficiency.

Benefits of Printable Expense Forms

Innit, printable expense forms are like the bomb for keeping track of your bread. They’re easy peasy to use and you can grab ’em whenever, wherever. No more faffing about with receipts or trying to remember what you spent a quid on.

With printable expense forms, you can sort out your expenses in a jiffy. Just jot down what you bought, how much it cost, and the date. It’s a piece of cake, mate!

Businesses Can Benefit

Businesses can get a right load of benefits from using printable expense forms, too. They can help you keep tabs on your spending, make sure everyone’s getting reimbursed, and even spot any dodgy dealings.

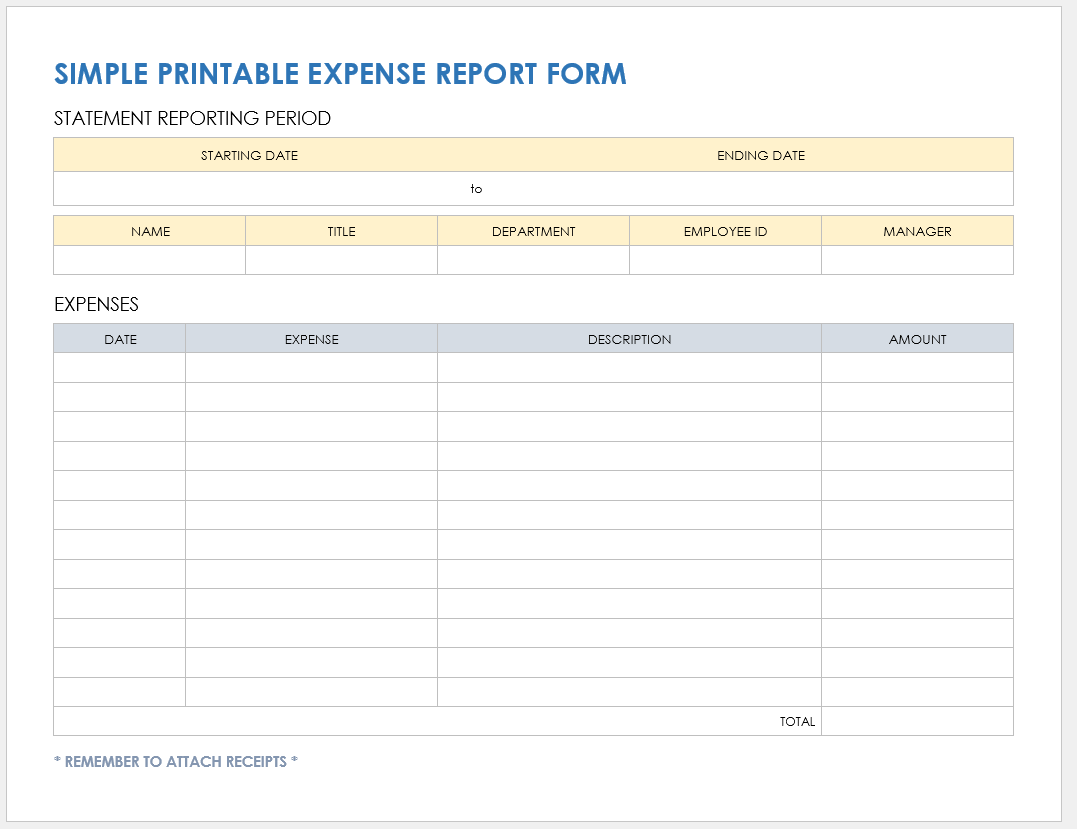

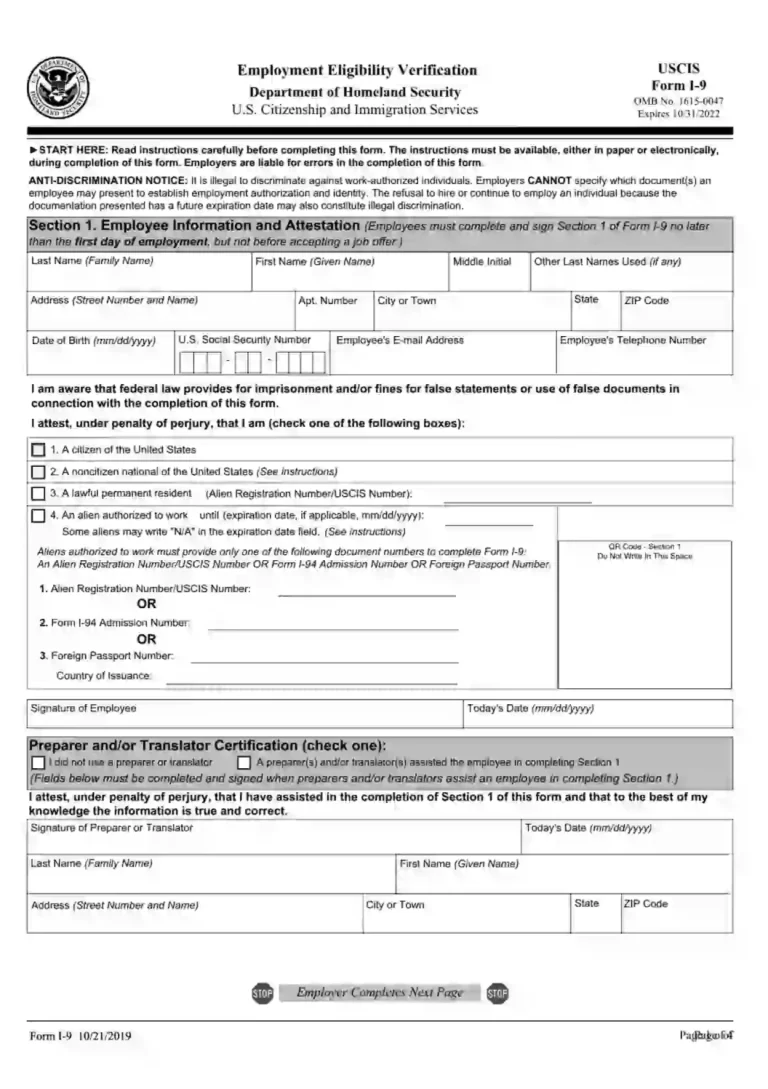

Essential Elements of a Printable Expense Form

A well-designed printable expense form is crucial for efficient expense tracking and reimbursement. It should include essential elements that provide clear and comprehensive details about the expenses incurred.

Each field on the form should be clearly labeled to avoid confusion and ensure accurate data entry. The following are essential elements that a printable expense form should include:

Date

The date the expense was incurred should be clearly indicated on the form. This information is crucial for chronological tracking and matching expenses to specific business activities.

Payee

The payee is the individual or entity to whom the payment was made. This field should capture the full name or business name of the payee.

Description

A brief but detailed description of the expense should be provided. This includes the purpose of the expense, the items or services purchased, and any relevant details.

Amount

The amount of the expense should be clearly stated in the appropriate currency format. This information is essential for calculating the total expenses and determining reimbursement amounts.

Signature or Approval Section

A signature or approval section is crucial for authorization purposes. This section should provide space for the employee to sign and date the form, as well as for a supervisor or manager to approve the expenses.

Customizing Printable Expense Forms

Businesses can customize printable expense forms to suit their specific needs, ensuring seamless integration with their existing processes.

Customizations can include adding company logos, pre-filling fields with default information, or incorporating additional sections tailored to specific expense categories.

Adding Company Logos

Including a company logo on the expense form adds a professional touch and reinforces brand identity. Businesses can upload their logo in a suitable format, ensuring it aligns with the overall design of the form.

Pre-filling Fields

Pre-filling certain fields with default information, such as the employee’s name, department, or cost center, can save time and reduce errors. Businesses can determine which fields to pre-fill based on their specific requirements.

Additional Expense Sections

Businesses can add additional sections to the expense form to capture expenses that fall outside of the standard categories. For instance, they can include sections for travel expenses, entertainment expenses, or mileage reimbursement.

Maintaining Consistency

Maintaining consistency in form design is crucial for easy recognition and use. Businesses should adhere to a standardized layout, font style, and color scheme across all expense forms. This consistency ensures that employees can quickly identify and complete the forms, reducing the risk of errors or confusion.

Distributing and Managing Printable Expense Forms

Distributing printable expense forms to employees is essential for efficient expense tracking and reimbursement. Here are some common methods:

- Email: Sending expense forms via email is a convenient and widely used method. It allows for quick and easy distribution to a large number of employees.

- Intranet: Publishing expense forms on the company’s intranet provides a centralized location for employees to access and download the forms whenever they need them.

- Physical distribution: Distributing expense forms physically, such as through interoffice mail or at employee workstations, may be necessary for employees who do not have regular access to email or the intranet.

Once expense forms have been distributed, it’s crucial to establish a system for tracking and managing submitted forms to ensure timely processing and reimbursement. This can be done through:

- Designated email address: Setting up a dedicated email address for expense form submissions allows for easy collection and organization of forms.

- Online portal: Utilizing an online portal or expense management software enables employees to submit expense forms electronically, providing a more streamlined and efficient process.

- Physical collection: For physical distribution, designating a specific location or individual responsible for collecting submitted expense forms ensures they are received and processed promptly.

Establishing clear guidelines for expense form submission and approval processes is vital to avoid delays and ensure consistency. These guidelines should include:

- Submission deadlines: Setting clear deadlines for expense form submission helps prevent late submissions and facilitates timely processing.

- Approval process: Outlining the approval process, including who is responsible for approving expenses and the criteria for approval, ensures transparency and accountability.

- Documentation requirements: Specifying the required documentation to support expense claims, such as receipts or invoices, helps prevent fraudulent or unsubstantiated claims.

By implementing these strategies, businesses can effectively distribute and manage printable expense forms, ensuring accurate expense tracking and timely reimbursement for employees.

Security Considerations for Printable Expense Forms

Using printable expense forms carries certain security risks, such as unauthorized access, alteration, or misuse of sensitive financial information. It’s crucial to implement measures to safeguard this data.

To protect sensitive information, consider the following best practices:

Encryption

- Encrypt expense forms before distributing them to prevent unauthorized access during transmission.

- Use secure encryption algorithms like AES-256 or RSA.

Secure Storage

- Store completed expense forms in a secure location, such as a locked cabinet or a password-protected digital file system.

- Limit access to these forms only to authorized personnel.

Secure Disposal

- Shred or incinerate completed expense forms to prevent unauthorized access to discarded documents.

- Consider using a cross-cut shredder to ensure complete destruction of sensitive information.

Integrating Printable Expense Forms with Accounting Systems

Integrating printable expense forms with accounting software allows for automated processing, eliminating manual data entry and reducing errors. This seamless data transfer streamlines the expense reimbursement process, saving time and resources.

Benefits of Seamless Data Transfer

– Reduced errors: Automated data transfer eliminates manual entry errors, ensuring data accuracy and consistency.

– Increased efficiency: Automating the process saves time and effort, allowing finance teams to focus on more strategic tasks.

– Improved compliance: Automated systems can track and enforce expense policies, ensuring compliance with internal and external regulations.

Importance of Data Accuracy and Consistency

Accurate and consistent data is crucial for effective accounting and financial reporting. Integration with accounting systems ensures that expense data is captured and processed correctly, providing a reliable basis for financial decision-making.

FAQ

Can printable expense forms be customized?

Yes, businesses can customize printable expense forms to include company logos, pre-fill fields, and additional sections for specific expenses, ensuring they align with their unique requirements.

How can I protect sensitive financial information on printable expense forms?

To protect sensitive financial information, consider using secure printing methods, storing completed forms in a locked cabinet, and shredding them securely once processed.

How do I integrate printable expense forms with my accounting system?

Integration with accounting software typically involves scanning or uploading completed expense forms, allowing for automated data transfer and seamless processing, eliminating manual data entry errors.