Simplify Payroll with Printable Direct Deposit Forms: A Comprehensive Guide

In the fast-paced world of payroll processing, efficiency and accuracy are paramount. Printable direct deposit forms offer a solution that streamlines the process, saving time and minimizing errors. This guide will provide a comprehensive overview of printable direct deposit forms, their benefits, essential elements, design considerations, distribution, legal compliance, and advanced features.

With the increasing adoption of digital payments, printable direct deposit forms have become an indispensable tool for businesses seeking to optimize their payroll operations. They provide a secure and convenient way to ensure timely and accurate payments to employees.

Definition and Overview

A Printable Direct Deposit Form is a document that allows you to provide your bank account details to your employer or other entity so that they can deposit your salary or other payments directly into your account. It’s a convenient way to get paid without having to wait for a physical check or visit the bank to deposit the funds.

Using a Printable Direct Deposit Form is important because it ensures that you receive your payments on time and securely. It also eliminates the risk of lost or stolen checks, and it can help you manage your finances more effectively by automating the deposit process.

Benefits of Using a Printable Direct Deposit Form

- Convenience: Direct deposit is a convenient way to get paid without having to wait for a physical check or visit the bank to deposit the funds.

- Security: Direct deposit is a secure way to receive payments, as it eliminates the risk of lost or stolen checks.

- Time-saving: Direct deposit can save you time, as you don’t have to wait for a physical check to clear or visit the bank to deposit the funds.

- Financial management: Direct deposit can help you manage your finances more effectively by automating the deposit process.

Benefits of Using Printable Direct Deposit Forms

Bruv, printable direct deposit forms are the biz for taking the hassle out of getting paid. No more waiting for cheques to clear or chasing after the bank for lost payments. These forms got your back, fam.

They’re like the speedy Gonzales of payroll, making sure your hard-earned dough hits your account in a jiffy. Plus, they’re secure as a vault, so you can rest easy knowing your cash is safe and sound.

Convenience and Time-Saving

- No more waiting for cheques to clear – get your money faster than a cheetah.

- Skip the bank queues and save precious time – it’s like having a personal money delivery service.

- No need to remember to sign and post cheques – just fill out the form and relax.

Security and Accuracy

- Encrypted data keeps your info safe from prying eyes – it’s like Fort Knox for your finances.

- Automatic calculations eliminate errors – no more manual math headaches.

- Easy to track your payments – no more wondering where your money went.

Streamlined Payroll Processes

- Payroll gets processed in a flash – say goodbye to late payments and angry employees.

- Less paperwork and admin – free up your time for more important things, like chilling.

- Improved efficiency – more time to focus on growing your business and making that cheddar.

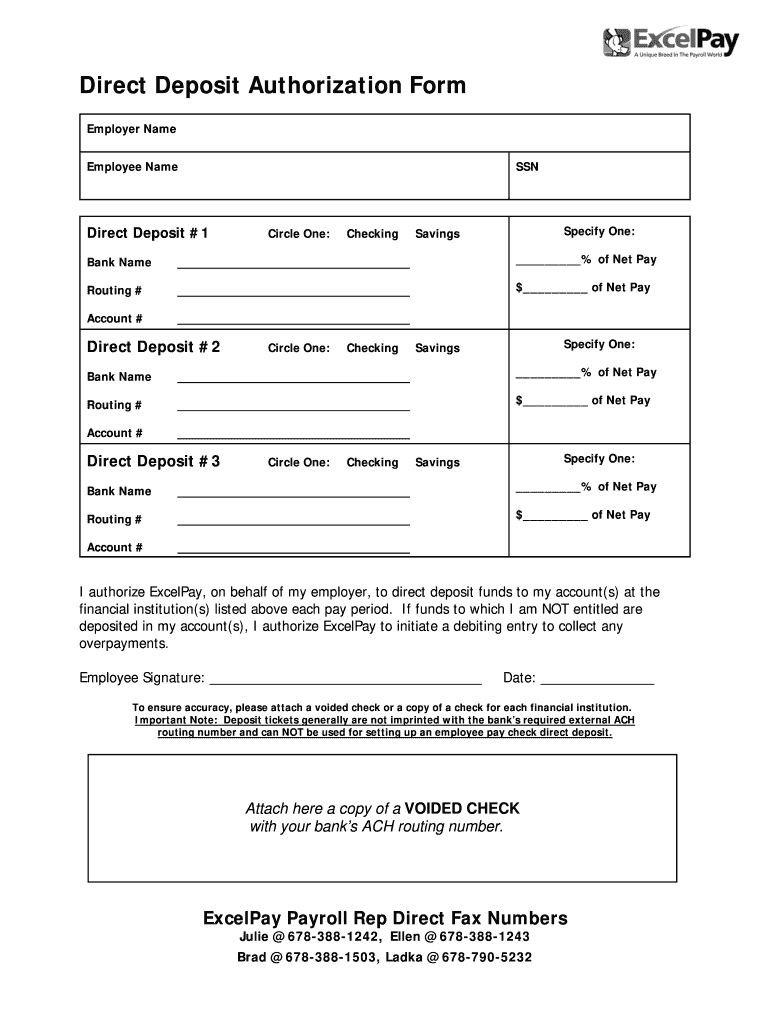

Essential Elements of a Printable Direct Deposit Form

A printable direct deposit form is a document that contains essential information for employers to initiate direct deposits into employees’ bank accounts. It’s crucial that the form includes all necessary data to ensure accurate and timely payments.

Here are the essential elements that a printable direct deposit form should include:

Employee Information

- Employee’s full name

- Employee’s address

- Employee’s phone number

- Employee’s email address

Bank Account Information

- Bank name

- Bank account number

- Bank routing number

- Account type (checking or savings)

Deposit Information

- Deposit amount

- Deposit frequency (weekly, bi-weekly, monthly)

- Effective date of direct deposit

Authorization

- Employee’s signature

- Date of signature

Employer Information

- Employer’s name

- Employer’s address

- Employer’s phone number

- Employer’s email address

Design Considerations for Printable Direct Deposit Forms

Bruv, when you’re designing a printable direct deposit form, you want it to be on point. It needs to be easy to read and understand, so peeps can fill it out without any aggro.

Here’s the lowdown on how to make your forms sick:

Font Size and Layout

Make sure the font size is big enough for your nan to read without squinting. Use a simple font that’s easy on the eyes, like Arial or Times New Roman.

Lay out the form in a logical way, with clear sections for each piece of info. Use headings and subheadings to make it easy to find what you’re looking for.

Spacing and Visuals

Don’t cram too much info onto one page. Leave some white space to make it easy to read and fill out.

Add some visual elements to make the form more engaging, like coloured boxes or icons. Just don’t go overboard – you don’t want it to look like a circus.

Examples of Visually Appealing Forms

Check out these examples of printable direct deposit forms that are both visually appealing and functional:

- Template 1: Link to Template 1

- Template 2: Link to Template 2

These forms are clear, concise, and easy to fill out. They use a simple font and layout, with plenty of white space.

Distribution and Usage

Printable direct deposit forms can be distributed in various ways, ensuring they reach the intended recipients securely and conveniently.

Methods of distribution include:

- Email: Sending forms via email allows for quick and easy distribution to multiple recipients, especially when combined with secure file-sharing platforms.

- Company intranet or portal: Uploading forms to a company’s intranet or employee portal provides a centralized location for employees to access and download them.

- Physical distribution: Distributing forms through physical means, such as handing them out during payroll meetings or posting them on company notice boards, ensures that all employees have access to them.

Secure and Confidential Handling

It is crucial to ensure the secure and confidential handling of printable direct deposit forms to protect sensitive financial information.

- Encryption: Encrypting forms during distribution and storage prevents unauthorized access to personal and financial data.

- Controlled access: Limit access to forms to authorized personnel only, such as payroll administrators or HR managers.

- Secure storage: Store completed forms in a secure location, such as a locked cabinet or encrypted digital storage, to prevent unauthorized access.

Effective Usage for Payroll Purposes

To effectively use printable direct deposit forms for payroll purposes, follow these tips:

- Clear instructions: Provide clear and concise instructions on the form, guiding employees through the completion process.

- Accurate information: Ensure that employees provide accurate and complete information, including their bank account details and any necessary authorizations.

- Regular updates: Encourage employees to update their direct deposit information regularly, especially if they change banks or account numbers.

- Reconciliation: Regularly reconcile direct deposit transactions with payroll records to ensure accuracy and prevent errors.

Legal Considerations and Compliance

When it comes to printable direct deposit forms, there are certain legal requirements and regulations that need to be taken into account.

It’s crucial to ensure compliance with payroll laws, which vary depending on the jurisdiction. These laws typically cover aspects like the frequency of pay, the method of payment, and the deductions that can be made from an employee’s wages.

Compliance with Payroll Laws

- Understanding the specific payroll laws applicable to your business and jurisdiction is essential.

- The printable direct deposit form should be designed in a way that aligns with these legal requirements.

- For instance, some jurisdictions may require employers to provide employees with a written notice of their pay details, including the amount of the deposit and the date it will be made.

Meeting Legal Standards

- The form should be clear and easy to understand, with all the necessary information prominently displayed.

- It should include fields for the employee’s name, address, bank account details, and the amount to be deposited.

- The form should also include a section for the employee’s signature, indicating their authorization for the direct deposit.

Advanced Features and Customization

Printable direct deposit forms can be customized to meet specific business needs, offering numerous benefits. Customizable forms allow businesses to include their logo, branding, and specific fields tailored to their unique requirements. They can also incorporate advanced features such as multi-language support, catering to diverse employee populations, and electronic signatures for enhanced security and convenience.

Creating Customized Forms

Creating customized printable direct deposit forms is straightforward. Businesses can use online form builders or design software to create forms that align with their specific requirements. These tools offer pre-designed templates and customizable fields, making it easy to tailor forms to meet unique business needs.

Advanced Features

Advanced features enhance the functionality and convenience of printable direct deposit forms. Multi-language support allows businesses to create forms in multiple languages, catering to employees with diverse linguistic backgrounds. Electronic signatures provide a secure and legally binding way for employees to authorize direct deposit transactions, eliminating the need for physical signatures.

Helpful Answers

What are the advantages of using printable direct deposit forms?

Printable direct deposit forms offer several advantages, including convenience, time savings, enhanced security, and accuracy in payroll processing.

How do I ensure the security of printable direct deposit forms?

To ensure security, distribute forms securely, use confidential handling procedures, and store completed forms in a secure location.

Are there any legal considerations related to printable direct deposit forms?

Yes, it is important to comply with payroll laws and regulations, including ensuring the forms meet legal standards and providing employees with clear instructions.