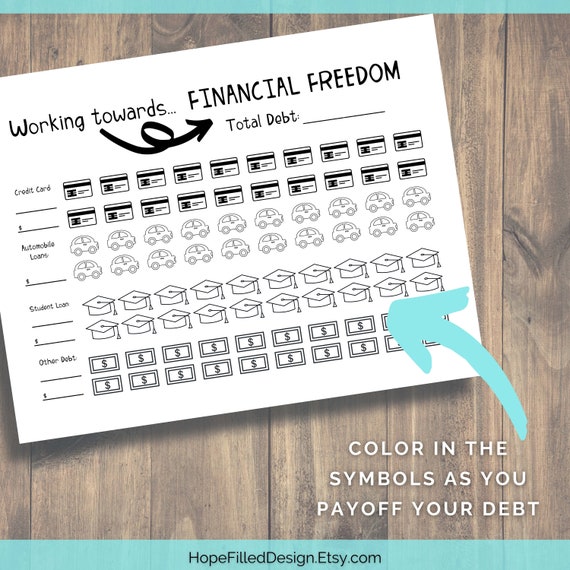

Printable Debt Worksheet: The Key to Financial Freedom

Debt can be a burden that weighs heavily on our minds and finances. However, managing debt doesn’t have to be an overwhelming task. With the help of a printable debt worksheet, you can take control of your debt and embark on the path to financial freedom.

Printable debt worksheets are customizable tools that allow you to track your debts, create repayment plans, and monitor your progress. They provide a clear and organized view of your financial obligations, empowering you to make informed decisions about your money.

Understanding Printable Debt Worksheets

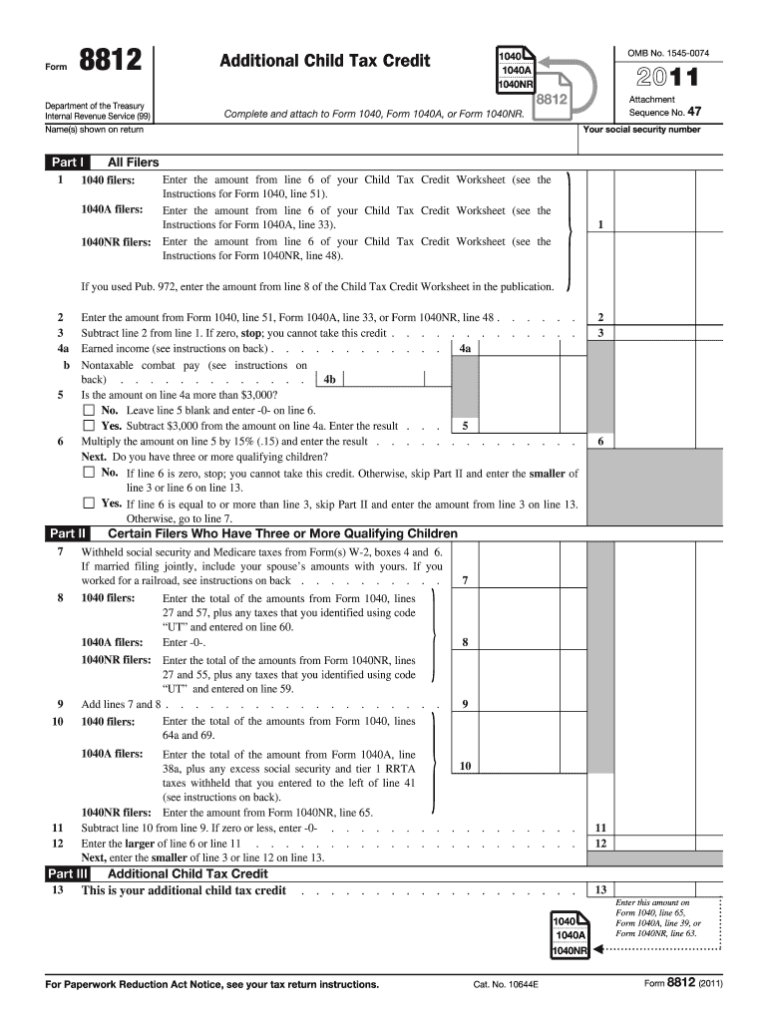

Printable debt worksheets are a valuable tool for managing and understanding your debts. They can help you track your balances, interest rates, and due dates, so you can create a plan to pay off your debts faster and save money on interest. There are many different types of debt worksheets available, so you can find one that fits your specific needs.

Types of Debt Worksheets

There are two main types of debt worksheets:

- Debt repayment calculators help you create a plan to pay off your debts faster. They take into account your income, expenses, and interest rates to calculate how much you can afford to pay each month towards your debts.

- Debt consolidation worksheets help you combine multiple debts into a single loan with a lower interest rate. This can simplify your monthly payments and save you money on interest.

Creating a Printable Debt Worksheet

Creating a printable debt worksheet can help you track your debts and make a plan to pay them off. Here are the steps to create a basic worksheet:

1. List all of your debts, including the name of the creditor, the account number, the balance, the interest rate, and the minimum payment.

2. Calculate the total amount of debt you owe.

3. Set a goal for paying off your debt.

4. Create a payment plan that includes how much you will pay each month and when you will pay it off.

5. Track your progress by updating your worksheet regularly.

You can customize your worksheet to suit your individual needs. For example, you can add columns for tracking extra payments, notes, or due dates. You can also use a spreadsheet program to create a more sophisticated worksheet.

Using a Printable Debt Worksheet

A debt worksheet is a tool that helps you track and manage your debts. It can help you see how much debt you have, where it’s coming from, and how to pay it off. Here’s how to use a printable debt worksheet:

First, you’ll need to gather some information about your debts. This includes the name of the creditor, the amount you owe, the interest rate, and the minimum payment. Once you have this information, you can start filling out your worksheet.

The worksheet will have a section for each debt. In each section, you’ll record the information you gathered. You’ll also calculate the balance of each debt by subtracting the amount you’ve paid from the original amount. Finally, you’ll set repayment goals for each debt. These goals should be realistic and achievable.

Once you’ve filled out the worksheet, you can start tracking your progress. As you make payments, you’ll mark them off on the worksheet. This will help you see how much progress you’re making and stay motivated.

Setting Repayment Goals

When setting repayment goals, it’s important to be realistic about how much you can afford to pay each month. You should also consider the interest rate on each debt. Debts with higher interest rates should be paid off first.

There are a few different methods you can use to repay your debts. One method is the debt snowball method. With this method, you pay off the smallest debt first, then move on to the next smallest debt, and so on. Another method is the debt avalanche method. With this method, you pay off the debt with the highest interest rate first, then move on to the debt with the next highest interest rate, and so on.

The best method for you will depend on your individual circumstances. However, the most important thing is to make a plan and stick to it.

Benefits of Using Printable Debt Worksheets

Yo, Printable debt worksheets are like the OG budgeting tools. They’re banging for keeping track of your bread and getting out of the red. Unlike digital tools or spreadsheets, printable worksheets are right there in your face, making it easier to stay on top of your cash flow.

Budgeting Made Easy

With a printable debt worksheet, you can map out your income and expenses like a pro. It’s like having a roadmap for your money, showing you where it’s coming from and where it’s going. This helps you spot leaks in your budget and make adjustments to save more dosh.

Debt Reduction on Point

These worksheets are like your debt-busting buddies. They help you prioritize your debts, from the ones with the highest interest rates to the smallest. By paying off your debts strategically, you can save a bundle on interest and get out of debt faster.

Financial Planning Sorted

Printable debt worksheets aren’t just for getting out of the hole. They can also help you plan for the future. By tracking your spending and debt, you can see where you’re at and what you need to do to reach your financial goals. It’s like having a financial crystal ball in your pocket.

Examples of Printable Debt Worksheets

Discover a range of printable debt worksheets to suit your needs, whether you’re tackling debt using the snowball or avalanche method.

These worksheets provide a structured approach to managing your debt and help you stay on track towards financial freedom.

Debt Snowball Method Worksheets

- Debt Snowball Worksheet: Prioritize debts from smallest to largest, focusing on paying off the smallest debt first.

- Debt Snowball Calculator: Calculate how long it will take to pay off your debt using the snowball method.

Debt Avalanche Method Worksheets

- Debt Avalanche Worksheet: Prioritize debts from highest interest rate to lowest, paying off the debt with the highest interest rate first.

- Debt Avalanche Calculator: Calculate how much interest you can save using the avalanche method.

Other Debt Management Worksheets

- Debt Consolidation Worksheet: Explore options for consolidating your debt into a single loan with a lower interest rate.

- Debt Management Plan Worksheet: Create a customized plan for managing your debt, including payment amounts and timelines.

Advanced Features of Printable Debt Worksheets

Printable debt worksheets can be enhanced with advanced features to provide a more comprehensive and interactive experience. These features can include:

- Tables: Tables can be used to organize and display debt information in a clear and structured format. For example, you can create a table to list your debts, balances, interest rates, and monthly payments.

- Charts and graphs: Charts and graphs can be used to visualize your debt data and identify trends. For example, you can create a pie chart to show the distribution of your debt across different categories, or a line graph to track your progress in paying off your debt.

- Interactive features: Some printable debt worksheets include interactive features, such as calculators or drop-down menus. These features can make it easier to use the worksheet and to customize it to your specific needs.

Integration with Other Tools

Printable debt worksheets are a versatile tool that can be integrated with other financial tools to enhance their functionality.

By connecting the worksheet to budgeting apps or debt management software, users can automatically track their expenses, income, and debt payments. This integration streamlines the process of managing finances, as data can be easily imported and analyzed.

Benefits of Integration

- Automated data entry eliminates the need for manual input, reducing errors and saving time.

- Real-time updates provide an accurate and up-to-date view of financial status.

- Integration with budgeting apps allows users to set financial goals and track progress towards them.

- Debt management software can help users create personalized debt repayment plans and monitor their progress.

Conclusion

So, there you have it, fam. Printable debt worksheets are a wicked tool for getting your finances in check. They’re easy to use, customizable, and can help you smash your debt goals in no time.

If you’re struggling to manage your debt, I urge you to give a printable debt worksheet a try. There are loads of different options out there, so you’re sure to find one that fits your needs. And remember, the sooner you start, the sooner you’ll be debt-free!

Q&A

What are the benefits of using a printable debt worksheet?

Printable debt worksheets offer numerous benefits, including:

- Visual representation of your debt situation

- Customized repayment plans based on your income and goals

- Easy tracking of debt payments and balances

- Motivation and accountability throughout the repayment process

How do I create a printable debt worksheet?

Creating a printable debt worksheet is simple. You can use a pre-designed template or create your own using a spreadsheet program. Include columns for creditor name, account number, balance, interest rate, minimum payment, and target repayment date.

How often should I update my printable debt worksheet?

It’s recommended to update your printable debt worksheet regularly, at least once a month. This will ensure that you have the most up-to-date information about your debt and can adjust your repayment plan as needed.