Printable CA 7A Form: A Comprehensive Guide to Filing

The California Franchise Tax Board (FTB) requires businesses and individuals to file Form CA 7A to report their income and expenses. This form is crucial for determining tax liability and ensuring compliance with state tax laws. Whether you’re a seasoned business owner or new to the California tax system, understanding how to complete Form CA 7A is essential.

In this comprehensive guide, we will delve into the intricacies of Form CA 7A, providing a clear and concise overview of its purpose, who is required to file it, when it is due, and where to file it. We will also provide a detailed line-by-line analysis, complete with examples and illustrations, to help you navigate the form with ease. Additionally, we will address frequently asked questions to provide you with the information you need to file Form CA 7A accurately and efficiently.

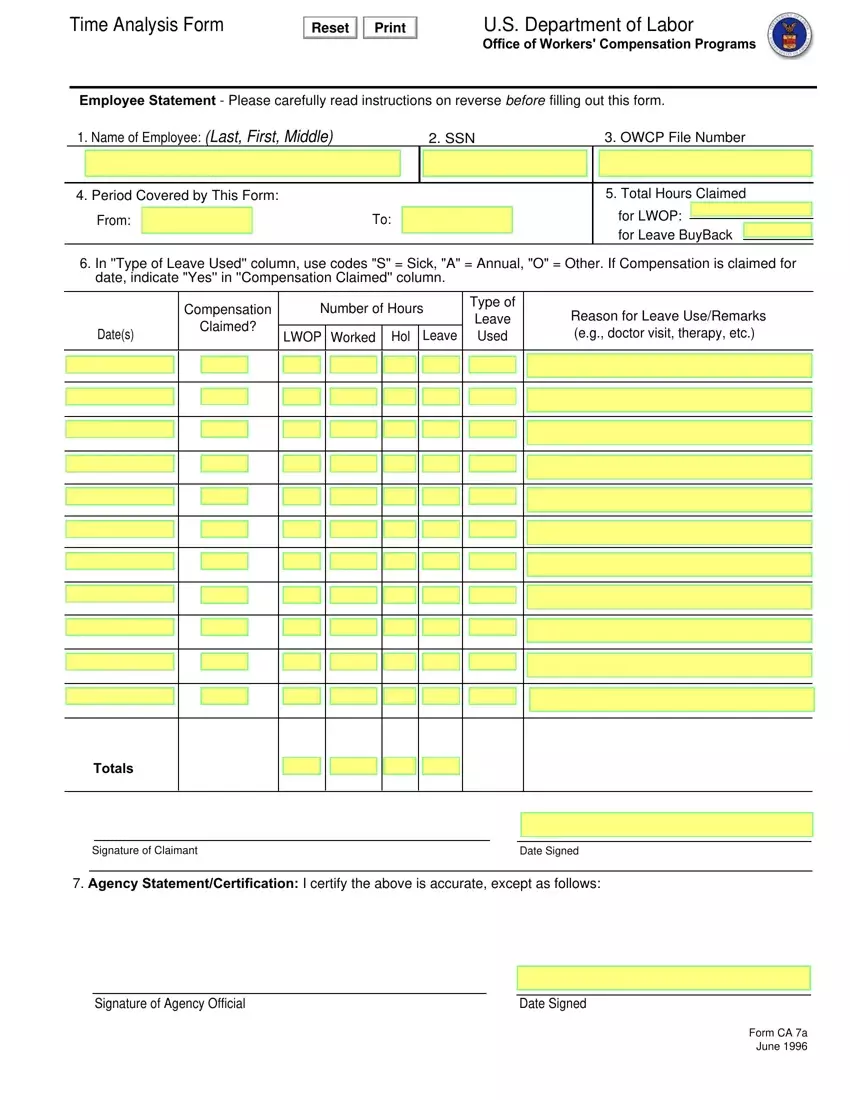

Form Overview

Form CA 7A is a tax return form used to report the sale of a business or a portion of a business in California.

It is required to be filed by the seller of a business or a portion of a business if the sale price is $150,000 or more.

When is Form CA 7A due?

Form CA 7A is due on or before the 15th day of the fourth month following the end of the taxable year in which the sale occurred.

Where to file Form CA 7A?

Form CA 7A can be filed electronically or by mail. If you file electronically, you can use the California Franchise Tax Board’s (FTB) website. If you file by mail, you can mail the form to the FTB at the following address:

Franchise Tax Board

PO Box 942867

Sacramento, CA 94267-0001

Form Sections

The CA 7A form is organized into several sections. Each section contains specific information related to the taxpayer’s income and deductions.

The following table provides an overview of the different sections of Form CA 7A:

| Section Name | Description | Line Numbers |

|---|---|---|

| Personal Information | This section includes the taxpayer’s name, address, and other personal information. | 1-11 |

| Income | This section includes the taxpayer’s income from various sources, such as wages, salaries, and investments. | 12-24 |

| Deductions | This section includes the taxpayer’s deductions for expenses such as mortgage interest, property taxes, and charitable contributions. | 25-39 |

| Taxable Income | This section calculates the taxpayer’s taxable income by subtracting deductions from income. | 40-43 |

| Tax | This section calculates the taxpayer’s tax liability based on their taxable income. | 44-49 |

| Credits | This section includes the taxpayer’s tax credits, which can reduce their tax liability. | 50-57 |

| Refund or Amount Due | This section calculates the taxpayer’s refund or amount due based on their tax liability and credits. | 58-60 |

Line-by-Line s

Filling out Form CA 7A can seem daunting, but with our comprehensive guide, you’ll be able to navigate it like a pro. We’ll break down each line and provide clear and concise s to ensure you complete the form accurately and efficiently.

Let’s dive into the nitty-gritty and make this form a breeze!

Line 1: Personal Information

- Enter your full name as it appears on your official documents.

- Provide your current address, including street address, city, state, and ZIP code.

- Enter your Social Security number (SSN) without dashes.

- Indicate your occupation and employer’s name.

Line 2: Income

- Report your total income from all sources, including wages, salaries, tips, and self-employment income.

- Enter your federal adjusted gross income (AGI) from your federal income tax return.

Line 3: Deductions

- List any itemized deductions you are claiming, such as mortgage interest, property taxes, and charitable contributions.

- Enter your standard deduction amount if you are not itemizing.

Line 4: Taxable Income

- Subtract your deductions from your income to calculate your taxable income.

Line 5: Tax

- Use the tax table provided in the instructions to determine the amount of tax you owe based on your taxable income.

Line 6: Credits

- List any tax credits you are claiming, such as the earned income tax credit or the child tax credit.

Line 7: Total Tax

- Subtract your credits from your tax to calculate your total tax.

Line 8: Payments

- Enter any estimated tax payments or other payments you have made towards your state income tax.

Line 9: Amount Due or Refund

- Subtract your payments from your total tax to determine if you owe any tax or are due a refund.

Line 10: Signature and Date

- Sign and date the form to certify that the information you have provided is true and correct.

Examples and Illustrations

Review completed Form CA 7A examples to grasp the nuances of the form’s completion. Dive into specific lines that may pose complexities or uncertainties.

Examples of Completed Form CA 7A

- Obtain sample forms from the Franchise Tax Board website or consult tax professionals for guidance.

- Study the examples to understand the layout, format, and essential information required.

- Note how different scenarios and situations are addressed on the form.

Detailed Explanations of Complex Lines

Some lines on Form CA 7A may require further clarification or explanation:

- Line 10: This line captures the gross receipts or sales of your business. It’s crucial to include all sources of income, even if they’re not taxable.

- Line 16: Enter the cost of goods sold (COGS) here. This includes the direct costs associated with producing your products or providing your services.

- Line 22: Calculate your net income by subtracting your deductions from your gross receipts. This figure represents your business’s profit.

Additional Resources

Getting stuck with your Form CA 7A? Fear not, fam! We’ve got your back with a bunch of resources to help you out.

If you’re after some official guidance, check out the California Franchise Tax Board website. They’ve got loads of info on the form, plus helpful FAQs and instructions.

Phone and Email Support

- Phone: (800) 852-5711

- Email: [email protected]

FAQ

Who is required to file Form CA 7A?

Individuals and businesses with California source income are required to file Form CA 7A.

When is Form CA 7A due?

Form CA 7A is due on April 15th for calendar-year filers and the 15th day of the 4th month after the end of the fiscal year for fiscal-year filers.

Where can I file Form CA 7A?

Form CA 7A can be filed online through the FTB website, by mail, or through a tax professional.