Printable Budget Worksheet Free Pdf: Your Guide to Financial Freedom

In today’s fast-paced world, managing your finances effectively is crucial. Budgeting is the key to achieving financial stability, and a printable budget worksheet can be an invaluable tool in this endeavor. Whether you’re struggling with overspending, debt accumulation, or simply want to gain control of your finances, this guide will provide you with all the information you need to create a successful budget using a free printable budget worksheet PDF.

This comprehensive guide will delve into the essential features of an effective budget worksheet, the benefits of using a free printable PDF, and step-by-step instructions on how to use it. We’ll also provide tips for creating a successful budget and additional resources to enhance your financial management skills.

Introduction

Sorted, budgeting is a sick way to keep your bread in check and a printable budget worksheet is like your secret weapon. It’s a banger that’ll help you sort out your dosh, so you can dodge the skint life and start saving for the peng tings you want.

Whether you’re balling on a budget or just wanna get your finances in order, a budget worksheet is the key. It’ll help you see where your cheddar’s going, so you can cut out the wasteful stuff and start stashing more cash.

Common Financial Challenges

Budgeting is the bomb for sorting out all sorts of financial dramas. It can help you:

- Dodge overspending and keep your cash under control.

- Pay off your debts quicker, so you can be debt-free and ballin’.

- Start saving for the future, whether it’s a new crib, a dope car, or just a rainy day.

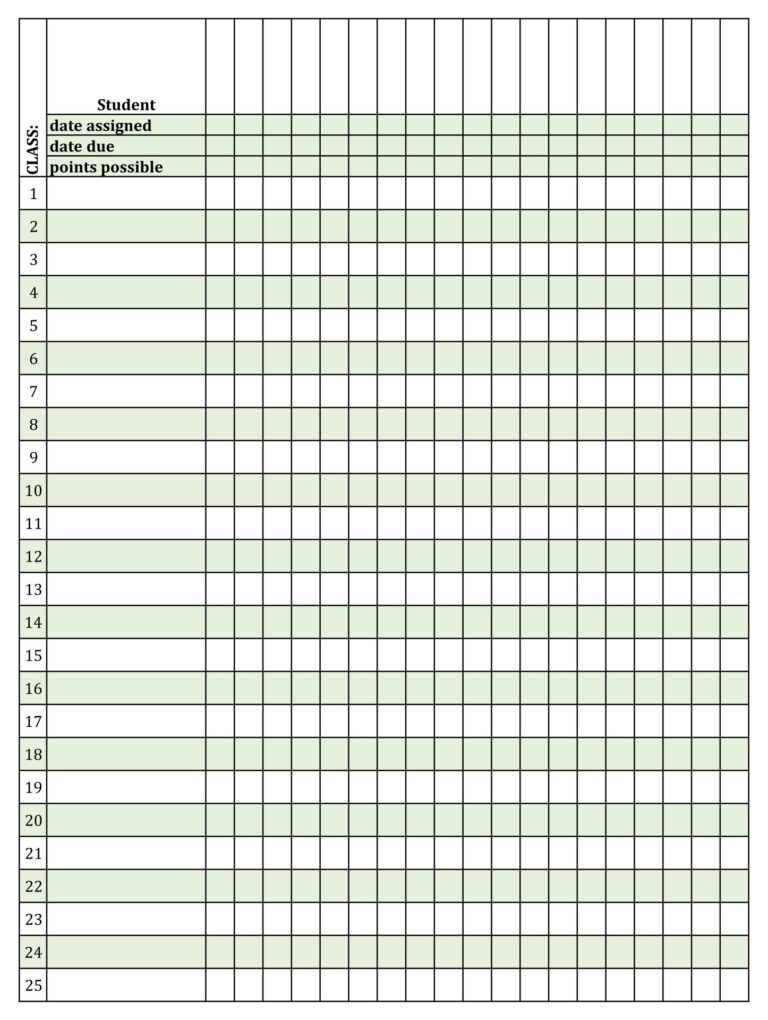

Features of an Effective Budget Worksheet

If you’re not a budgeting pro, finding a budget worksheet that meets your needs can be a bit of a mission. Here’s a rundown of the features you should be looking out for:

Customizable Categories

The best budget worksheets let you create categories that work for your spending habits. This way, you can track your spending in the areas that matter most to you, whether it’s groceries, entertainment, or travel.

Expense Tracking

A good budget worksheet will help you track your expenses, so you can see where your money is going. This is crucial for identifying areas where you can cut back and save more.

Income and Expense Summaries

An effective budget worksheet will provide summaries of your income and expenses. This gives you a quick and easy way to see how much money you’re bringing in and spending, so you can make adjustments as needed.

Financial Goals Sections

If you have any financial goals, such as saving for a down payment on a house or retiring early, a good budget worksheet will help you track your progress towards those goals.

Automated Calculations

Automated calculations can make budgeting a breeze. Look for a budget worksheet that automatically categorizes your expenses, calculates your balances, and updates your budget as you enter new transactions.

Free Printable Budget Worksheet PDF

Free printable budget worksheet PDFs are an excellent tool for individuals looking to manage their finances effectively. They offer numerous advantages, including:

Accessibility

These worksheets are readily available online, making them easily accessible to anyone with an internet connection. Individuals can download and print these worksheets at their convenience, without the need for special software or subscriptions.

Cost-effectiveness

Unlike paid budgeting apps or software, free printable budget worksheet PDFs are completely free to use. This makes them an ideal option for individuals who are on a tight budget or prefer not to spend money on budgeting tools.

Ease of customization

Free printable budget worksheet PDFs are typically customizable, allowing individuals to tailor them to their specific needs. They can add or remove categories, adjust the layout, and make other modifications to create a worksheet that works best for them.

How to Use a Budget Worksheet

Using a budget worksheet is a great way to take control of your finances and make sure you’re living within your means. Here’s a step-by-step guide on how to use a budget worksheet effectively:

Step 1: Fill Out Your Income and Expense Categories

The first step is to fill out your income and expense categories. This will give you a clear picture of where your money is coming from and where it’s going.

- For income, list all of the sources of money you have, such as your salary, wages, investments, and any other regular income.

- For expenses, list all of the things you spend money on, such as housing, food, transportation, entertainment, and debt repayment.

Step 2: Set Financial Goals

Once you have a clear picture of your income and expenses, you can start to set financial goals. What do you want to save for? A down payment on a house? A new car? Retirement?

Once you know what you’re saving for, you can start to create a plan to reach your goals.

Step 3: Track Your Progress

The final step is to track your progress. This will help you stay on track and make sure you’re reaching your financial goals.

There are a number of different ways to track your progress, such as using a budgeting app, a spreadsheet, or simply writing down your expenses in a notebook.

Tips for Creating a Successful Budget

Creating a budget can be daunting, but it’s a crucial step in taking control of your finances. Here are some tips and best practices to help you create a successful budget:

Setting Realistic Financial Goals

Start by setting clear and achievable financial goals. Whether you want to save for a down payment on a house, pay off debt, or simply get your spending under control, having a specific goal will give you something to strive for and help you stay motivated.

Prioritizing Expenses

Once you know what you’re working towards, it’s time to prioritize your expenses. Essential expenses, such as housing, food, and transportation, should come first. Non-essential expenses, such as entertainment and dining out, can be included in your budget, but they should be limited.

Reviewing the Budget Regularly

Your budget is not set in stone. As your income and expenses change, you’ll need to review and adjust your budget accordingly. Regular reviews will help you stay on track and make sure that your budget is still meeting your needs.

Sticking to the Budget

The hardest part of budgeting is sticking to it. There will be times when you’re tempted to spend more than you should. But if you stay disciplined and remind yourself of your financial goals, you’ll be more likely to stay on track.

Making Adjustments as Needed

Life is unpredictable, and your budget will need to be adjusted accordingly. If you lose your job, have a medical emergency, or experience any other unexpected financial changes, don’t be afraid to make adjustments to your budget. The important thing is to stay flexible and make sure that your budget is working for you.

Additional Resources

Budgeting and financial management are essential skills for individuals of all ages. There are numerous resources available to help you learn more about these topics and improve your financial well-being.

Online Courses

- Coursera offers a free course on Personal Finance from the University of Michigan.

- edX provides a range of courses on financial management, including Budgeting and Financial Planning.

Books

- “Broke Millennial” by Erin Lowry is a practical guide to budgeting and financial planning for young adults.

- “The Total Money Makeover” by Dave Ramsey is a comprehensive guide to getting out of debt and building wealth.

Financial Counseling Services

- The National Foundation for Credit Counseling (NFCC) offers free and confidential credit counseling services.

- The Consumer Financial Protection Bureau (CFPB) provides a list of reputable financial counseling agencies.

Free Budgeting Tools and Support

- Mint is a free budgeting app that helps you track your spending and create budgets.

- YNAB (You Need A Budget) is a paid budgeting software that provides a comprehensive set of tools for managing your finances.

Answers to Common Questions

Q: Where can I find a reputable source to download a free printable budget worksheet PDF?

A: Reputable sources for free printable budget worksheet PDFs include financial institutions, non-profit organizations, and government agencies. Some examples include Bank of America, the National Endowment for Financial Education, and the U.S. Department of the Treasury.

Q: How often should I review and update my budget?

A: It’s recommended to review your budget at least once a month. This will allow you to track your progress, identify areas where adjustments are needed, and ensure that your budget remains aligned with your financial goals.

Q: What are some tips for sticking to my budget?

A: To stick to your budget, set realistic financial goals, prioritize expenses, and avoid impulse purchases. Additionally, track your spending regularly to identify areas where you can cut back and make adjustments as needed.