Printable Budget Worksheet Dave Ramsey: A Comprehensive Guide to Financial Freedom

Dave Ramsey’s revolutionary budgeting method has empowered millions to take control of their finances and achieve financial freedom. At the core of this method is the Printable Budget Worksheet, a simple yet powerful tool that helps you create a roadmap for your money. In this comprehensive guide, we will delve into the principles of Dave Ramsey’s budgeting philosophy, provide step-by-step instructions on creating a printable budget worksheet, and explore its numerous benefits.

Whether you’re struggling to make ends meet or simply want to optimize your financial health, this guide will equip you with the knowledge and tools to transform your financial future. Let’s embark on a journey towards financial freedom, one printable budget worksheet at a time.

Dave Ramsey’s Budgeting Philosophy

Dave Ramsey is a renowned financial expert who advocates for a practical and effective budgeting method. His approach emphasizes financial responsibility, discipline, and a commitment to getting out of debt.

Ramsey’s budgeting philosophy is based on several key principles:

Establishing a Zero-Based Budget

A zero-based budget ensures that every pound earned is accounted for and allocated to specific categories. This means there is no surplus or deficit at the end of the month.

To create a zero-based budget, you need to:

- List all sources of income.

- Categorize expenses into essential (needs) and non-essential (wants).

- Allocate every pound to a specific category, ensuring that the total expenses equal the total income.

Prioritizing Essential Expenses

Ramsey emphasizes the importance of prioritizing essential expenses, such as housing, food, transportation, and utilities. These expenses should be covered first before allocating funds to non-essential categories.

By focusing on essential expenses, you can ensure that your basic needs are met while working towards financial stability.

Reducing Non-Essential Expenses

Ramsey encourages reducing non-essential expenses to free up funds for essential expenses and debt repayment. This may involve cutting back on unnecessary purchases, entertainment, or dining out.

By being mindful of non-essential expenses, you can create more financial flexibility and reach your financial goals faster.

Paying Off Debt Aggressively

Ramsey believes in paying off debt aggressively using the “debt snowball” method. This involves focusing on paying off the smallest debt first, while making minimum payments on other debts.

By paying off debts one at a time, you can build momentum and gain a sense of accomplishment, which can motivate you to continue paying off debt.

Creating a Printable Budget Worksheet

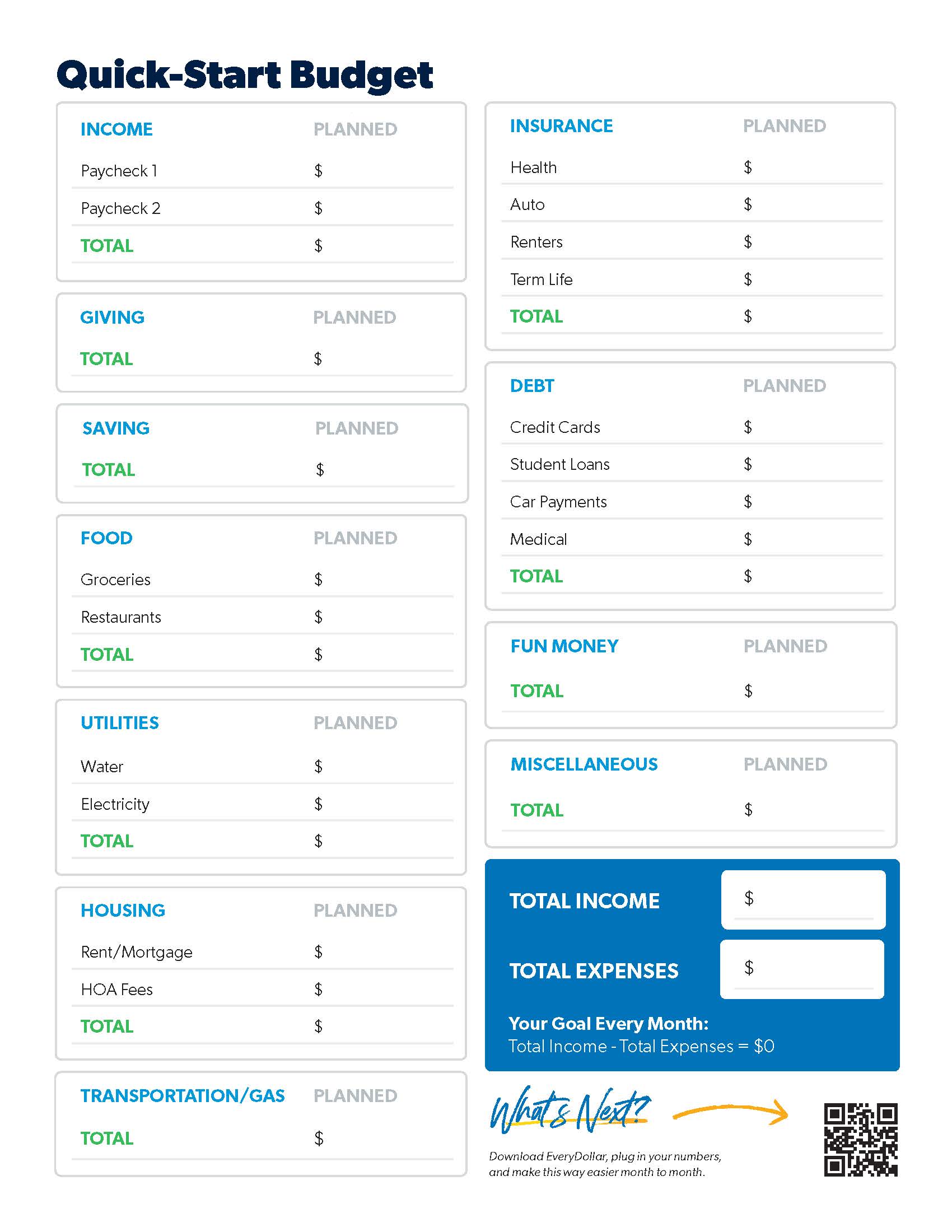

Design a printable budget worksheet that aligns with Dave Ramsey’s budgeting philosophy. Include sections for income, expenses, and savings.

The worksheet should be easy to use and track your financial progress. It should also help you identify areas where you can save money.

Income

The income section should include all of your sources of income. This can include wages, salaries, tips, and any other forms of income.

- List your income sources

- Enter the amount of income you receive from each source

Expenses

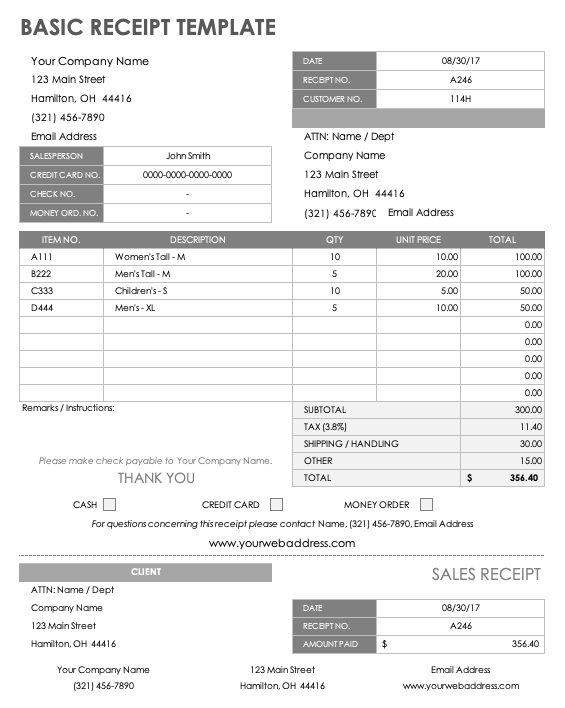

The expenses section should include all of your fixed and variable expenses. Fixed expenses are those that stay the same each month, such as rent or mortgage payments. Variable expenses are those that can change each month, such as groceries or gas.

- List your fixed expenses

- Enter the amount of each fixed expense

- List your variable expenses

- Enter the amount of each variable expense

Savings

The savings section should include all of your savings goals. This can include saving for a down payment on a house, a new car, or retirement.

- List your savings goals

- Enter the amount you want to save for each goal

Using the Budget Worksheet

The printable budget worksheet is a crucial tool for managing your finances effectively. It helps you track your income and expenses, identify areas where you can save, and stay on top of your financial goals.

To use the worksheet effectively, follow these tips:

Tracking Expenses

Record every expense, no matter how small. This includes everything from rent and groceries to entertainment and transportation.

- Use a notebook, spreadsheet, or budgeting app to keep track of your expenses.

- Categorize your expenses into different categories (e.g., housing, food, entertainment).

- Review your expenses regularly to identify areas where you can cut back.

Categorizing Transactions

Categorizing your expenses is essential for understanding your spending habits and identifying areas where you can save.

- Create a list of categories that are relevant to your lifestyle.

- Assign each expense to a specific category.

- Use different colors or symbols to represent different categories.

Staying on Track

Staying on track with your budget requires discipline and consistency.

- Review your budget regularly (e.g., weekly or monthly).

- Make adjustments as needed based on your actual spending.

- Don’t be afraid to ask for help from a financial advisor or counselor if you need it.

Benefits of Printable Budget Worksheets

Yo, check it, using a printable budget worksheet is like having a sick roadmap for your dough. Unlike digital or spreadsheet stuff, it’s right there in your face, making you accountable for every quid you spend.

With a printable budget, you can see exactly where your cash is going, so you can make boss moves to control your spending. It’s like having a personal money manager, but way cheaper.

Accountability and Organization

Printable budget worksheets force you to confront your spending habits head-on. By writing down every penny you spend, you can’t hide from the truth. It’s like having a mirror for your finances, showing you exactly what you need to change.

Plus, it’s super organized. No more fumbling through receipts or trying to remember what you bought last week. Everything’s right there in one place, making it a breeze to track your spending and spot any dodgy areas.

Printable Budget Worksheet Templates

Printable budget worksheet templates are a handy tool for organizing and tracking your finances. These templates can be easily downloaded and used to create a customized budget that meets your specific needs.

There are many different printable budget worksheet templates available online, so you can find one that fits your style and budget. Some templates are designed for specific income levels, household sizes, or financial goals. Others are more general and can be used by anyone.

Design and Features

When choosing a printable budget worksheet template, there are a few things to keep in mind:

- Simplicity: The template should be easy to understand and use. Avoid templates with complex formulas or jargon.

- Customization: The template should allow you to customize it to fit your needs. This includes being able to add or remove categories, change the layout, and adjust the amounts.

- Flexibility: The template should be flexible enough to accommodate your changing financial situation. This means being able to track multiple income streams and expenses, and adjust the budget as needed.

Creating a Printable Budget Worksheet

Once you have chosen a printable budget worksheet template, you can start creating your budget. Here are a few tips:

- Start with your income: List all of your income sources and the amount you earn from each source.

- Categorize your expenses: Divide your expenses into categories, such as housing, food, transportation, and entertainment.

- Estimate your expenses: For each category, estimate how much you spend each month. Be as accurate as possible.

- Subtract expenses from income: Subtract your total expenses from your total income. This will give you your net income.

- Adjust your budget: If your net income is negative, you will need to adjust your budget. This may mean cutting back on expenses or finding ways to increase your income.

Customization and Personalization

You can modify your budget worksheet to meet your specific needs. This may include adding notes, reminders, or even creating your own expense categories.

For instance, if you have a particular financial goal, such as saving for a down payment on a house, you can add a specific line item for that goal to your budget.

Notes and Reminders

- Add notes to remind yourself of important dates, such as when bills are due or when you receive your paycheck.

- Include reminders for yourself to review your budget regularly and make adjustments as needed.

Expense Categories

- Create custom expense categories that are specific to your lifestyle and spending habits.

- For example, if you have a pet, you could create a category for pet expenses.

Integration with Other Budgeting Tools

The printable budget worksheet can be easily integrated with other budgeting tools, such as apps or online platforms, to enhance your budgeting experience. By combining the convenience of a physical worksheet with the digital capabilities of these tools, you can streamline your budgeting process and gain a more comprehensive view of your finances.

For example, you can use a budgeting app to track your daily expenses and automatically categorize them. You can then export this data into your printable budget worksheet to create a monthly budget. This allows you to easily see where your money is going and make adjustments as needed.

Benefits of Combining Different Methods

- Enhanced accuracy: By using multiple budgeting tools, you can cross-check your data and reduce the chances of errors.

- Comprehensive view: Combining different methods gives you a more holistic view of your finances, allowing you to identify areas for improvement.

- Increased flexibility: You can tailor your budgeting approach to your individual needs and preferences by using a combination of tools.

Success Stories and Testimonials

Countless individuals have achieved financial freedom by implementing Dave Ramsey’s budgeting principles. Their success stories serve as a testament to the effectiveness of the printable budget worksheet.

Users have reported experiencing significant improvements in their financial situations, including:

Reduced Debt

- Eliminating credit card balances and other high-interest debts.

- Accelerating mortgage payments and paying off homes faster.

Increased Savings

- Building emergency funds and achieving financial stability.

- Investing for retirement and long-term goals.

Improved Financial Habits

- Gaining control over spending and avoiding impulse purchases.

- Making informed financial decisions and avoiding costly mistakes.

Questions and Answers

What is the main principle behind Dave Ramsey’s budgeting method?

Dave Ramsey’s budgeting method emphasizes the importance of living on a written budget, paying off debt using the debt snowball method, building an emergency fund, and investing for the future.

How do I create a Printable Budget Worksheet?

To create a Printable Budget Worksheet, you need to list your income, expenses, and savings goals. Divide your expenses into fixed expenses (e.g., rent, mortgage) and variable expenses (e.g., groceries, entertainment). Allocate your income to each category, ensuring that your expenses do not exceed your income.

What are the benefits of using a Printable Budget Worksheet?

Printable Budget Worksheets promote accountability, organization, and control over your finances. They provide a tangible representation of your financial situation, making it easier to track your progress and stay on track.

Can I customize the Printable Budget Worksheet?

Yes, you can customize the Printable Budget Worksheet to meet your specific needs. Add notes, reminders, and specific expense categories to tailor it to your financial situation and goals.

How can I integrate the Printable Budget Worksheet with other budgeting tools?

You can integrate the Printable Budget Worksheet with budgeting apps or online platforms to enhance your budgeting process. This allows you to track your expenses digitally while still having a physical record of your budget.