Printable Budget Tracker for Families: A Guide to Financial Success

Managing finances as a family can be a daunting task. With the ever-increasing cost of living, it’s more important than ever to have a solid budget in place. A printable budget tracker can be an invaluable tool for families looking to take control of their finances and achieve their financial goals.

In this comprehensive guide, we’ll explore the essential features of an effective printable budget tracker, provide tips on how to customize it to suit your family’s needs, and discuss the numerous benefits of using one. Whether you’re a seasoned budgeter or just starting out, this guide will provide you with the knowledge and tools you need to create a budget that works for your family.

Understanding Family Budgeting Needs

Budgeting is a crucial aspect of family life, helping families manage their finances effectively and plan for the future. However, budgeting for families can be challenging, especially considering the unique financial responsibilities and expenses associated with raising children.

Families with children face various financial considerations, such as childcare costs, education expenses, and extracurricular activities. These expenses can put a significant strain on a family’s budget, making it essential to have a comprehensive budgeting plan in place.

Financial Considerations for Families

- Childcare: Childcare expenses can be a significant portion of a family’s budget, especially for families with young children. The cost of childcare varies depending on the type of care (e.g., daycare, nanny, babysitter) and the location.

- Education: Education expenses include tuition fees, school supplies, uniforms, and other related costs. These expenses can be substantial, particularly for families with children attending private schools or universities.

- Extracurricular Activities: Extracurricular activities, such as sports, music lessons, and clubs, can provide valuable experiences for children. However, these activities can also add to a family’s expenses.

- Healthcare: Healthcare costs for children include doctor’s visits, vaccinations, and any necessary medical treatments. These expenses can be unpredictable and can put a strain on a family’s budget.

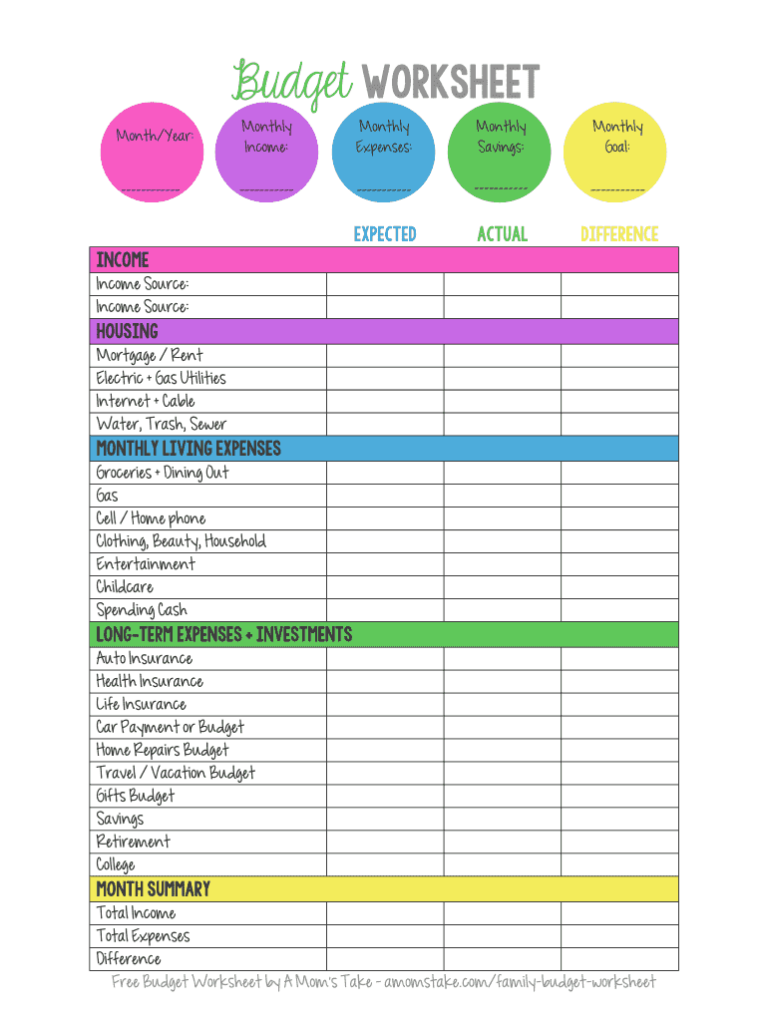

Features of an Effective Printable Budget Tracker

A printable budget tracker for families should include specific features to meet their unique budgeting needs. These features should provide a comprehensive and user-friendly tool for managing household finances.

Essential features include:

Categories and Subcategories

A well-organized budget tracker should include categories and subcategories to help families allocate their income effectively. Categories could include housing, transportation, food, and entertainment. Subcategories within each category, such as rent, mortgage, car payments, and fuel, provide a more detailed view of expenses.

Tracking Methods

Budget trackers should offer various tracking methods to accommodate different family preferences. These methods could include:

- Manual Tracking: Families can manually record expenses in a physical notebook or spreadsheet.

- App-Based Tracking: Mobile apps can simplify expense tracking and provide automated features.

- Bank Integration: Some trackers connect to bank accounts to automatically import transactions.

Designing a User-Friendly Tracker

Creating a budget tracker that’s easy on the eyes and a breeze to use is key. Visual appeal and simplicity go hand in hand in making your tracker a joy to work with.

Start by picking colors that are pleasing to the eye and won’t make you want to tear your hair out. Think soft pastels or calming blues. Avoid bright neon colors that’ll give you a headache after five minutes.

Choosing Fonts and Layout

Fonts matter too. Stick to clear, easy-to-read fonts like Arial or Helvetica. Avoid fancy fonts that are hard to decipher. As for layout, keep it clean and organized. Use headings, subheadings, and bullet points to break up the text and make it easy to skim.

Customizing the Tracker for Specific Needs

Families come in all shapes and sizes, with unique financial circumstances and goals. To ensure the printable budget tracker effectively meets your specific needs, customization is key. Here’s how you can tailor it to your family’s situation:

Adding or Removing Categories

The tracker may include pre-defined categories, but you can add or remove categories to reflect your family’s unique spending patterns. For instance, if you have a child in daycare, you might want to add a “Childcare” category. Conversely, if a category is irrelevant to your family, simply delete it.

Adjusting Time Frames

The tracker may be set up for a monthly budget, but you can adjust the time frame to suit your needs. If you get paid weekly, you might want to create a weekly budget. Alternatively, if you have a seasonal income, you might prefer a quarterly or annual budget.

Tracking Specific Financial Goals

The tracker can be used to track specific financial goals, such as saving for a down payment on a house or paying off debt. To do this, create a separate category for the goal and set a target amount. The tracker will then help you monitor your progress towards achieving your goal.

Utilizing the Tracker Effectively

To make the most of your printable budget tracker, consistency and effective use are key. Here are some tips to help you stay on track:

1. Make it a habit: Set aside a specific time each week or month to update your tracker. This will help you stay organized and avoid falling behind.

2. Review your progress regularly: Take some time to review your tracker each week or month. This will help you identify areas where you’re doing well and where you need to improve.

3. Be flexible: As your needs change, so will your budget. Don’t be afraid to adjust your tracker as needed to make sure it’s still working for you.

4. Share your tracker: If you’re sharing your finances with a partner or family member, it’s a good idea to share your tracker with them. This will help everyone stay on the same page and make financial decisions together.

Benefits of Printable Budget Trackers for Families

Printable budget trackers offer families numerous advantages. They enhance financial literacy, reduce stress, and boost savings.

Increased Financial Awareness

Tracking expenses and income provides a clear picture of cash flow. Families can identify areas where they overspend and make informed decisions about their finances.

Reduced Stress

Budgeting eliminates financial uncertainty and anxiety. Families know where their money is going and can plan for unexpected expenses, reducing stress levels.

Increased Savings

By identifying unnecessary expenses, families can allocate more funds towards savings. Over time, this can lead to substantial financial gains.

Real-Life Example

The Smith family implemented a printable budget tracker and reduced their dining-out expenses by 25%. They also discovered a subscription they no longer used, saving them £50 per month.

Additional Resources and Support

Families looking to improve their budgeting practices can access a range of resources and support. These include websites, books, and online forums that provide guidance and assistance on budgeting and financial management.

Online Resources

There are numerous websites that offer budgeting tools, tips, and advice. Some popular options include:

– MoneySavingExpert.com: A comprehensive website that covers all aspects of personal finance, including budgeting, saving, and investing.

– Which.co.uk: A consumer rights organization that provides independent advice on a range of topics, including budgeting and money management.

– CitizensAdvice.org.uk: A charity that offers free, confidential advice on a range of issues, including debt and budgeting.

Books

There are also several books available that can help families with budgeting. Some recommended titles include:

– “The Complete Tightwad Gazette” by Amy Dacyczyn: A classic guide to frugal living and budgeting.

– “Broke Millennial” by Erin Lowry: A practical guide to budgeting and financial planning for young adults.

– “The Budget Kit” by The Budget Mom: A comprehensive guide to creating a budget that works for your family.

Online Forums

Online forums can be a valuable source of support and advice for families looking to improve their budgeting practices. Some popular forums include:

– MoneySavingExpert Forum: A large and active forum where users can share tips, ask questions, and get support on all aspects of personal finance.

– The Budget Mom Community: A forum dedicated to budgeting and financial planning for families.

– Reddit’s /r/personalfinance: A subreddit where users can discuss budgeting, investing, and other personal finance topics.

Frequently Asked Questions

What are the benefits of using a printable budget tracker?

Printable budget trackers offer numerous benefits for families, including improved financial awareness, reduced stress, and increased savings. By tracking your income and expenses, you can gain a clear understanding of your financial situation and make informed decisions about how to allocate your resources.

How do I customize a printable budget tracker?

You can customize a printable budget tracker to suit your family’s needs by adding or removing categories, adjusting time frames, and tracking specific financial goals. For example, if you have children, you might want to add categories for childcare, education, and extracurricular activities.

How often should I review my printable budget tracker?

It’s important to review your printable budget tracker regularly, at least once a month. This will help you stay on track with your financial goals and make adjustments as needed. You can also use your budget tracker to track your progress over time and see how your spending habits are changing.