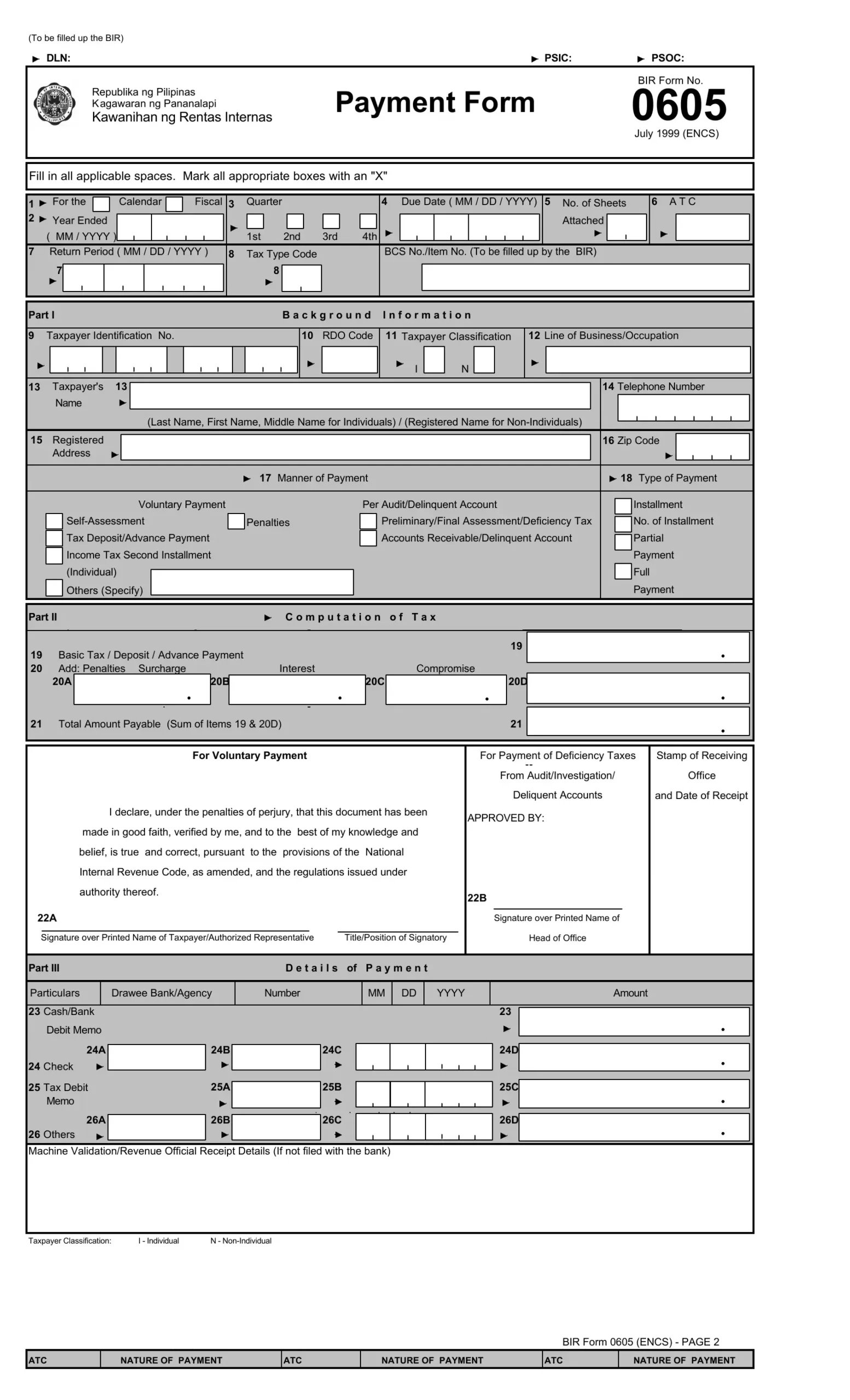

Printable BIR Form 0605: A Comprehensive Guide to Its Uses and Benefits

Navigating the complexities of tax filing can be daunting, but understanding the purpose and significance of essential forms like the Printable BIR Form 0605 can make the process more manageable. This form serves as a crucial tool for taxpayers, providing a structured and efficient way to fulfill their tax obligations. In this comprehensive guide, we will delve into the details of Printable BIR Form 0605, exploring its purpose, structure, and the advantages it offers.

The Printable BIR Form 0605, also known as the Certificate of Income Tax Withheld, is an indispensable document that plays a vital role in the Philippine taxation system. It serves as a record of the income tax withheld from an individual’s salary or other sources of income. Understanding the proper completion and submission of this form is essential for ensuring compliance with tax regulations and avoiding potential penalties.

Introduction

Yo, listen up, fam! Printable Bir Form 0605 is the real deal when it comes to sorting out your tax situation. It’s like a magic wand that helps you get your tax refund or credits sorted, no sweat.

This form is like a roadmap, guiding you through the process of claiming your hard-earned dough. It’s packed with all the essential info, like your income, expenses, and personal details. Plus, it’s easy as pie to fill out, even if you’re not a maths whizz.

Structure

The form is split into sections, like a boss. Each section has its own purpose, so you can easily find the info you need. It’s like a well-organized toolbox, with everything in its place.

Purpose and Uses

Printable Bir Form 0605 is a highly versatile form designed to serve a wide range of purposes in various contexts.

It’s primarily used for:

– Capturing and recording personal information, such as name, address, contact details, and date of birth.

– Gathering employment details, including job title, company name, and work history.

– Collecting educational qualifications, including degrees, diplomas, and certificates obtained.

– Documenting professional memberships and affiliations.

– Providing references and contact information for further verification.

Use in Different Contexts

This form finds applications in numerous settings, including:

– Job applications: Candidates use it to showcase their qualifications and experience to potential employers.

– Student registrations: Educational institutions utilize it to gather student information for enrollment and record-keeping.

– Membership applications: Organizations use it to collect details from individuals seeking to become members.

– Background checks: Employers and other entities may request it for verifying an individual’s identity and credentials.

– Personal record-keeping: Individuals can maintain a personal copy for future reference or use it to track their own achievements and progress.

Form Structure and Components

Printable Bir Form 0605 is designed with a clear and organized structure to facilitate easy completion and submission.

The form is divided into distinct sections, each containing specific information related to the birth registration process.

Key Components and Sections

The key components and sections of Printable Bir Form 0605 include:

| Section | Description |

|---|---|

| Header | Contains the form title, version number, and instructions for completion. |

| Personal Details | Collects information about the child’s parents, including their names, addresses, and occupations. |

| Birth Details | Records the date, time, and place of the child’s birth, as well as the attending healthcare professional. |

| Registration Details | Includes information about the registrar who registered the birth and the date of registration. |

| Additional Information | Provides space for any additional information or notes related to the birth registration. |

Completing and Submitting the Form

Yo, listen up! Completing and submitting this Bir Form 0605 is like a piece of cake, but here’s the lowdown on how to smash it.

Before you get started, grab a pen and paper or jump online to the Bir website. Once you’ve got your form sorted, follow these steps:

Filling Out the Form

First things first, fill in your personal deets like your name, address, and date of birth. Make sure it’s all correct, cuz you don’t want any mix-ups.

Next up, you’ll need to provide info about the person who’s passed away. This includes their name, date of death, and where they lived.

After that, you’ll be asked about the informant. That’s basically the person who’s giving all this info. It can be you or someone else who knows the deceased well.

Finally, sign and date the form. This is your way of saying that everything you’ve written is true and correct.

Submitting the Form

Once you’ve filled out the form, you can either mail it or submit it online. If you’re mailing it, use the address on the form.

If you’re submitting it online, head to the Bir website and follow the instructions. It’s usually pretty straightforward, but if you get stuck, there’s a help section you can check out.

Tips and Tricks

- Make sure you fill out the form completely and accurately. Any missing or incorrect information can delay the process.

- If you’re not sure about something, don’t guess. Contact the Bir for help.

- Keep a copy of the completed form for your records.

Benefits and Advantages

Printable Bir Form 0605 offers a myriad of advantages that make it a valuable tool for various purposes.

By utilizing this form, individuals can streamline processes, enhance efficiency, and accomplish their objectives effortlessly.

Simplified Processes

The form’s user-friendly design simplifies complex processes, making them accessible to individuals of all backgrounds.

Its clear instructions and organized structure guide users through each step, ensuring accuracy and minimizing errors.

Improved Efficiency

The form eliminates the need for manual data entry and reduces the risk of human error, leading to increased efficiency.

Its digital format allows for quick and easy sharing, collaboration, and storage, saving valuable time and resources.

Achieved Goals

Numerous individuals have utilized Printable Bir Form 0605 to successfully achieve their goals.

- Business owners have used the form to streamline their hiring processes, saving time and improving candidate quality.

- Students have used the form to apply for scholarships and grants, increasing their chances of financial assistance.

- Individuals have used the form to request official documents, such as birth certificates and passports, with ease and convenience.

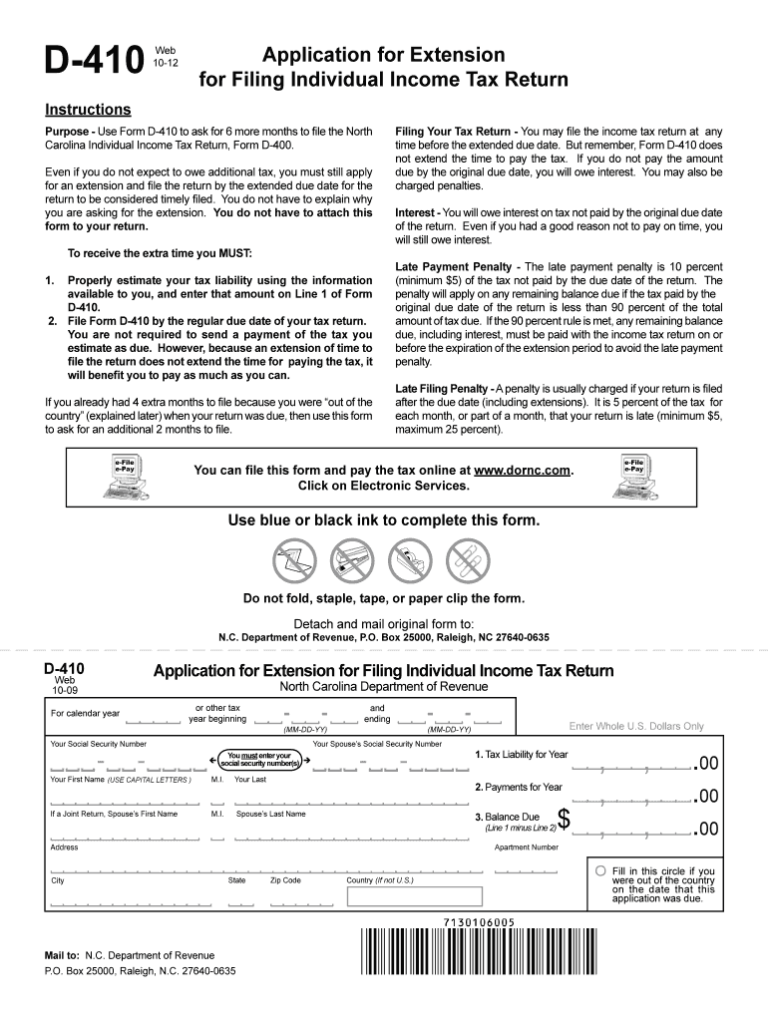

Related Forms and Resources

Printable BIR Form 0605 is part of a larger system of tax forms and resources provided by the Bureau of Internal Revenue (BIR) in the Philippines. There are several related forms and resources that can be useful for taxpayers who need to file and submit BIR Form 0605.

The following is a list of related forms and resources that are associated with Printable BIR Form 0605:

BIR Website

- The BIR website provides a wealth of information and resources for taxpayers, including downloadable forms, guides, and FAQs. Taxpayers can also access the BIR’s online filing system, eBIRForms, through the website.

- BIR website

BIR Regional Offices

- The BIR has regional offices located throughout the Philippines. Taxpayers can visit these offices to get assistance with filing and submitting BIR Form 0605, as well as other tax-related matters.

- BIR Regional Offices

Tax Preparers

- Tax preparers can assist taxpayers with preparing and filing BIR Form 0605. Tax preparers are typically accountants or other professionals who are familiar with the tax code and can help taxpayers ensure that their forms are filed correctly.

- List of Accredited Tax Preparers

Tax Software

- There are a number of tax software programs available that can help taxpayers prepare and file BIR Form 0605. These programs can save taxpayers time and hassle, and can help ensure that their forms are filed correctly.

- List of Accredited Tax Software

Q&A

What is the purpose of the Printable BIR Form 0605?

The Printable BIR Form 0605 serves as a record of the income tax withheld from an individual’s salary or other sources of income. It is used to declare and certify the amount of tax withheld during a specific period, typically a calendar year.

Who is required to file the Printable BIR Form 0605?

Individuals who have received income subject to withholding tax are required to file the Printable BIR Form 0605. This includes employees, freelancers, and individuals receiving income from investments or other sources.

What information is required on the Printable BIR Form 0605?

The Printable BIR Form 0605 requires information such as the taxpayer’s personal details, income details, and the amount of tax withheld. It also includes sections for the employer or withholding agent to provide their information.

When is the deadline for filing the Printable BIR Form 0605?

The deadline for filing the Printable BIR Form 0605 is typically April 15th of each year. However, it is advisable to check with the Bureau of Internal Revenue (BIR) for any updates or changes to the filing deadline.

What are the consequences of not filing the Printable BIR Form 0605?

Failure to file the Printable BIR Form 0605 may result in penalties and surcharges imposed by the BIR. It is important to file the form on time to avoid any potential legal consequences.