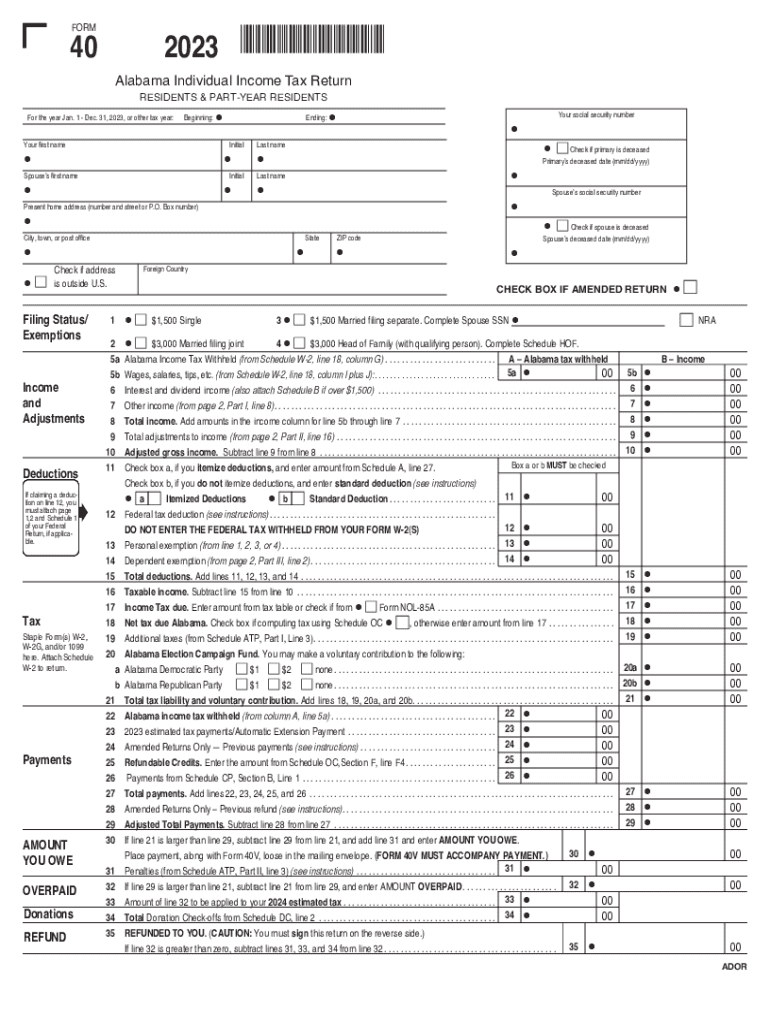

Printable Alabama Form 40 2023: A Comprehensive Guide to Filing

Navigating tax season can be a daunting task, but understanding and completing the necessary forms is crucial for fulfilling your tax obligations. Among these essential documents is the Alabama Form 40, a vital component in reporting your state income taxes accurately. This guide will delve into the intricacies of Printable Alabama Form 40 2023, providing a comprehensive overview of its purpose, accessibility, and completion process.

The Alabama Form 40 is an official document used by Alabama residents to file their state income tax returns. It captures crucial financial information, including income, deductions, and credits, to determine the amount of tax owed or refund due. Understanding the significance of this form empowers you to fulfill your tax responsibilities efficiently and avoid potential penalties.

Alabama Form 40 2023 Overview

Alabama Form 40 is a tax return form used by individuals to file their state income taxes. It is a comprehensive form that requires taxpayers to report their income, deductions, and credits. Filing Form 40 is mandatory for all Alabama residents who have a filing requirement under the Alabama state income tax laws. The form is typically due on April 15th of each year, unless an extension is granted.

Who Needs to File Form 40?

All Alabama residents who meet any of the following criteria are required to file Form 40:

- You have a taxable income of $1,000 or more.

- You are self-employed and have a net profit of $400 or more.

- You received unemployment benefits during the year.

- You had income from a rental property or business.

- You received a Form 1099-MISC showing income of $600 or more.

Printable Form 40

You can download and print Form 40 from the Alabama Department of Revenue website. Here are the steps:

Step 1: Access the Form 40 webpage

Go to the Alabama Department of Revenue website (https://revenue.alabama.gov/) and click on the “Forms” tab. Then, select “Individual Income Tax” from the drop-down menu and click on “Form 40.”

Step 2: Download the Form 40 PDF

On the Form 40 webpage, click on the “Download Form 40 PDF” link. The PDF file will be downloaded to your computer.

Step 3: Print the Form 40

Once the PDF file is downloaded, open it in a PDF viewer like Adobe Acrobat Reader. Click on the “Print” icon or go to the “File” menu and select “Print.” Make sure to select the correct printer and paper size.

Potential Challenges and Errors

There are a few potential challenges or errors that may arise during the printing process:

- Printer issues: Make sure your printer is connected properly and has enough ink or toner.

- Paper size: Ensure that the paper size you select in the print settings matches the size of the Form 40 PDF.

- PDF viewer issues: If you are unable to open or print the PDF file, try using a different PDF viewer or updating your current one.

Form 40 Filling s

Completing Form 40 accurately is crucial for a successful application. Here’s a breakdown of the sections and fields, along with guidance on filling them out.

Sections and Fields

- Section 1: Personal Information

– Provide your full name, address, contact details, and Social Security number. - Section 2: Income Information

– Report your total income from all sources, including wages, salaries, tips, and self-employment income. - Section 3: Dependents

– List the names, ages, and relationships of any dependents you claim. - Section 4: Filing Status

– Indicate your filing status, such as single, married filing jointly, or head of household. - Section 5: Credits

– Claim any applicable tax credits, such as the Earned Income Tax Credit or the Child Tax Credit. - Section 6: Payments and Refund

– Enter any tax payments you’ve made, including estimated tax payments and withholding from your paycheck.

– Indicate whether you want a refund or owe additional taxes.

Specific Requirements

- Use black or blue ink. Do not use pencils or other writing instruments that may smudge or fade.

- Write legibly. Make sure your handwriting is clear and easy to read.

- Provide all required information. Incomplete forms may delay processing or result in errors.

- Attach supporting documents. If you’re claiming any credits or deductions, you may need to provide supporting documentation, such as W-2 forms or receipts.

By following these guidelines, you can ensure that your Form 40 is filled out accurately and submitted successfully.

Common Mistakes and Corrections

Innit bruv, filling out Form 40 can be a right pain in the neck. But don’t fret, I’ve got your back. Let’s chat about the common blunders people make and how to avoid them like the plague.

First off, don’t be a donut and leave sections blank. It’s like going to the chippy and not ordering chips – it just ain’t right. Make sure you fill in every single box that applies to you, even if it’s just to write “N/A”.

Secondly, don’t be a plonker and get your numbers mixed up. Double-check your calculations and make sure the figures you’re putting down are spot on. Even a tiny mistake can throw the whole thing out of whack.

Thirdly, don’t be a tit and forget to sign and date the form. It’s like sending a text without putting your name at the end – it’s just not valid. Make sure you sign and date it in the right spot, or it’s as good as toilet paper.

Lastly, don’t be a mug and send in an incomplete or incorrect form. The taxman won’t be best pleased, and you could end up with a right headache. So, take your time, fill it in properly, and make sure it’s all correct before you hit send.

Consequences of Incorrect Form 40

- The taxman might come knocking on your door, demanding an explanation.

- You could end up paying more tax than you should have.

- You might get a nasty fine or even a criminal record.

Form 40 Submission Options

Blud, you got a few ways to send off your Form 40, innit? Let’s break it down, bruv:

Online Submission

This is the easiest way, fam. Just hop on the Alabama Department of Revenue’s website, fill in your details, and hit that submit button. It’s a piece of cake.

Mail Submission

If you’re more of an old-school type, you can always send your Form 40 through the post. Just make sure you’ve filled it in properly and included all the right bits. Address it to:

Alabama Department of Revenue

P.O. Box 327460

Montgomery, AL 36132-7460

In-Person Submission

Fancy a face-to-face chat? You can hand in your Form 40 at any of the Alabama Department of Revenue’s local offices. Just check their website for the nearest one.

Remember, you need to submit your Form 40 by April 15th, so don’t be a tit and leave it to the last minute.

Form 40 Filing Assistance

Need a helping hand with your Form 40? Fret not, bruv! Here’s the lowdown on where to get some top-notch assistance.

The Alabama Department of Revenue is your go-to crew for any questions or issues you might have. Give ’em a buzz at (334) 242-1170 or drop them an email at [email protected]. They’re like the Form 40 hotline, ready to sort you out.

Online Tools and Guidance

If you’re more of a self-starter, there are some nifty online resources that can guide you through the Form 40 maze. Check out the Alabama Department of Revenue’s website for downloadable forms, instructions, and even an online filing option. It’s like having a virtual Form 40 guru at your fingertips.

Q&A

What is the deadline for filing Alabama Form 40?

The deadline to file Alabama Form 40 for the 2023 tax year is April 18, 2024.

Where can I find the Printable Alabama Form 40 2023?

You can access the Printable Alabama Form 40 2023 on the Alabama Department of Revenue website.

What are the common mistakes to avoid when filling out Alabama Form 40?

Common mistakes include mathematical errors, incorrect Social Security numbers, and missing or incomplete information. Carefully review your form before submitting it to avoid delays or errors in processing.

Can I file Alabama Form 40 electronically?

Yes, you can file Alabama Form 40 electronically through the Alabama Department of Revenue’s e-filing system.