Mastering Form 941: A Comprehensive Guide to Printable 941 Form 2024

Navigating the complexities of tax forms can be a daunting task, but Form 941 stands out as a crucial document for businesses and individuals alike. In this comprehensive guide, we delve into the intricacies of the Printable 941 Form 2024, empowering you with the knowledge and tools to complete it accurately and efficiently.

As we explore the essential components, filing requirements, and potential pitfalls associated with Form 941, you’ll gain a deeper understanding of its significance and how it impacts your tax obligations. Let’s embark on this journey together, ensuring that your Form 941 submission is seamless and compliant.

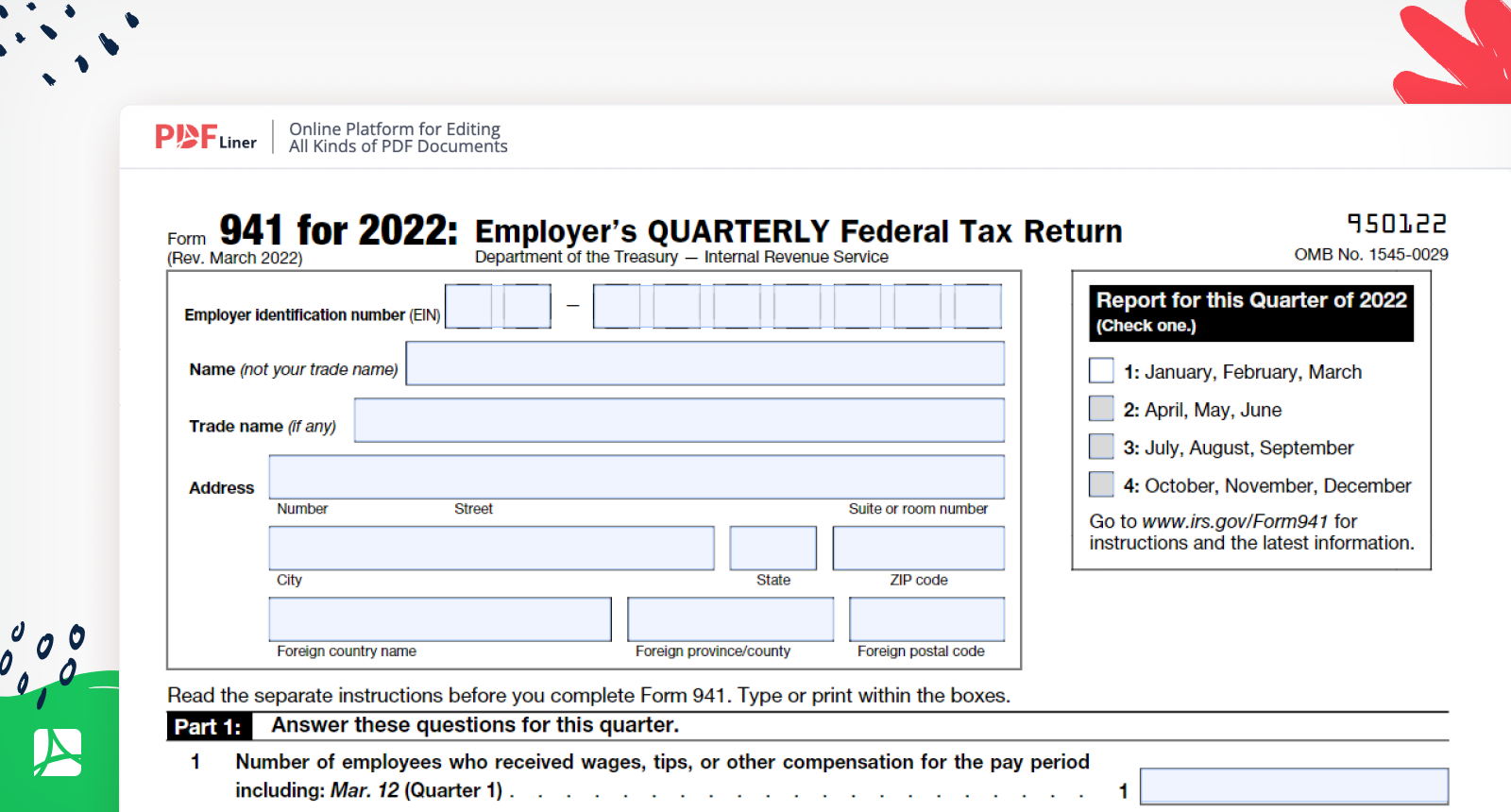

Definition and Overview

Form 941 is a quarterly tax return used by employers to report their federal income tax, Social Security tax, and Medicare tax liabilities. It’s a crucial document for businesses, as it ensures that the correct amount of taxes is paid to the government. The form is divided into several sections, including sections for reporting wages, tips, and other compensation; withholding taxes; and tax payments.

Who Must File Form 941?

All employers who pay wages to employees are required to file Form 941. This includes businesses of all sizes, from small businesses to large corporations. Employers are required to file Form 941 on a quarterly basis, even if they do not owe any taxes. The due dates for Form 941 are April 15, July 15, October 15, and January 15 of the following year.

s for Printable Form 941 (2024)

Filling out the printable Form 941 can be a daunting task, but with a step-by-step guide and some helpful tips, you can complete it accurately and efficiently. This guide will walk you through each line item and calculation, providing detailed instructions and best practices to ensure your form is submitted correctly.

Step 1: Gather Your Information

Before you start filling out the form, gather all the necessary information, including:

- Your employer identification number (EIN)

- Your business name and address

- The tax period covered by the form

- Your total wages and tips paid

- Your total taxable wages and tips

- Your total taxes withheld

Step 2: Complete the Header Information

Start by filling out the header information at the top of the form, including your EIN, business name, address, and the tax period covered by the form.

Step 3: Calculate Your Taxes

The next step is to calculate your taxes. Use the following formulas to calculate your:

- Social Security tax: Multiply your total taxable wages by 12.4%

- Medicare tax: Multiply your total taxable wages by 2.9%

- Federal income tax: Use the tax tables provided in the form instructions to calculate your federal income tax based on your total taxable wages and withholding allowances.

Step 4: Fill Out the Line Items

Once you have calculated your taxes, fill out the line items on the form. These line items include:

- Line 1: Total wages and tips

- Line 2: Total taxable wages and tips

- Line 3: Total taxes withheld

- Line 4: Total tax liability

- Line 5: Total amount due or refund

Step 5: Sign and Submit the Form

Once you have completed all the line items, sign and date the form. Mail the completed form to the address provided in the form instructions.

Tips for Accurate Completion

- Use a calculator to ensure accuracy.

- Double-check your calculations before submitting the form.

- Keep a copy of the completed form for your records.

- If you have any questions, contact the IRS for assistance.

By following these steps and using the tips provided, you can complete the printable Form 941 (2024) accurately and efficiently.

Common Errors and Troubleshooting

Completing Form 941 can be a breeze, but it’s always good to be aware of the potential pitfalls. Here’s a heads-up on some common errors and how to dodge ’em like a pro:

First up, make sure you’ve got the right form. Form 941 has a different version for each year, so double-check you’re using the one for 2024.

Next, take your time filling in the form. Rushing through can lead to silly mistakes like misplacing decimal points or entering incorrect numbers. It’s better to take it slow and steady and get it right the first time.

Another common error is forgetting to sign the form. Without your signature, it’s not valid, so don’t forget to put pen to paper before you send it off.

If you’re still having trouble, don’t fret. There are plenty of resources available to help you out.

Frequently Asked Questions

Got a burning question about Form 941? Here are some of the most frequently asked questions and their answers:

- When is Form 941 due? It’s due by the last day of the month following the quarter you’re reporting for.

- Where do I send Form 941? The address depends on your location. Check the IRS website for the correct address.

- What if I make a mistake on Form 941? Don’t panic! Just make the necessary corrections and file an amended return.

If you can’t find the answer to your question here, don’t hesitate to reach out to the IRS for help. They’re always happy to lend a hand.

Support Resources

Need some extra guidance? Here are some helpful resources:

- IRS website: The IRS website has a wealth of information on Form 941, including instructions, FAQs, and helpful tips.

- IRS helpline: You can call the IRS helpline at 1-800-829-1040 for assistance with Form 941.

- Tax professionals: If you’re still struggling, you can always seek the help of a tax professional.

With these resources at your fingertips, you’ll be able to tackle Form 941 with confidence and avoid any unnecessary headaches.

Additional Resources and Considerations

Related Forms and Documents

Filing Form 941 requires knowledge of other forms and documents to ensure accuracy and completeness. These include:

- Form W-2, Wage and Tax Statement

- Form 1099-MISC, Miscellaneous Income

- Schedule C, Profit or Loss from Business

Electronic Filing

The IRS strongly encourages electronic filing for Form 941, as it offers several benefits:

- Faster processing and reduced risk of errors

- Access to online payment options

- Automatic calculation of penalties and interest

IRS Deadlines and Penalties

Timely filing of Form 941 is crucial to avoid penalties. The due date for each quarter is as follows:

- 1st Quarter (January – March): April 15th

- 2nd Quarter (April – June): July 15th

- 3rd Quarter (July – September): October 15th

- 4th Quarter (October – December): January 31st

Failure to file on time can result in penalties and interest charges.

Sample Form and Case Studies

This section provides a sample printable Form 941 (2024) with annotations, along with case studies to demonstrate the practical application of the form. A table or infographic comparing the printable and electronic versions of Form 941 is also included.

Sample Printable Form 941 (2024) with Annotations

The sample printable Form 941 (2024) with annotations highlights important fields and provides guidance on how to complete the form accurately. The annotations include explanations of each field, tips for avoiding common errors, and examples of how to fill in the information.

Case Studies

The case studies provide real-world examples of how Form 941 is used to report quarterly employment taxes. The case studies cover a variety of scenarios, including businesses with different sizes and structures, as well as businesses that have experienced changes in their employment status.

Comparison of Printable and Electronic Versions of Form 941

The table or infographic compares the printable and electronic versions of Form 941, highlighting the advantages and disadvantages of each version. The comparison includes factors such as ease of use, accuracy, and security.

Helpful Answers

What is the purpose of Form 941?

Form 941 is a quarterly tax return used to report federal income tax, Social Security tax, Medicare tax, and additional Medicare tax withheld from employees’ wages.

Who is required to file Form 941?

Businesses and individuals who have employees and are subject to federal income tax withholding are required to file Form 941.

What are the common errors associated with Form 941?

Common errors include incorrect calculations, missing information, and late filing. To avoid these errors, carefully review the instructions and seek professional assistance if needed.

What are the benefits of filing Form 941 electronically?

Electronic filing offers convenience, accuracy, and timely processing. It also reduces the risk of errors and ensures prompt delivery to the IRS.