Printable 8840 Form: A Comprehensive Guide to Filing

Navigating the complexities of tax filing can be a daunting task, especially when dealing with specialized forms like the 8840. This guide aims to simplify the process by providing a comprehensive overview of the Printable 8840 Form, empowering you to complete and file it with confidence.

The 8840 Form is an essential tool for taxpayers who need to report certain types of income and expenses. Understanding its purpose and the sections it encompasses is crucial for accurate filing. Additionally, having a printable version of the form offers convenience and flexibility, making it easier to prepare and submit your taxes on time.

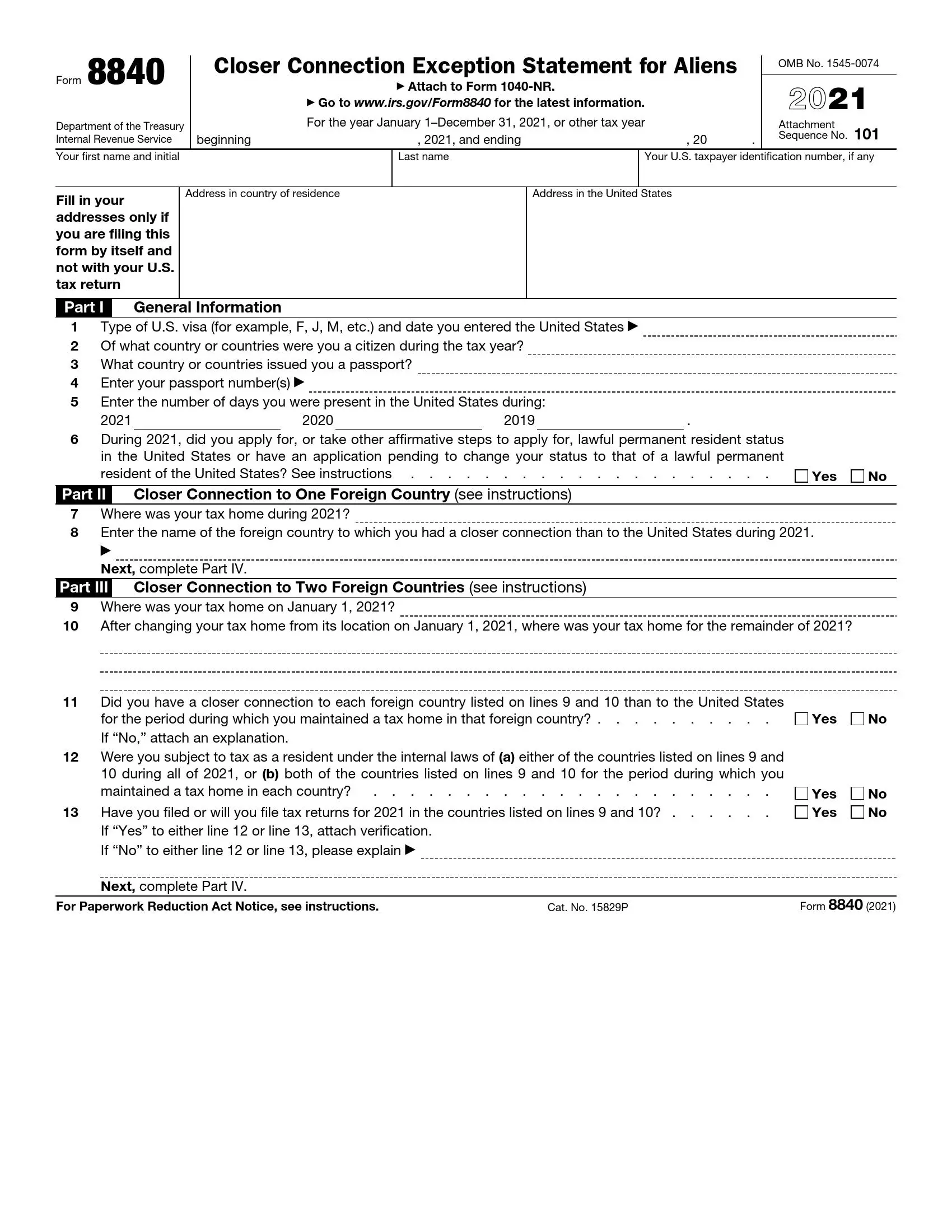

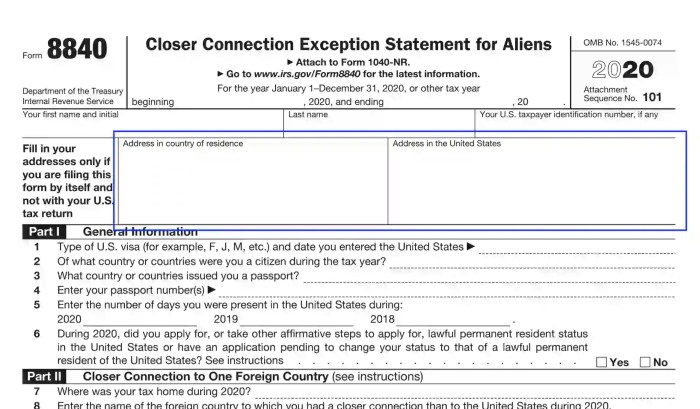

Form Overview

Form 8840, also known as the “Credit for Qualified Active Finacial Income Received by an Individual”, is a tax form used to report and claim the Qualified Active Finacial Income (QAFI) credit. This credit is available to individuals who receive certain types of active finacial income, such as dividends, interest, and royalties.

The purpose of Form 8840 is to calculate the amount of the QAFI credit that you are eligible to claim. The credit is calculated based on your taxable income and the amount of QAFI that you received during the tax year.

Sections Included in Form 8840

Form 8840 is divided into several sections, including:

- Section 1: Taxpayer Information

- Section 2: Active Finacial Income

- Section 3: Calculation of Credit

- Section 4: Other Information

Printable Form

Blud, having a paper version of Form 8840 is a right result. You can fill it in on your own time, innit? No need to be stressed about filling it in online or waiting for it to come in the post. Plus, you can keep a copy for your own records, which is always a good shout.

There are a few different ways you can get your hands on a printable copy of Form 8840. You can download it from the HMRC website, or you can order a copy by phone or post. If you’re downloading it from the website, just click on the link and follow the instructions. If you’re ordering it by phone or post, you’ll need to provide your name, address, and phone number.

How to Download and Print the Form

To download and print the form, follow these steps:

- Go to the HMRC website.

- Click on the “Forms and guidance” link.

- Type “Form 8840” into the search bar.

- Click on the link for the form.

- Click on the “Download” button.

- Select the format you want to download the form in (PDF or Word).

- Click on the “Save” button.

- Open the file and print it out.

Completing the Form

Filling out Form 8840 is a straightforward process that requires careful attention to detail. This guide will provide a step-by-step walkthrough of each section, ensuring you complete the form accurately and efficiently.

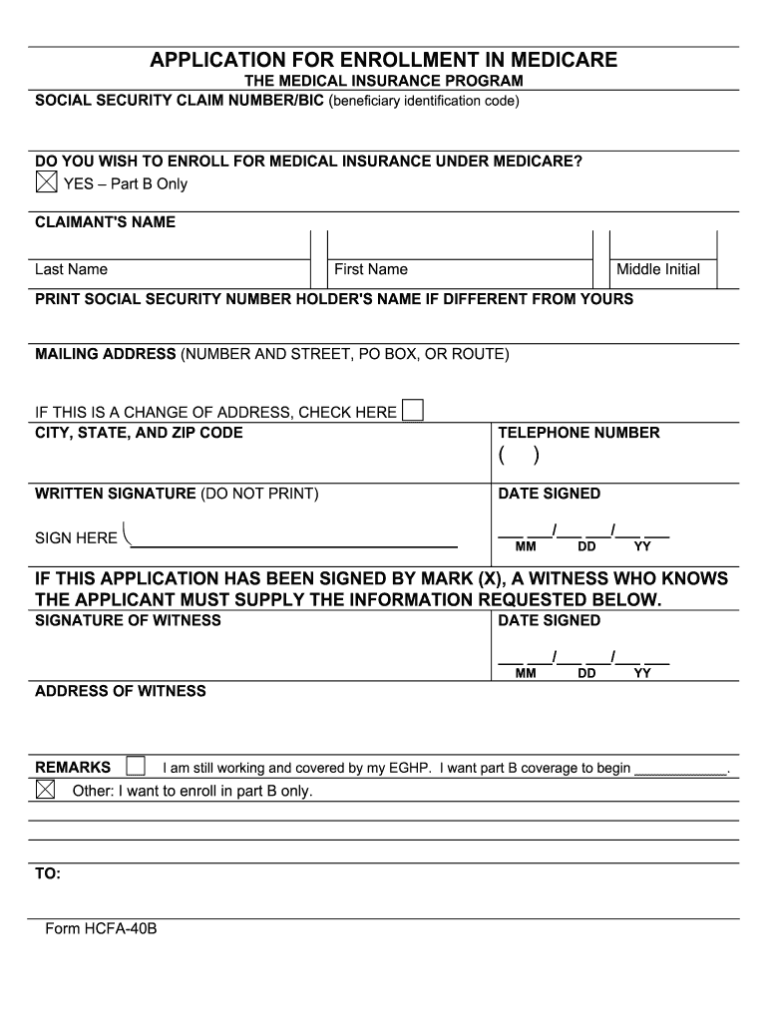

Personal Information

Start by providing your personal information, including your name, address, and Social Security number. Ensure that all information is correct and up-to-date.

Income Information

Next, you’ll need to enter your income information. This includes wages, salaries, dividends, and any other taxable income you received during the year. Refer to your tax documents for accurate figures.

Deductions and Credits

In this section, you’ll list any deductions and credits you’re eligible for. Common deductions include mortgage interest, charitable donations, and student loan interest. Credits, such as the child tax credit, can reduce your tax liability.

Additional Information

The final section of the form includes questions about your marital status, dependents, and any other relevant information. Answer these questions truthfully and provide any necessary documentation.

Review and Submit

Once you’ve completed all sections, carefully review your form for any errors. Make sure all information is accurate and complete. Then, sign and date the form and submit it to the IRS.

Common Mistakes

Blud, don’t be a donut when filling out Form 8840. Here’s the 411 on some common cock-ups and how to dodge them like a ninja.

These gaffes can land you in hot water, so pay attention, fam.

Bungling Box Ticking

- Double-checking the right boxes is crucial. Ticking the wrong ones can mess up your claim and delay your refund.

- If you’re not sure about a box, don’t be a hero. Ask a tax advisor or hit up the IRS website for help.

Missing Info

- Leaving out essential info is like playing Russian roulette with your tax return. Fill in every blank, even if it’s a zero.

- Not signing and dating the form is a major no-no. It’s like handing in an essay without your name on it.

Math Mishaps

- Double-check your calculations, bruv. Any errors can throw off your refund or land you in the penalty zone.

- Use a calculator or tax software to make sure your numbers are spot on.

Filing the Form

Filing Form 8840 is an important step to claim the credit for qualified expenses incurred for the care of a qualifying individual. There are several ways to file Form 8840, including:

- By mail: You can mail the completed Form 8840 to the Internal Revenue Service (IRS) at the address provided in the form instructions.

- Electronically: You can file Form 8840 electronically using tax preparation software or through the IRS e-file system.

It is important to file Form 8840 by the deadline to avoid penalties. The deadline for filing Form 8840 is generally April 15th, but it can be extended if you file for an extension. If you file Form 8840 late, you may be subject to penalties and interest charges.

Electronic Filing

Electronic filing is a convenient and secure way to file Form 8840. There are several benefits to electronic filing, including:

- Faster processing: Electronically filed returns are processed faster than paper returns.

- Fewer errors: Electronic filing software can help you avoid errors on your return.

- Confirmation of receipt: You will receive an email confirmation when your return is received by the IRS.

To file Form 8840 electronically, you will need to use tax preparation software or the IRS e-file system. Tax preparation software can help you prepare your return and file it electronically. The IRS e-file system is a free service that allows you to file your return electronically.

Supporting Documents

When filing Form 8840, you may need to provide supporting documents to verify the information you’ve provided. These documents can include:

Proof of Identity

You’ll need to provide a government-issued ID, such as a passport or driver’s license, to prove your identity.

Proof of Residence

You’ll need to provide a document that shows your current address, such as a utility bill or bank statement.

Proof of Income

If you’re claiming a refund or credit, you’ll need to provide proof of your income, such as a pay stub or tax return.

Proof of Expenses

If you’re claiming a deduction or credit for expenses, you’ll need to provide proof of those expenses, such as receipts or invoices.

Obtaining Supporting Documents

You can usually obtain supporting documents from the source that issued them. For example, you can get a copy of your passport from the passport office or a copy of your utility bill from the utility company.

Resources

If you’re a blud looking for more info on Form 8840, check out these sick resources:

These bad boys will help you suss out the nitty-gritty and get your mitts on the knowledge you need.

Websites

- IRS website: https://www.irs.gov/forms-pubs/about-form-8840

- Tax Foundation: https://taxfoundation.org/publications/tax-tips-form-8840-credit-new-energy-efficient-homes/

Publications

- IRS Publication 527: https://www.irs.gov/pub/irs-pdf/p527.pdf

- Tax Policy Center: https://www.taxpolicycenter.org/briefing-book/what-tax-credits-new-energy-efficient-homes

Organizations

- National Association of Home Builders: https://www.nahb.org/

- American Council for an Energy-Efficient Economy: https://aceee.org/

IRS Contact Information

If you’re still stumped, don’t be a div and hit up the IRS:

- Phone: 1-800-829-1040

- TTY/TDD: 1-800-829-4059

- Website: https://www.irs.gov/help/contact-your-local-irs-office

FAQ Summary

What is the purpose of Form 8840?

Form 8840 is used to report certain types of income and expenses related to the sale or exchange of a main home, rental property, or vacation home.

Who should file Form 8840?

Individuals who have sold or exchanged a main home, rental property, or vacation home may need to file Form 8840 to report any capital gains or losses from the transaction.

Where can I get a printable copy of Form 8840?

You can download a printable copy of Form 8840 from the IRS website or obtain one from your local IRS office.

What are some common mistakes to avoid when filling out Form 8840?

Common mistakes include incorrectly calculating the cost basis of the property, failing to report all required income and expenses, and missing the filing deadline.

What supporting documents may be required when filing Form 8840?

Depending on your situation, you may need to provide supporting documents such as a copy of the sales contract, closing statement, and property tax records.