Printable 602 Form: A Comprehensive Guide to Filing and Submission

Navigating the intricacies of tax forms can be daunting, but with the Printable 602 Form, the process becomes streamlined and accessible. This form, designed by the Internal Revenue Service (IRS), serves as a crucial tool for individuals seeking to report certain types of income and deductions. Whether you’re a seasoned tax filer or embarking on your first tax season, understanding the Printable 602 Form is essential for ensuring accuracy and timely submission.

In this comprehensive guide, we will delve into the nuances of the Printable 602 Form, providing clear instructions, helpful tips, and answers to frequently asked questions. By the end of this exploration, you will possess the knowledge and confidence to complete and submit your Printable 602 Form with ease.

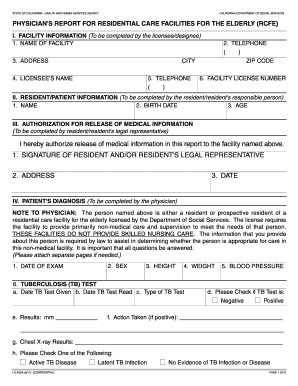

Printable 602 Form Overview

Form 602, also known as the United States Individual Income Tax Return, is a crucial document used by taxpayers to report their annual income and calculate their tax liability to the Internal Revenue Service (IRS). It serves as a comprehensive record of an individual’s financial situation and is essential for determining the amount of taxes owed or any potential refunds.

Purpose and Significance

The primary purpose of Form 602 is to assist taxpayers in fulfilling their legal obligation to report their income and pay taxes. It provides a structured framework for individuals to accurately disclose their financial information, including wages, investments, deductions, and credits. By completing and submitting Form 602, taxpayers can ensure compliance with tax laws and avoid potential penalties.

Target Audience and Intended Use Cases

Form 602 is primarily intended for individual taxpayers residing in the United States. It is typically used by wage earners, self-employed individuals, and retirees to report their annual income and calculate their tax liability. The form is also essential for claiming deductions, credits, and exemptions that may reduce the amount of taxes owed.

Completing Form 602

Yo, listen up! Fillin’ out Form 602 ain’t no piece of cake, but I’m here to drop some knowledge and make it a breeze for you.

First off, this form is your golden ticket to gettin’ your mitts on some dosh. It’s all about tellin’ the taxman what you’re up to with your dough.

Filling in the Blanks

Now, let’s dive into the nitty-gritty. The form is split into three main sections:

- Personal Details: This is where you spill the beans about who you are and where you’re at.

- Income: Time to cough up the deets on all the dough you’ve raked in.

- Tax: Here’s where you figure out how much you owe the taxman.

Form 602 Download and Printing

Blud, you can grab the official Printable 602 Form right here:

- Printable 602 Form (PDF)

- Printable 602 Form (Word)

Once you’ve got it, make sure you print it out on A4 paper. It’s the standard size for this form, innit. If you’re having any printing issues, check out these tips:

Printing Issues and Troubleshooting

* Printer not connecting? Turn it off and on again, fam.

* Form not printing properly? Check your printer settings and make sure the paper size is set to A4.

* Form is blurry or cut off? Try cleaning your printer heads.

Form 602 Submission and Processing

Submitting Form 602 is a crucial step in ensuring that your application for a visa or citizenship is processed smoothly. There are several methods available for submitting the form, and it’s important to choose the one that best suits your needs and circumstances.

Submission Methods

- Online submission: This is the most convenient and fastest way to submit Form 602. You can access the online submission portal through the official website of the relevant government agency.

- Mail: You can also mail the completed Form 602 to the designated address provided by the government agency.

- In-person submission: In some cases, you may be able to submit Form 602 in person at a government office or embassy.

Processing Time and Follow-up Procedures

The processing time for Form 602 varies depending on the method of submission and the specific circumstances of your application. Generally, online submissions are processed faster than mail or in-person submissions.

Once you have submitted Form 602, you will receive a confirmation email or letter. This confirmation will provide you with a reference number that you can use to track the status of your application online.

If you do not receive a confirmation within a reasonable time, or if you have any questions about the status of your application, you can contact the government agency directly.

Common Errors and Guidance

To avoid any delays or complications in the processing of your Form 602, it is important to ensure that the form is completed accurately and completely. Some common errors to watch out for include:

- Incomplete information: Make sure to fill out all required fields on the form and provide all necessary documentation.

- Inconsistent information: Ensure that the information you provide on the form is consistent with the information on other supporting documents.

- Unclear handwriting: If you are submitting the form by mail, make sure to write legibly to avoid any confusion.

- Incorrect submission method: Choose the correct submission method based on the instructions provided by the government agency.

By following these guidelines, you can increase the chances of your Form 602 being processed smoothly and efficiently.

Benefits of Using Printable 602 Form

Utilizing a Printable 602 Form offers a plethora of advantages compared to alternative methods. It streamlines the completion and submission process, making it more efficient and user-friendly.

One significant benefit is the convenience it provides. Individuals can access and print the form at their own pace, eliminating the need to visit specific locations or rely on third-party services.

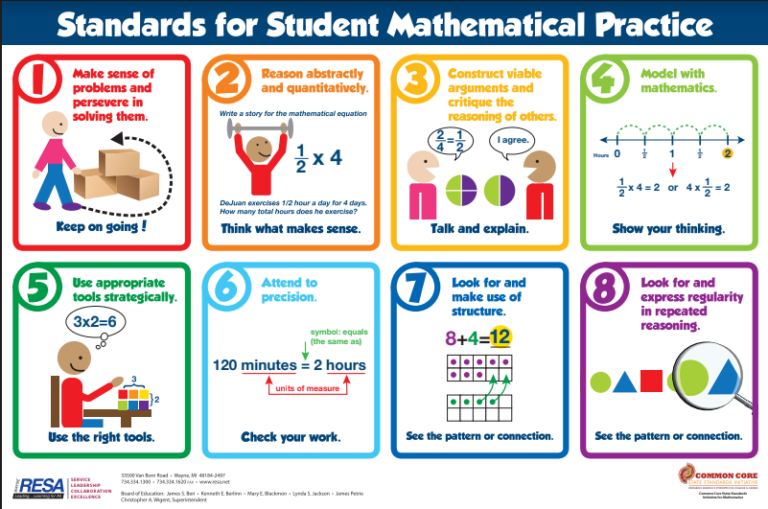

Enhanced Accuracy

Printable 602 Forms allow for meticulous completion, reducing the likelihood of errors. By having a physical copy, individuals can carefully review and double-check their entries before submission.

Cost-Effective

Compared to online or professional services, Printable 602 Forms are a cost-effective solution. Individuals can print the form at home or at a local printing shop, saving money on additional fees.

Increased Control

Printable 602 Forms provide users with greater control over the completion and submission process. They can choose the most convenient time and location, ensuring privacy and confidentiality.

Case Study: Streamlined Submission for Small Businesses

A small business owner used a Printable 602 Form to streamline the employee onboarding process. By printing the form and having new hires complete it in-house, the business saved time and resources, ensuring a smooth and efficient onboarding experience.

Printable 602 Form Accessibility

The Printable 602 Form is designed to be accessible to individuals with disabilities and limited English proficiency. It provides several accessibility features to ensure that everyone can access and use the form easily.

Alternative Formats

The Printable 602 Form is available in multiple alternative formats, including:

– Large print format for individuals with low vision

– Braille format for individuals who are blind or visually impaired

– Audio format for individuals who are deaf or hard of hearing

– Electronic format for individuals who prefer to complete the form online

Language Translations

The Printable 602 Form is also available in multiple language translations, including:

– Spanish

– Chinese

– Vietnamese

– Korean

– Russian

Resources for Individuals with Disabilities or Limited English Proficiency

Individuals with disabilities or limited English proficiency can access resources to help them complete the Printable 602 Form. These resources include:

– The Social Security Administration’s website has a section dedicated to disability services, which provides information on how to obtain alternative formats of the form and how to get assistance completing it.

– The National Council on Disability’s website has a section dedicated to resources for individuals with disabilities, which includes information on how to obtain alternative formats of the form and how to get assistance completing it.

– The U.S. Department of Health and Human Services’ website has a section dedicated to resources for individuals with limited English proficiency, which includes information on how to obtain translated versions of the form and how to get assistance completing it.

Printable 602 Form Updates and Changes

The Printable 602 Form has undergone regular updates and revisions to improve its functionality and user experience. These changes are made to ensure that the form remains current with tax regulations and provides the best possible experience for taxpayers.

The timeline of revisions and a summary of the modifications made to the Printable 602 Form are as follows:

Revision Timeline and Modifications

- 2023: Minor updates to the form layout and instructions to enhance clarity and user-friendliness.

- 2022: Significant updates to the form to align with the latest tax regulations and incorporate new reporting requirements.

- 2021: Introduction of the fillable PDF version of the form, allowing taxpayers to complete and submit the form electronically.

These changes impact users by ensuring that they are using the most up-to-date version of the form, which includes the latest tax regulations and reporting requirements. By staying informed about these updates, taxpayers can avoid errors and ensure that their tax returns are accurate and complete.

To stay informed about the latest updates and changes to the Printable 602 Form, taxpayers can visit the official website of the relevant tax authority or subscribe to email notifications.

FAQ Summary

What is the purpose of the Printable 602 Form?

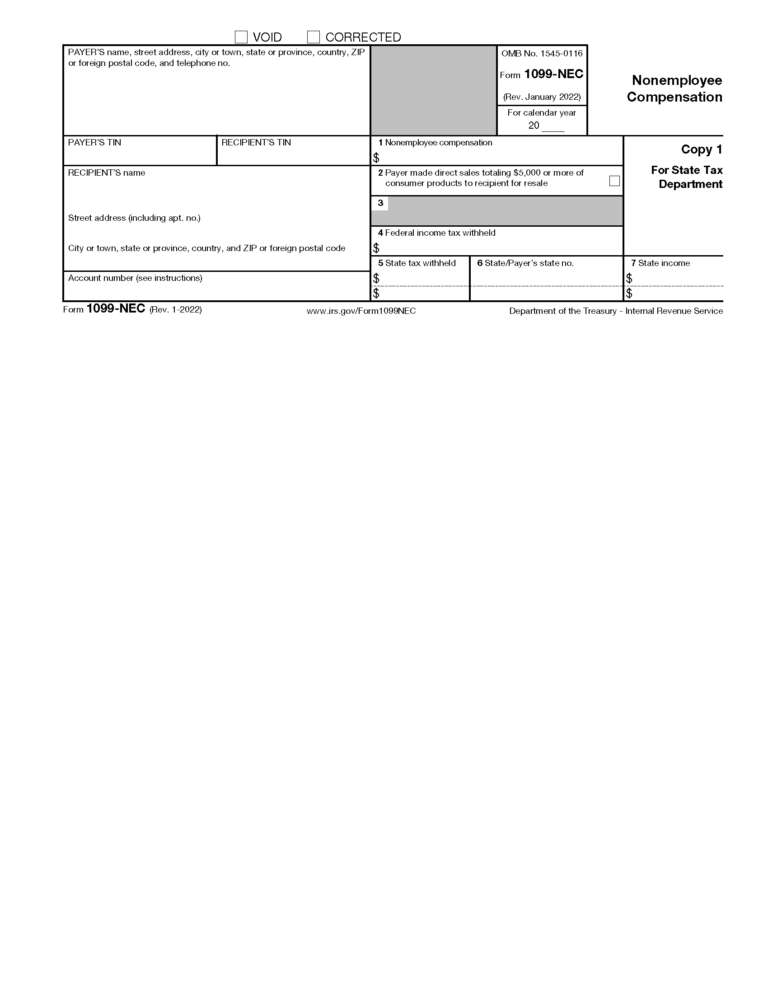

The Printable 602 Form is primarily used to report certain types of income and deductions, such as nonemployee compensation, self-employment income, and expenses related to being an independent contractor or gig worker.

Who should use the Printable 602 Form?

The Printable 602 Form is intended for individuals who receive income from sources other than traditional employment, such as freelancers, independent contractors, sole proprietors, and gig workers.

Where can I download the official Printable 602 Form?

You can download the official Printable 602 Form from the IRS website at https://www.irs.gov/forms-pubs/about-form-602.

What are the common errors to avoid when completing the Printable 602 Form?

Common errors to avoid include incorrect Social Security numbers, missing or incomplete information, and mathematical errors. Carefully review your form before submitting it to minimize the risk of errors.