Printable 501c3 Form: A Comprehensive Guide to Tax-Exempt Status

Navigating the complexities of tax-exempt status for your 501c3 organization can be a daunting task. However, with the right tools and guidance, you can streamline the process and ensure a successful application. This guide will provide you with all the essential information you need to obtain a Printable 501c3 Form, understand its key sections, and complete it accurately.

The benefits of obtaining 501c3 status are numerous, including tax exemption, increased credibility, and enhanced fundraising opportunities. By using a Printable 501c3 Form, you can enjoy the convenience, cost-effectiveness, and accessibility of completing the application at your own pace and on your own schedule.

Definition of Printable 501c3 Form

Yo, check it, a Printable 501c3 Form is like a special document that helps organizations get their tax exemption on, innit? It’s a form you can print out and fill in, easy peasy.

When an organization gets tax-exempt status, it means they don’t have to pay taxes on their income, which is a big deal. It helps them keep more of their dough to do good stuff for the community.

Getting Tax-Exempt Status

To get tax-exempt status, organizations need to fill out the Printable 501c3 Form and send it to the IRS. The IRS will then review the form and decide if the organization meets the requirements to be tax-exempt.

There are different types of 501c3 organizations, like charities, religious groups, and educational institutions. Each type has its own set of requirements that they need to meet to get tax-exempt status.

Benefits of Using a Printable 501c3 Form

Yo, listen up! Using a printable 501c3 form is the bomb for getting that tax-exempt status. It’s like having a cheat code for saving money and making your org legit.

First off, it’s bloody convenient. You can fill it in at your own pace, in the comfort of your own crib. No need to rush or pay for expensive lawyers. Plus, you can make mistakes and fix them without any hassle.

Cost-effectiveness

Printable forms are bang on budget-friendly. No need to splash out on fancy software or consultants. Just print it out and you’re good to go. It’s like getting a freebie, innit?

Accessibility

These forms are available online, so you can grab one whenever you need. No need to go hunting for them or wait for the post. It’s like having a superpower, always ready to save the day.

Key Sections of a Printable 501c3 Form

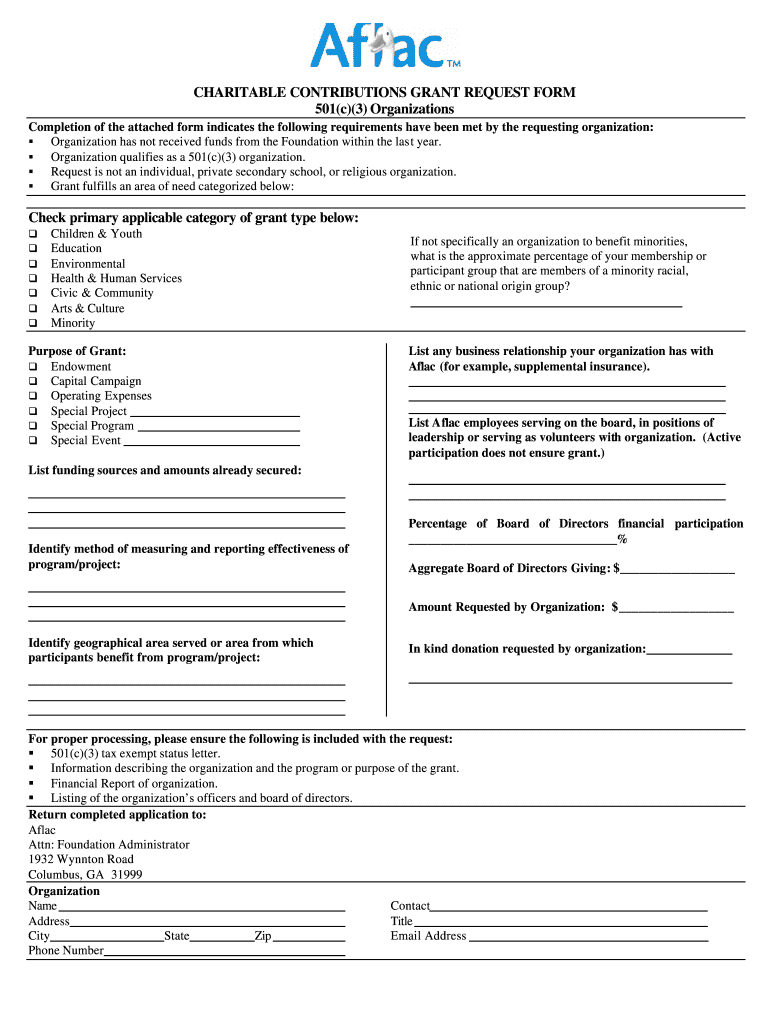

Applying for 501c3 status can be a daunting task, but using a printable 501c3 form can make the process much easier. These forms are designed to guide you through the application process and ensure that you provide all of the necessary information. In this section, we will identify and explain the essential sections of a Printable 501c3 Form.

The following are the key sections of a Printable 501c3 Form:

Part I: Application for Recognition of Exemption

This section includes basic information about your organization, such as its name, address, and contact information. You will also need to provide information about your organization’s purpose and activities, as well as its financial status.

Part II: Statement of Activities

This section provides a detailed description of your organization’s activities. You will need to list all of your organization’s programs and services, as well as the number of people who benefit from them. You will also need to provide information about your organization’s income and expenses.

Part III: Balance Sheets

This section provides a snapshot of your organization’s financial health. You will need to list all of your organization’s assets and liabilities, as well as its net worth.

Part IV: Schedules

This section provides additional information about your organization’s activities. You will need to provide information about your organization’s employees, volunteers, and donors. You will also need to provide information about your organization’s governance structure.

Part V: Signature and Verification

This section includes the signatures of your organization’s authorized representatives. You will also need to provide a verification statement that attests to the accuracy of the information provided in the form.

Step-by-Step Guide to Completing a Printable 501c3 Form

Filling out a Printable 501c3 Form can be a daunting task, but it doesn’t have to be. This comprehensive guide will walk you through each step of the process, making it easy for you to get your application submitted quickly and efficiently.

Before you start, it’s important to gather all of the necessary information. This includes your organization’s name, address, contact information, and financial statements. You’ll also need to have a copy of your organization’s bylaws and articles of incorporation.

Step 1: Complete the Header

The header of the 501c3 Form is where you’ll provide basic information about your organization. This includes your organization’s name, address, contact information, and the date.

Step 2: Describe Your Organization

In this section, you’ll need to provide a brief description of your organization’s mission and activities. You’ll also need to indicate the type of organization you are, such as a corporation, trust, or unincorporated association.

Step 3: Provide Financial Information

The financial information section is where you’ll provide information about your organization’s finances. This includes your organization’s income, expenses, and assets. You’ll also need to provide a copy of your organization’s financial statements.

Step 4: Sign and Submit the Form

Once you’ve completed all of the sections of the 501c3 Form, you’ll need to sign and submit the form. You can do this by mailing the form to the IRS or by submitting it electronically.

Common Mistakes to Avoid When Completing a Printable 501c3 Form

Completing a Printable 501c3 Form can be a daunting task, but by avoiding common pitfalls, you can increase your chances of a successful application. Here are some key mistakes to watch out for:

Not providing accurate and complete information

The IRS requires detailed and accurate information on your 501c3 Form. Ensure all fields are filled out correctly and provide supporting documentation where necessary. Missing or incomplete information can delay the processing of your application.

Not understanding the eligibility requirements

Before filling out the form, carefully review the eligibility requirements for 501c3 status. Not meeting these requirements can result in your application being rejected.

Not seeking professional advice

If you’re unsure about any aspect of the 501c3 Form, consider seeking professional advice from an accountant or attorney. They can help you understand the requirements and avoid costly mistakes.

Not attaching supporting documentation

In addition to the form itself, you must attach supporting documentation to prove your organization’s eligibility for 501c3 status. This includes financial statements, articles of incorporation, and bylaws.

Not following the instructions carefully

The 501c3 Form comes with detailed instructions. Make sure to read and follow these instructions carefully. Failure to do so can result in errors that delay the processing of your application.

Resources for Obtaining a Printable 501c3 Form

To get your hands on a printable 501c3 Form, you’ve got a few reliable options. Check out the official government website of the Internal Revenue Service (IRS) or the websites of reputable non-profit organizations like the National Council of Nonprofits or the Alliance for Nonprofit Management. These sources are legit and will provide you with the most up-to-date version of the form.

Official Government Websites

- Internal Revenue Service (IRS): https://www.irs.gov/forms-pubs/about-form-1023

Reputable Non-Profit Organizations

- National Council of Nonprofits: https://www.councilofnonprofits.org/tools-resources/501c3-application-assistance

- Alliance for Nonprofit Management: https://www.nonprofitlearninglab.org/topics/resources-for-nonprofits/starting-a-nonprofit/applying-for-501c3-status

FAQ Summary

What is the difference between a 501c3 and a 501c4 organization?

A 501c3 organization is a non-profit organization that is exempt from federal income tax and may receive tax-deductible donations. A 501c4 organization is a non-profit organization that is not exempt from federal income tax but may receive tax-deductible donations for certain activities.

Can I use a Printable 501c3 Form to apply for both federal and state tax exemption?

Yes, you can use a Printable 501c3 Form to apply for both federal and state tax exemption. However, you may need to submit additional documents or forms depending on the requirements of your state.

How long does it take to process a Printable 501c3 Form?

The processing time for a Printable 501c3 Form can vary depending on the volume of applications being processed by the IRS. Generally, you can expect the process to take several months.