Printable 1099 Form: A Comprehensive Guide for Businesses

In the realm of tax reporting, the 1099 form stands as a crucial document, serving as a vital bridge between businesses and independent contractors. This comprehensive guide delves into the intricacies of printable 1099 forms, empowering businesses with the knowledge and resources they need to navigate the complexities of tax compliance.

Whether you’re a seasoned professional or new to the world of 1099 reporting, this guide provides an in-depth exploration of printable 1099 forms. From understanding their purpose and types to mastering the art of filling them out, we’ve got you covered. So, grab a cup of coffee, settle in, and let’s embark on this journey together.

Printable 1099 Forms: An Overview

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at12.01.40PM-9e232e8b991047fabfe3041a51889486.png?w=700)

Printable 1099 forms are essential documents for businesses and individuals to report income earned from non-employee compensation. These forms provide a detailed record of payments made to contractors, freelancers, and other self-employed individuals. Understanding the purpose, types, and usage of printable 1099 forms is crucial for accurate tax reporting and compliance.

The Internal Revenue Service (IRS) requires businesses to issue 1099 forms to individuals who have been paid $600 or more for services rendered during the tax year. These forms serve as official documentation of income earned and are used by both the payer and the recipient to report and pay taxes accordingly.

Types of 1099 Forms

There are several types of 1099 forms, each designed for specific types of income:

- Form 1099-NEC: Reports nonemployee compensation, such as payments to independent contractors.

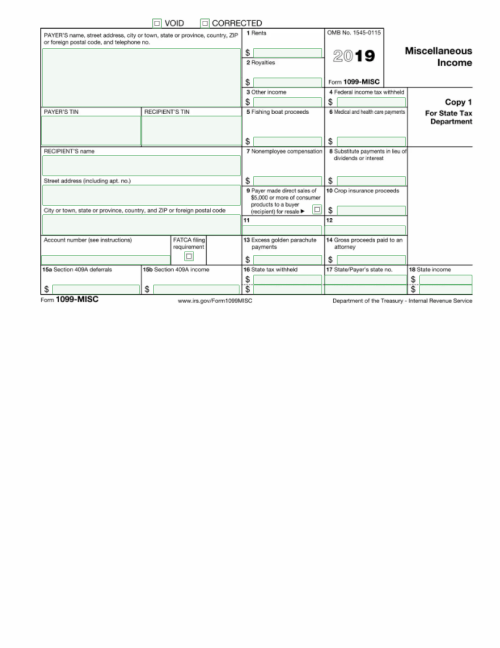

- Form 1099-MISC: Used for miscellaneous income, including rent, prizes, and awards.

- Form 1099-INT: Reports interest earned from savings accounts, bonds, and other investments.

- Form 1099-DIV: Documents dividends paid from stocks and mutual funds.

- Form 1099-B: Used to report proceeds from the sale of stocks, bonds, and other financial instruments.

Choosing the correct 1099 form is essential to ensure accurate reporting. The IRS provides guidelines and instructions for each form, which should be carefully followed to avoid errors or penalties.

Benefits of Using Printable 1099 Forms

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg?w=700)

Bruv, using printable 1099 forms can be a right result for your business. They’re way cheaper than electronic methods, innit? Plus, you can customise them to your heart’s content, making them a doddle to use. And let’s not forget about the security benefits – they’re not gonna get hacked, so your data’s safe as houses.

Cost-Effectiveness

Printable 1099 forms are the bees knees when it comes to saving dough. You don’t have to pay for any fancy software or subscriptions, just print ’em off and you’re sorted. Plus, they’re way cheaper than pre-printed forms, so you can save a bundle.

Flexibility

Printable 1099 forms are like a Swiss army knife – they can be used for anything. You can customise them to include your own logo, branding, and even add extra fields if you need to. This makes them perfect for any business, no matter how big or small.

Security

Printable 1099 forms are super secure. Unlike electronic methods, they’re not gonna get hacked, so your data’s safe and sound. This is especially important if you’re dealing with sensitive information.

Real-Life Examples

Don’t just take our word for it – here are a few examples of businesses that have benefited from using printable 1099 forms:

- A small business owner saved over £100 a year by switching to printable 1099 forms.

- A large corporation was able to streamline its 1099 processing by using printable forms.

- A non-profit organisation was able to reduce its risk of fraud by using printable 1099 forms.

How to Fill Out Printable 1099 Forms

Filling out printable 1099 forms accurately is crucial for tax reporting. Here’s a step-by-step guide to help you navigate the process smoothly:

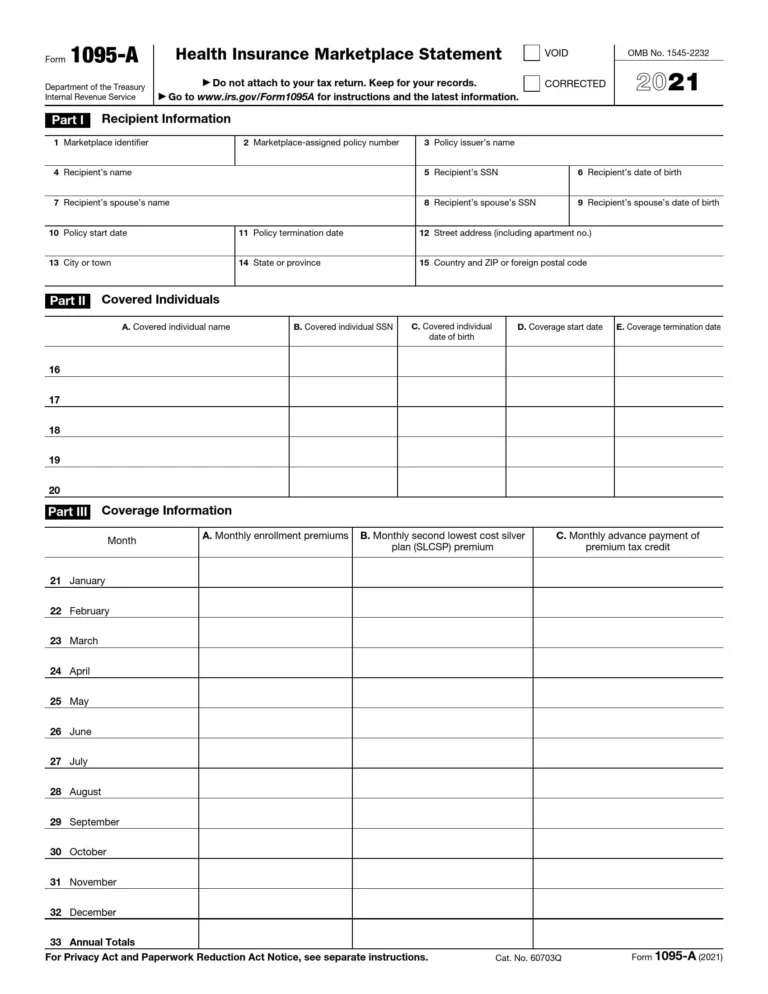

Section 1: Recipient Information

Start by providing the recipient’s name, address, and Taxpayer Identification Number (TIN). Ensure the information matches the recipient’s tax records to avoid errors.

Section 2: Payer Information

Next, enter the payer’s name, address, and TIN. This information should match your business records for accuracy.

Section 3: Income Information

Accurately report the income paid to the recipient in Box 1. Specify the type of income, such as nonemployee compensation, in the appropriate box. If applicable, fill out other relevant boxes, such as Box 7 for nonqualified plans.

Section 4: Federal Income Tax Withheld

Indicate the amount of federal income tax withheld from the recipient’s income in Box 4. This information is crucial for the recipient’s tax calculations.

Section 5: State Income Tax Information

If applicable, complete the state income tax information, including the state code and the amount of state income tax withheld.

Section 6: Filing Information

Finally, provide the filing information, including the date the form was prepared and the recipient’s copy distribution date. Ensure this information is accurate and aligns with the filing deadlines.

By following these steps and carefully reviewing the form before submitting it, you can effectively complete printable 1099 forms and ensure accurate tax reporting.

Legal Considerations for Printable 1099 Forms

Using printable 1099 forms carries legal implications that must be understood and adhered to. Non-compliance can result in penalties and other consequences. To ensure compliance, it is crucial to understand the tax regulations and follow the guidelines provided by the relevant authorities.

Penalties for Non-Compliance

Failure to file 1099 forms accurately and on time can lead to penalties and fines. The severity of the penalties varies depending on the specific violation and the number of forms not filed. It is advisable to consult with a tax professional to determine the potential penalties for non-compliance.

Ensuring Compliance

To ensure compliance, businesses should:

– Keep accurate records of all payments made to independent contractors.

– Issue 1099 forms to all contractors who meet the reporting threshold.

– File 1099 forms with the IRS and the recipient by the specified deadlines.

– Retain copies of all 1099 forms for at least four years.

Troubleshooting Common Issues with Printable 1099 Forms

Using printable 1099 forms can streamline your tax reporting process, but you may occasionally encounter common issues. Here are some of the most frequent problems and their corresponding solutions to help you resolve them quickly and efficiently.

To ensure a smooth experience, it’s crucial to address these issues promptly. By following the troubleshooting tips provided, you can minimize disruptions and maintain accuracy in your tax reporting.

Incorrect Data

- Problem: Data entered on the form is incorrect or incomplete.

- Solution: Double-check the information against your records and make the necessary corrections. Ensure all required fields are filled out accurately.

Printing Issues

- Problem: The form is not printing correctly or is misaligned.

- Solution: Check your printer settings and ensure the form is properly aligned in the tray. Try printing a test page to verify the alignment and adjust accordingly.

Software Compatibility

- Problem: The software you’re using is not compatible with the printable 1099 form.

- Solution: Ensure that your software is up-to-date and supports the specific 1099 form you’re trying to print. If necessary, download the latest version of the software or consider using a different program.

Filing Deadlines

- Problem: You missed the filing deadline for your 1099 forms.

- Solution: File the forms as soon as possible to avoid penalties. You may need to file an extension to request more time.

Resources for Printable 1099 Forms

The internet has made it easier than ever to obtain printable 1099 forms. There are a number of reputable sources where you can download these forms for free.

Each resource offers its own advantages and disadvantages. Some resources provide a wide variety of forms, while others specialize in specific types of 1099 forms. Some resources offer free downloads, while others charge a small fee.

Here are a few of the most popular resources for printable 1099 forms:

Official Government Websites

The IRS website offers a variety of printable 1099 forms. These forms are free to download and are the most up-to-date versions available. However, the IRS website can be difficult to navigate and the forms can be complex to complete.

Software Providers

There are a number of software providers that offer printable 1099 forms. These providers typically charge a small fee for their services, but they offer a number of advantages over the IRS website. Software providers typically offer a wider variety of forms, and they can help you complete the forms electronically.

Other Relevant Resources

There are a number of other resources available for printable 1099 forms. These resources include:

– Office supply stores

– Tax preparation services

– Accountants

Questions and Answers

Q: What are the different types of 1099 forms available?

A: There are various types of 1099 forms, each designed for specific income categories. Some common types include 1099-NEC (Nonemployee Compensation), 1099-MISC (Miscellaneous Income), 1099-DIV (Dividends), and 1099-INT (Interest Income).

Q: How do I choose the correct 1099 form for my situation?

A: The type of 1099 form you need depends on the nature of the income being reported. Refer to the IRS guidelines or consult with a tax professional to determine the appropriate form for your specific circumstances.

Q: What are the advantages of using printable 1099 forms?

A: Printable 1099 forms offer several advantages, including cost-effectiveness, flexibility, and control over the printing process. They also provide a tangible record of transactions, making them valuable for both businesses and independent contractors.

Q: What are the legal considerations for using printable 1099 forms?

A: Businesses must adhere to specific legal requirements when using printable 1099 forms. These include timely filing, accurate reporting of income, and compliance with tax regulations. Failure to comply can result in penalties and other consequences.

Q: Where can I find reputable resources for printable 1099 forms?

A: Numerous reputable sources provide printable 1099 forms, including the IRS website, software providers, and online platforms. Each resource offers its own advantages and disadvantages, so it’s important to research and choose the one that best meets your needs.