Navigating Tax Season with Ease: A Guide to the Printable 1040ez Form

Filing taxes can be a daunting task, but it doesn’t have to be. The Printable 1040ez Form is designed to simplify the process for taxpayers with straightforward financial situations. In this comprehensive guide, we’ll delve into the ins and outs of the Printable 1040ez Form, empowering you to complete your taxes with confidence.

This user-friendly form offers a streamlined approach to tax preparation, catering to those with limited income and deductions. As we explore the benefits, drawbacks, and recent updates of the Printable 1040ez Form, you’ll gain a clear understanding of its purpose and target audience.

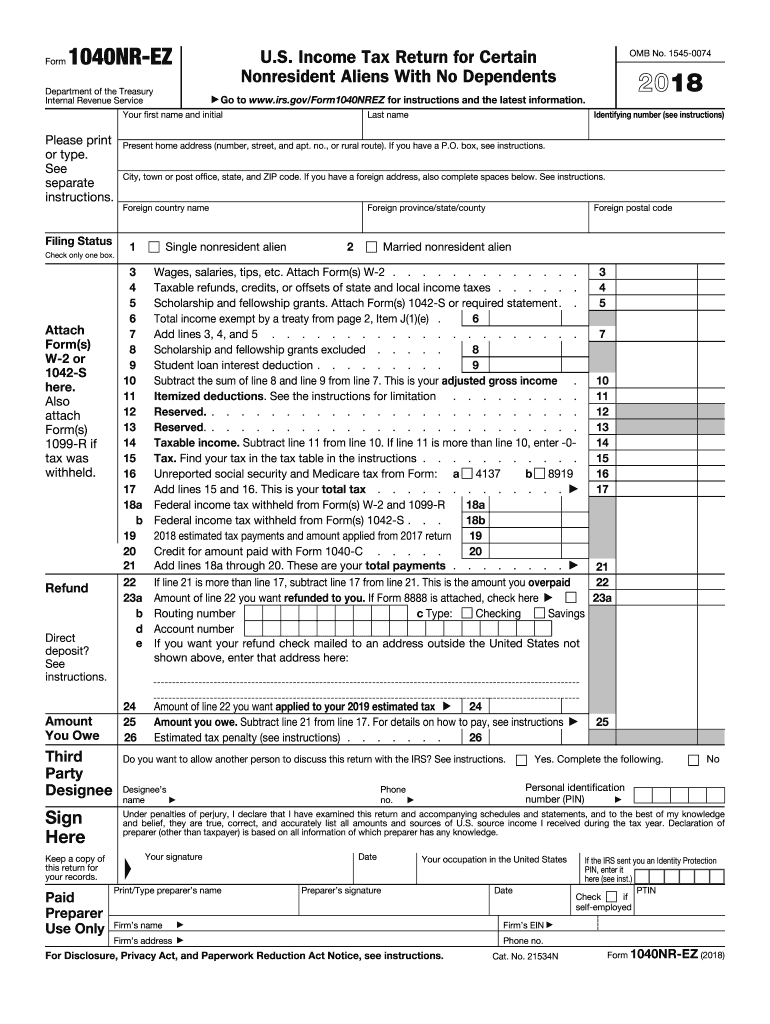

Overview of Printable 1040ez Form

The Printable 1040ez Form is a simplified version of the standard 1040 tax form designed for taxpayers with straightforward tax situations. It’s a one-page form that can be filled out by hand or electronically and printed for submission to the Internal Revenue Service (IRS).

The Printable 1040ez Form is intended for taxpayers who meet specific criteria, such as having only wage income, no dependents, and no itemized deductions. It’s a convenient option for individuals with simple tax returns who want to avoid the complexity of the standard 1040 form.

Benefits of Using the Printable 1040ez Form

- Simplicity: The Printable 1040ez Form is designed to be easy to understand and complete, making it a suitable choice for taxpayers with basic tax situations.

- Convenience: Taxpayers can print the form from the IRS website or use tax software to fill it out electronically, providing flexibility and accessibility.

- Time-saving: The streamlined nature of the Printable 1040ez Form reduces the time required to complete and file taxes compared to more complex forms.

Drawbacks of Using the Printable 1040ez Form

- Limited applicability: The Printable 1040ez Form is only suitable for taxpayers with simple tax situations. Individuals with more complex tax circumstances, such as itemized deductions or self-employment income, may need to use a different tax form.

- Potential errors: Taxpayers who are not familiar with tax regulations may be more prone to making errors when completing the Printable 1040ez Form, which could lead to incorrect tax calculations.

History and Updates of the Printable 1040ez Form

The Printable 1040ez Form was introduced in 1982 to simplify the tax filing process for individuals with basic tax situations. Over the years, the form has undergone several updates to reflect changes in tax laws and regulations. The most recent update was in 2023, which included adjustments to the income thresholds and tax rates.

s for Completing the Printable 1040ez Form

Completing the Printable 1040ez Form is a straightforward process that can be done in a few simple steps. Here’s a step-by-step guide to help you get started:

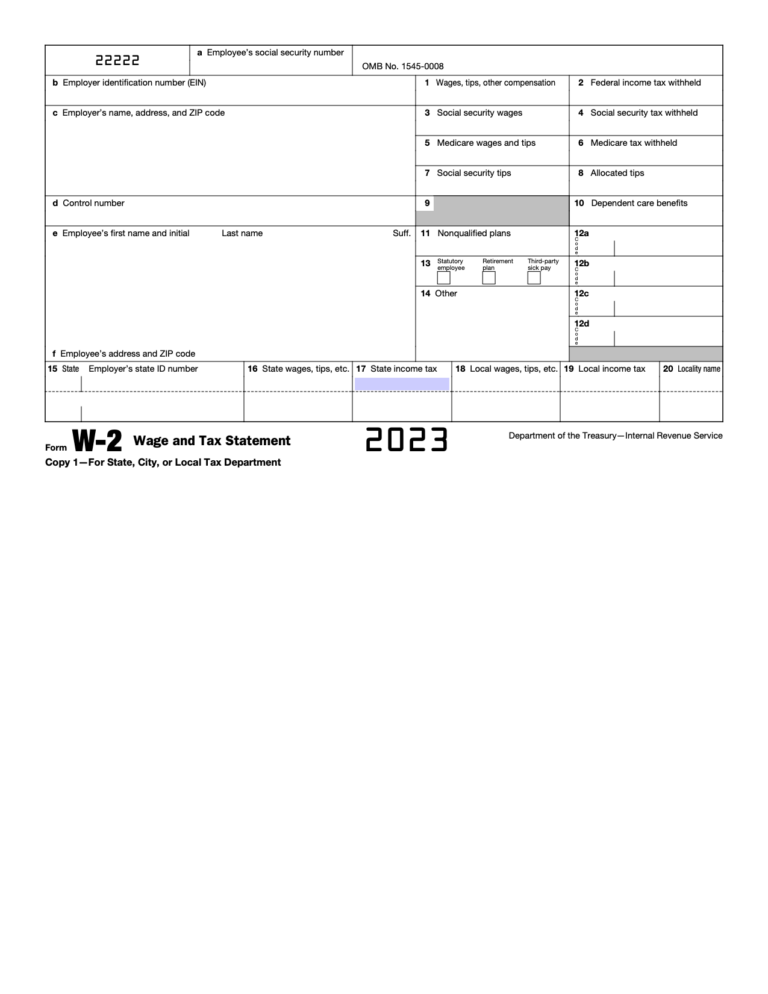

Before you begin, gather all the necessary information, including your Social Security number, income, and deductions. Having this information on hand will make the process go more smoothly.

Step 1: Personal Information

- Enter your personal information, including your name, address, and Social Security number.

- Indicate your filing status, which is either single, married filing jointly, married filing separately, or head of household.

Step 2: Income

- Enter your total wages, salaries, and tips on line 1.

- Include any taxable interest you received on line 2.

- If you received any unemployment compensation, enter it on line 3.

Step 3: Adjustments to Income

- If you made any contributions to a traditional IRA or 401(k) plan, enter the amount on line 16.

- If you paid any student loan interest, enter the amount on line 17.

Step 4: Taxable Income

- Subtract your adjustments to income from your total income to calculate your taxable income.

Step 5: Tax

- Use the tax table in the instructions to determine your tax liability.

Step 6: Credits

- If you qualify for any tax credits, enter the amount on line 34.

Step 7: Refund or Amount You Owe

- Subtract your total credits from your tax liability to determine if you are due a refund or owe additional taxes.

Tips

- Use the instructions provided with the form to help you complete it correctly.

- If you make a mistake, don’t panic. Simply cross out the incorrect information and write the correct information above it.

- Double-check your calculations before you mail in your return.

Where to Find the Printable 1040ez Form

The Printable 1040ez Form is available from several official sources, ensuring easy access for individuals who prefer to complete their tax returns manually.

Here are the key sources where you can obtain the Printable 1040ez Form:

Internal Revenue Service (IRS) Website

- Visit the official IRS website at https://www.irs.gov/.

- Navigate to the “Forms and Publications” section.

- Search for “Form 1040ez” or use the specific form number.

- Select the “Download” option to save the PDF file to your computer.

- Print the form using your preferred printer.

IRS Tax Forms Ordering System

- Call the IRS Tax Forms Ordering System at 1-800-829-3676.

- Request Form 1040ez by providing your name and address.

- The IRS will mail the form to you within a few days.

Local IRS Office

- Visit your local IRS office in person.

- Inquire about obtaining a copy of Form 1040ez.

- The office staff will provide you with the form free of charge.

Alternative Options

In addition to the official sources mentioned above, there are alternative options for accessing the Printable 1040ez Form:

- Tax Preparation Software: Many tax preparation software programs include the Printable 1040ez Form as part of their software package.

- Online Tax Filing Services: Some online tax filing services offer the option to print the completed 1040ez Form before submitting it electronically.

Comparison to Other Tax Forms

The Printable 1040ez Form is one of several tax forms available to taxpayers in the United Kingdom. It is designed to be simple and easy to use, and it is suitable for taxpayers with straightforward tax situations.

There are a few key differences between the Printable 1040ez Form and other common tax forms, such as the 1040 and 1040-SR.

1040 Form

The 1040 Form is the most comprehensive tax form available. It is used by taxpayers with more complex tax situations, such as those who have self-employment income, rental income, or capital gains.

The 1040 Form is more complex than the Printable 1040ez Form, and it requires taxpayers to provide more information about their income and deductions.

1040-SR Form

The 1040-SR Form is a simplified tax form that is designed for senior citizens. It is similar to the Printable 1040ez Form, but it includes some additional features that are designed to make it easier for senior citizens to file their taxes.

The 1040-SR Form is only available to taxpayers who are age 65 or older.

Which Form Is Right for You?

The Printable 1040ez Form is the best choice for taxpayers with simple tax situations. It is easy to use and it does not require taxpayers to provide a lot of information.

The 1040 Form is the best choice for taxpayers with more complex tax situations. It is more comprehensive than the Printable 1040ez Form, and it allows taxpayers to report all of their income and deductions.

The 1040-SR Form is the best choice for senior citizens who are age 65 or older. It is similar to the Printable 1040ez Form, but it includes some additional features that are designed to make it easier for senior citizens to file their taxes.

Filing Options for the Printable 1040ez Form

Yo, there are a few different ways you can file your Printable 1040ez Form. Each one has its own pros and cons, so let’s break ’em down.

First up, you can file by mail. This is the most common way to file, and it’s pretty straightforward. Just fill out the form and send it in to the IRS. The downside is that it can take a while for your return to be processed, and you won’t get your refund as quickly as you would with some other methods.

Filing Online

If you’re a bit more tech-savvy, you can file your 1040ez Form online. There are a few different software programs you can use, and they’ll walk you through the process step-by-step. The big advantage of filing online is that it’s faster and more convenient than mailing your return. Plus, you can e-file your return for free using the IRS Free File program.

Filing with a Tax Preparer

If you’re not comfortable filing your taxes on your own, you can always hire a tax preparer. They’ll take care of everything for you, from filling out the forms to filing your return. Of course, you’ll have to pay for their services, so keep that in mind.

Common Errors and Troubleshooting

Completing the Printable 1040ez Form can be a straightforward process, but it’s essential to avoid common errors to ensure accuracy. Here are some typical mistakes and tips for resolving them:

Math Errors

Mathematical errors are among the most common when filling out tax forms. To avoid these mistakes, double-check all calculations thoroughly, especially when dealing with large numbers or multiple deductions and credits.

Incorrect Social Security Number

Entering an incorrect Social Security Number (SSN) can lead to delays in processing your tax return. Verify the SSN carefully before submitting the form, as any errors can result in significant issues.

Missing or Incomplete Information

Leaving out required information or providing incomplete answers can delay the processing of your tax return. Ensure that all fields are filled out accurately and completely.

Signing Errors

The Printable 1040ez Form must be signed by the taxpayer to be valid. Failure to sign the form or signing it incorrectly can result in the rejection of your return.

Consequences of Errors

Errors on your tax return can have several consequences, including:

- Delays in processing your return

- Reduced refund or increased tax liability

- Audits or penalties

Tips for Avoiding Errors

To minimize the chances of making errors, follow these tips:

- Gather all necessary documents and information before starting.

- Read the instructions carefully and follow them precisely.

- Use a calculator or tax software to ensure accurate calculations.

- Review your return thoroughly before submitting it.

- If unsure about any part of the form, seek professional assistance.

Answers to Common Questions

Can I use the Printable 1040ez Form if I have dependents?

No, the Printable 1040ez Form is not suitable for taxpayers with dependents.

Where can I find the Printable 1040ez Form in Spanish?

The Printable 1040ez Form is currently only available in English.

What are the income limits for using the Printable 1040ez Form?

To use the Printable 1040ez Form, your taxable income must be within the limits set by the IRS.