Printable 1040 Form 2024: A Comprehensive Guide to Filing Your Taxes

Navigating the complexities of tax filing can be a daunting task, but with the right tools and resources, it doesn’t have to be. The Printable 1040 Form 2024 is a valuable tool that can simplify the process for individuals, providing a convenient and flexible way to file their taxes accurately and efficiently.

In this comprehensive guide, we will delve into the details of the Printable 1040 Form 2024, exploring its purpose, accessibility, features, benefits, and potential drawbacks. We will also address common questions and troubleshooting tips to ensure a smooth and successful tax filing experience.

Definition and Purpose of Printable 1040 Form 2024

The 1040 tax form is a crucial document for individuals in the United Kingdom who need to file their annual tax returns to Her Majesty’s Revenue and Customs (HMRC). It’s like the report card you give to the taxman, showing how much dosh you’ve earned and what you owe. The printable version of the 1040 form is a lifesaver for those who prefer to fill it out on their own time, in the comfort of their own gaff.

Intended Audience

The printable 1040 form is primarily intended for self-employed individuals, sole traders, and anyone who needs to file a tax return but doesn’t want to go through an accountant. It’s like a DIY tax kit, perfect for those who are confident in their tax knowledge and want to save a few quid.

s for Accessing and Printing the Form

Blud, getting your mitts on the printable 1040 form for 2024 is a doddle. Just follow these easy steps, and you’ll be sorted in no time.

Online Access

Head on over to the IRS website, mate. You’ll find the form right there, ready for the taking. Just click the “Forms” tab, then select “Individual Income Tax Returns.”

Printing Requirements

Once you’ve got the form, you’ll need a printer and some paper. Make sure your printer is up to the task, innit? You’ll also need Adobe Reader or a similar PDF viewer to open the form.

Features and Sections of the Printable Form

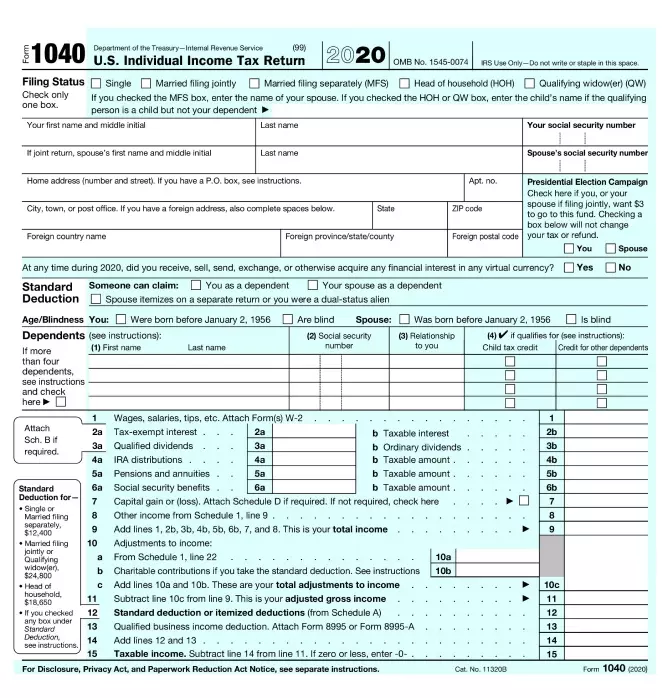

The printable 1040 form for 2024 is designed to be user-friendly and easy to navigate. It is divided into several sections, each of which serves a specific purpose.

The first section of the form is the “Personal Information” section. This section collects basic information about the taxpayer, such as their name, address, and Social Security number.

The next section is the “Income” section. This section lists all of the taxpayer’s income sources, such as wages, salaries, tips, and dividends. The taxpayer must report the amount of income they earned from each source.

The third section is the “Adjustments to Income” section. This section allows the taxpayer to make certain adjustments to their income, such as deducting certain expenses or claiming certain credits.

The fourth section is the “Taxable Income” section. This section calculates the taxpayer’s taxable income by subtracting their adjustments to income from their total income.

The fifth section is the “Tax” section. This section calculates the taxpayer’s tax liability by applying the appropriate tax rates to their taxable income.

The sixth section is the “Payments” section. This section lists all of the payments that the taxpayer has made towards their tax liability, such as withholding taxes and estimated tax payments.

The seventh section is the “Refund or Amount You Owe” section. This section calculates the taxpayer’s refund or the amount they owe.

Layout and Organization

The printable 1040 form is laid out in a logical and easy-to-follow format. The form is divided into several sections, each of which is clearly labeled. The instructions for each section are printed on the form itself, so the taxpayer can easily find the information they need.

Key Sections and Their Purpose

The key sections of the printable 1040 form are:

- Personal Information: This section collects basic information about the taxpayer, such as their name, address, and Social Security number.

- Income: This section lists all of the taxpayer’s income sources, such as wages, salaries, tips, and dividends.

- Adjustments to Income: This section allows the taxpayer to make certain adjustments to their income, such as deducting certain expenses or claiming certain credits.

- Taxable Income: This section calculates the taxpayer’s taxable income by subtracting their adjustments to income from their total income.

- Tax: This section calculates the taxpayer’s tax liability by applying the appropriate tax rates to their taxable income.

- Payments: This section lists all of the payments that the taxpayer has made towards their tax liability, such as withholding taxes and estimated tax payments.

- Refund or Amount You Owe: This section calculates the taxpayer’s refund or the amount they owe.

Benefits and Considerations of Using the Printable Form

The printable 1040 form offers several advantages, making it a convenient and flexible option for taxpayers.

One key benefit is the ability to customize the form according to individual needs and preferences. Taxpayers can fill out the form at their own pace, making corrections or adjustments as necessary. This flexibility allows for a more thorough and accurate completion of the tax return.

Control and Flexibility

- Control over the Process: Using the printable form gives taxpayers complete control over the tax preparation process. They can choose when and where to complete the form, allowing for better time management and a more convenient tax filing experience.

- Flexibility in Completion: The printable form allows taxpayers to work on their tax return at their own pace. They can take breaks, review the information carefully, and make changes as needed, ensuring accuracy and reducing the risk of errors.

Drawbacks and Limitations

- Potential for Errors: While the printable form offers flexibility, it also increases the risk of errors if not filled out carefully. Taxpayers must pay close attention to instructions and ensure all information is entered correctly to avoid potential issues with the IRS.

- Time-Consuming: Compared to electronic filing, using the printable form can be more time-consuming. Taxpayers need to manually fill out the form, which may take longer than using tax software or online platforms.

Common Questions and Troubleshooting

Navigating the printable 1040 form can raise questions or lead to technical difficulties. This section aims to anticipate and resolve common queries, ensuring a smooth and efficient experience.

If you encounter any issues while accessing, printing, or using the form, consult the following guidance for assistance.

Accessing and Printing Issues

- Can’t find the printable form online: Check the official IRS website or reputable tax preparation platforms to download the latest version.

- Unable to print the form: Ensure your printer is connected, has sufficient ink/toner, and supports the correct paper size.

Form-Related Queries

- Where can I find specific information on the form? Refer to the Form 1040 Instructions, available on the IRS website, for detailed explanations of each line and section.

- What if I make a mistake on the form? Use correction fluid or white-out to fix minor errors. For significant mistakes, consider using a new form.

- How do I calculate my refund or amount owed? The form includes worksheets and instructions to guide you through the calculations.

Technical Problems

- Form won’t open or is corrupted: Try downloading the form again or contact the IRS for assistance.

- Software issues: Ensure you have the latest software updates installed and compatible with the form.

Common Queries

What is the purpose of the Printable 1040 Form 2024?

The Printable 1040 Form 2024 is an official IRS form used by individuals to file their federal income taxes. It provides a comprehensive and structured way to report income, deductions, credits, and other tax-related information.

How do I access and print the Printable 1040 Form 2024?

You can access the Printable 1040 Form 2024 online at the IRS website. Once you have downloaded the form, you can print it using any standard printer.

What are the key sections of the Printable 1040 Form 2024?

The Printable 1040 Form 2024 is divided into several key sections, including personal information, income, deductions, credits, and tax calculation. Each section serves a specific purpose and helps you organize and report your tax information accurately.

What are the benefits of using the Printable 1040 Form 2024?

Using the Printable 1040 Form 2024 offers several benefits, such as flexibility, control, and potential cost savings. You can file your taxes at your own pace, review your information carefully, and avoid potential errors associated with electronic filing.

What are some common questions and troubleshooting tips related to the Printable 1040 Form 2024?

There are several common questions and troubleshooting tips related to the Printable 1040 Form 2024. For example, you may encounter issues with accessing the form online, printing errors, or understanding specific sections of the form. Refer to the IRS website or seek professional guidance for assistance with these matters.