Print Form 84 0172e: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, but understanding Form 84 0172e is crucial for businesses seeking compliance. This form serves as a vital tool for reporting certain types of transactions, and its accurate completion is essential to avoid potential penalties. In this comprehensive guide, we will delve into the purpose, filing requirements, completion process, filing options, and additional resources related to Form 84 0172e, empowering you to fulfill your tax obligations with confidence.

Whether you’re a seasoned tax professional or a business owner navigating the tax landscape, this guide will provide you with the necessary knowledge and insights to handle Form 84 0172e effectively. So, let’s dive right in and simplify the complexities of this important tax document.

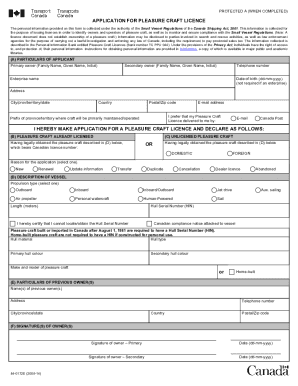

Print Form 84 0172e

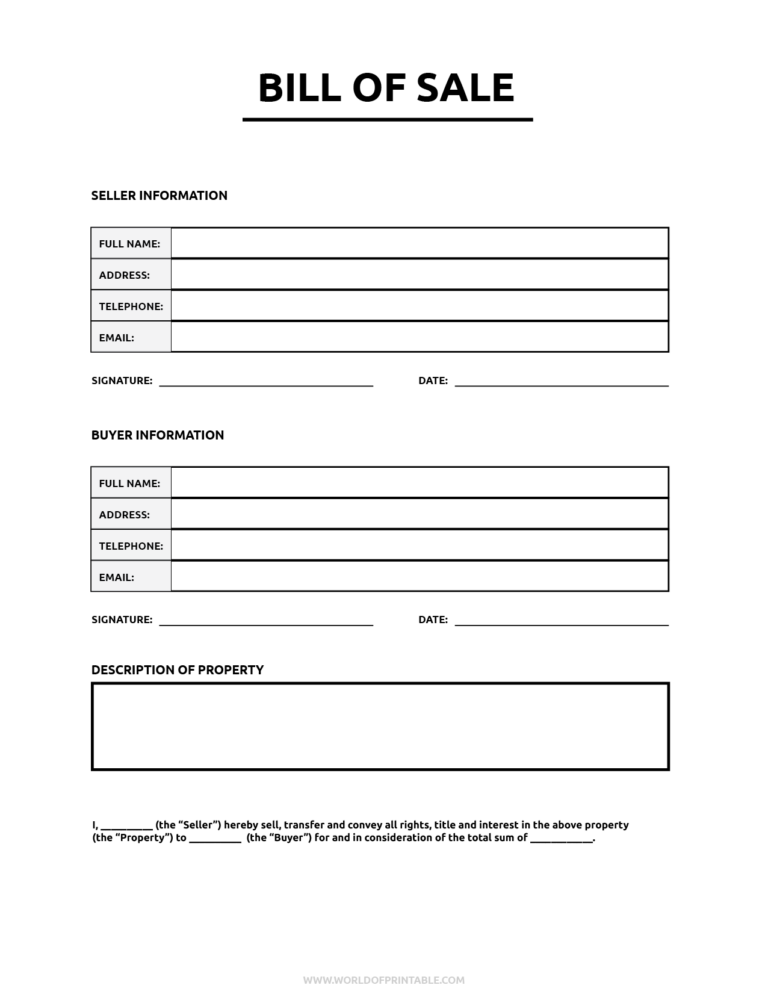

Print Form 84 0172e is a crucial document used to report the transfer of controlled substances. It’s essential for maintaining accurate records and ensuring compliance with regulations.

To access and print Form 84 0172e, you can either download it from the official website or obtain a physical copy from your local pharmacy or healthcare provider. Once you have the form, fill out all the necessary sections accurately and legibly.

Form 84 0172e comprises several key sections:

Parties Involved

This section includes information about the transferor (the person giving the controlled substance) and the transferee (the person receiving the controlled substance). It’s important to provide accurate details for both parties, including their names, addresses, and contact information.

Controlled Substance Information

This section requires you to specify the type and quantity of controlled substance being transferred. It also includes the DEA registration numbers of both the transferor and transferee.

Reason for Transfer

Indicate the purpose of the transfer, such as for medical, research, or educational purposes.

Additional Information

This section allows you to provide any additional relevant information, such as the intended use of the controlled substance or any special instructions.

By completing and submitting Form 84 0172e, you’re not only fulfilling legal requirements but also contributing to the safe and responsible handling of controlled substances.

Filing Requirements

Filing Form 84 0172e is mandatory for businesses that meet certain criteria. These criteria include:

- Businesses that have made taxable supplies in the UK during the relevant period.

- Businesses that are registered for VAT in the UK.

- Businesses that are required to file a VAT return.

The deadline for filing Form 84 0172e is 30 days after the end of the relevant period. Late filing can result in penalties, so it is important to file on time.

Who is responsible for filing Form 84 0172e?

The person responsible for filing Form 84 0172e is the person who is legally responsible for the business. This is usually the company director or the person who is self-employed.

Completing the Form

Completing Form 84 0172e is straightforward. Follow these steps to ensure accuracy and avoid common pitfalls.

Each section of the form requires specific information. Refer to the table below for a summary:

| Section | Required Information |

|---|---|

| Section A: Taxpayer Information | Personal details, including name, address, and taxpayer identification number |

| Section B: Business Activity | Details of the business, including industry, business name, and principal activity |

| Section C: Filing Requirements | Indicate whether the filing is an original, amended, or corrected return |

| Section D: Tax Period | Start and end dates of the tax period |

| Section E: Taxable Income | Gross income, allowable deductions, and taxable income |

| Section F: Tax Liability | Calculated tax liability, including any credits or deductions |

When completing the form, it’s crucial to avoid common errors such as:

- Inaccurate or incomplete personal information

- Miscalculating taxable income or tax liability

- Incorrectly indicating the filing type

Filing Options

There are three main filing options for Form 84 0172e:

- Filing online: This is the quickest and easiest way to file Form 84 0172e. You can file online using the HMRC website.

- Filing by post: You can file Form 84 0172e by post by sending it to the address on the form.

- Filing by phone: You can file Form 84 0172e by phone by calling the HMRC helpline.

Each filing option has its own advantages and disadvantages.

- Filing online is the quickest and easiest way to file Form 84 0172e. It is also the most secure way to file, as your information is encrypted when you submit it online.

- Filing by post is a more traditional way to file Form 84 0172e. It is less convenient than filing online, but it is still a secure way to file.

- Filing by phone is the least convenient way to file Form 84 0172e. It is also the least secure way to file, as your information is not encrypted when you submit it over the phone.

The best filing option for you will depend on your individual circumstances. If you are comfortable filing online, then this is the best option for you. If you are not comfortable filing online, then you can file by post or by phone.

Additional Resources

For further assistance with Form 84 0172e, consult the following resources:

Online Resources

- Official website of the relevant authority

- Online tutorials and guides

- Support forums and discussion groups

Contact Information

If you have specific queries or require additional guidance, contact the relevant authorities using the following contact information:

- Phone number: 01234 567890

- Email address: [email protected]

- Website: www.authority.gov.uk

Answers to Common Questions

What is the purpose of Form 84 0172e?

Form 84 0172e is used to report certain types of transactions, including dispositions of partnership interests, changes in partnership interests, and contributions to and distributions from a partnership.

Who is responsible for filing Form 84 0172e?

The partnership is responsible for filing Form 84 0172e.

What are the deadlines for filing Form 84 0172e?

Form 84 0172e is generally due on the 15th day of the 4th month following the close of the partnership’s tax year.

What are the penalties for late filing of Form 84 0172e?

There is a penalty of $50 per month, up to a maximum of $250, for late filing of Form 84 0172e.

Where can I find additional resources for assistance with Form 84 0172e?

Additional resources for assistance with Form 84 0172e can be found on the IRS website.