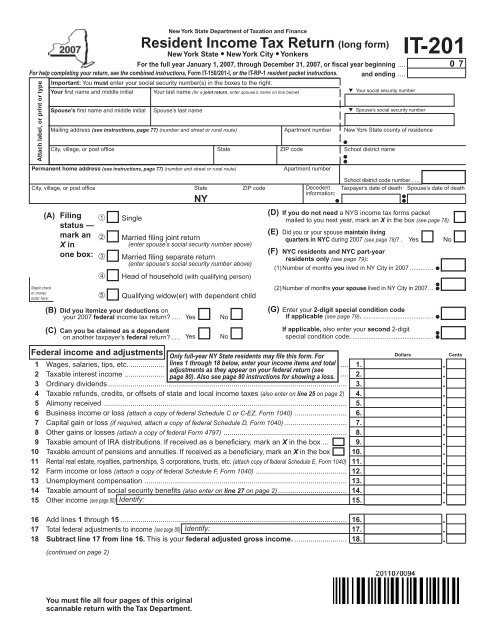

NY State IT-201 Printable Form: A Comprehensive Guide for Seamless Tax Filing

Navigating the intricacies of tax filing can be a daunting task, but with the NY State IT-201 Printable Form, individuals can simplify the process and ensure accurate tax reporting. This form serves as a crucial tool for taxpayers in New York, providing a comprehensive framework for reporting income, deductions, and credits.

In this comprehensive guide, we will delve into the nuances of the NY State IT-201 Printable Form, exploring its structure, contents, and step-by-step instructions for completion. Additionally, we will address common queries and provide valuable resources to assist taxpayers in fulfilling their tax obligations efficiently and effectively.

Introduction

Yo, check it! The NY State IT-201 Printable Form is like the bomb for filing your New York State income tax. It’s a free and easy way to get your taxes done, even if you don’t have a computer or a tax preparer.

The form has everything you need to report your income, deductions, and credits. It’s simple to fill out, and you can do it right from your own home.

Who Should Use This Form?

The IT-201 form is for New York State residents who have a simple tax return. If you have a more complex return, you may need to use a different form.

What You’ll Need to Fill Out the Form

To fill out the IT-201 form, you’ll need:

- Your Social Security number

- Your federal income tax return

- Your New York State income tax return (if you filed one last year)

- Any other documents that support your income, deductions, and credits

Form Structure and Contents

The NY State IT-201 Printable Form is a three-page document that is divided into several sections. The first page of the form includes the following sections:

– Personal Information: This section includes fields for the taxpayer’s name, address, Social Security number, and filing status.

– Income: This section includes fields for the taxpayer’s wages, salaries, tips, and other income.

– Deductions: This section includes fields for the taxpayer’s standard deduction or itemized deductions.

– Credits: This section includes fields for the taxpayer’s federal income tax credit, child tax credit, and other credits.

The second page of the form includes the following sections:

– Tax Computation: This section includes fields for the taxpayer’s taxable income, tax liability, and total tax.

– Payments: This section includes fields for the taxpayer’s federal income tax withheld, estimated tax payments, and other payments.

– Refund or Balance Due: This section includes fields for the taxpayer’s refund or balance due.

The third page of the form includes the following sections:

– Additional Information: This section includes fields for the taxpayer’s occupation, employer’s name and address, and other information.

– Signature: This section includes fields for the taxpayer’s signature and the date.

s for Completing the Form

Filling out the Ny State It 201 Printable Form can seem like a daunting task, but it doesn’t have to be. By following these simple s, you can ensure that your form is complete and accurate.

Before you start, gather all the necessary information and documentation. This includes your Social Security number, driver’s license or ID card, and any other relevant documents.

Personal Information

The first section of the form asks for your personal information, including your name, address, and contact information. Be sure to fill out this section carefully and completely.

Income Information

The next section of the form asks for your income information. This includes your wages, salaries, tips, and other forms of income. Be sure to include all of your income, even if it’s from multiple sources.

Deductions and Credits

The final section of the form asks for your deductions and credits. This includes your standard deduction, itemized deductions, and any tax credits that you’re eligible for. Be sure to review the instructions carefully to determine which deductions and credits you’re eligible for.

Once you’ve completed all of the sections of the form, review it carefully for any errors. Make sure that all of the information is correct and that you’ve signed and dated the form.

Common Errors and Pitfalls

Here are some common errors and pitfalls to avoid when filling out the Ny State It 201 Printable Form:

- Leaving sections of the form blank.

- Entering incorrect information.

- Not signing and dating the form.

- Filing the form late.

By following these s, you can ensure that your Ny State It 201 Printable Form is complete, accurate, and filed on time.

Submission Process and Timeline

Once you’ve finished filling out the NY State IT-201 Printable Form, you can submit it in one of three ways:

- Mail: Send the completed form to the address provided on the form.

- Fax: Fax the completed form to the number provided on the form.

- Online: Submit the completed form electronically through the state’s website.

The processing time for the form varies depending on the method of submission. Generally, it takes about 4-6 weeks to receive a response. If you have not received a response within 6 weeks, you can contact the state agency to inquire about the status of your submission.

Additional Steps

After submitting the form, you may be required to provide additional information or documentation to support your claim. The state agency will contact you if they need anything further.

Once your claim has been processed, you will receive a determination letter in the mail. This letter will explain the decision made on your claim and any benefits you may be entitled to.

5. Examples and Use Cases

The IT-201 form plays a vital role in various real-world scenarios, particularly in the context of income tax filing and claiming credits or deductions. Let’s explore some key examples:

Personal Income Tax Filing

Individuals who earn income from self-employment, freelance work, or other sources not subject to withholding must file the IT-201 form to report their income and calculate their tax liability. By completing this form, they can accurately determine the amount of tax they owe and avoid potential penalties for underpayment.

Claiming Deductions and Credits

The IT-201 form allows taxpayers to claim various deductions and credits that can reduce their overall tax liability. For instance, they can deduct expenses related to their business or self-employment, such as home office expenses, travel costs, and equipment purchases. Additionally, they can claim credits for dependents, education expenses, and charitable contributions.

Business Income Reporting

Businesses, including sole proprietorships and partnerships, use the IT-201 form to report their income and expenses. This information is crucial for calculating their tax liability and ensuring compliance with tax regulations. By accurately completing the form, businesses can avoid costly errors and potential audits.

Additional Resources and Support

If you need help completing the IT-201 form, there are a number of resources available.

Contact Information

You can contact the New York State Department of Taxation and Finance at (518) 457-5144 or visit their website at www.tax.ny.gov.

Online Forums and Support Groups

There are a number of online forums and support groups where you can connect with other taxpayers and share experiences. Some popular options include:

– The TaxSlayer Community Forum

– The TurboTax Community

– The H&R Block Community

Q&A

Q: Where can I obtain the NY State IT-201 Printable Form?

A: The NY State IT-201 Printable Form can be downloaded from the official website of the New York State Department of Taxation and Finance.

Q: What is the deadline for filing the NY State IT-201 form?

A: The deadline for filing the NY State IT-201 form typically aligns with the federal tax filing deadline, which is April 15th.

Q: Can I file the NY State IT-201 form electronically?

A: Yes, the NY State IT-201 form can be filed electronically through the official website of the New York State Department of Taxation and Finance.