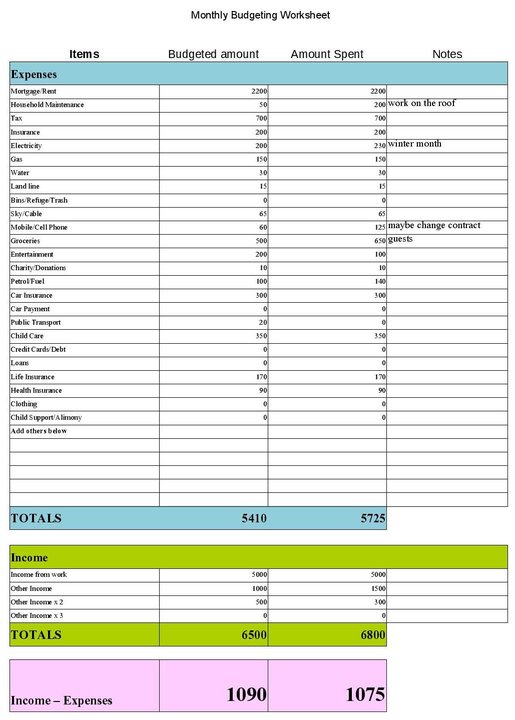

Monthly Budget Printable Worksheet: Your Key to Financial Success

In today’s fast-paced world, managing personal finances can be a daunting task. With expenses lurking around every corner, it’s easy to lose track of your financial well-being. That’s where a monthly budget printable worksheet comes into play – your secret weapon for financial freedom.

A monthly budget worksheet is an indispensable tool that provides a comprehensive overview of your income and expenses. It empowers you to take control of your finances, make informed decisions, and achieve your financial goals.

Budget Worksheet Introduction

Yo, check it, a monthly budget printable worksheet is like your money manager, bruv. It’s a sick way to keep tabs on your dough and make sure you’re not blowing it all on peng ting.

Using a budget worksheet is like having a roadmap for your finances. It helps you figure out where your money’s going, what you can cut back on, and how to save more dough for the things you really want.

Benefits of Using a Budget Worksheet

- Get a clear picture of your income and expenses.

- Identify areas where you can save money.

- Set financial goals and track your progress.

- Avoid debt and improve your credit score.

- Gain peace of mind knowing you’re in control of your finances.

Sections of a Monthly Budget Worksheet

Blud, getting your finances in check is like sorting out your messy room – you gotta break it down into smaller bits. That’s where a monthly budget worksheet comes in, fam. It’s like a blueprint for your dough, helping you keep track of where your bread’s going and where you can trim the fat.

A budget worksheet is split into different sections, each with its own special purpose. Let’s dive into each one, shall we?

Income

This is where you jot down all the ways you’re bringing in the bacon. It could be your paycheck, benefits, or even side hustles. This section helps you see how much you’ve got to work with each month.

Fixed Expenses

These are the bills that don’t change much from month to month, like rent, mortgage, car payment, and insurance. These are the commitments you’ve already made and can’t really wiggle out of.

Variable Expenses

Unlike fixed expenses, these ones can fluctuate, like groceries, entertainment, and petrol. These are the areas where you can tighten your belt or splurge a bit, depending on your cash flow.

Savings

This section is crucial for building a rainy day fund or reaching your financial goals. It’s where you set aside a portion of your income for future expenses or investments.

Debt Repayment

If you’ve got any outstanding loans or credit card balances, this section helps you track your progress in paying them off. It’s like a roadmap to getting rid of your debts and improving your credit score.

Budget Balance

This is the grand finale, where you compare your income to your expenses. If you’re in the green, you’re winning. If you’re in the red, it’s time to re-evaluate and make some adjustments to your spending.

Creating a Monthly Budget

Creating a monthly budget is essential for managing your finances effectively. It helps you track your income and expenses, set financial goals, and make informed decisions about how to spend your money.

To create a monthly budget, follow these steps:

Categorizing Expenses

Start by categorizing your expenses. This will help you identify areas where you can save money. Common expense categories include:

- Fixed expenses (e.g., rent, mortgage, car payments)

- Variable expenses (e.g., groceries, entertainment, gas)

- Discretionary expenses (e.g., shopping, dining out, travel)

Setting Financial Goals

Once you have categorized your expenses, you can start setting financial goals. What do you want to save for? A new car? A down payment on a house? Retirement?

Setting specific, achievable financial goals will help you stay motivated and on track.

Tracking Progress

Finally, it’s important to track your progress. This will help you identify areas where you can improve your budgeting habits.

There are many different ways to track your progress, such as using a budgeting app, spreadsheet, or simply writing down your expenses in a notebook.

Customizing the Worksheet

The Monthly Budget Worksheet is a versatile tool that can be tailored to suit your specific needs and preferences. You can add or remove sections, adjust categories, and personalize it to create a budget that works best for you.

Adding or Removing Sections

If there are sections in the worksheet that you don’t need, simply delete them. Conversely, if you need to track additional expenses or income streams, you can add new sections by creating new rows or columns.

Additional Features

In addition to the core components of a monthly budget worksheet, there are a number of additional features that can be included to make it even more useful. These features can help you to track your progress towards your financial goals, identify areas where you can save money, and make better decisions about how you spend your money.

Some of the most common additional features include:

Debt Repayment Calculators

Debt repayment calculators can help you to create a plan for paying off your debts faster. These calculators take into account your current debt balance, interest rate, and monthly payment to calculate how long it will take you to pay off your debt and how much interest you will pay over time.

Savings Trackers

Savings trackers can help you to track your progress towards your savings goals. These trackers allow you to set a savings goal and then track your progress towards that goal over time. This can help you to stay motivated and on track to reach your savings goals.

Financial Planning Tools

Financial planning tools can help you to make better decisions about how you spend your money. These tools can help you to create a budget, track your expenses, and identify areas where you can save money. They can also help you to plan for your future financial goals, such as retirement or buying a home.

Benefits of Using a Monthly Budget Worksheet

Monthly budget worksheets are a priceless tool for taking control of your finances. They offer a clear and organised way to track your income and expenses, which can be a huge help in identifying areas where you can save money and make better financial decisions.

Here are some of the benefits of using a monthly budget worksheet:

Tracking Income and Expenses

A budget worksheet allows you to keep track of all of your income and expenses in one place. This can help you to see where your money is going and where you can cut back. You can also use your budget worksheet to track your progress over time and see how your spending habits are changing.

Identifying Areas for Savings

Once you have a clear picture of your income and expenses, you can start to identify areas where you can save money. For example, you may realise that you are spending too much money on eating out or on entertainment. By cutting back in these areas, you can free up some extra cash that you can put towards your savings goals.

Making Informed Financial Decisions

A budget worksheet can help you to make more informed financial decisions. For example, if you are considering making a large purchase, you can use your budget worksheet to see if you can afford it. You can also use your budget worksheet to compare different financial products, such as loans and credit cards, to find the best deal.

Achieving Financial Goals

A budget worksheet can help you to achieve your financial goals. By tracking your income and expenses, you can see how much money you have available to save and invest. You can also use your budget worksheet to set financial goals and track your progress towards achieving them.

Design Considerations

The design of your monthly budget worksheet can have a big impact on how easy it is to use and how visually appealing it is. Here are a few things to consider:

Color schemes: Use colors that are easy on the eyes and that help you to differentiate between different categories of expenses. For example, you could use green for income, red for expenses, and blue for savings.

Font choices

Choose a font that is easy to read and that doesn’t take up too much space. You may also want to use different fonts for different types of information, such as headings, subheadings, and body text.

Layout and organization

The layout of your worksheet should be logical and easy to follow. Make sure that the most important information is easy to find and that there is plenty of white space so that the worksheet doesn’t look cluttered.

Call to Action

Grab your free monthly budget worksheet today and start taking control of your finances! This comprehensive tool will help you track your income and expenses, identify areas where you can save, and create a plan for financial success.

Don’t wait any longer to get your finances in order. Download your worksheet now and start budgeting like a boss!

Frequently Asked Questions

Is a monthly budget printable worksheet suitable for everyone?

Absolutely! Whether you’re a seasoned budgeter or just starting out, our worksheet is designed to cater to all levels of financial experience. It provides a structured framework that can be tailored to your unique needs.

How often should I update my monthly budget worksheet?

Consistency is key. We recommend updating your worksheet regularly, at least once a month. This allows you to track your progress, identify areas for improvement, and stay on top of your financial goals.

Can I customize the monthly budget printable worksheet?

Yes, customization is encouraged! Our worksheet is designed to be flexible, allowing you to add or remove sections, adjust categories, and create a budget that aligns perfectly with your financial situation and goals.