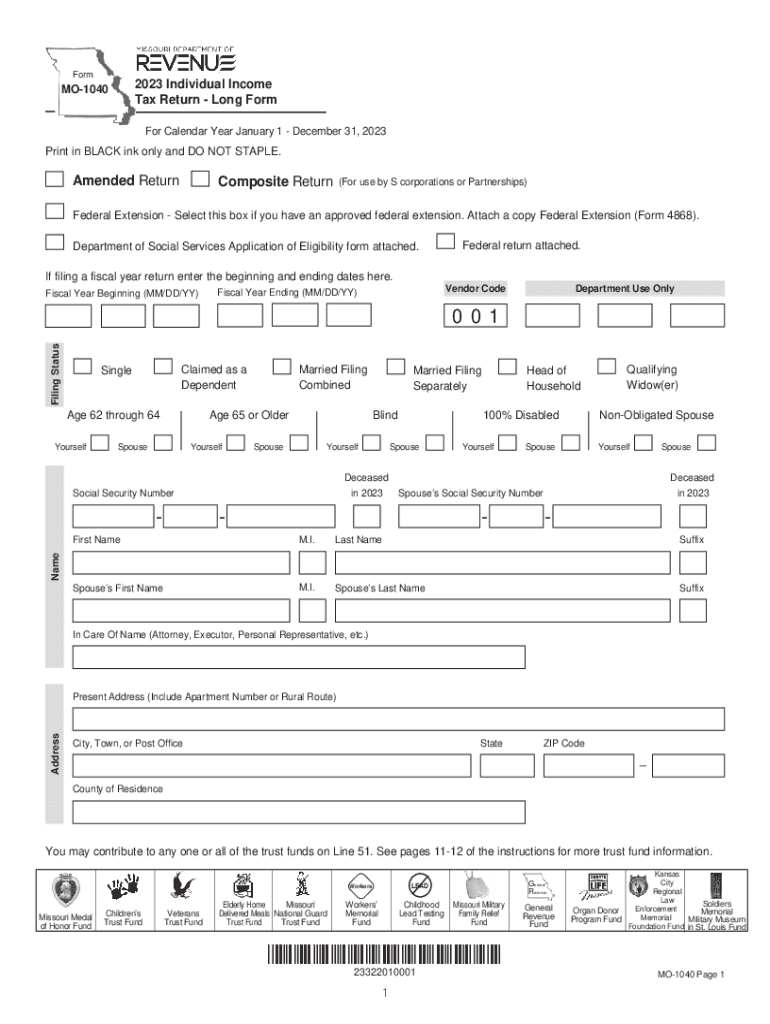

Mo 1040 Printable Form: A Comprehensive Guide to Filing Your Taxes

The Mo 1040 Printable Form is a crucial document for individuals and businesses alike. It is used to report income, deductions, and credits to the Internal Revenue Service (IRS) for the purpose of calculating tax liability. Understanding how to obtain, complete, and file Form 1040 is essential for fulfilling tax obligations accurately and efficiently.

In this comprehensive guide, we will delve into the intricacies of Form 1040, providing step-by-step instructions and valuable insights to ensure a seamless tax filing experience. Whether you are a first-time filer or a seasoned taxpayer, this guide will empower you with the knowledge and confidence to navigate the tax filing process with ease.

What is Form 1040?

Form 1040 is the primary income tax return form used by individuals in the United States to report their annual income and calculate their tax liability. It is an essential document that helps the Internal Revenue Service (IRS) determine the amount of taxes owed or the refund due to the taxpayer.

Form 1040 is designed to capture various types of income, including wages, salaries, investments, and self-employment earnings. It also allows taxpayers to claim deductions and credits that can reduce their taxable income and, subsequently, their tax liability.

There are different types of Form 1040 available, each tailored to specific circumstances. These include:

- Form 1040-EZ: A simplified version for taxpayers with straightforward tax situations.

- Form 1040-A: A more comprehensive form for taxpayers with itemized deductions or certain types of income.

- Form 1040: The most comprehensive form, used by taxpayers with complex tax situations or those who cannot use the EZ or A forms.

How to Obtain a Printable Form 1040

Getting your hands on a printable Form 1040 is a doddle. There are a few different ways you can do it, so pick the one that suits you best.

From the IRS Website

The IRS website is the official source for Form 1040. Here’s how to download and print it:

- Go to the IRS website: https://www.irs.gov/

- In the search bar, type “Form 1040”

- Click on the “Forms and Publications” tab

- Find Form 1040 in the list and click on it

- Click on the “Download PDF” button

- Print the PDF file

Other Sources

If you don’t want to download the form from the IRS website, there are other places you can get it:

- Local IRS office

- Public libraries

- Tax preparation software

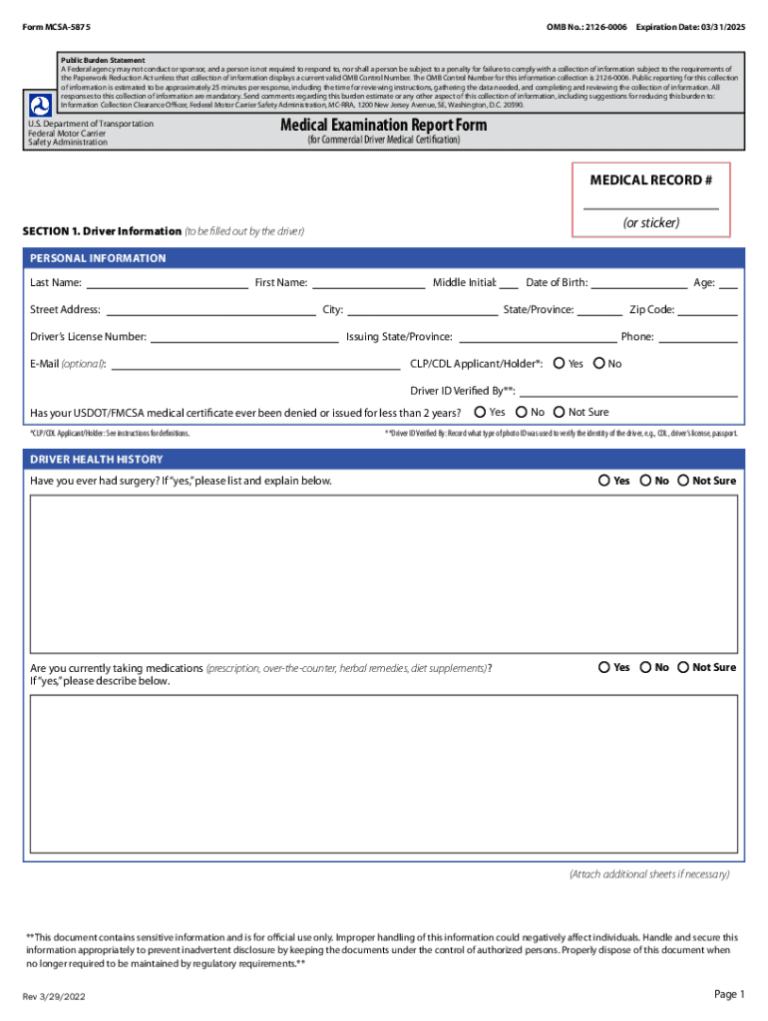

Completing Form 1040

Filing Form 1040 can be a bit of a headache, but it’s important to get it right. This form is how you tell the taxman how much you owe, and if you make a mistake, you could end up paying more than you should. That’s why it’s important to take your time and fill out the form accurately.

The good news is that Form 1040 is actually pretty straightforward. It’s divided into several sections, and each section asks for specific information. If you can just follow the instructions and fill out each section carefully, you should be able to get your taxes done without any problems.

Key Sections of Form 1040

The key sections of Form 1040 are:

- Personal information

- Income

- Adjustments to income

- Taxable income

- Taxes

- Credits

- Payments

- Refund or amount you owe

Each of these sections is important, so make sure you fill them out completely and accurately.

Providing Accurate and Complete Information

It’s important to provide accurate and complete information on your Form 1040. If you make a mistake, you could end up paying more taxes than you should. That’s why it’s important to take your time and double-check your work before you file your return.

If you’re not sure how to fill out a particular section of the form, you can always consult the instructions. The instructions are available online or you can get a copy from your local tax office.

Filing Form 1040

Filing Form 1040 is the final step in completing your tax return. There are three primary methods of filing: mailing, e-filing, and using a tax preparer.

Methods of Filing Form 1040

- Mailing: You can mail your completed Form 1040 to the IRS using the address provided on the form. It’s important to ensure your return is postmarked by the filing deadline to avoid late filing penalties.

- E-filing: E-filing is a convenient and secure way to file your tax return electronically. You can use tax preparation software or an IRS-approved e-file provider to submit your return online. E-filing can significantly reduce processing time and the risk of errors.

- Tax Preparer: If you’re not comfortable preparing your tax return yourself, you can hire a tax preparer to assist you. Tax preparers can help you gather the necessary documents, complete the forms, and ensure your return is filed correctly.

Filing Deadlines and Penalties

The filing deadline for Form 1040 is typically April 15th. However, if you file an extension, you have until October 15th to file your return. Late filing can result in penalties, so it’s crucial to file on time.

Printable Form 1040 Examples

Let’s look at some types of Form 1040, fam.

Form Types and Their Purpose

Here’s a lit breakdown:

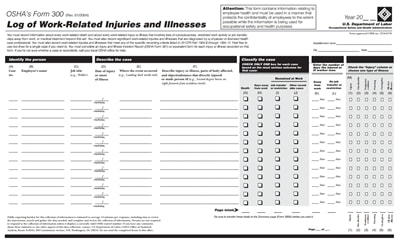

| Form Type | Purpose | Relevant Information |

|---|---|---|

| 1040 | Basic individual income tax return | Income, deductions, credits |

| 1040-EZ | Simplified individual income tax return | Limited income, no dependents |

| 1040-SR | Individual income tax return for seniors | Additional tax credits, standard deduction |

| 1040-NR | Individual income tax return for non-resident aliens | US income only, special tax rates |

| 1040-X | Amended individual income tax return | Corrections to previously filed return |

Common Errors to Avoid

Navigating Form 1040 can be tricky, but it’s important to steer clear of common pitfalls to ensure an accurate submission. Here’s the lowdown on some frequent blunders and how to dodge them like a pro.

Double-checking your work is crucial. Mathematical mistakes can lead to a tax nightmare. Make sure your calculations are spot-on to avoid any unnecessary headaches.

Math Mishaps

-

Ensure your arithmetic is flawless. Mistakes in addition, subtraction, multiplication, or division can throw off your entire return.

-

Carefully check your figures when transferring amounts from other forms or schedules. Even a minor error can create a ripple effect.

Oversights and Omissions

Leaving out essential information is a big no-no. Make sure you fill out every applicable section and include all necessary attachments.

-

Don’t forget to sign and date your return. Without your signature, it’s not valid.

-

Attach all required schedules and forms. Missing documents can delay your refund or even trigger an audit.

Incorrect Information

Accuracy is key when it comes to your tax return. Providing incorrect information can lead to penalties or even criminal charges.

-

Double-check your Social Security number and other personal details to ensure they’re accurate.

-

Be meticulous when entering your income and deductions. Any discrepancies can raise red flags with the tax authorities.

FAQ

What are the different types of Form 1040 available?

There are three main types of Form 1040: Form 1040-EZ, Form 1040-A, and Form 1040. Form 1040-EZ is the simplest form and is suitable for taxpayers with straightforward tax situations. Form 1040-A is more complex than Form 1040-EZ but is still relatively simple. Form 1040 is the most comprehensive form and is used by taxpayers with complex tax situations.

How can I obtain a printable Form 1040?

You can obtain a printable Form 1040 from the IRS website, by mail, or through a tax professional. To download the form from the IRS website, visit www.irs.gov and search for “Form 1040.”

What are some common errors to avoid when completing Form 1040?

Some common errors to avoid when completing Form 1040 include:

- Incorrectly reporting income or deductions

- Using the wrong tax bracket

- Making math errors

- Missing deadlines