Kansas W2 Form Printable: A Comprehensive Guide

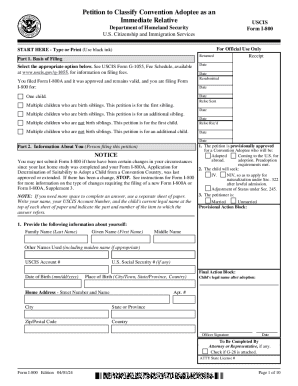

The Kansas W2 Form Printable is a crucial document for individuals in Kansas who are required to report their income and taxes. Understanding how to download, fill out, and submit this form is essential for ensuring accurate and timely tax filing. This guide will provide a comprehensive overview of the Kansas W2 Form Printable, covering its purpose, structure, and key sections. We will also discuss the process of downloading, printing, filling out, and submitting the form, along with troubleshooting common issues. Additionally, we will address frequently asked questions to enhance your understanding of this important document.

The Kansas W2 Form Printable is a legal document that serves as a record of an individual’s income and taxes withheld during the tax year. It is issued by employers to their employees and must be submitted to the Kansas Department of Revenue by the established deadline. The form consists of several sections, each containing specific information such as the employee’s personal data, income details, and tax withholdings. Accurate and complete filling of the Kansas W2 Form Printable is crucial to ensure proper tax calculation and timely processing of tax returns.

W2 Form Basics

The Kansas W2 Form is a crucial document that serves as a record of your earnings and tax information for the previous year. It’s like a report card for your taxes, mate.

The form is divided into several sections, including your personal info, your employer’s info, and a breakdown of your wages, taxes, and other deductions. It’s essential to fill out the form accurately and completely, or you could end up paying more tax than you should or even getting a nasty letter from the taxman.

Key Sections of the Form

The key sections of the Kansas W2 Form include:

- Box 1: Wages, tips, other compensation – This is the total amount of money you earned from your job, before any taxes or deductions were taken out.

- Box 2: Federal income tax withheld – This is the amount of federal income tax that was taken out of your paycheck.

- Box 3: Social security tax withheld – This is the amount of social security tax that was taken out of your paycheck.

- Box 4: Medicare tax withheld – This is the amount of Medicare tax that was taken out of your paycheck.

- Box 5: Medicare wages and tips – This is the total amount of your wages and tips that are subject to Medicare tax.

- Box 6: Social security wages – This is the total amount of your wages and tips that are subject to social security tax.

- Box 7: Social security tips – This is the total amount of tips you received that are subject to social security tax.

- Box 8: Advance EIC payment – This is the amount of the earned income credit that was paid to you in advance.

- Box 9: Dependent care benefits – This is the amount of dependent care benefits that you received from your employer.

- Box 10: Nonqualified plans – This is the amount of nonqualified plans that you received from your employer.

Downloading and Printing the Form

Blag it and get your mits on the Kansas W2 Form, bruv. It’s a doddle to download and print, innit? Just follow these sick steps, and you’ll be sorted in no time.

Online Platforms

Smash the link to the Kansas Department of Revenue website: www.ksrevenue.org. Once you’re there, it’s like a treasure hunt. Look for the “Forms” tab, and then click on “Individual Income Tax Forms.” Boom! You’ll find the W2 Form ready to download.

Step-by-Step Guide

- Navigate to the Kansas Department of Revenue website.

- Click on the “Forms” tab, then “Individual Income Tax Forms.”

- Find the W2 Form and click the “Download” button.

- Save the form to your computer.

- Open the saved file and print it out.

Filling Out the Form

Completing the Kansas W2 Form accurately is crucial for tax filing. It requires essential information from both the employer and employee to ensure correct tax calculations and reporting.

Each field on the form has a specific purpose and significance. Understanding these fields and providing accurate information is essential to avoid errors and ensure a smooth tax filing process.

Employee Information

- Employee’s Name and Address: Enter your full legal name and mailing address.

- Social Security Number (SSN): Provide your nine-digit SSN, which is essential for tax identification.

Employer Information

- Employer’s Name and Address: Enter the full legal name and address of your employer.

- Employer Identification Number (EIN): This is a nine-digit number assigned to your employer by the Internal Revenue Service (IRS) for tax purposes.

Wage and Tax Information

- Wages, Tips, Other Compensation: Report the total amount of wages, tips, and other taxable compensation you received from your employer during the tax year.

- Federal Income Tax Withheld: This is the amount of federal income tax withheld from your paycheck throughout the year.

- Social Security Tax Withheld: The amount of Social Security tax withheld from your paycheck.

- Medicare Tax Withheld: The amount of Medicare tax withheld from your paycheck.

Other Information

- Control Number: This is a unique number assigned to your W2 Form by your employer, which helps in tracking and processing.

- State Income Tax: If applicable, enter the amount of state income tax withheld from your paycheck.

Submitting the Form

Once you have completed filling out the Kansas W2 Form, you need to submit it to the appropriate authorities. There are several methods available for submitting the form:

Mailing the Form

You can mail the completed form to the Kansas Department of Revenue (KDOR) at the following address:

Kansas Department of Revenue

P.O. Box 3341

Topeka, KS 66612-3341

Make sure to mail the form on time to avoid late submission penalties.

Electronically Filing the Form

You can also electronically file the Kansas W2 Form using the Kansas Online Filing System (KOFS). To do this, you will need to create an account on the KOFS website and follow the instructions provided.

Electronic filing is a convenient and secure way to submit your W2 Form, and it can help you avoid mailing delays or errors.

Personally Delivering the Form

If you prefer, you can also personally deliver the completed W2 Form to the KDOR office in Topeka.

The KDOR office is located at:

915 SW Harrison St

Topeka, KS 66612

The office is open from 8:00 AM to 5:00 PM, Monday through Friday.

Deadlines and Consequences of Late Submissions

The deadline for submitting the Kansas W2 Form is April 15th. If you fail to submit the form by this deadline, you may be subject to penalties and interest charges.

The penalties for late submissions vary depending on the circumstances. If you have any questions about the deadlines or penalties, you should contact the KDOR.

Troubleshooting Common Issues

Navigating the Kansas W2 Form can sometimes present challenges. Here are some common issues you might encounter and how to tackle them:

Error: Incorrect Social Security Number

Ensure the Social Security Number (SSN) entered is accurate and matches the recipient’s official records. If there’s a discrepancy, contact the Social Security Administration (SSA) for assistance.

Error: Missing or Invalid Employer Identification Number (EIN)

Verify that the EIN provided by the employer is correct. If it’s missing or invalid, reach out to the employer to obtain the accurate information.

Error: Discrepancies in Income and Tax Withholdings

Carefully review the income and tax withholding amounts on the W2 Form. If there are any discrepancies, contact your employer for clarification. It’s also advisable to consult with a tax professional for guidance.

Error: Incomplete or Illegible Form

Ensure that all required fields on the W2 Form are completed and legible. If there are any missing or illegible sections, contact the employer for a corrected form.

Importance of Professional Assistance

If you encounter persistent issues or have complex tax situations, don’t hesitate to seek professional assistance from a tax advisor or certified public accountant (CPA). They can provide expert guidance and ensure accurate tax filing.

FAQ

What is the purpose of the Kansas W2 Form Printable?

The Kansas W2 Form Printable is used to report an individual’s income and taxes withheld during the tax year. It is issued by employers to their employees and must be submitted to the Kansas Department of Revenue by the established deadline.

Where can I download the Kansas W2 Form Printable?

The Kansas W2 Form Printable can be downloaded from the official website of the Kansas Department of Revenue.

What information is required to fill out the Kansas W2 Form Printable?

To fill out the Kansas W2 Form Printable, you will need the following information: your personal data, income details, and tax withholdings.

How do I submit the completed Kansas W2 Form Printable?

You can submit the completed Kansas W2 Form Printable by mail, electronically, or in person.

What are the consequences of late submission of the Kansas W2 Form Printable?

Late submission of the Kansas W2 Form Printable may result in penalties and interest charges.