Is There A Printable 1099 Form? A Comprehensive Guide

Navigating the complexities of tax reporting can be a daunting task, especially when it comes to 1099 forms. Whether you’re a freelancer, independent contractor, or business owner, understanding the availability and benefits of printable 1099 forms is crucial for accurate and efficient tax filing.

In this comprehensive guide, we will delve into the world of printable 1099 forms, exploring their accessibility, advantages, printing instructions, common issues, legal considerations, and the latest advancements. By the end of this discussion, you’ll have a clear understanding of everything you need to know about printable 1099 forms, empowering you to fulfill your tax obligations with confidence.

Printable 1099 Form Availability

Innit, need a 1099 form? You can easily bag one for free, no sweat! Just hit up the IRS website or swing by their local office. They’ve got a stash of printable 1099 forms in various flavours, including PDF, fillable, and even good ol’ paper.

Where to Find Printable 1099 Forms

- IRS Website: Cruise on over to irs.gov and dive into the “Forms & Pubs” section. There, you’ll find a treasure trove of printable 1099 forms.

- IRS Office: If you’re more of a face-to-face type, pop into your local IRS office. They’ll hook you up with the 1099 forms you need.

Formats of Printable 1099 Forms

- PDF: These are the digital versions of 1099 forms. You can download them, fill them out on your comp, and print them off.

- Fillable: These 1099 forms are like magic! You can fill them out right on your screen and then print them out. No need for scribbles and ink stains.

- Paper: If you’re a traditionalist, you can still get your hands on paper 1099 forms. Just visit your local IRS office or order them online.

Benefits of Using Printable 1099 Forms

Utilising printable 1099 forms brings about a plethora of advantages that can simplify tax season and enhance efficiency. These forms provide a convenient and cost-effective solution for businesses and individuals alike.

Printable 1099 forms eliminate the need for manual data entry, reducing the risk of errors and saving valuable time. They can be easily filled out and printed, ensuring accuracy and streamlining the tax filing process.

Time-Saving

Printable 1099 forms significantly reduce the time spent on tax preparation. By eliminating the need for handwritten entries and data transfer, businesses can save hours of labour. This allows them to focus on other critical tasks, such as growing their operations.

Cost-Effectiveness

Printable 1099 forms offer a cost-effective solution compared to pre-printed forms. Businesses can purchase blank forms in bulk, reducing the overall expense associated with tax filing. Additionally, printable forms eliminate the need for postage and handling fees.

s for Printing 1099 Forms

Follow these detailed s to print your 1099 forms effortlessly and accurately.

Begin by selecting the appropriate 1099 form for your specific reporting needs. Once you have the correct form, ensure that your printer is properly set up and configured.

Step 1: Form Selection and Printer Setup

- Select the correct 1099 form type based on the income being reported.

- Configure your printer settings, including paper size and orientation, to match the selected form.

- Ensure that the printer is connected to your computer and has sufficient ink or toner.

Step 2: Form Preparation and Printing

- Enter the necessary information into the 1099 form, ensuring accuracy and completeness.

- Preview the form before printing to verify the layout and content.

- Print the form on high-quality paper that meets IRS requirements.

Step 3: Accuracy Verification and Handling

- Double-check the printed form for any errors or omissions.

- Handle the printed forms with care to prevent damage or smudging.

- Make copies of the forms for your records and distribute them as required.

Common Issues with Printable 1099 Forms

Printing 1099 forms can sometimes run into hitches. Here are a few common issues and how to fix them:

If your printer is acting up, try these troubleshooting tips:

– Make sure the printer is properly connected to your computer.

– Check if the printer has enough paper and ink.

– Restart the printer and your computer.

Alternative Methods for Obtaining 1099 Forms

If you’re still having trouble printing, you can get 1099 forms from other sources:

- Request them from the IRS: You can order 1099 forms directly from the IRS website or by calling 1-800-TAX-FORM (1-800-829-3676).

- Download them from the IRS website: You can download fillable 1099 forms from the IRS website and print them yourself.

- Use a tax software program: Many tax software programs include the ability to print 1099 forms.

Legal Considerations for Printable 1099 Forms

Using printable 1099 forms comes with legal obligations that businesses must adhere to. Understanding these requirements is crucial to ensure compliance and avoid potential penalties.

Ensuring Compliance

Businesses are legally bound to issue 1099 forms to independent contractors who meet specific criteria, such as earning over a certain threshold. Failure to comply can result in fines and penalties. To avoid these, businesses must accurately determine who qualifies as an independent contractor and issue 1099 forms promptly.

Advancements in Printable 1099 Forms

The world of printable 1099 forms has undergone a series of advancements in recent years, making the printing process more efficient, accurate, and user-friendly. These advancements have introduced new features and technologies that cater to the evolving needs of businesses and individuals.

One significant advancement is the integration of cloud-based platforms. Cloud-based 1099 form printing services allow users to access and manage their forms from anywhere with an internet connection. This eliminates the need for physical storage and manual handling, streamlining the printing process and reducing the risk of errors.

Automated Data Import

Another advancement is the introduction of automated data import features. These features enable users to import data from various sources, such as accounting software or spreadsheets, directly into the 1099 form printing software. This eliminates the need for manual data entry, saving time and reducing the likelihood of errors.

Improved Security Measures

Advancements in printable 1099 forms have also focused on enhancing security measures. Many software providers now offer features such as password protection, encryption, and digital signatures to ensure the confidentiality and integrity of sensitive taxpayer information.

Enhanced Accessibility

Recognizing the diverse needs of users, developers have made significant strides in improving the accessibility of printable 1099 forms. Software interfaces have been designed with intuitive navigation and clear instructions, making it easier for users of all skill levels to generate accurate forms.

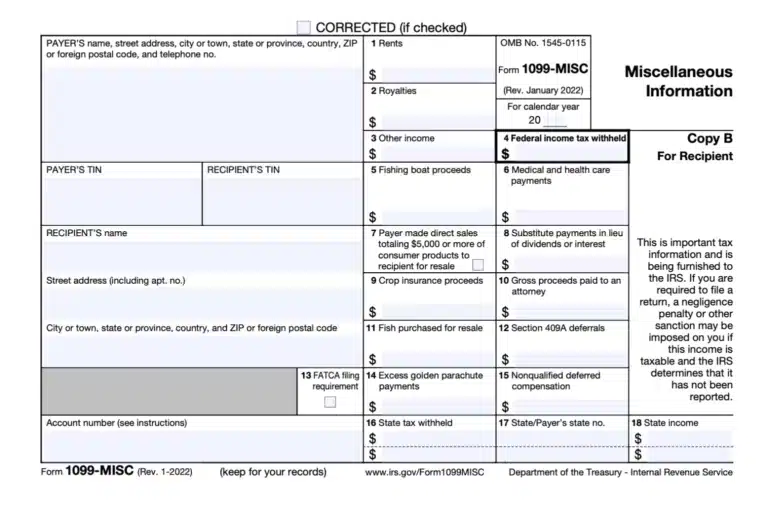

Printable 1099 Form Examples

Blokes and birds, let’s get down to the nitty-gritty of printable 1099 forms, shall we? In this crib, we’ll suss out some corkers you can print off right this minute.

Before we dive in, let’s bone up on why printable 1099 forms are the bee’s knees. They’re right handy for filing your taxes, especially if you’re self-employed or a contractor. Plus, they’re free and easy to get your mitts on.

| Form Type | Purpose | Download Link |

|---|---|---|

| 1099-MISC | For payments made to independent contractors for services performed. | Download |

| 1099-NEC | For payments made to nonemployees for services performed. | Download |

| 1099-INT | For payments made on interest earned. | Download |

| 1099-DIV | For payments made on dividends received. | Download |

| 1099-R | For payments made on distributions from retirement plans. | Download |

FAQ Section

What are the different types of printable 1099 forms available?

There are various types of printable 1099 forms available, each designed for specific income categories. Some common types include 1099-NEC (Nonemployee Compensation), 1099-MISC (Miscellaneous Income), 1099-K (Payment for Property or Services Received through a Third-Party Network), and 1099-DIV (Dividends and Distributions).

Can I use any printable 1099 form I find online?

While there are many printable 1099 forms available online, it’s important to ensure you’re using the correct form for your specific income type. Using an incorrect form can lead to errors and potential tax issues. It’s recommended to obtain the official forms from the IRS website or reputable tax software providers.

What are the legal requirements for using printable 1099 forms?

The IRS requires businesses and individuals to file 1099 forms for payments made to nonemployees who earn $600 or more in a tax year. Failure to file accurate and timely 1099 forms can result in penalties and interest charges.

How can I ensure accurate printing of 1099 forms?

To ensure accurate printing, verify that you’re using the latest version of the form, select the correct paper size and orientation, and preview the document before printing. Additionally, double-check the data entered on the form for any errors.