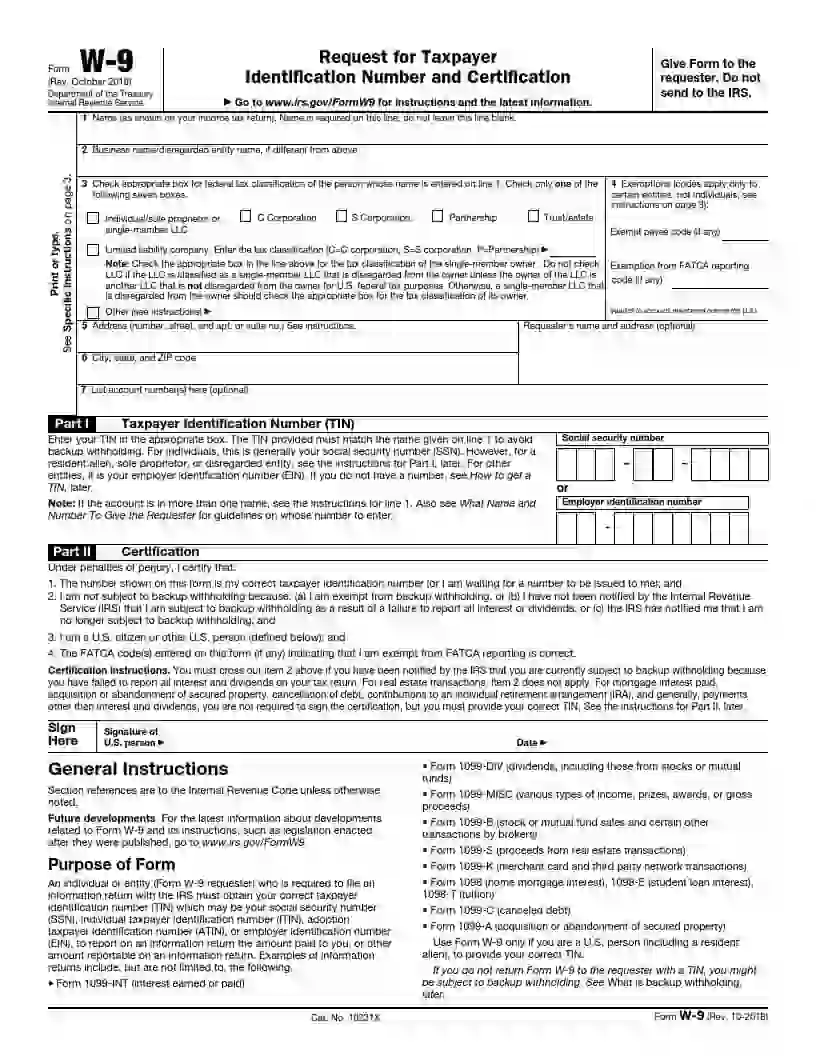

IRS W-9 Printable Form: A Comprehensive Guide to Accurate Completion and Submission

Navigating the intricacies of tax forms can be a daunting task, but understanding and completing the IRS W-9 form is crucial for businesses and individuals alike. This printable form serves as a vital tool for reporting income and ensuring compliance with tax regulations. In this comprehensive guide, we will delve into the significance, structure, and intricacies of the IRS W-9 Printable Form, providing step-by-step guidance to ensure accurate completion and hassle-free submission.

The IRS W-9 form is a cornerstone of tax reporting, enabling businesses to gather essential information from independent contractors, vendors, and other non-employees. By understanding the purpose and requirements of this form, you can streamline your tax processes and maintain compliance with the Internal Revenue Service (IRS).

IRS W-9 Form Overview

The IRS W-9 form, also known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States for tax reporting purposes. It plays a significant role in ensuring accurate tax withholding and reporting for both individuals and businesses.

The W-9 form was introduced in 1972 as a means to combat tax fraud and improve tax administration. It serves as a standard method for businesses to collect and verify the Taxpayer Identification Number (TIN) of individuals or entities they make payments to. This TIN is typically a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses.

Legal Requirements

The completion and submission of the IRS W-9 form are legally required in certain situations. Generally, any business or organization that makes payments to independent contractors, freelancers, or other non-employees is obligated to obtain a completed W-9 form from the recipient of the payments. This requirement helps ensure that the business has the correct taxpayer information on file and can properly withhold and report taxes on the payments made.

Understanding the W-9 Form Structure

The W-9 form is divided into several sections, each with specific fields that need to be completed. Understanding the layout and purpose of these sections is crucial for accurate form completion.

The first section, titled “Name,” requests the legal name of the payee. This can be an individual, a business, or any other legal entity. The “Business Name” field is used for businesses that operate under a different name than their legal name.

TIN (Taxpayer Identification Number)

The “Taxpayer Identification Number” (TIN) section is used to provide the payee’s unique identification number. For individuals, this is their Social Security Number (SSN). For businesses, it is their Employer Identification Number (EIN).

Certification

The “Certification” section is a declaration by the payee that the information provided on the form is true and correct. It also includes a statement that the payee is not subject to backup withholding. Backup withholding is a tax withholding that may be applied to certain types of income, such as interest or dividends.

Signature and Date

The final section of the W-9 form requires the payee’s signature and the date the form was signed. This signature serves as the payee’s acknowledgment that the information provided is accurate and complete.

Completing the W-9 Form Accurately

Filling out the W-9 form correctly is essential to ensure accurate tax reporting and avoid potential issues. Here’s a step-by-step guide to help you complete the form with confidence:

Part I: Taxpayer Identification Information

- Name: Enter your full legal name as it appears on your tax return.

- Business Name: If you’re a sole proprietor or operate under a business name, enter that name here.

- Address: Provide your current mailing address.

- Taxpayer Identification Number (TIN): This is your Social Security Number (SSN) or Employer Identification Number (EIN).

Part II: Certification

- Sign and Date: Both the taxpayer and the requester should sign and date the form.

- Exemptions: If you qualify for any tax exemptions, indicate them in the appropriate boxes.

- Backup Withholding: If you’re subject to backup withholding, provide your backup withholding certificate here.

Common Errors to Avoid

- Entering incorrect or incomplete information.

- Mixing up your SSN and EIN.

- Leaving fields blank.

- Not signing and dating the form.

- Providing false or misleading information.

Ensuring Accuracy

To ensure accuracy, double-check all the information you’ve provided before submitting the form. If you have any doubts, consult a tax professional for guidance.

Printable W-9 Form Options

Downloading and printing the IRS W-9 form is crucial for individuals and businesses to provide accurate tax information to payers. Here are various options to access and print the form:

Official IRS Website

The most reliable source to obtain the printable W-9 form is the official IRS website. You can directly download the form from the following link:

Alternative Sources

In addition to the IRS website, several other platforms provide access to the W-9 form:

- Tax software providers: Many tax software programs include the W-9 form as part of their services.

- Online form repositories: Websites like Adobe Acrobat Reader and PDFfiller offer fillable W-9 forms that can be downloaded and printed.

- Financial institutions: Some banks and credit unions may provide W-9 forms to their customers.

Advantages and Disadvantages

Using printable W-9 forms offers both advantages and disadvantages:

Advantages:

- Free and readily available: The W-9 form is free to download and print from various sources.

- Physical copies for record-keeping: Printable forms provide tangible copies for documentation and record-keeping purposes.

Disadvantages:

- Prone to errors: Manual completion of the form increases the risk of errors, especially in complex situations.

- Not always up-to-date: Printable forms may not always reflect the latest updates or changes made by the IRS.

W-9 Form Electronic Submission

Submitting the W-9 form electronically is a convenient and secure way to provide your tax information to the requesting party. There are two main methods for electronic submission:

- Email: You can scan or take a clear photo of your completed W-9 form and email it to the requesting party.

- Online submission: Some businesses and organizations offer online portals where you can upload or fill out your W-9 form electronically.

Benefits of Electronic Submission:

- Convenience: Electronic submission saves time and effort compared to mailing or faxing your W-9 form.

- Security: Many online submission portals use encryption and other security measures to protect your sensitive information.

- Faster processing: Electronic submissions are typically processed more quickly than mailed or faxed forms.

Security Measures and Best Practices

When submitting your W-9 form electronically, it’s important to take the following security measures:

- Use a secure internet connection.

- Ensure the website or portal you’re using is reputable and secure.

- Do not include any sensitive information (such as your Social Security number) in the email subject line or body.

- Consider using a password manager to generate and store strong passwords for online submission portals.

By following these best practices, you can help protect your sensitive information and ensure the secure submission of your W-9 form electronically.

Troubleshooting W-9 Form Issues

When completing the W-9 form, you might face a few common issues. Here are some tips to help you resolve them:

Incorrect or Missing Information

Check the form thoroughly to ensure that all required fields are completed accurately and completely. Missing or incorrect information can delay the processing of your form.

Signature and Date

Don’t forget to sign and date the form in the designated areas. An unsigned or undated form is not valid.

Unsupported File Format

If you’re submitting the form electronically, make sure it’s in an acceptable format. Common formats include PDF, TIFF, and JPEG.

Contact Information

Provide clear and accurate contact information, including your name, address, and phone number. This will help the recipient reach you if they have any questions.

Need for Additional Support

If you encounter any difficulties that you can’t resolve, you can reach out to the IRS for assistance. Visit the IRS website or call the IRS helpline at (800) 829-1040.

Frequently Asked Questions

Q: Where can I download the official IRS W-9 Printable Form?

A: You can download the official IRS W-9 Printable Form directly from the IRS website: https://www.irs.gov/forms-pubs/about-form-w-9.

Q: Is it mandatory to use the printable W-9 form?

A: While the printable W-9 form is widely used, it is not mandatory. You can also submit the W-9 form electronically through IRS-approved software or platforms.

Q: What are the consequences of submitting an inaccurate W-9 form?

A: Submitting an inaccurate W-9 form can result in penalties and delays in tax processing. It is crucial to provide accurate and complete information to avoid any potential issues.