IRS W-2 Printable Form: A Comprehensive Guide for Employees

The IRS W-2 form is a crucial document for both employees and employers during tax season. It serves as an official record of an employee’s annual wages and other compensation, which is essential for accurate tax reporting and claiming deductions and credits.

This guide will provide a comprehensive overview of the IRS W-2 printable form, including its purpose, how to obtain and complete it, and important filing instructions. We will also address frequently asked questions and troubleshooting tips to ensure a seamless and compliant tax filing process.

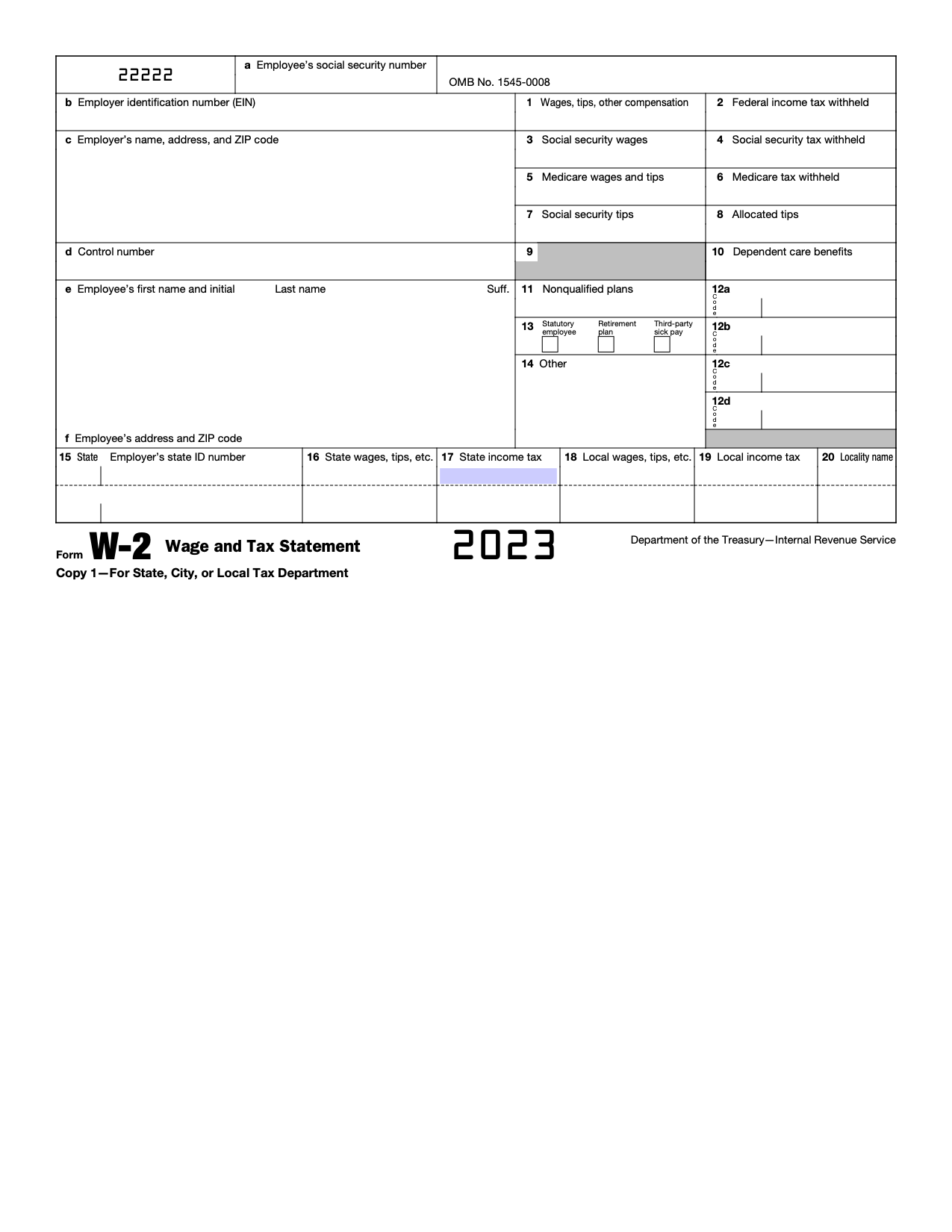

W-2 Form Overview

Blud, the W-2 form, short for Wage and Tax Statement, is a crucial document for tax season. It’s like your tax ID card, bruv. It tells the taxman all the dough you made and the taxes you paid last year.

On this bad boy, you’ll find your name, address, and Social Security number. It also shows how much money your boss paid you, any taxes taken out, and how much you owe. It’s like a cheat sheet for doing your taxes, innit?

Importance of W-2 Form for Tax Purposes

The W-2 form is your golden ticket to filing your taxes. Without it, you’re lost in the tax jungle. It’s the key to getting your tax refund or paying what you owe. Plus, it helps you claim deductions and credits that can save you some dough.

Printable Form Options

You can easily obtain a printable W-2 form from official sources. The Internal Revenue Service (IRS) website offers a free printable PDF version of the W-2 form. You can download the form by clicking on the “Forms and Publications” tab and then selecting “Form W-2, Wage and Tax Statement.”

Once you have downloaded the form, you can print it out on your home printer. Make sure to print the form on high-quality paper to ensure that it is legible and can be easily scanned.

There are no significant differences between the printable and digital versions of the W-2 form. The information on both versions is identical, and both versions are accepted by the IRS. However, some individuals may find it more convenient to use the printable version, as they can fill it out by hand and mail it to the IRS.

Completing the W-2 Form

Filling out a W-2 form can seem daunting, but it’s a crucial step in filing your taxes. Here’s a step-by-step guide to help you complete the form accurately:

1. Gather your information. You’ll need your Social Security number, name, address, and employer information.

2. Start with Box 1. Enter the total wages, tips, and other compensation you received from your employer during the year.

3. Fill in Box 2. This is your federal income tax withheld.

4. Complete Box 3. Enter your Social Security tax withheld.

5. Fill in Box 4. This is your Medicare tax withheld.

6. Enter your employer’s information. Include their name, address, and employer identification number (EIN).

7. Sign and date the form. This verifies that the information you’ve provided is correct.

Common Errors to Avoid

* Using the wrong Social Security number

* Entering incorrect wages or compensation

* Forgetting to sign and date the form

* Mixing up your federal and state tax information

Filing s

Filing your completed W-2 form is crucial to ensure accurate tax reporting and avoid penalties.

The W-2 form must be submitted to the Internal Revenue Service (IRS) and your state tax agency (if applicable) by the end of January 31st following the tax year. There are three primary methods for filing:

Electronic Filing

- File through an authorized e-file provider.

- Use the IRS’s Free File program (available to eligible taxpayers).

Paper Filing

Mail the completed W-2 form to the IRS and state tax agency (if applicable) using the addresses provided on the form.

In-Person Filing

Visit an IRS office or authorized tax assistance center to file your W-2 form in person.

Consequences of Late or Incorrect Filing

Late or incorrect filing of your W-2 form can result in penalties, including:

- Failure-to-file penalty

- Failure-to-pay penalty

- Accuracy-related penalty

These penalties can vary depending on the severity of the error and the length of time the filing is overdue.

FAQs and Troubleshooting

This section provides answers to frequently asked questions and offers troubleshooting tips to help you navigate the W-2 form process smoothly.

If you encounter any difficulties or have additional questions, refer to the resources listed at the end of this section for further assistance.

Common Questions

- What is a W-2 form?

A W-2 form is an official document that reports an employee’s annual wages, taxes withheld, and other important information to the IRS and the employee. - Who is required to receive a W-2 form?

All employees who earn more than a certain amount of money during the tax year must receive a W-2 form from their employer. - When should I receive my W-2 form?

Employers are required to send W-2 forms to employees by January 31st of the following year. - What if I lose my W-2 form?

You can request a duplicate W-2 form from your employer. You can also access your W-2 form online through the IRS website. - What if I have questions about my W-2 form?

If you have any questions about your W-2 form, you should contact your employer or the IRS.

Troubleshooting Tips

- My employer hasn’t sent me my W-2 form yet.

If you haven’t received your W-2 form by the end of January, you should contact your employer. They may have misplaced it or there may be a delay in processing. - I received a W-2 form with incorrect information.

If you believe there is an error on your W-2 form, you should contact your employer immediately. They can correct the form and send you a corrected copy. - I can’t access my W-2 form online.

If you’re having trouble accessing your W-2 form online, you can try clearing your browser’s cache and cookies. You can also try using a different browser or contacting the IRS for assistance.

Resources for Additional Support

- IRS website

- Social Security Administration website

- National Association of State Workforce Agencies website

Questions and Answers

Where can I obtain an official IRS W-2 printable form?

You can download the printable W-2 form directly from the IRS website or obtain it from your employer.

What are the key differences between the printable and digital versions of the W-2 form?

The printable and digital versions of the W-2 form contain the same information and have the same legal validity. However, the digital version allows for electronic submission, which may be more convenient for some users.

What are some common errors to avoid when completing the W-2 form?

Common errors include incorrect Social Security numbers, missing or incorrect employer information, and mathematical errors. Carefully review the form before submitting it to avoid any potential issues.