IRS Form 8857 Printable: A Comprehensive Guide for Hassle-Free Filing

Navigating the complexities of tax filing can be a daunting task, but with the IRS Form 8857 Printable, you can simplify the process and ensure accuracy. This printable form offers a convenient and time-saving alternative to traditional paper filing, making it an invaluable tool for individuals and businesses alike.

In this comprehensive guide, we will delve into the purpose and benefits of using the IRS Form 8857 Printable. We will provide step-by-step instructions on how to obtain, fill out, and submit the form, ensuring a seamless filing experience. Additionally, we will address common mistakes to avoid and answer frequently asked questions to empower you with the knowledge and confidence to file your taxes efficiently and effectively.

Introduction

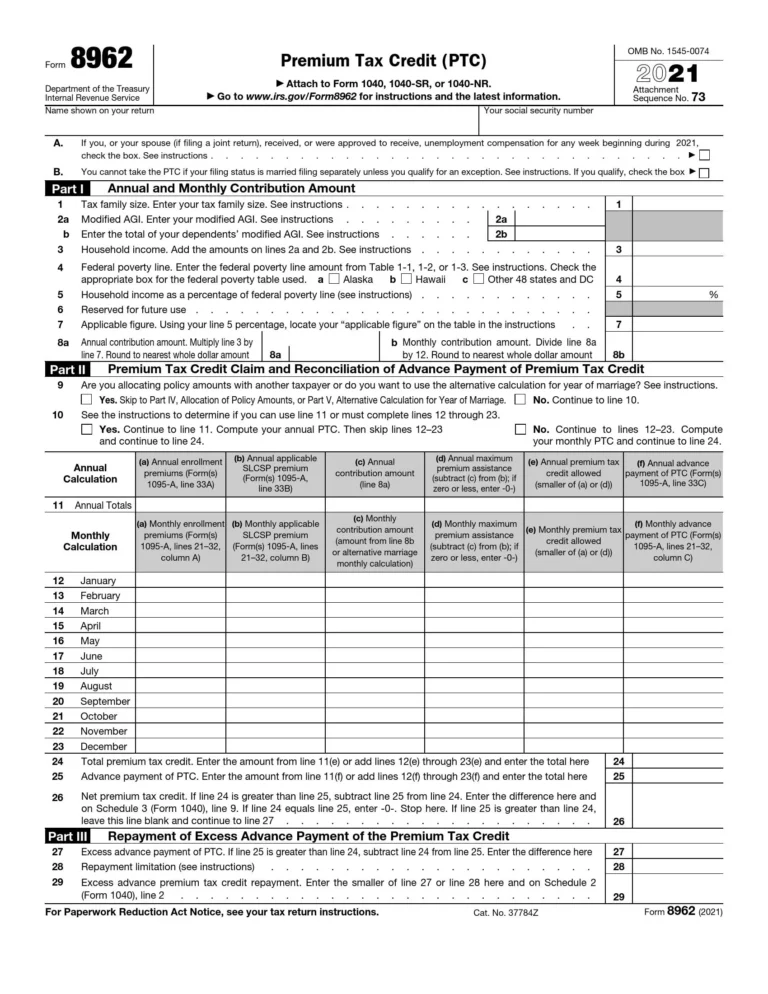

Irs Form 8857 Printable is a tax form that individuals use to claim the renewable energy production tax credit (PTC) or the investment tax credit (ITC) for qualified energy property expenses.

The PTC is a tax credit that is available to taxpayers who install qualified renewable energy property, such as solar panels, wind turbines, and geothermal heat pumps. The ITC is a tax credit that is available to taxpayers who install qualified energy-efficient property, such as energy-efficient windows, doors, and insulation.

Significance

The PTC and ITC can provide significant tax savings for taxpayers who install qualified energy property. The PTC is a tax credit of 30% of the cost of qualified renewable energy property, and the ITC is a tax credit of 26% of the cost of qualified energy-efficient property.

Benefits of Using Irs Form 8857 Printable

Innit, bruv? If you’re a bit of a geezer or bird that needs to fill out that Irs Form 8857, then you should deffo grab a printable version. It’s like, the bomb, man. It’ll save you a bucketload of time and effort, no sweat.

See, when you’ve got a printable version, you don’t have to go through the hassle of filling it out online or, even worse, by hand. You can just print it out, fill it in at your leisure, and then send it back in the post. It’s that simple, my friend.

Time-saving

You don’t have to waste your precious time waiting for the form to load online or filling it out by hand. Just print it out and get it done in a jiffy.

Effortless

Filling out a form online can be a bit of a pain, especially if you’re not familiar with the process. With a printable version, you can just fill it out at your own pace, without any fuss.

How to Obtain Irs Form 8857 Printable

Acquiring the Irs Form 8857 Printable is a breeze. You can download it from the official IRS website or use a reliable source like tax software or an online tax preparation service.

Downloading from the IRS Website

To download the form directly from the IRS website:

- Visit the IRS website at https://www.irs.gov/forms-pubs/about-form-8857.

- Scroll down to the “Forms” section and click on “Form 8857.”

- Click on the “Download PDF” button to save the form to your computer.

Using Tax Software or Online Services

If you’re using tax software or an online tax preparation service, you can usually find the Irs Form 8857 Printable within the software or service. Simply search for “Form 8857” and it should pop up.

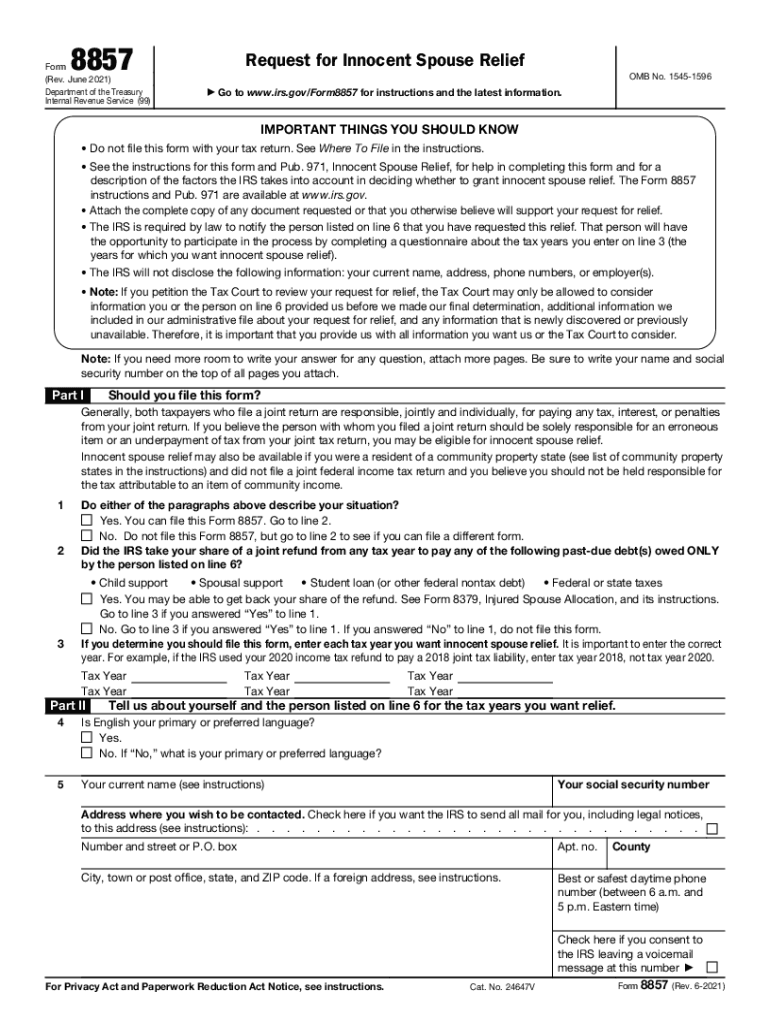

Filling Out Irs Form 8857 Printable

Filling out IRS Form 8857 Printable can seem daunting, but it doesn’t have to be. Follow this guide to ensure you complete the form accurately and avoid any potential errors.

Each section of the form has its own specific purpose and requires different information. Here’s a breakdown of each section and tips for filling it out correctly:

Part I: Taxpayer Information

- Enter your name, address, and Social Security number exactly as they appear on your tax return.

- If you’re filing a joint return, enter the information for both spouses.

- If you’re filing for a deceased taxpayer, enter the decedent’s name and Social Security number.

Part II: Information About the Claim

- Identify the tax year for which you’re claiming the refund.

- Provide details about the overpayment, including the amount, the reason for the overpayment, and any supporting documentation.

- Indicate whether you want the refund to be applied to your current year’s taxes or refunded to you.

Part III: Verification

- Sign and date the form.

- Enter your occupation.

- Provide your phone number and email address for contact purposes.

Submitting Irs Form 8857 Printable

There are three primary ways to submit the completed IRS Form 8857 Printable: mailing, faxing, or e-filing. Each method has its own set of instructions and requirements.

Mailing

To mail the form, complete it and send it to the address provided on the form. Ensure that you have included all the necessary supporting documentation and that the form is signed and dated.

Faxing

If you wish to fax the form, complete it and fax it to the number provided on the form. Again, ensure that all the necessary supporting documentation is included, and the form is signed and dated.

E-filing

E-filing is the most convenient method of submitting the IRS Form 8857 Printable. To e-file, you will need to use a tax software program that supports e-filing. The software will guide you through the process of completing and submitting the form electronically.

Tracking the Status of Irs Form 8857 Printable

After submitting your IRS Form 8857 Printable, you might be keen on tracking its progress to stay updated on its processing status. Here are a few ways to do that:

Online Tracking

- You can track the status of your form online by visiting the IRS website and using their “Where’s My Refund?” tool. To use this tool, you’ll need to provide your Social Security number, filing status, and the amount of your refund.

Phone Inquiry

- You can also call the IRS at 1-800-829-1040 to inquire about the status of your form. When you call, you’ll need to provide your Social Security number and some other personal information.

Mail Inquiry

- If you prefer, you can also mail a written inquiry to the IRS. Your letter should include your name, address, Social Security number, and the date you filed your form. You should also include a copy of your form and any other relevant documents.

Regardless of the method you choose, you should receive a response from the IRS within a few weeks. If you don’t receive a response after several weeks, you may want to contact the IRS again.

Common Mistakes to Avoid

When filling out IRS Form 8857 Printable, it’s crucial to steer clear of common pitfalls that could delay or even jeopardize your application. To ensure a smooth process, here are some crucial tips to keep in mind:

Errors to Watch Out For

Avoid leaving any fields blank. Even if you’re not sure about the answer, write “N/A” or “Unknown” instead of leaving it empty.

Double-check your Social Security Number (SSN) and Employer Identification Number (EIN) for accuracy. Any discrepancies can lead to processing delays.

Ensure you’re using the correct version of the form. The IRS updates its forms periodically, so make sure you’re using the latest edition.

Pay attention to the filing deadline. Missing the deadline can result in penalties and additional hassle.

Don’t forget to sign and date the form. An unsigned form is incomplete and won’t be processed.

Frequently Asked Questions (FAQs)

When completing Irs Form 8857 Printable, you may encounter some queries. To address these, we have compiled a list of commonly asked questions and their corresponding answers.

These FAQs provide valuable insights and guidance, helping you navigate the process of filling out Irs Form 8857 Printable with ease and accuracy.

Where can I get help filling out Irs Form 8857 Printable?

If you encounter difficulties or have specific queries regarding Irs Form 8857 Printable, you can seek assistance from various resources. The Internal Revenue Service (IRS) website offers a comprehensive online support system, including FAQs, tutorials, and contact information for further guidance.

Additionally, you may consult with a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA), who can provide expert advice and ensure the accuracy of your form.

What is the deadline for filing Irs Form 8857 Printable?

The deadline for filing Irs Form 8857 Printable varies depending on the specific tax situation. In general, for individuals, the deadline is April 15th of the following year. However, if you are filing as part of a business or organization, the deadline may differ.

It is recommended to refer to the IRS website or consult with a tax professional to determine the applicable deadline for your specific case.

What are the consequences of filing Irs Form 8857 Printable late?

Filing Irs Form 8857 Printable late may result in penalties and interest charges imposed by the IRS. The specific amount of penalties and interest will depend on the extent of the delay and the amount of tax owed.

To avoid these penalties, it is crucial to file your form on time or request an extension if necessary. You can request an extension by filing Form 4868, Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

What should I do if I make a mistake on Irs Form 8857 Printable?

If you discover an error on your Irs Form 8857 Printable after filing, you should take prompt action to correct it. The IRS provides several options for correcting errors, including filing an amended return or submitting a Form 1040X, Amended U.S. Individual Income Tax Return.

It is important to note that filing an amended return may result in additional tax liability or a refund, depending on the nature of the error.

FAQ Corner

What is the purpose of IRS Form 8857?

IRS Form 8857 is used to request a waiver of the penalty for failure to file a tax return or pay taxes on time. It can also be used to request a reduction in the penalty amount.

Who can file IRS Form 8857?

Individuals or businesses who have failed to file a tax return or pay taxes on time can file IRS Form 8857.

Where can I obtain IRS Form 8857 Printable?

You can download IRS Form 8857 Printable from the IRS website or order a copy by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

How do I fill out IRS Form 8857 Printable?

Follow the instructions on the form carefully. You will need to provide information about your tax situation, including the reason for your failure to file or pay on time, and any supporting documentation.

How do I submit IRS Form 8857 Printable?

You can mail IRS Form 8857 Printable to the IRS address listed on the form, or you can fax it or e-file it.

What is the deadline for filing IRS Form 8857 Printable?

There is no deadline for filing IRS Form 8857 Printable, but it is generally recommended that you file it as soon as possible after you realize that you have failed to file or pay on time.