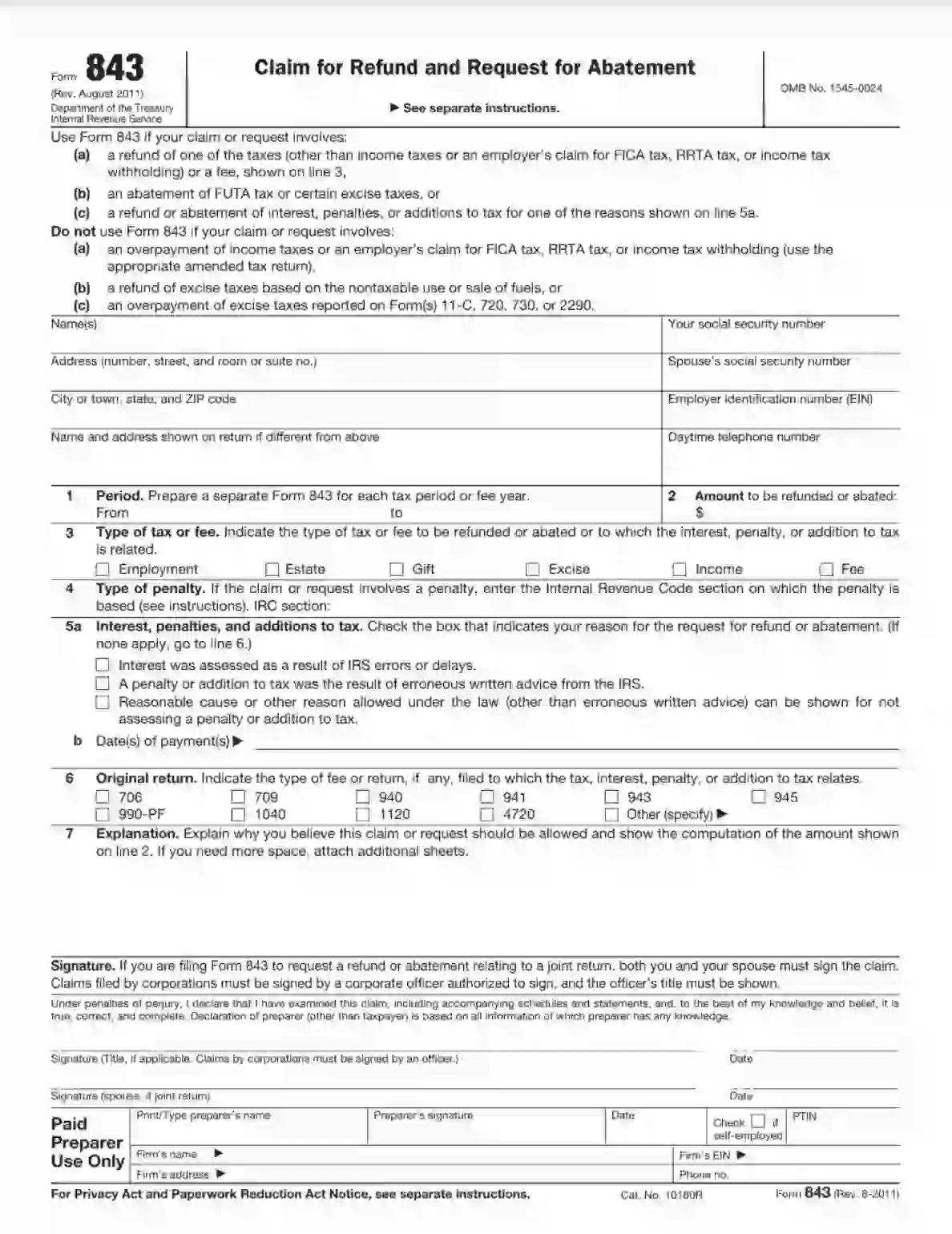

Irs Form 843 Printable: A Comprehensive Guide to Understanding and Completing the Form

Navigating the complexities of tax filing can be a daunting task, but understanding and completing IRS Form 843 Printable is a crucial step towards ensuring accurate tax reporting. This form serves as a vital tool for individuals seeking to claim a refund or credit for overpaid taxes. In this comprehensive guide, we will delve into the purpose, significance, and step-by-step process of completing IRS Form 843 Printable. We will also explore various scenarios where the form is required and provide additional resources to assist you in completing and filing it seamlessly.

Whether you’re a seasoned taxpayer or filing your taxes for the first time, this guide will empower you with the knowledge and understanding to navigate IRS Form 843 Printable with confidence. By providing clear instructions, practical examples, and comprehensive FAQs, we aim to simplify the process and ensure that you maximize your tax refund or credit while adhering to IRS regulations.

IRS Form 843 Printable Overview

IRS Form 843 Printable, officially known as “Claim for Refund and Request for Abatement”, is a crucial document utilized by taxpayers to seek reimbursement for overpaid taxes and request the reduction or elimination of tax liabilities.

This form holds significant importance as it enables individuals to rectify errors, reclaim excessive payments, and address tax-related discrepancies. By completing and submitting Form 843, taxpayers can initiate the process of recovering their due refunds and resolving outstanding tax obligations.

Purpose and Significance

The primary purpose of IRS Form 843 Printable is to provide taxpayers with a standardized and efficient means to:

- Claim refunds for overpaid taxes, including income taxes, employment taxes, and excise taxes.

- Request the abatement of tax liabilities, such as penalties, interest, or additional assessments that are deemed erroneous or excessive.

- Correct errors or discrepancies in tax returns, ensuring that taxpayers receive accurate and fair treatment.

Completing and Filing IRS Form 843 Printable

Filling out IRS Form 843 Printable is a crucial step in claiming a refund or credit for overpaid taxes. Completing it accurately and submitting it on time is essential to avoid delays or rejections. Here’s a step-by-step guide to help you complete and file IRS Form 843 Printable efficiently.

Before you begin, gather all the necessary documents and information, including your Social Security number, tax return, and any supporting documentation for your claim. Ensure you have a clear understanding of the instructions provided on the form and any additional guidance from the IRS website.

Personal Information

Start by providing your personal information in Section 1 of the form, including your name, address, Social Security number, and daytime phone number. Double-check the accuracy of this information to ensure proper communication and processing of your claim.

Claim Information

In Section 2, specify the tax year for which you’re claiming a refund or credit. Clearly state the amount you’re claiming and provide a brief explanation of the reason for your claim. If you’re claiming a refund, indicate the method you prefer to receive it, whether by check or direct deposit.

Supporting Documentation

Section 3 allows you to attach any supporting documentation that strengthens your claim. This may include copies of tax returns, payment receipts, or other relevant documents. Make sure the copies are clear and legible to facilitate easy review by the IRS.

Signature and Date

The final step is to sign and date the form in Section 4. Your signature serves as a legal declaration that the information provided on the form is true and accurate. Keep a copy of the completed form for your records.

Filing Options

Once you’ve completed the form, you have two options for filing: mail or fax. If you choose to mail the form, send it to the address provided on the form. For fax submissions, follow the instructions on the IRS website. Remember to keep a copy of the form for your records.

Where to Find IRS Form 843 Printable

Locating IRS Form 843 Printable is a doddle, mate. You can grab it from the official IRS website or other reliable sources.

Official IRS Website

Head over to the IRS website and search for “Form 843”. Once you’ve found it, simply click the “Download” button to save the PDF file.

Other Reputable Sources

Apart from the IRS website, you can also find IRS Form 843 Printable on reputable websites like TaxAct, H&R Block, and TurboTax. Just make sure the source is trustworthy before downloading.

Alternative Options

If you’re not able to download the form online, you can always request a copy by mail. Contact the IRS at 1-800-TAX-FORM (1-800-829-3676) to get a copy sent to you.

Using IRS Form 843 Printable for Specific Purposes

IRS Form 843 Printable is a versatile document that can be used for a wide range of purposes. It is primarily used to claim a refund or credit for taxes that have been overpaid. However, it can also be used to make changes to your tax return, such as correcting errors or adding missing information.

Claiming a Refund or Credit

The most common use of IRS Form 843 Printable is to claim a refund or credit for overpaid taxes. This can occur for a variety of reasons, such as:

– You had more withholding taken out of your paycheck than you owed.

– You received a tax refund that was larger than you were entitled to.

– You made a mistake on your tax return and overpaid your taxes.

If you believe that you have overpaid your taxes, you can use IRS Form 843 Printable to claim a refund or credit. The form is relatively simple to complete, and you can usually file it yourself. However, if you are not comfortable filing the form yourself, you can hire a tax preparer to help you.

Making Changes to Your Tax Return

In addition to claiming a refund or credit, you can also use IRS Form 843 Printable to make changes to your tax return. This can be necessary if you made a mistake on your original return or if you need to add missing information.

Some of the most common reasons for making changes to your tax return include:

– You forgot to include a deduction or credit.

– You made a mistake in your calculations.

– Your income or expenses changed after you filed your return.

If you need to make changes to your tax return, you can use IRS Form 843 Printable to do so. The form is relatively simple to complete, and you can usually file it yourself. However, if you are not comfortable filing the form yourself, you can hire a tax preparer to help you.

Implications and Consequences

Using IRS Form 843 Printable for specific purposes can have a number of implications and consequences. These include:

– Filing deadlines: IRS Form 843 Printable must be filed within three years of the date your original tax return was due. If you file the form after this deadline, you may not be able to claim a refund or credit.

– Penalties: If you make a mistake on your tax return and do not correct it using IRS Form 843 Printable, you may be subject to penalties. These penalties can be significant, so it is important to make sure that your tax return is accurate and complete.

– Interest: If you receive a refund as a result of filing IRS Form 843 Printable, you will be charged interest on the refund. The interest rate is set by the IRS and is based on the current federal short-term rate.

It is important to be aware of the implications and consequences of using IRS Form 843 Printable for specific purposes. By understanding these implications and consequences, you can make informed decisions about how to use the form.

Additional Resources and Support

Need more help with IRS Form 843 Printable? Check out these resources:

Contact Details

- IRS Customer Service: 1-800-829-1040

- IRS Website: www.irs.gov

- Local IRS office: Find your local office here.

Online Forums and Discussion Groups

Connect with others and get support in online forums or discussion groups:

- r/tax on Reddit

- Bogleheads Forum

- Tax Almanac Forums

FAQ Section

What is the purpose of IRS Form 843 Printable?

IRS Form 843 Printable is used to claim a refund or credit for overpaid taxes. It is commonly utilized when individuals have overpaid their taxes through withholding, estimated tax payments, or other means.

Where can I obtain IRS Form 843 Printable?

You can download and print IRS Form 843 Printable directly from the official IRS website or through reputable tax preparation software. Alternatively, you can request a copy by mail by contacting the IRS.

What are some common scenarios where IRS Form 843 Printable is required?

IRS Form 843 Printable is typically used in situations where individuals have overpaid their taxes due to changes in income, deductions, or credits. It is also commonly used to claim a refund for unused education credits or to adjust tax liability based on life events such as marriage or divorce.

What are the implications of using IRS Form 843 Printable for different purposes?

Using IRS Form 843 Printable for purposes other than claiming a refund or credit for overpaid taxes may have implications. It is important to consult with a tax professional or refer to IRS guidelines to ensure proper usage.

What additional resources are available to assist with completing and filing IRS Form 843 Printable?

The IRS provides a range of resources to assist taxpayers, including online instructions, FAQs, and contact information for support. Additionally, many tax preparation software programs offer guidance and assistance with completing IRS Form 843 Printable.