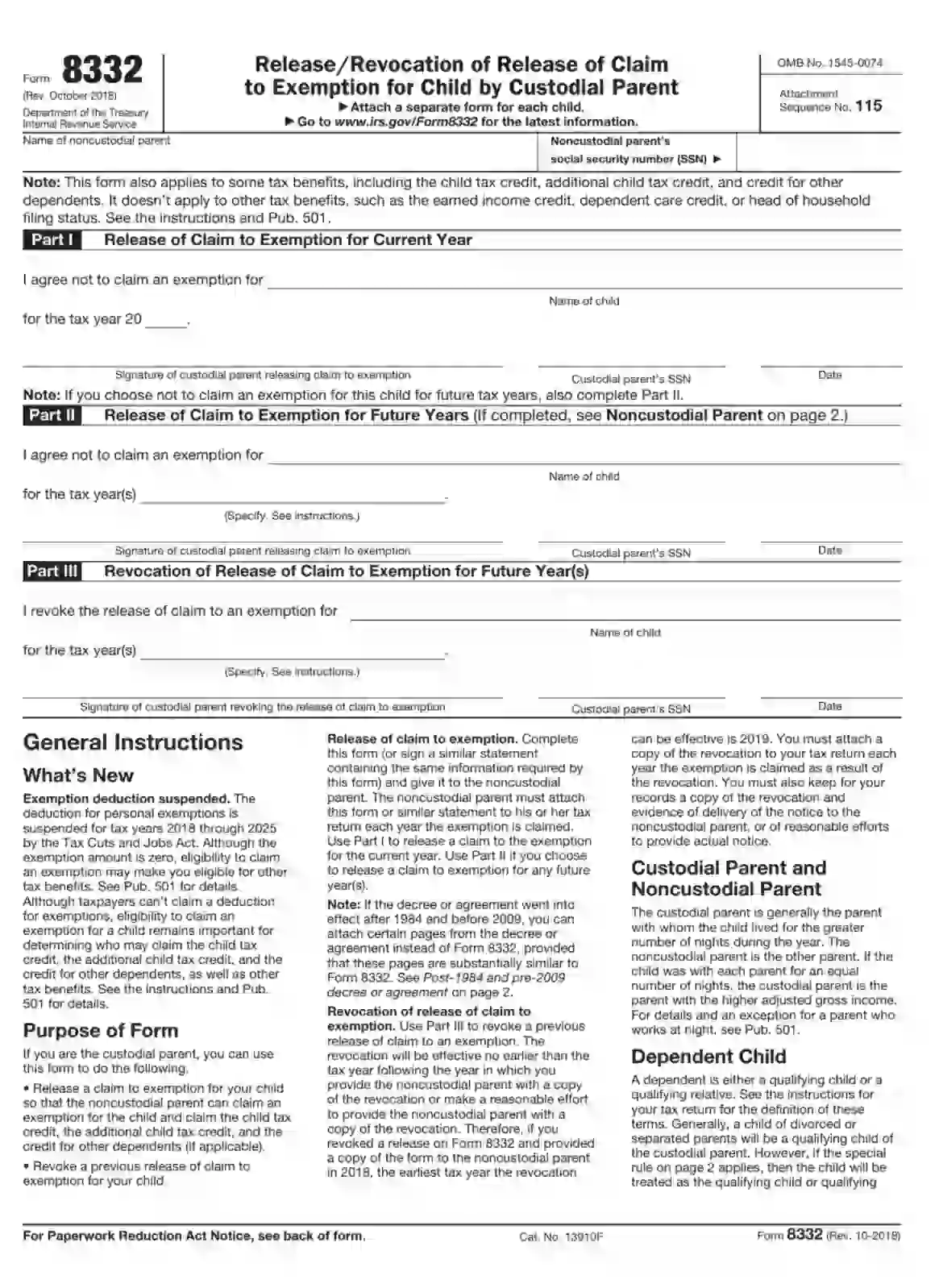

IRS Form 8332 Printable: A Comprehensive Guide to Filing

IRS Form 8332, also known as the Release of Claim to Exemption for Specific Child or Children, is a crucial document used by taxpayers to release their claim to exemption for a specific child or children. Understanding how to properly fill out and file this form is essential for accurate tax reporting and avoiding potential issues with the IRS.

This comprehensive guide will provide you with all the necessary information about IRS Form 8332, including its purpose, sections, eligibility criteria, and step-by-step instructions on how to download, fill out, and file the form. Additionally, we’ll cover common errors to avoid and provide answers to frequently asked questions to ensure a seamless filing process.

IRS Form 8332 Printable

Form 8332 is a printable document provided by the Internal Revenue Service (IRS) for individuals and businesses to claim a refund or credit for taxes paid on qualified energy-efficient improvements.

The form is divided into several sections, including:

- Taxpayer Information

- Property Information

- Energy-Efficient Improvements

- Tax Credit Calculation

- Signature and Verification

To be eligible to file Form 8332, you must meet the following criteria:

- You must have made qualified energy-efficient improvements to your home or business.

- The improvements must have been completed during the tax year for which you are claiming the credit.

- You must have paid for the improvements yourself.

- You must have documentation to support your claim, such as receipts, invoices, and manufacturer’s specifications.

Downloading and Printing the Form

Yo, peeps! Ready to get your hands on that sweet Form 8332? We got you covered. Let’s dive right in, fam.

First off, head on over to the official IRS website, the one and only: https://www.irs.gov/forms-pubs/about-form-8332. Once you’re there, it’s a piece of cake.

Step-by-Step Guide

- Hit that “Download Form 8332” button. Bam!

- Choose your poison: PDF or fillable PDF. We recommend the fillable one for that extra convenience.

- Once it’s downloaded, open that bad boy up and start filling in your deets.

- Make sure you’re using the latest version, bruv. The IRS is always changing stuff, so it’s crucial to have the most up-to-date form.

Filling Out the Form

Filling out Form 8332 is a crucial step in the process of claiming a refund or credit for overpaid taxes. To ensure accuracy and avoid delays in processing, it’s essential to provide the correct information and follow the instructions carefully.

Before you start filling out the form, gather the necessary documents and information. These include:

- Copy of your original tax return

- Any amended returns

- Proof of payment for the overpaid taxes

- A clear explanation of why you believe you overpaid your taxes

Common Errors to Avoid

When filling out Form 8332, there are a few common errors to watch out for:

- Incorrectly calculating the amount of overpaid taxes

- Failing to provide sufficient documentation to support your claim

- Submitting the form to the wrong address

- Missing the filing deadline

Example of Filling Out Specific Sections

Here are some examples of how to fill out specific sections of Form 8332:

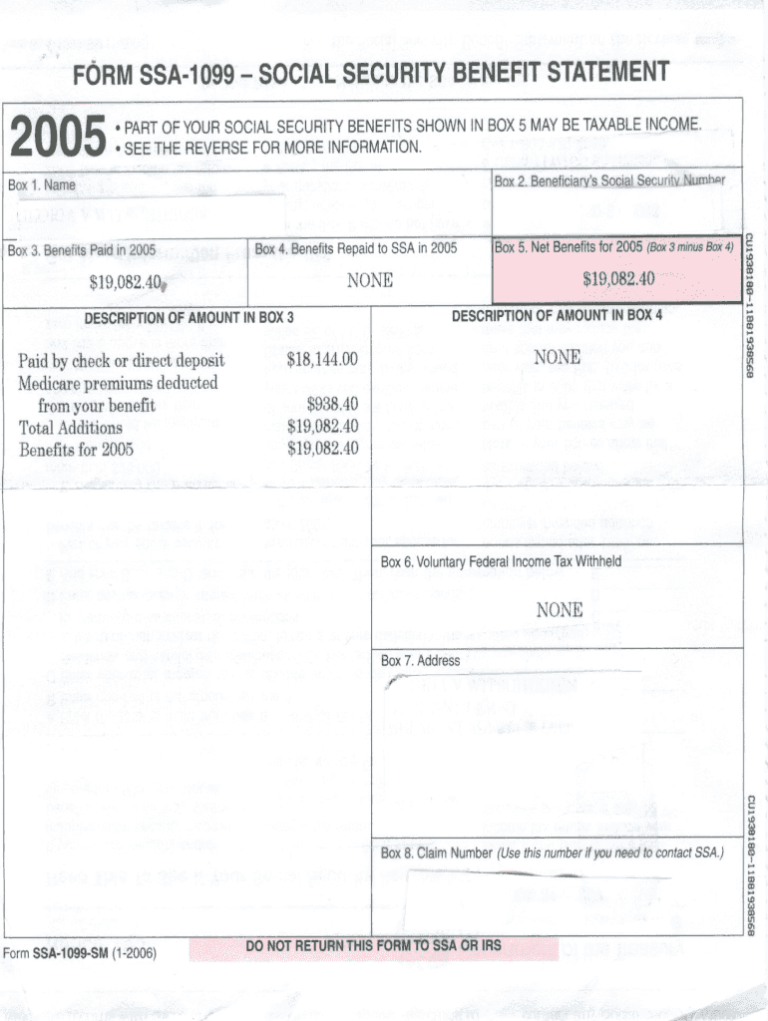

- Part I: Taxpayer Information – Enter your personal information, including your name, address, and Social Security number.

- Part II: Overpayment Information – Indicate the tax year for which you are claiming the overpayment, the amount of the overpayment, and the reason for the overpayment.

- Part III: Signature – Sign and date the form in the designated area.

Filing the Form

Filing Form 8332 is simple and can be done in various ways. You can either mail it or e-file it electronically.

If you choose to mail the form, the address is:

Internal Revenue Service

Ogden, UT 84201-0040

The processing time for Form 8332 is typically 6-8 weeks. Once the form is processed, you will receive a notice from the IRS confirming that your request has been processed.

Additional Resources

Need extra help with Form 8332? Here are some resources that can help you:

Online Resources

- IRS Publication 5125: Relief from Joint and Several Liability on a Joint Return

- IRS FAQs on Relief from Joint and Several Liability for Innocent Spouses

- IRS Form 8332: Release of Joint and Several Liability on Tax Underpayment

Professional Assistance

If you need more personalized assistance, you can consult a tax professional, such as a certified public accountant (CPA) or enrolled agent (EA). They can help you understand the requirements for Form 8332 and guide you through the process of filing.

FAQ Section

What is the purpose of IRS Form 8332?

IRS Form 8332 allows taxpayers to release their claim to exemption for a specific child or children, enabling another taxpayer to claim the child as a dependent on their tax return.

Where can I download the printable IRS Form 8332?

The printable IRS Form 8332 can be downloaded from the official IRS website at https://www.irs.gov/forms-pubs/about-form-8332.

What are the common errors to avoid when filling out IRS Form 8332?

Common errors to avoid include providing incorrect or incomplete information, failing to sign and date the form, and using an outdated version of the form.

Can I e-file IRS Form 8332?

Currently, IRS Form 8332 cannot be e-filed. It must be mailed to the IRS using the provided mailing address.