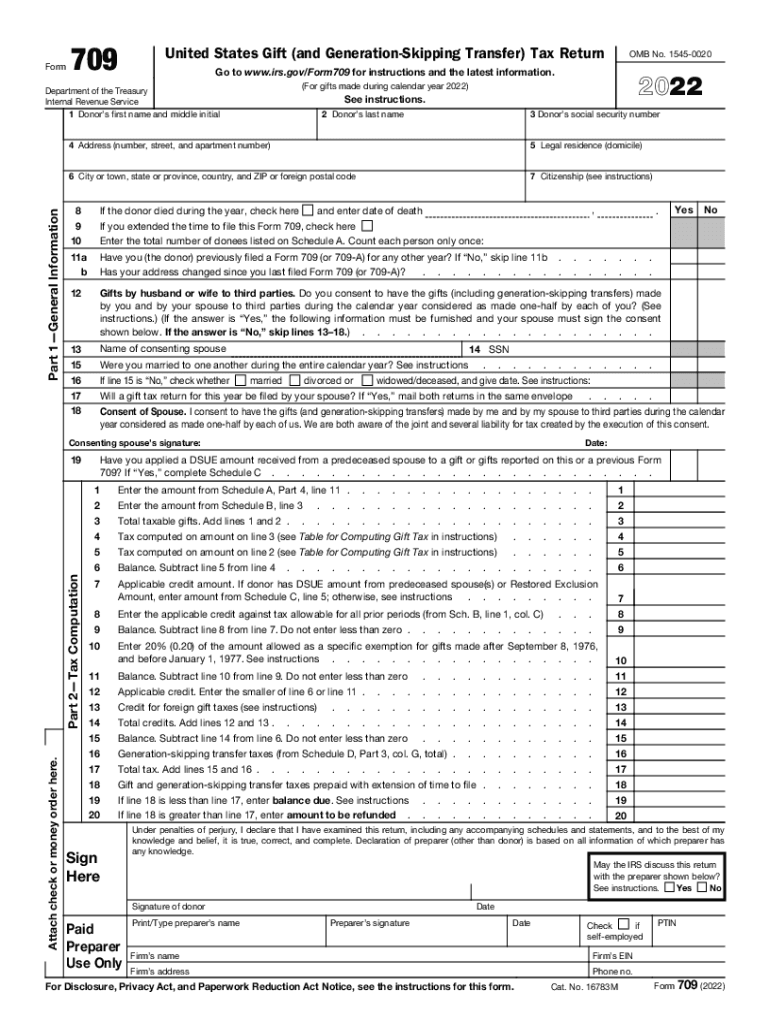

IRS Form 709 for 2023: Printable, Instructions, and FAQs

Navigating the intricacies of estate and gift tax can be a daunting task, but with the right guidance, it doesn’t have to be. Enter IRS Form 709, a crucial document that helps individuals report their estate and gift tax liability to the Internal Revenue Service (IRS). In this comprehensive guide, we’ll delve into the ins and outs of Form 709 for 2023, providing you with a clear understanding of its purpose, eligibility criteria, and filing requirements. We’ll also walk you through the form’s sections and schedules, offering practical tips and examples to ensure accurate completion. Plus, we’ve included a downloadable PDF version of Form 709 for your convenience.

Whether you’re an executor of an estate, a trustee of a trust, or an individual making substantial gifts, this guide will empower you with the knowledge and resources you need to navigate Form 709 with confidence. So, let’s dive right in and simplify the complexities of estate and gift tax reporting.

Overview of IRS Form 709 for 2023

Blud, IRS Form 709 is a banging document that you need to fill in if you’re dealing with the estate of someone who’s passed on. It’s like a tax return for dead people, innit?

You’re only gonna need to file Form 709 if the value of the estate is over a certain amount, which is £60,000 as of 2023. If the estate’s worth less than that, you’re all good and don’t need to bother with this form.

The deadline for filing Form 709 is usually nine months after the person dies. So, if your nan kicked the bucket in January, you’ve got until October to get this sorted.

Tips for Completing IRS Form 709

Completing IRS Form 709 can be a daunting task, but it’s essential for reporting the transfer of property at death. Here are some tips to help you navigate the sections and schedules of Form 709 effectively:

First, gather all the necessary documents, such as the decedent’s will, trust documents, and property appraisals. These documents will provide the information you need to complete the form accurately.

Next, start by completing the basic information on the first page of the form, including the decedent’s name, date of death, and social security number. Then, proceed to the schedules, which provide detailed information about the decedent’s assets and liabilities.

Schedule A lists the decedent’s real estate holdings. Be sure to include the address, legal description, and fair market value of each property.

Schedule B lists the decedent’s personal property, such as cash, stocks, bonds, and jewelry. Again, include the fair market value of each item.

Schedule C lists the decedent’s debts and other liabilities. Be sure to include the amount owed and the name of the creditor for each liability.

Schedule D lists the decedent’s funeral expenses and administrative costs. These expenses can be deducted from the gross estate before calculating the taxable estate.

Schedule E lists the decedent’s charitable bequests. These bequests can also be deducted from the gross estate before calculating the taxable estate.

Once you have completed all the schedules, you can calculate the taxable estate by subtracting the total deductions from the gross estate. The taxable estate is then used to calculate the estate tax due.

If you have any questions about completing IRS Form 709, you can consult with a tax professional for assistance.

Printable Version of IRS Form 709

:max_bytes(150000):strip_icc()/ScreenShot2023-01-18at10.29.18AM-e267e40858b8414fb34572a6eb3d7594.png?w=700)

Access a printable PDF version of the 2023 IRS Form 709 for convenient filing.

This high-quality PDF ensures clarity and ease of printing, allowing you to complete the form accurately.

Accessing and Printing the Form

- Visit the official IRS website or use a reputable tax software.

- Search for “Form 709” and select the PDF version for 2023.

- Download the PDF to your computer.

- Open the PDF using a PDF reader (e.g., Adobe Acrobat Reader).

- Ensure your printer is connected and has sufficient ink/toner.

- Select “Print” from the PDF reader menu.

- Choose the appropriate paper size (usually US Letter or A4).

- Set the print quality to “High” or “Best” for optimal results.

- Click “Print” to generate a clear and printable version of Form 709.

Frequently Asked Questions (FAQs)

Here are answers to some frequently asked questions about Form 709. If you have a question that is not addressed here, you can visit the IRS website or contact a tax professional.

General Questions

- Who needs to file Form 709?

Form 709 is used to report the generation-skipping transfer (GST) tax. You need to file Form 709 if you make a gift or bequest that is subject to the GST tax.

- What is the GST tax?

The GST tax is a tax on certain transfers of property from one generation to another. The GST tax is intended to prevent people from avoiding the estate tax by giving their property to their grandchildren or other younger generations.

- How do I calculate the GST tax?

The GST tax is calculated using a complex formula. You can use the IRS website to calculate the GST tax.

Filing Questions

- When is Form 709 due?

Form 709 is due on April 15th of the year following the year in which the gift or bequest was made.

- Where do I file Form 709?

You can file Form 709 by mail or electronically. If you file by mail, you should send the form to the Internal Revenue Service Center in Cincinnati, Ohio.

- What happens if I file Form 709 late?

If you file Form 709 late, you may have to pay a penalty. The penalty for filing late is 5% of the GST tax due for each month that the return is late, up to a maximum of 25% of the GST tax due.

Additional Resources

Innit, fam? Get ready to smash that tax return with these extra bits and bobs.

If you’re stuck, don’t be a mug – reach out to a pro for some expert advice.

Official IRS Sites

- IRS Form 709: United States Gift (and Generation-Skipping Transfer) Tax Return

- Instructions for Form 709 (2023)

- Gift Tax

Professional Assistance

If you’re feeling overwhelmed, don’t fret. Get help from a qualified tax professional, like a certified public accountant (CPA) or enrolled agent (EA).

Tax Software

Fancy making tax time a breeze? Check out these tax software options that’ll have you filing like a pro:

- TurboTax

- H&R Block

- TaxAct

Answers to Common Questions

Q: Who is required to file IRS Form 709?

A: Form 709 must be filed by executors of estates with a gross value exceeding $12.92 million and by individuals who make taxable gifts exceeding the annual exclusion amount ($17,000 in 2023).

Q: What is the deadline for filing Form 709?

A: Form 709 is generally due 9 months after the date of the decedent’s death (or the date of the gift for gift tax returns).

Q: Can I file Form 709 electronically?

A: Yes, you can file Form 709 electronically using tax preparation software or through the IRS e-file system.

Q: What are some common errors to avoid when completing Form 709?

A: Common errors include incorrect valuation of assets, overlooking deductions and exemptions, and failing to properly calculate the tax liability.