IRS Form 3911 Printable: A Comprehensive Guide to Downloading and Completing

Navigating the complexities of tax filing can be daunting, but with the right tools and guidance, it doesn’t have to be. IRS Form 3911, a crucial document for tax-exempt organizations, plays a significant role in ensuring compliance and maintaining tax-exempt status. This comprehensive guide will provide you with a clear understanding of IRS Form 3911, its purpose, and how to download, complete, and submit it accurately.

Understanding the intricacies of IRS Form 3911 is essential for tax-exempt organizations. This guide will delve into the purpose and history of the form, empowering you with the knowledge to fulfill your tax obligations efficiently and effectively.

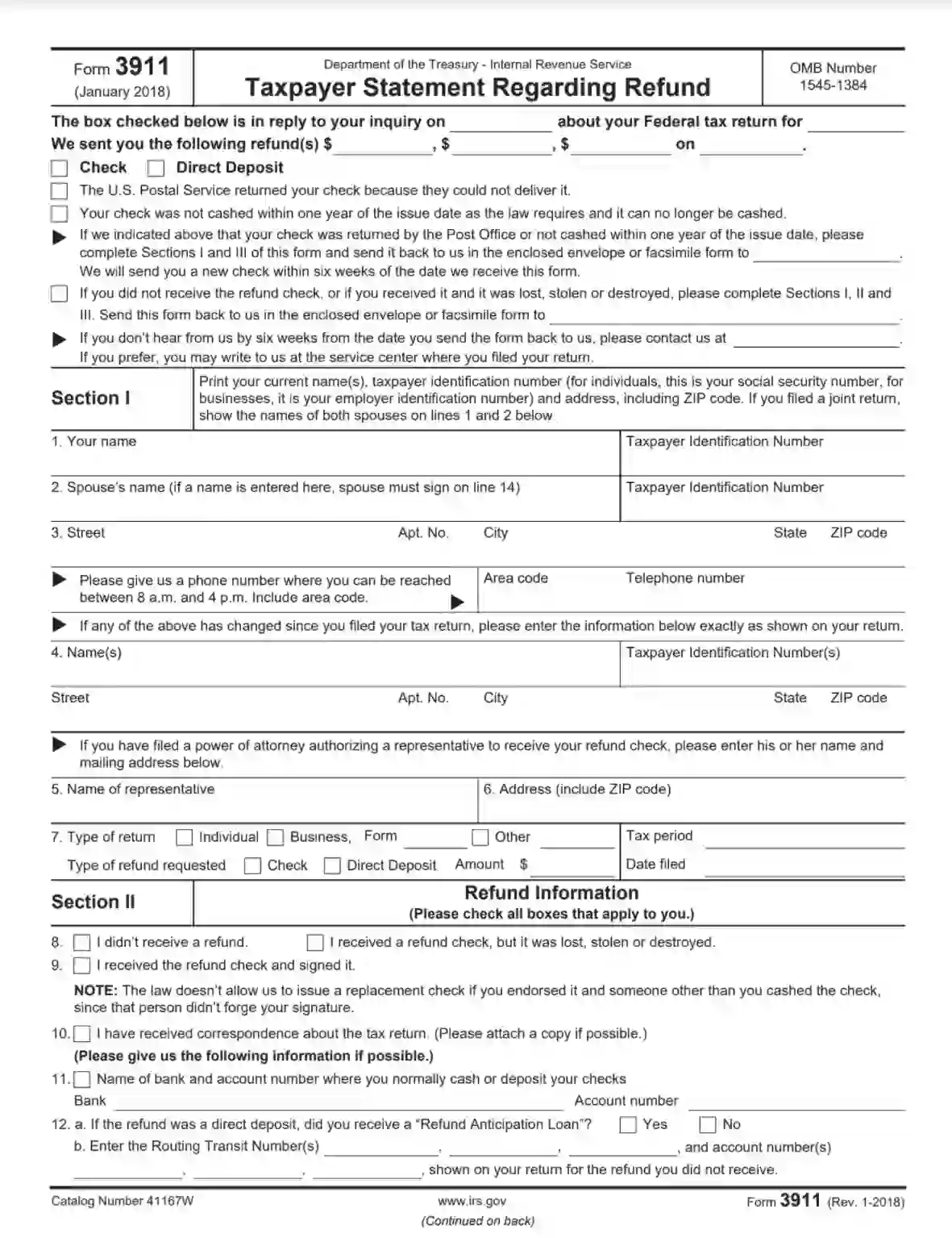

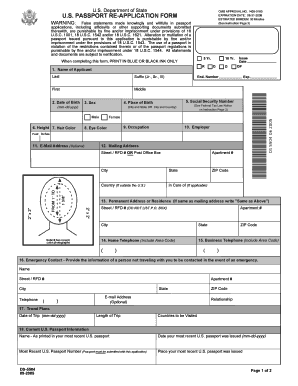

IRS Form 3911 Overview

IRS Form 3911, Taxpayer Statement for Refund Offset, is a crucial document used by the Internal Revenue Service (IRS) to inform taxpayers about offsets applied to their federal tax refunds. When a taxpayer owes certain debts to federal or state agencies, the IRS may use their tax refund to settle these outstanding obligations.

The IRS has been utilizing Form 3911 since 1998 to provide taxpayers with a clear understanding of the offset process and the specific debts being satisfied. It serves as an official notification to taxpayers, outlining the amount of refund withheld, the agency receiving the offset, and the reason for the offset.

Printable IRS Form 3911

Banging on about taxes can be a right drag, but if you’re a US citizen, you’ve got to file them. And when it comes to tax forms, IRS Form 3911 is a bit of a beast. But fear not, mate, we’ve got your back. This bad boy is your go-to guide for getting your hands on a printable version of IRS Form 3911.

Direct Link to Official IRS Website

Smash this link: https://www.irs.gov/forms-pubs/about-form-3911 and you’ll be taken straight to the official IRS website where you can download and print the form.

Importance of Using the Most Recent Version

Don’t be a mug and use an old version of the form. The tax laws are always changing, so you need to make sure you’re using the most up-to-date version. The IRS updates Form 3911 every year, so always grab the latest one.

Tips on Printing and Completing the Form

Printing and filling out Form 3911 is easy as pie. Just follow these tips:

- Use high-quality paper.

- Print the form double-sided.

- Fill out the form in black ink.

- Write clearly and legibly.

- Don’t forget to sign and date the form.

Completing IRS Form 3911

Filling out IRS Form 3911, Taxpayer Statement Regarding Refund, is crucial to avoid any delays or issues in processing your tax refund. This form is a legal document that provides the IRS with essential information to verify your identity and ensure the accuracy of your refund claim.

The form is divided into several sections, each requiring specific information. Let’s delve into the sections and provide guidance on completing them accurately.

Section 1: Taxpayer Information

In this section, you’ll provide your personal information, including your name, address, Social Security number, and daytime phone number. Ensure that the information you enter matches the details on your tax return.

Section 2: Refund Information

This section captures the amount of the refund you’re claiming and the method you prefer to receive it. You can choose to have your refund directly deposited into your bank account, mailed to you as a check, or used to purchase U.S. Savings Bonds.

Section 3: Certification

The certification section requires you to sign and date the form. By signing, you’re declaring that the information provided on the form is true and accurate to the best of your knowledge. It’s essential to take your time and review the form carefully before signing.

Common Errors to Avoid

- Inaccurate or incomplete information: Ensure that all the information you provide is accurate and complete to avoid delays or rejections.

- Incorrect Social Security number: Double-check your Social Security number to ensure it’s entered correctly. An incorrect number can result in processing errors.

- Mismatched information: The information on Form 3911 should match the details on your tax return. Any discrepancies can trigger additional scrutiny and potential delays.

By carefully completing IRS Form 3911 and avoiding common errors, you can expedite the processing of your tax refund and ensure that you receive your funds promptly.

Submitting IRS Form 3911

Submitting IRS Form 3911 is crucial to avoid penalties and ensure the timely processing of your tax information. There are multiple methods available for submitting the form, each with its own deadlines and requirements.

Methods for Submitting IRS Form 3911

- Mail: You can mail the completed form to the designated IRS address mentioned on the form instructions.

- Electronic Filing: You can electronically file Form 3911 through an authorized e-file provider. This method offers convenience and faster processing times.

Deadlines and Requirements

The deadline for submitting Form 3911 is typically April 15th of the year following the tax year being reported. However, extensions may be granted under certain circumstances. It’s essential to check the IRS website or consult with a tax professional for specific deadlines and requirements.

Where to Mail or Electronically File

The mailing address for IRS Form 3911 can be found on the form instructions. For electronic filing, you can visit the IRS website and search for authorized e-file providers.

Resources for Assistance

If you need further guidance or support while completing IRS Form 3911, various resources are available to help you navigate the process effectively.

The Internal Revenue Service (IRS) provides a range of publications and online guides that offer detailed instructions and explanations. These resources are easily accessible and can be found on the official IRS website.

Professional Tax Assistance

If you prefer personalized assistance, you can consider seeking professional help from a tax preparer or accountant. These experts can provide tailored guidance based on your specific situation, ensuring accuracy and maximizing potential tax savings.

IRS Helpline

For immediate assistance, you can reach out to the IRS helpline at 1-800-829-1040. The helpline is staffed by knowledgeable IRS representatives who can answer your questions and provide support throughout the Form 3911 completion process.

FAQs

What is the purpose of IRS Form 3911?

IRS Form 3911 is specifically designed for tax-exempt organizations to report their annual income, expenses, and other financial information to the Internal Revenue Service (IRS).

Where can I download the official IRS Form 3911?

The official IRS Form 3911 can be downloaded directly from the IRS website at https://www.irs.gov/forms-pubs/about-form-3911.

Is it mandatory to use the most recent version of IRS Form 3911?

Yes, it is crucial to use the most recent version of IRS Form 3911 to ensure that you are reporting your organization’s financial information according to the latest IRS regulations and requirements.

What are some common errors to avoid when completing IRS Form 3911?

Common errors to avoid include mathematical mistakes, incorrect calculations, missing or incomplete information, and failing to sign and date the form.

Where can I seek professional assistance with completing IRS Form 3911?

If you require professional assistance with completing IRS Form 3911, you can consult with a tax accountant, tax attorney, or other qualified tax professional.