IRS 1099 Printable Form 2023: Your Comprehensive Guide

Navigating the world of taxes can be daunting, but understanding the IRS 1099 Printable Form 2023 is crucial for accurate income reporting. This essential document plays a vital role in ensuring compliance and avoiding potential penalties. In this comprehensive guide, we’ll delve into the intricacies of the 1099 form, empowering you with the knowledge to complete it confidently.

The 1099 form serves as a record of income received from sources other than your primary employer. Understanding the different types of 1099 forms and their specific purposes is paramount. Whether you’re a freelancer, independent contractor, or recipient of various income streams, this guide will provide clarity and help you determine which form is right for your situation.

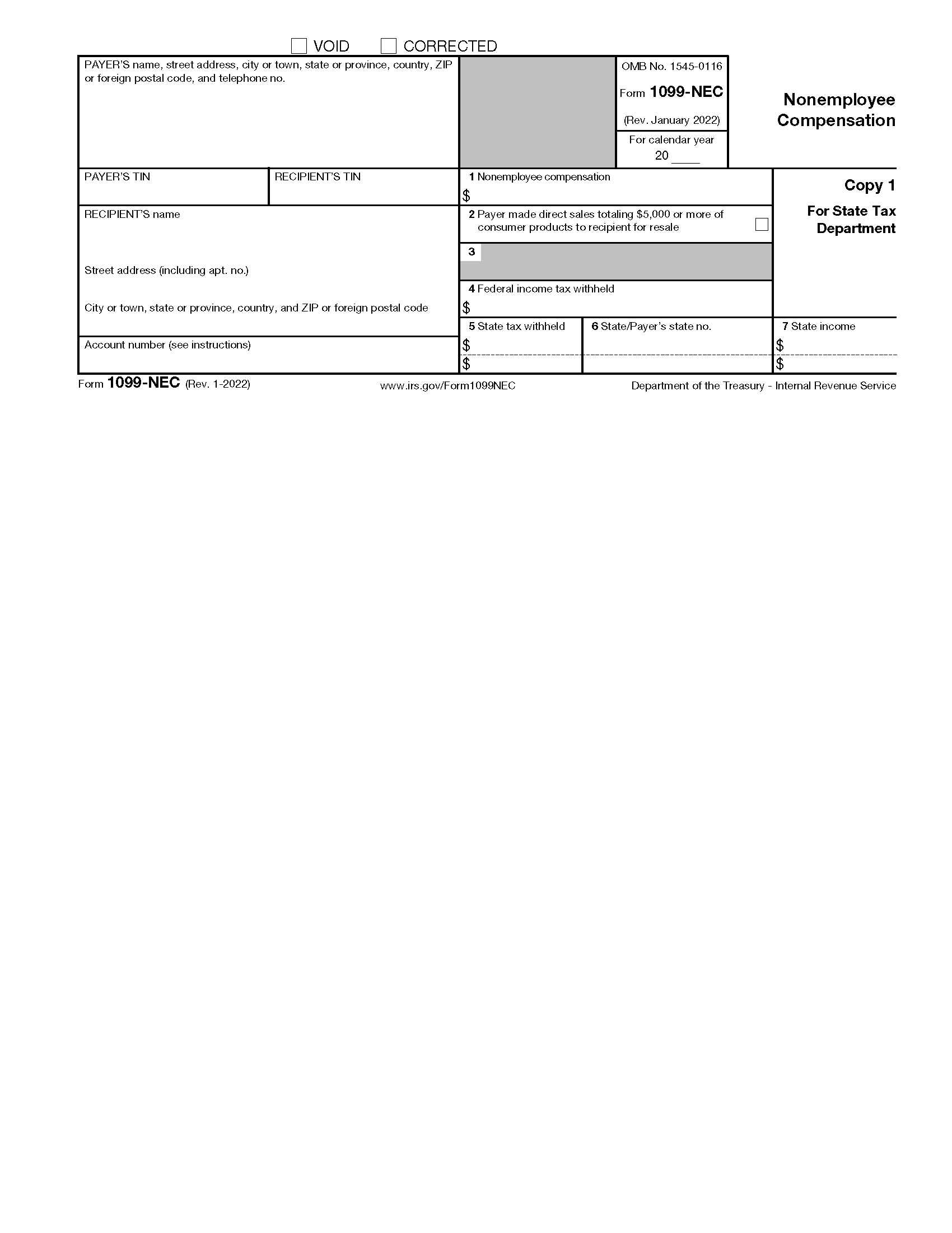

IRS 1099 Printable Form 2023

The IRS 1099 form is a tax document used to report income earned from non-employee work, such as freelance or contract work. It is important to use the correct 1099 form for your specific income type, as this will ensure that you are reporting your income correctly and avoiding any potential tax penalties.

Types of 1099 Forms

There are several different types of 1099 forms, each with its own specific purpose:

- Form 1099-MISC: This form is used to report miscellaneous income, such as income from freelance work, contract work, or prize winnings.

- Form 1099-NEC: This form is used to report nonemployee compensation, such as income from self-employment or independent contracting.

- Form 1099-K: This form is used to report income from merchant card transactions, such as credit card or debit card payments.

- Form 1099-INT: This form is used to report interest income, such as interest earned from savings accounts or bonds.

- Form 1099-DIV: This form is used to report dividend income, such as dividends earned from stocks or mutual funds.

It is important to note that the IRS 1099 form is not a tax return. It is simply a way to report your income to the IRS. You will still need to file a tax return to report your total income and calculate your tax liability.

Downloading and Printing the Form

To obtain the official 1099 printable form, visit the IRS website at https://www.irs.gov/forms-pubs/about-form-1099-nec. Once on the website, follow these steps:

Downloading the Form

- Click on the “Forms” tab at the top of the page.

- Scroll down and click on the “Forms by Topic” link.

- Under the “Income” section, click on the “1099-NEC” link.

- On the 1099-NEC page, click on the “Download PDF” button.

- Save the PDF file to your computer.

Printing the Form

- Open the saved PDF file in a PDF viewer such as Adobe Acrobat Reader.

- Click on the “File” menu and select “Print”.

- Select your printer from the list of available printers.

- Click on the “Print” button to print the form.

Completing the Form

Filling out the 1099 form accurately is crucial for tax purposes. Each type of 1099 form has specific sections that must be completed. Let’s delve into the essential information required for each section.

Key Sections and Corresponding Codes

The 1099 form consists of several key sections, each with its corresponding code:

- Box 1: Income Amount

- Box 2: Federal Income Tax Withheld

- Box 3: Social Security Tax Withheld

- Box 4: Medicare Tax Withheld

- Box 5: State Income Tax

- Box 6: State/Locality Name

- Box 7: State Identification Number

Required Fields for Each 1099 Type

Depending on the type of 1099 form, certain fields are mandatory:

- 1099-NEC: Income, Federal Income Tax Withheld, Social Security Tax Withheld, Medicare Tax Withheld

- 1099-MISC: Income, State Income Tax, State/Locality Name, State Identification Number

- 1099-INT: Interest Income

- 1099-DIV: Dividends

- 1099-R: Retirement Distributions

Examples and Illustrations

To illustrate the filling process, consider the following example:

You are self-employed and provide consulting services. You receive a 1099-NEC from your client, showing the following information:

| Box | Amount |

|---|---|

| 1 | $10,000 |

| 2 | $500 |

| 3 | $300 |

| 4 | $150 |

Based on this information, you would fill out the 1099-NEC form as follows:

| Section | Information |

|---|---|

| Payer Name and Address | Your client’s information |

| Recipient Name and Address | Your information |

| Income Amount (Box 1) | $10,000 |

| Federal Income Tax Withheld (Box 2) | $500 |

| Social Security Tax Withheld (Box 3) | $300 |

| Medicare Tax Withheld (Box 4) | $150 |

Reporting Income and Expenses

Reporting income and expenses accurately is crucial for tax purposes. Individuals receiving income from self-employment or other non-employee sources must report it on Form 1099.

The 1099 form captures various types of income, including:

- Self-employment income (e.g., freelance work, consulting)

- Dividends

- Interest

- Royalties

- Prizes and awards

It’s equally important to deduct allowable expenses from your income. These expenses reduce your taxable income, saving you money on taxes.

Allowable expenses include:

- Business expenses (e.g., office supplies, equipment, travel)

- Home office expenses (if you work from home)

- Vehicle expenses (if you use your car for business)

- Education expenses (if related to your work)

- Health insurance premiums (for self-employed individuals)

Organising your income and expenses into a table or using bullet points can help you track your finances effectively and ensure accurate reporting on your 1099 form.

Filing and Submission Requirements

Filing the 1099 form is crucial for reporting income and expenses. Understanding the deadlines and methods for submission ensures timely and accurate reporting.

Filing Deadlines

- Electronic Filing: March 31, 2023

- Paper Mailing: February 28, 2023

Methods of Submission

You can submit the 1099 form electronically or via paper mail:

- Electronic Filing: Use IRS-approved software or e-file providers to submit the form online.

- Paper Mailing: Mail the completed form to the IRS address specified in the instructions.

Consequences of Late Filing or Incorrect Submission

Failure to file the 1099 form on time or submitting incorrect information may result in penalties:

- Late Filing Penalty: $50 per form, up to $250,000

- Incorrect Information Penalty: $500 per incorrect form, up to $1.5 million

Penalties and Common Mistakes

Failing to file or incorrectly filing Form 1099 can result in significant penalties. It’s crucial to understand the potential consequences and common pitfalls to ensure accurate and timely submission.

The penalties for non-compliance vary depending on the severity of the error and whether it was intentional or not. Penalties can include fines, interest charges, and even criminal prosecution in severe cases.

Common Mistakes

- Incorrectly identifying the recipient’s tax status.

- Entering incorrect or incomplete recipient information.

- Miscalculating or omitting income and expense amounts.

- Filing the form late or failing to file altogether.

- Using an outdated version of the form.

To avoid these mistakes, it’s essential to:

- Gather all necessary information from the recipient before completing the form.

- Double-check all entries for accuracy before submitting the form.

- Keep a copy of the completed form for your records.

- File the form on time to avoid penalties.

- Refer to the IRS website or consult with a tax professional for guidance if needed.

FAQs and Additional Resources

If you have any questions or need further assistance regarding the IRS 1099 Printable Form 2023, here are some frequently asked questions (FAQs) and resources that may be helpful:

FAQs

| Question | Answer |

|---|---|

| What is the IRS 1099 Printable Form 2023 used for? | The IRS 1099 Printable Form 2023 is used to report income and expenses from self-employment, independent contracting, or other types of non-employee compensation. |

| Who is required to file Form 1099? | Individuals or businesses who have paid $600 or more to a non-employee during the tax year are required to file Form 1099. |

| What types of income are reported on Form 1099? | Income reported on Form 1099 includes earnings from self-employment, independent contracting, prizes, and awards. |

| When is Form 1099 due? | Form 1099 is due to the IRS and the recipient by January 31st of the year following the tax year. |

Additional Resources

- IRS Publication 17: Your Federal Income Tax

- IRS Form 1099 Instructions

- IRS website: https://www.irs.gov/

- Tax professionals: Contact a certified public accountant (CPA) or enrolled agent (EA) for personalized guidance.

Contact Information

If you need further assistance, you can contact the IRS at 1-800-829-1040 or visit their website at https://www.irs.gov/.

Answers to Common Questions

What is the deadline for filing the IRS 1099 Printable Form 2023?

The deadline for filing the IRS 1099 Printable Form 2023 is January 31, 2024.

Can I file the IRS 1099 Printable Form 2023 electronically?

Yes, you can file the IRS 1099 Printable Form 2023 electronically using the IRS FIRE system or through a tax software program.

What are the penalties for failing to file the IRS 1099 Printable Form 2023?

The penalties for failing to file the IRS 1099 Printable Form 2023 can range from $50 to $250,000 per form, depending on the length of the delay and whether the failure was intentional.