IRS 1099 Printable Form: A Comprehensive Guide to Downloading, Filling, and Filing

Navigating the world of taxes can be a daunting task, but understanding and utilizing the IRS 1099 Printable Form is a crucial step in ensuring accurate and timely reporting of income and expenses. This comprehensive guide will delve into the intricacies of Form 1099, providing a clear and concise roadmap for downloading, filling, and filing this essential document.

The IRS 1099 Printable Form is an official document used to report various types of income, such as non-employee compensation, dividends, and interest payments. By understanding the different types of Form 1099 and their specific uses, you can ensure that you are using the correct form for your reporting needs.

Introduction

Form 1099 is a tax document that reports income earned from non-employee sources. It’s important because it helps the IRS track income and ensure that taxes are paid accurately. There are different types of Form 1099, each used for specific types of income.

The IRS website provides printable versions of Form 1099, making it easy to access and complete the form.

Types of Form 1099

There are several types of Form 1099, each used for different types of income:

- Form 1099-NEC: Reports nonemployee compensation (previously reported on Form 1099-MISC).

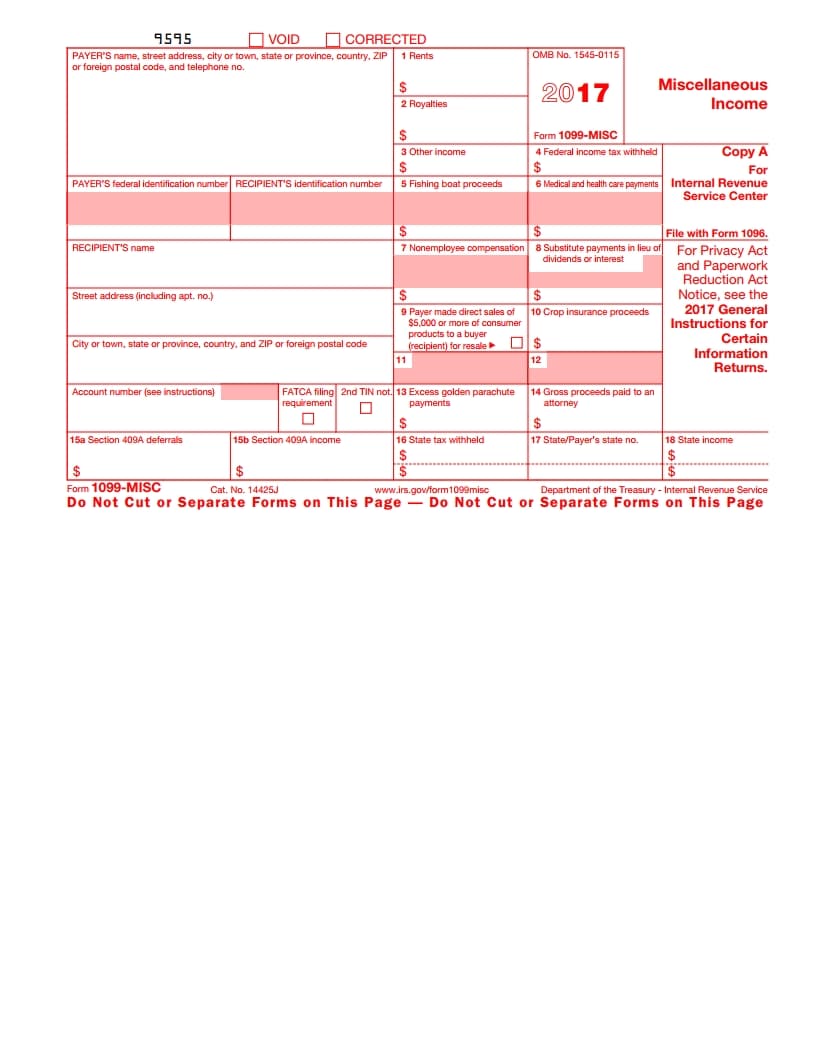

- Form 1099-MISC: Reports miscellaneous income, such as rent or prizes.

- Form 1099-INT: Reports interest earned from banks and other financial institutions.

- Form 1099-DIV: Reports dividends earned from stocks and mutual funds.

- Form 1099-B: Reports proceeds from the sale of stocks, bonds, and other investments.

Downloading and Printing Form 1099

Innit, need to grab a copy of Form 1099 from the taxman? Here’s the lowdown on how to get it and print it out sharpish.

Downloading the Form

Blag the form from the IRS website. Just hit up irs.gov and search for “Form 1099.” Click on the download link, and it’s all yours.

Printing Options

Fancy printing it out? No stress. You can print it in PDF format or as a fillable form. If you’re going for the fillable form, make sure you’ve got Adobe Reader or a similar program to open it up.

Printing Tips

Don’t go printing like a numpty. Check your printer settings to make sure it’s printing at the right size and quality. And don’t forget to use high-quality paper so it doesn’t look like a dog’s dinner.

Filling Out Form 1099

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg?w=700)

Filling out Form 1099 is essential for reporting income from self-employment or freelance work. It’s crucial to complete the form accurately to avoid penalties and ensure proper tax reporting.

Purpose of Each Section

Form 1099 consists of several sections, each with a specific purpose:

- Payer Information: Identifies the person or business paying you.

- Recipient Information: Includes your name, address, and Taxpayer Identification Number (TIN).

- Income Information: Reports the amount of income you received from the payer.

- Additional Information: Provides space for any other relevant information, such as state or local tax withholding.

Completing Each Section

Follow these tips to complete each section accurately:

- Payer Information: Enter the payer’s name, address, and TIN exactly as they appear on the payment documents.

- Recipient Information: Provide your full name, address, and TIN. If you’re a sole proprietor, use your personal TIN.

- Income Information: Report the total amount of income you received from the payer during the tax year.

- Additional Information: Include any state or local tax withholding or other relevant details.

Common Mistakes to Avoid

Avoid these common mistakes when filling out Form 1099:

- Incorrect Payer Information: Make sure the payer’s information is accurate to ensure proper tax reporting.

- Missing or Incorrect TIN: Providing the correct TIN is crucial for tax identification.

- Incomplete Income Information: Report all income received from the payer, even if it’s already been reported on other forms.

- Ignoring Additional Information: State or local tax withholding must be included if applicable.

Filing Form 1099

Once you’ve filled out your Form 1099, it’s time to file it with the IRS. The deadline for filing Form 1099 is January 31st of the year following the year in which the income was earned. For example, if you earned income in 2023, you would need to file Form 1099 by January 31st, 2024.

There are two ways to file Form 1099: electronically or by mail. If you file electronically, you can use the IRS’s FIRE system. If you file by mail, you can send your form to the IRS at the address listed on the form.

If you do not file Form 1099 on time, you may be subject to penalties. The penalty for late filing is $50 per form, with a maximum penalty of $250,000 per year.

Filing Electronically

To file Form 1099 electronically, you will need to use the IRS’s FIRE system. FIRE stands for “Filing Information Returns Electronically.” You can access the FIRE system at the IRS website.

Once you have accessed the FIRE system, you will need to create an account. Once you have created an account, you will be able to upload your Form 1099 files.

The IRS recommends that you file Form 1099 electronically if you have more than 250 forms to file. Filing electronically is faster and more accurate than filing by mail.

Filing by Mail

To file Form 1099 by mail, you will need to send your form to the IRS at the address listed on the form. You can find the address for your state on the IRS website.

When you file by mail, you should make sure to send your form in a timely manner. The IRS recommends that you mail your form at least 30 days before the filing deadline.

Resources and Support

Seeking help with Form 1099? Here’s a cheat sheet of resources:

Contact Information

- IRS Helpline: 1-800-829-1040

- IRS Website: www.irs.gov

- National Taxpayer Advocate: 1-877-777-4778

Organizations

- Tax Foundation: www.taxfoundation.org

- Institute on Taxation and Economic Policy: www.itep.org

li>Tax Policy Center: www.taxpolicycenter.org

Staying Informed

Stay in the loop with Form 1099 updates by:

- Subscribing to IRS email alerts

- Following IRS on social media

- Checking the IRS website regularly

FAQ Section

Can I file Form 1099 electronically?

Yes, you can file Form 1099 electronically through the IRS website or authorized e-filing providers. Electronic filing offers convenience, accuracy, and faster processing times.

What are the penalties for not filing Form 1099 on time?

Failure to file Form 1099 on time can result in penalties and interest charges. The penalties vary depending on the type of Form 1099 and the length of the delay.

Where can I find resources and support for completing Form 1099?

The IRS website provides comprehensive resources, including instructions, FAQs, and contact information for assistance. Additionally, tax professionals and software programs can offer guidance and support throughout the process.