IRS 1040 Printable Form: A Comprehensive Guide to Understanding, Accessing, and Filing

Navigating the complexities of tax filing can be daunting, but understanding and accessing the IRS 1040 Printable Form is crucial for accurate and timely tax preparation. This comprehensive guide will provide a clear and accessible overview of the 1040 form, its significance, and the process of accessing, filling out, and filing it. Whether you’re a seasoned tax filer or tackling your taxes for the first time, this guide will empower you with the knowledge and resources you need for a successful tax season.

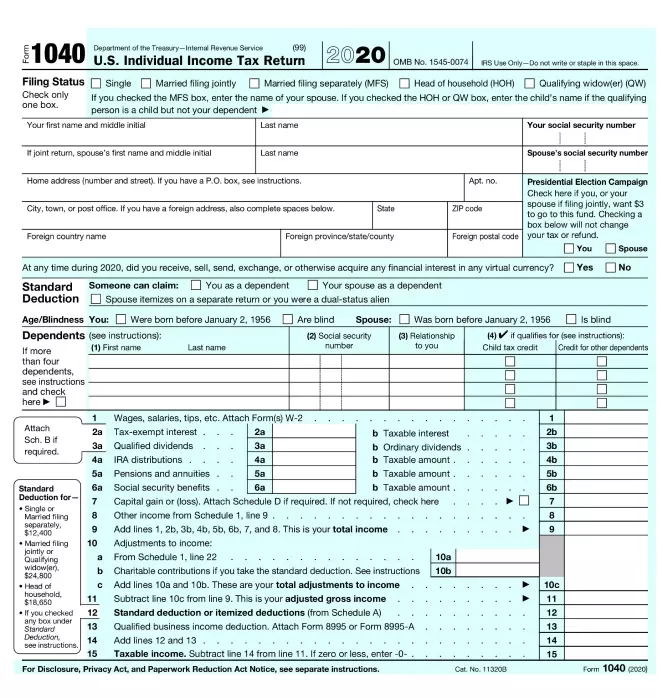

The IRS 1040 form is the primary document used by individuals to file their annual income taxes with the Internal Revenue Service (IRS). It serves as a detailed record of your income, deductions, and tax liability for the previous year. Understanding the different sections and schedules of the form is essential to ensure accurate reporting and avoid costly mistakes.

Understanding the IRS 1040 Form

The IRS 1040 form is a tax return form used by individuals to report their annual income and calculate their tax liability to the Internal Revenue Service (IRS). It’s a crucial document for taxpayers, as it determines the amount of taxes they owe or the refund they’re entitled to.

Sections of the Form

The 1040 form consists of several sections and schedules. Each section is designed to collect specific information about the taxpayer’s income, deductions, credits, and other financial data.

- Personal Information: This section includes the taxpayer’s name, address, and Social Security number.

- Income: This section reports the taxpayer’s income from various sources, such as wages, salaries, dividends, and interest.

- Adjustments to Income: This section allows taxpayers to make adjustments to their income, such as contributions to retirement accounts and alimony payments.

- Itemized Deductions: This section lists deductible expenses, such as medical expenses, charitable contributions, and mortgage interest.

- Standard Deduction: This section allows taxpayers to take a standard deduction instead of itemizing their expenses.

- Taxable Income: This section calculates the taxpayer’s taxable income, which is their income minus any deductions and exemptions.

- Tax: This section calculates the taxpayer’s tax liability based on their taxable income.

- Credits: This section lists tax credits that can reduce the taxpayer’s tax liability, such as the child tax credit and the earned income tax credit.

- Payments: This section records any tax payments made during the year, such as estimated tax payments and withholdings from paychecks.

- Refund or Amount Due: This section calculates the taxpayer’s refund or the amount they owe to the IRS.

Who Must File Form 1040

Generally, individuals with a gross income above a certain threshold are required to file Form 1040. The threshold varies depending on factors such as filing status, age, and dependency status. It’s important to check the IRS guidelines to determine if you’re required to file.

Accessing and Downloading the Form

:max_bytes(150000):strip_icc()/1040-SR-TaxReturnforSeniors-1-ccfefd6fef7b4798a50037db30a91193.png?w=700)

The official website to access the printable IRS 1040 form is the Internal Revenue Service (IRS) website: https://www.irs.gov/forms-pubs/about-form-1040.

Downloading the Form

Once on the IRS website, follow these steps to download the form:

1. Click on the “Forms” tab at the top of the page.

2. Under the “Individual” section, select “Form 1040”.

3. On the Form 1040 page, click on the “Download PDF” button.

4. Choose the desired format (e.g., PDF, fillable PDF).

5. Save the file to your computer.

Opening and Filling Out the Form

To open and fill out the form, you will need a PDF reader such as Adobe Acrobat Reader. Once the form is open, you can fill it out manually or electronically using the fillable PDF version.

Filling Out the Form

Filling out the IRS 1040 form can be a bit of a chore, but it’s important to get it right to avoid any nasty surprises from the taxman. Here’s a step-by-step guide to help you complete each section of the form.

Step 1: Personal Information

Start by filling in your personal information, including your name, address, and Social Security number. If you’re married, you’ll need to include your spouse’s information as well.

Step 2: Income

Next, you’ll need to report your income from all sources. This includes wages, salaries, tips, dividends, interest, and any other income you received during the year.

Step 3: Deductions

Once you’ve reported your income, you can start to claim any deductions that you’re eligible for. These can include things like mortgage interest, charitable donations, and student loan interest.

Step 4: Taxable Income

Your taxable income is your total income minus any deductions you’ve claimed. This is the amount that you’ll use to calculate your tax liability.

Step 5: Taxes

The final step is to calculate your taxes. You’ll do this by using the tax tables or tax software to determine how much you owe. You’ll also need to make any estimated tax payments or adjustments.

Common Mistakes to Avoid

Here are a few common mistakes to avoid when filling out your 1040 form:

- Forgetting to sign the form.

- Making math errors.

- Claiming deductions that you’re not eligible for.

- Filing late.

Filing the Form

There are several ways to file your IRS 1040 form:

- Mail: You can mail your completed form to the IRS using the address provided on the form.

- E-file: You can file your form electronically using tax software or the IRS website.

E-filing

E-filing is the fastest and most accurate way to file your taxes. To e-file, you will need:

- A computer with internet access

- Tax software or an IRS-approved e-file provider

- Your Social Security number

- Your bank account information (if you are expecting a refund)

Once you have gathered your information, you can follow these steps to e-file your taxes:

- Choose a tax software or e-file provider.

- Enter your personal and financial information into the software.

- Review your return and make any necessary corrections.

- Submit your return to the IRS.

Deadlines and Penalties

The deadline to file your IRS 1040 form is April 15th. If you file your return late, you may be subject to penalties. The penalty for late filing is 5% of the unpaid tax for each month that your return is late, up to a maximum of 25%.

Additional Resources

The IRS offers a variety of resources to help you with Form 1040. These resources include:

- IRS Publication 17: Your Federal Income Tax

- IRS Publication 501: Exemptions, Standard Deduction, and Filing Information

- IRS Publication 972: Child Tax Credit and Credit for Other Dependents

- IRS Publication 1040-ES: Estimated Tax for Individuals

You can also get help with tax preparation from organizations or professionals. These organizations include:

- The Volunteer Income Tax Assistance (VITA) program

- The Tax Counseling for the Elderly (TCE) program

- The IRS Taxpayer Assistance Centers (TACs)

If you have any questions or issues, you can contact the IRS by phone, mail, or online.

- Phone: 1-800-829-1040

- Mail: Internal Revenue Service, P.O. Box 25044, Cincinnati, OH 45225

- Online: https://www.irs.gov

FAQs

What is the purpose of the IRS 1040 form?

The IRS 1040 form is the primary document used by individuals to file their annual income taxes with the Internal Revenue Service (IRS). It serves as a detailed record of your income, deductions, and tax liability for the previous year.

Where can I access the IRS 1040 Printable Form?

You can access the IRS 1040 Printable Form on the official IRS website at www.irs.gov. The form is available in various formats, including PDF and fillable PDF, for easy download and completion.

What are the common mistakes to avoid when filling out the IRS 1040 form?

Some common mistakes to avoid when filling out the IRS 1040 form include: entering incorrect Social Security numbers, making mathematical errors, overlooking deductions and credits, and missing filing deadlines.

What are the different options for filing the IRS 1040 form?

You can file the IRS 1040 form by mail, electronically using tax software or the IRS website, or through a tax professional.

What is the deadline for filing the IRS 1040 form?

The deadline for filing the IRS 1040 form is typically April 15th of each year. However, this deadline may vary depending on factors such as weekends and holidays.