**Hmrc P85 Printable Form: Your Guide to Completing and Submitting**

Navigating the complexities of UK taxation can be a daunting task. The HMRC P85 Printable Form plays a crucial role in ensuring accurate tax deductions and allowances, simplifying the process for both individuals and employers. In this comprehensive guide, we’ll delve into the purpose, eligibility, and step-by-step instructions for completing this essential document, empowering you to confidently manage your tax affairs.

Whether you’re a seasoned taxpayer or new to the UK tax system, this guide will provide valuable insights and practical tips to ensure a smooth and error-free submission. Join us as we explore the intricacies of the HMRC P85 Printable Form, unlocking its benefits and helping you navigate the tax landscape with ease.

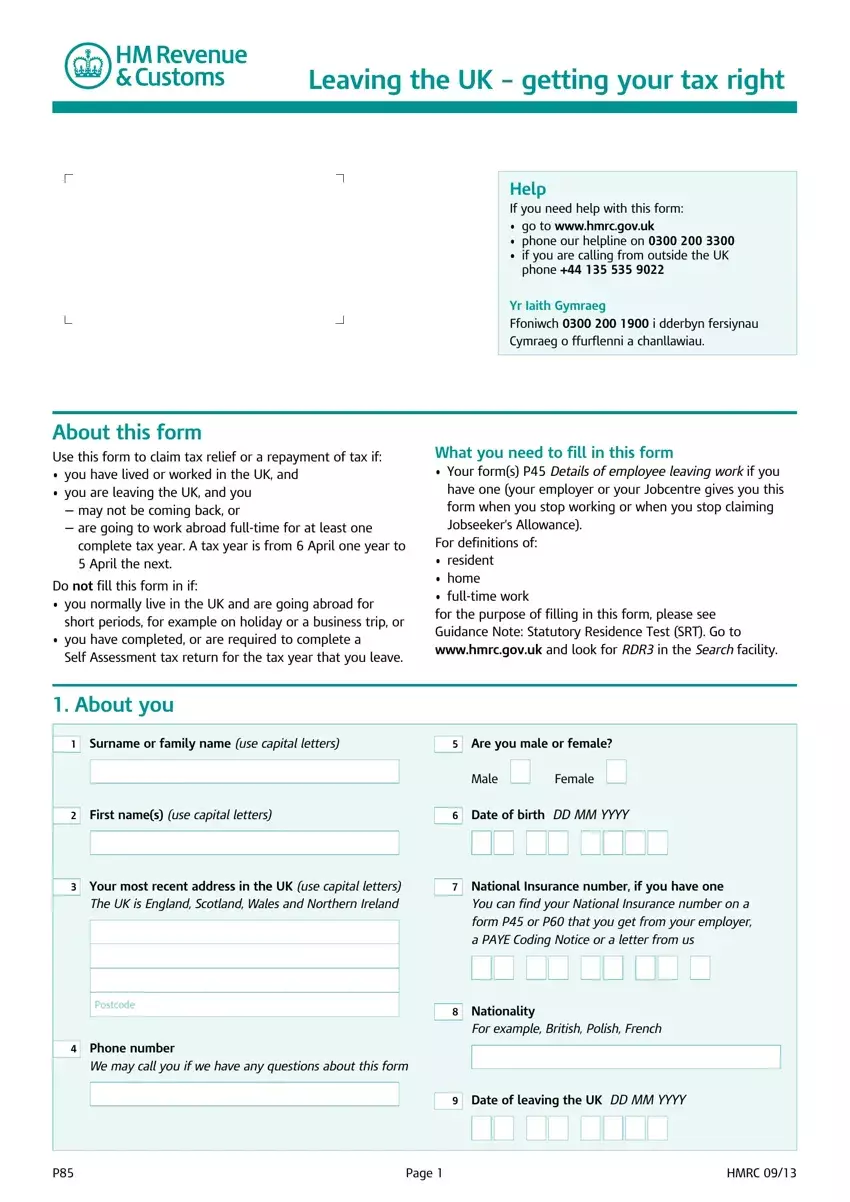

HMRC P85 Printable Form

The HMRC P85 Printable Form is an essential document used to inform Her Majesty’s Revenue and Customs (HMRC) about an individual’s tax status and circumstances. Completing this form is mandatory for individuals who have recently started a new job or experienced a change in their personal or financial situation that may affect their tax liability.

The P85 form consists of several sections, each designed to gather specific information about the taxpayer. These sections include personal details, employment details, income details, and deductions and allowances. By providing accurate and up-to-date information on the P85 form, individuals can ensure that they are paying the correct amount of tax and receiving the appropriate tax reliefs and benefits.

Eligibility Criteria

The P85 Printable Form is primarily intended for individuals who are employed in the United Kingdom and are required to pay taxes on their earnings. It is particularly important for individuals who have recently started a new job, as they need to register with HMRC and provide their tax details. Additionally, individuals who have experienced changes in their personal or financial circumstances, such as a change in marital status, number of dependents, or income level, may also need to complete a P85 form to update their tax records.

Form Sections and Functions

The HMRC P85 Printable Form is divided into several sections, each with a specific purpose. These sections include:

– Personal Details: This section collects basic personal information such as name, address, date of birth, and National Insurance number.

– Employment Details: This section gathers information about the taxpayer’s employment, including their employer’s name and address, job title, and start date.

– Income Details: This section collects information about the taxpayer’s income from various sources, such as employment, self-employment, and investments.

– Deductions and Allowances: This section allows the taxpayer to claim any applicable deductions or allowances that may reduce their taxable income, such as pension contributions or charitable donations.

By completing each section of the P85 form accurately and comprehensively, individuals can ensure that HMRC has the necessary information to calculate their tax liability correctly and provide them with the appropriate tax reliefs and benefits.

Completing the HMRC P85 Printable Form

The HMRC P85 Printable Form is an essential document for employees who are starting a new job or changing their tax details. Completing it accurately is crucial to ensure that you pay the correct amount of tax and receive the benefits you’re entitled to.

Here’s a step-by-step guide to help you fill out the form accurately:

Personal Details

This section requires you to provide basic information about yourself, including your name, address, and National Insurance number. Make sure to enter your information exactly as it appears on your official documents.

Employment Details

In this section, you need to provide details about your new job, including the name and address of your employer, your job title, and your start date. If you’re not sure about any of this information, check with your employer.

Income and Tax Details

This section is where you’ll enter information about your income and any tax deductions you’re claiming. Be sure to include all sources of income, including wages, salaries, pensions, and benefits. You can find the information you need on your payslips or P60.

Additional Information

The final section of the form asks for additional information, such as whether you’re claiming Child Benefit or have any other sources of income. Answer these questions honestly and completely.

Submitting the Form

Once you’ve completed the form, you need to send it to HMRC. You can do this by post or online. If you’re sending it by post, make sure to use the pre-paid envelope that came with the form. If you’re sending it online, you’ll need to create an account with HMRC.

Common Errors to Avoid

Here are some common errors to avoid when completing the HMRC P85 Printable Form:

- Entering incorrect personal details

- Leaving sections blank

- Claiming tax deductions that you’re not entitled to

- Submitting the form late

Troubleshooting Tips

If you’re having trouble completing the HMRC P85 Printable Form, here are some troubleshooting tips:

- Refer to the HMRC website for guidance

- Contact your employer for assistance

- Call the HMRC helpline

By following these tips, you can ensure that you complete the HMRC P85 Printable Form accurately and avoid any potential problems.

Submission and Processing of the HMRC P85 Printable Form

Submitting the HMRC P85 Printable Form is a crucial step in notifying HMRC of your employment and tax status. You can choose from various submission methods, each with its own processing timeline and potential consequences.

Online Submission

- Advantages: Quick, convenient, and secure.

- Timeline: HMRC processes online submissions immediately.

- Consequences: Incorrect or incomplete submissions may delay processing.

Postal Submission

- Advantages: Easy and accessible, no internet access required.

- Timeline: Processing may take several weeks due to postal delays.

- Consequences: Lost or delayed mail can result in late or incorrect processing.

Telephone Submission

- Advantages: Immediate confirmation, no need for postage.

- Timeline: HMRC processes telephone submissions over the phone.

- Consequences: Errors or misunderstandings during the call may affect processing.

Late or Incorrect Submissions

- Consequences: Incorrect or late submissions can lead to delays in tax refunds or incorrect tax calculations.

- Recommendation: Submit your form accurately and on time to avoid any potential issues.

Benefits of Using the HMRC P85 Printable Form

Yo, check it, the HMRC P85 Printable Form is a game-changer for tax affairs. It’s like having a cheat code to simplify your life and save you precious time and energy. Let’s break down the perks:

Ease of Use

The printable form is a breeze to use. Just print it out, fill in the blanks, and boom, you’re done. No need to mess around with online portals or complicated software.

Time-Saving

Using the printable form can save you loads of time. You don’t have to wait for online portals to load or deal with technical glitches. Just print, fill, and submit.

Error Reduction

Filling out the printable form by hand reduces the risk of making mistakes. You can take your time, double-check your entries, and make sure everything’s spot on.

Testimonials

Don’t just take our word for it. Here’s what some happy users have to say:

“The printable form made tax filing a doddle. It was so easy to use, I had it done in no time.” – Sarah, satisfied taxpayer

Alternatives to the HMRC P85 Printable Form

The HMRC P85 Printable Form is a convenient option for completing and submitting your tax details to HMRC. However, there are a few alternatives that you can consider, each with its own advantages and disadvantages.

Online P85 Form

You can complete and submit your P85 form online through HMRC’s website. This method is quick and easy, and it allows you to save a copy of your form for your records.

Advantages:

- Quick and easy to complete

- Can be saved for your records

Disadvantages:

- May not be suitable for everyone, especially those who are not comfortable using computers

- May require you to have a Government Gateway account

Telephone P85 Service

You can complete and submit your P85 form over the phone by calling HMRC’s dedicated P85 helpline. This method is convenient, especially if you do not have access to a computer.

Advantages:

- Convenient, especially for those who do not have access to a computer

- Can be completed over the phone

Disadvantages:

- May require you to wait on hold

- May not be suitable for everyone, especially those who are not comfortable speaking on the phone

Choosing the Right Method

The best method for completing and submitting your P85 form depends on your individual circumstances. If you are comfortable using computers and have access to a Government Gateway account, then the online P85 form is a good option. If you do not have access to a computer or are not comfortable using one, then the telephone P85 service may be a better choice.

Frequently Asked Questions

What is the purpose of the HMRC P85 Printable Form?

The HMRC P85 Printable Form is used to declare your tax code and personal allowances to your employer. It ensures that the correct amount of tax is deducted from your salary or pension.

Who is eligible to complete the HMRC P85 Printable Form?

You are eligible to complete the HMRC P85 Printable Form if you are starting a new job or have a change in circumstances that affects your tax code or allowances.

Where can I find the HMRC P85 Printable Form?

You can download the HMRC P85 Printable Form from the GOV.UK website.

How do I complete the HMRC P85 Printable Form?

Follow the step-by-step instructions provided in this guide to complete the HMRC P85 Printable Form accurately.

What are the common errors to avoid when completing the HMRC P85 Printable Form?

Common errors include entering incorrect personal information, selecting the wrong tax code, and failing to sign and date the form.

What are the consequences of submitting an incorrect HMRC P85 Printable Form?

Submitting an incorrect HMRC P85 Printable Form may result in incorrect tax deductions and potential penalties.

What are the benefits of using the HMRC P85 Printable Form?

The HMRC P85 Printable Form is a convenient and efficient way to declare your tax code and personal allowances. It simplifies the process, saves time, and reduces the risk of errors.

What are the alternatives to the HMRC P85 Printable Form?

You can also complete the HMRC P85 form online or by phone. However, the printable form is generally the most convenient option.