HMRC P50 Printable Form: A Comprehensive Guide to Downloading, Understanding, and Submitting

Navigating the complexities of the HMRC P50 Printable Form can be a daunting task, but with the right guidance, it can be a straightforward process. This comprehensive guide will provide you with a clear understanding of the form’s purpose, structure, and submission requirements, empowering you to complete and submit it accurately and efficiently.

The HMRC P50 Printable Form plays a crucial role in ensuring accurate payroll records and tax calculations for individuals and organizations. It is a vital document that captures essential employee information, earnings, and deductions, forming the basis for calculating income tax and National Insurance contributions.

Introduction to HMRC P50 Printable Form

The HMRC P50 Printable Form is an official document provided by Her Majesty’s Revenue and Customs (HMRC) in the United Kingdom. It’s a yearly statement that summarizes an individual’s earnings, deductions, and tax information for a specific tax year.

The P50 form is a crucial document for both individuals and organizations. It provides a comprehensive overview of an employee’s income and tax situation, making it essential for tax filing, understanding tax obligations, and managing personal finances.

Purpose and Significance

The primary purpose of the P50 Printable Form is to provide a clear and concise record of an individual’s income and tax deductions. It helps individuals:

– Track their earnings and tax payments throughout the tax year

– Identify any errors or discrepancies in their tax calculations

– Ensure accurate tax filing and avoid penalties

– Plan for future tax liabilities

For organizations, the P50 form serves as a valuable tool for:

– Verifying employee income and tax information

– Reconciling payroll records and ensuring compliance

– Managing employee tax obligations and liabilities

s for Downloading and Printing the HMRC P50 Form

Innit, getting your hands on the HMRC P50 form is a breeze. Whether you’re a tech-savvy geezer or a paper-loving traditionalist, we’ve got you covered. Dive in to find out the lowdown on downloading and printing this essential document.

Accessing the Form

To bag yourself a P50 form, head on over to the GOV.UK website and type ‘P50’ into the search bar. Once you’ve found the right page, click on the ‘Download’ button. That’s it, mate! The form will be yours to do with as you please.

Downloading and Printing Options

Now, let’s chat about your options. You can either download the form as a PDF or print it straight away. If you’re going digital, save the PDF to your computer or device. For a physical copy, simply hit the ‘Print’ button. Sorted!

Troubleshooting Tips

If you’re having a bit of a mare downloading or printing the form, here’s a few things to try:

- Make sure your internet connection is stable.

- Try using a different browser or device.

- Check your printer settings and make sure it’s connected properly.

- If all else fails, give HMRC a bell on 0300 200 3300.

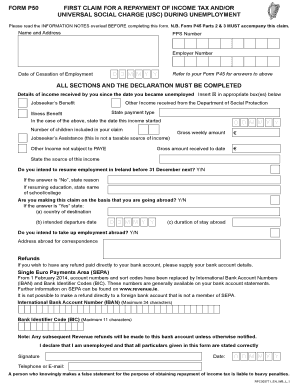

Understanding the Content and Structure of the HMRC P50 Form

The HMRC P50 Form is divided into several sections, each containing specific information about your income and deductions. Understanding the content and structure of the form is crucial for accurate tax calculations.

Section 1: Personal Details

This section captures your personal information, including your name, address, National Insurance number, and tax code. These details are essential for identifying you and ensuring your tax calculations are correct.

Section 2: Employment Details

This section provides information about your employment, such as your employer’s name and address, your job title, and your pay period. It also includes details of any benefits or expenses you receive from your employer.

Section 3: Income

This section lists all your taxable income, including your wages, bonuses, and any other payments subject to tax. It also includes details of any tax deductions, such as PAYE or National Insurance contributions.

Section 4: Deductions

This section Artikels any deductions from your income, such as pension contributions, student loan repayments, or charitable donations. These deductions reduce your taxable income and can impact your tax liability.

Section 5: Tax Calculation

This section calculates your tax liability based on your income and deductions. It shows the amount of tax you owe and any tax credits or allowances you may be entitled to.

Section 6: Payment Details

This section provides information about how your tax payments will be made, including the frequency and method of payment. It also includes details of any tax refunds you may be due.

Filling Out the HMRC P50 Form

Completing the HMRC P50 form accurately and thoroughly is crucial for ensuring a smooth and hassle-free tax return process. Here’s a comprehensive guide to help you fill out the form like a pro:

Before you start, make sure you have all the necessary information at hand, including your National Insurance number, employment details, and income and tax information.

Accuracy and Completeness

Accuracy is of paramount importance when filling out the P50 form. Double-check all the information you provide, especially your personal details and financial figures. Inaccurate information can lead to delays in processing your tax return or even penalties.

Completeness is equally important. Ensure that you fill out all the required sections of the form and provide all the requested information. Incomplete forms may be rejected or returned for correction, which can cause unnecessary delays.

Consequences of Incorrect Information

Providing incorrect information on the P50 form can have serious consequences. If HMRC discovers any discrepancies or errors, they may adjust your tax liability, impose penalties, or even initiate an investigation.

To avoid any such issues, it’s essential to be honest and transparent when filling out the form. If you’re unsure about anything, seek professional advice from a tax advisor or accountant.

Submitting the HMRC P50 Form

Submitting the HMRC P50 form is a crucial step in ensuring that your tax information is up-to-date and accurate. Here’s what you need to know about the different methods for submitting the form, deadlines, and tracking your submission.

Methods of Submission

You can submit the HMRC P50 form in three ways:

- Online: Submit the form through HMRC’s online portal, available at https://www.gov.uk/hmrc/online-services. This is the quickest and most convenient method.

- By post: Print the form and mail it to the address provided on the form.

- Through your employer: If your employer is responsible for handling your tax affairs, they may submit the form on your behalf.

Deadlines and Consequences

The deadline for submitting the HMRC P50 form is usually October 31st of the tax year it relates to. If you miss the deadline, you may face penalties and interest charges.

Tracking Your Submission

Once you have submitted the form, you can track its status online using HMRC’s online portal. This allows you to check if the form has been received and processed.

Common Questions and Troubleshooting

Got questions about the HMRC P50 Form? We’ve got answers. Plus, we’ll give you some tips to sort out any problems you might face. If you still need help, we’ll point you to some useful resources.

FAQs

- What’s the HMRC P50 Form all about?

It’s a yearly tax statement that shows how much tax you’ve paid and how much you’ve earned.

- Why do I need it?

You need it to check if you’re paying the right amount of tax and to claim any tax refunds you might be due.

- Where can I get a copy?

You can download it from the HMRC website or ask your employer for one.

- What if I’ve lost my P50?

You can request a new one from HMRC.

- I’ve got a question about my P50. Who can I ask?

You can call the HMRC helpline or visit their website.

Troubleshooting Tips

Having trouble with your P50? Here are some common issues and how to fix them:

- My P50 is wrong.

Check the information carefully. If you find any errors, contact HMRC.

- I can’t understand my P50.

There’s a guide on the HMRC website that can help you.

- I’ve lost my P50.

You can request a new one from HMRC.

- I’m having problems submitting my P50.

Make sure you’re using the correct form and that you’ve filled it out correctly.

Resources

Need more help? Here are some useful resources:

Helpful Answers

What is the purpose of the HMRC P50 Printable Form?

The HMRC P50 Printable Form is used to record employee earnings, deductions, and tax information for the tax year. It is an essential document for calculating income tax and National Insurance contributions.

How can I download the HMRC P50 Printable Form?

You can download the HMRC P50 Printable Form from the GOV.UK website. Simply search for “HMRC P50 Form” and follow the link to the download page.

What information is required on the HMRC P50 Printable Form?

The HMRC P50 Printable Form requires information such as the employee’s name, address, National Insurance number, tax code, earnings, deductions, and benefits.

How do I submit the HMRC P50 Printable Form?

You can submit the HMRC P50 Printable Form by post or online. If submitting by post, send it to the address provided on the form. If submitting online, you can use HMRC’s online portal.

What are the consequences of submitting an incorrect HMRC P50 Printable Form?

Submitting an incorrect HMRC P50 Printable Form can result in incorrect tax calculations and potential penalties. It is important to ensure that the information provided on the form is accurate and complete.