Gst34 2 Printable Form: A Comprehensive Guide to Understanding and Submitting

Navigating the intricacies of GST compliance can be a daunting task, but understanding and submitting the Gst34 2 Printable Form is a crucial step towards ensuring seamless adherence. This comprehensive guide delves into the purpose, structure, and significance of this form, providing you with the knowledge and tools necessary to complete it accurately and avoid potential pitfalls.

The Gst34 2 Printable Form serves as a vital document for businesses registered under the Goods and Services Tax (GST) regime. It enables taxpayers to furnish details of their outward supplies, ensuring transparency and accountability in the GST ecosystem.

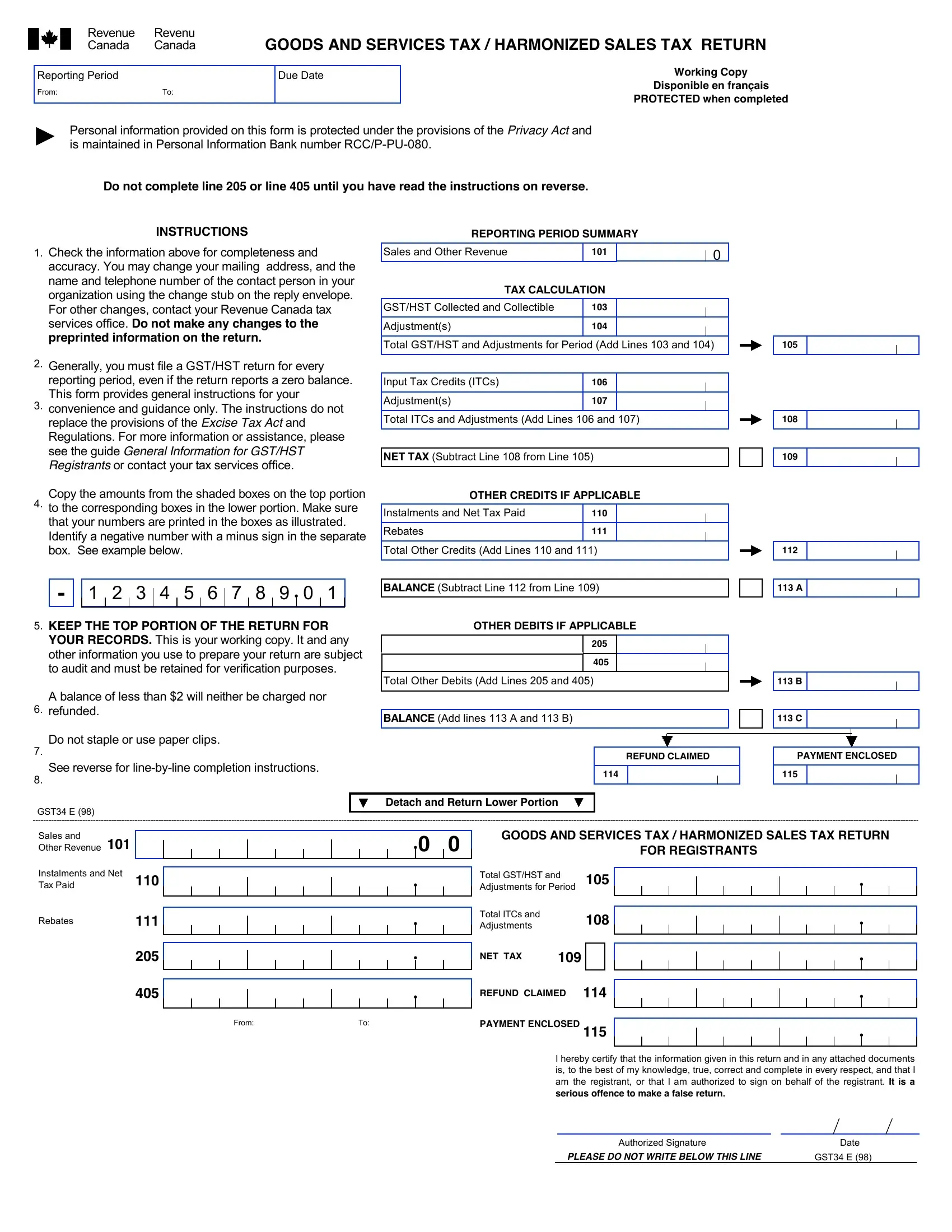

Gst34 2 Printable Form Overview

The Gst34 2 Printable Form is a crucial document for businesses registered under the Goods and Services Tax (GST) regime in India. It is a monthly return that provides a detailed summary of outward supplies made by a business during a specific tax period.

The form is designed to capture information such as the value of taxable supplies, tax liability, and input tax credit claimed. It serves as a vital tool for businesses to comply with GST regulations and avoid penalties.

Purpose and Significance

- Facilitates accurate reporting of outward supplies for GST compliance.

- Enables businesses to calculate their GST liability accurately.

- Provides a record of input tax credit claimed, ensuring proper utilization of credits.

- Helps businesses avoid penalties for non-compliance with GST regulations.

Contents and Structure

The Gst34 2 Printable Form consists of several sections, including:

- Business details

- Details of outward supplies

- Tax liability calculation

- Input tax credit claimed

Each section is further divided into sub-sections to capture specific information related to the business’s GST transactions.

Relevance to GST Compliance

Filing the Gst34 2 Printable Form is mandatory for all GST-registered businesses. It is a key requirement for GST compliance and helps businesses meet their legal obligations. By accurately reporting their outward supplies and tax liability, businesses can avoid penalties and ensure smooth functioning of their operations.

s for Completing Gst34 2 Printable Form

Completing the Gst34 2 Printable Form is a crucial step in ensuring accurate and timely filing of your Goods and Services Tax (GST) returns. Here’s a comprehensive guide to help you navigate the form seamlessly:

Step 1: Personal Details

Enter your personal information, including your name, address, and PAN (Permanent Account Number). Ensure the details match those registered with the GST portal.

Step 2: Return Period

Indicate the period for which you’re filing the return, such as monthly or quarterly. Select the appropriate month or quarter from the drop-down menu.

Step 3: Aggregate Turnover

Enter your aggregate turnover for the specified return period. This refers to the total value of all taxable supplies made during the period.

Step 4: Tax Liability

Calculate your tax liability based on the applicable GST rates. Break down the tax into Central GST (CGST), State GST (SGST), Integrated GST (IGST), and Union Territory GST (UTGST) components.

Step 5: Input Tax Credit

List the input tax credit (ITC) claimed on purchases made during the return period. Provide details such as the invoice number, date, and amount of ITC claimed.

Step 6: Output Tax

Provide details of all taxable supplies made during the return period. Include information on the invoice number, date, value of supply, and applicable GST rates.

Step 7: Net Tax Payable

Calculate the net tax payable by deducting the ITC from the total tax liability. If the ITC exceeds the tax liability, you’re entitled to a refund.

Step 8: Payment Details

Enter the details of any payments made towards the GST liability. Specify the mode of payment, transaction ID, and date of payment.

Step 9: Verification

Once all sections are complete, verify the accuracy of the information provided. Sign and date the form to submit it to the GST portal.

Common Errors and Pitfalls

Filling out the Gst34 2 Printable Form can be a breeze, but it’s crucial to steer clear of common blunders that can trip you up. These mistakes not only delay processing but can also lead to penalties and fines. So, let’s dive into the common pitfalls and how to avoid them like a pro.

Inaccurate Information

Submitting inaccurate information is a big no-no. Ensure that all details, including your personal information, business details, and transaction data, are accurate and up-to-date. Double-check everything before hitting the submit button to avoid any hassles.

Incomplete Data

Leaving out essential information is another common pitfall. Make sure you fill out all the required fields on the form. Incomplete forms will be rejected, causing unnecessary delays in processing your application or transaction.

Incorrect Calculations

Mistakes in calculations can lead to incorrect tax liabilities. Take your time to carefully calculate all amounts and cross-check your figures before submitting the form. Errors in calculations can result in penalties or overpayments.

Late Filing

Missing the filing deadline can result in penalties and interest charges. Mark your calendar and make sure you submit your Gst34 2 Printable Form on time. Procrastination is not your friend in this case!

Online Submission Process

Submitting Gst34 2 Printable Form online is a convenient and secure process that can be completed in a few simple steps.

To ensure a smooth submission, it is important to have a stable internet connection and a compatible web browser. The form is supported by most modern browsers, including Chrome, Firefox, and Safari.

Technical Requirements

- Stable internet connection

- Compatible web browser (Chrome, Firefox, Safari, etc.)

- Adobe Acrobat Reader or a similar PDF viewer

Security Measures

The online submission process employs robust security measures to protect sensitive taxpayer information. The form is encrypted using SSL technology, ensuring that data is transmitted securely over the internet.

Step-by-Step Submission Instructions

- Visit the official GST portal.

- Log in to your account using your credentials.

- Navigate to the ‘Returns’ section and select ‘GST34-2 Printable Form’.

- Click on the ‘Upload’ button and select the completed Gst34 2 Printable Form in PDF format.

- Review the uploaded form and ensure that all information is correct.

- Click on the ‘Submit’ button to complete the submission process.

Consequences of Non-Compliance

Ignoring the submission of Gst34 2 Printable Form within the specified timeframe can lead to serious consequences, both legal and financial.

Failure to file Gst34 2 Printable Form on time may result in:

Penalties and Fines

- Late filing fees and penalties

- Interest on unpaid taxes

- Penalties for incorrect or incomplete information

Legal Implications

- Legal proceedings, including prosecution

- Damage to business reputation

- Suspension or revocation of business license

Financial Losses

- Loss of input tax credit

- Increased tax liability

- Additional costs for legal and professional assistance

How to Avoid Non-Compliance

To avoid these consequences, businesses must ensure timely filing of Gst34 2 Printable Form. This can be achieved by:

- Staying updated on filing deadlines

- Maintaining accurate records

- Seeking professional assistance if needed

Answers to Common Questions

What is the purpose of the Gst34 2 Printable Form?

The Gst34 2 Printable Form is used to declare details of outward supplies made by a taxpayer registered under GST.

What are the consequences of non-compliance?

Failure to file the Gst34 2 Printable Form on time can result in penalties, interest charges, and even prosecution.

Can I submit the Gst34 2 Printable Form online?

Yes, you can submit the Gst34 2 Printable Form online through the GST portal.