Free Printable QDRO Form California: A Comprehensive Guide

Navigating the complexities of legal matters involving divorce and retirement accounts can be daunting. This guide provides a comprehensive overview of QDRO forms in California, empowering you with the knowledge to effectively manage your financial interests. Whether you’re a legal professional, a divorcing individual, or simply seeking information, this resource will guide you through the intricacies of QDROs.

In California, a Qualified Domestic Relations Order (QDRO) is a legal document that allows a portion of a retirement account to be divided between spouses during divorce. Understanding the purpose, legal requirements, and types of QDROs is essential for ensuring a fair and equitable distribution of assets.

Overview of QDRO Forms in California

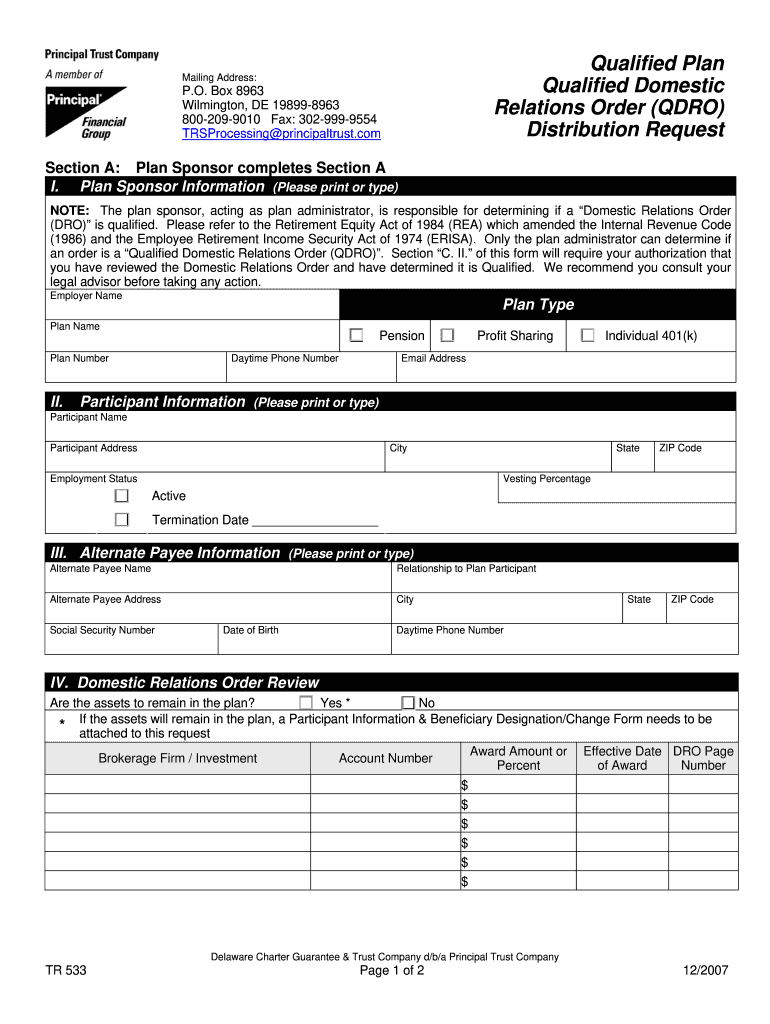

A Qualified Domestic Relations Order (QDRO) is a court order that divides a retirement plan between a plan participant and their former spouse, child, or other dependent. QDROs are governed by the Employee Retirement Income Security Act (ERISA) and must meet specific requirements to be valid.

In California, QDROs are used to divide retirement plans that are subject to ERISA. This includes plans such as 401(k) plans, 403(b) plans, and pensions. QDROs can be used to divide both vested and unvested benefits.

Legal Requirements for Obtaining a QDRO

To obtain a QDRO in California, you must file a petition with the court. The petition must include the following information:

- The name and address of the plan participant

- The name and address of the plan administrator

- The name and address of the alternate payee

- The amount of the benefits to be divided

- The form of the benefits to be divided

The court will review the petition and make a decision on whether to issue a QDRO. If the court issues a QDRO, the plan administrator must divide the retirement plan benefits according to the terms of the order.

Brief History of QDROs in California

QDROs were first created in 1984 by the Retirement Equity Act. The purpose of the act was to protect the rights of spouses and dependents who were not covered by traditional pension plans.

In California, QDROs have been used to divide retirement plans since 1986. The California Legislature has enacted several laws that have amended the QDRO process. These laws have made it easier for spouses and dependents to obtain QDROs.

Free Printable QDRO Forms

Using free printable QDRO forms can save you a significant amount of money and time. These forms are available online and can be downloaded and printed for free. They are easy to use and can be completed in minutes.

There are two main types of free printable QDRO forms: generic forms and state-specific forms. Generic forms can be used in any state, while state-specific forms are designed to meet the specific requirements of a particular state. State-specific forms are often more complex than generic forms, but they can help to ensure that your QDRO is valid.

Advantages of Using Free Printable QDRO Forms

- Save money: Free printable QDRO forms can save you a significant amount of money. Attorneys typically charge a fee to prepare a QDRO, which can range from $500 to $1,000 or more. By using a free printable QDRO form, you can avoid these fees.

- Save time: Free printable QDRO forms are easy to use and can be completed in minutes. This can save you a lot of time compared to hiring an attorney to prepare a QDRO.

- Peace of mind: Using a free printable QDRO form can give you peace of mind knowing that your QDRO is valid and will be accepted by the court.

Disadvantages of Using Free Printable QDRO Forms

- May not be valid: If you use a generic QDRO form, it may not be valid in your state. This could cause your QDRO to be rejected by the court, which could delay or even prevent you from receiving your share of the retirement benefits.

- May not be complete: Free printable QDRO forms may not be complete. They may not include all of the information that the court requires, which could also cause your QDRO to be rejected.

- May be difficult to understand: Free printable QDRO forms can be difficult to understand, especially if you are not familiar with legal terminology. This could lead to mistakes that could delay or even prevent you from receiving your share of the retirement benefits.

s for Completing QDRO Forms

Completing a QDRO form can be a daunting task, but it’s important to do it correctly to ensure that your divorce settlement is fair and equitable. Here are some tips and tricks to help you avoid common mistakes:

Before you start filling out the form, make sure you have all of the necessary information, including your spouse’s name, address, and Social Security number. You’ll also need to know the amount of money that you’re entitled to receive from your spouse’s retirement account.

Once you have all of the necessary information, you can start filling out the form. The form is divided into several sections, including a section for your personal information, a section for your spouse’s personal information, and a section for the division of assets.

It’s important to be accurate and complete when filling out the form. Any errors could delay the processing of your QDRO or even result in your request being denied.

Once you’ve completed the form, you’ll need to have it signed by both you and your spouse. You’ll also need to have the form notarized.

Once the form is signed and notarized, you’ll need to submit it to the plan administrator for your spouse’s retirement account. The plan administrator will review the form and make sure that it meets all of the requirements.

If the form is approved, the plan administrator will start paying you the money that you’re entitled to receive.

Here are some examples of completed QDRO forms for reference:

Legal Considerations for QDROs

Filing a QDRO has significant legal implications. It’s crucial to understand the potential consequences before proceeding.

A QDRO is a legal document that divides retirement benefits between spouses during a divorce. It’s essential to ensure the QDRO meets all legal requirements to avoid any issues with the distribution of assets.

Role of an Attorney

An attorney can provide invaluable guidance throughout the QDRO process. They can help you:

- Draft and review the QDRO to ensure it complies with all legal requirements.

- Represent you in court if necessary.

- Negotiate with your spouse’s attorney on your behalf.

Obtaining Legal Assistance

If you need legal assistance with a QDRO, several resources are available:

- Legal Aid Organizations: Provide free or low-cost legal services to low-income individuals.

- State Bar Associations: Offer referral services to connect you with qualified attorneys.

- Private Attorneys: You can hire a private attorney specializing in family law or QDROs.

QDRO Form Resources

There are numerous resources available to assist individuals in obtaining QDRO forms and information. These resources include official government websites, legal aid organizations, and online platforms.

Government Websites

- California Courts: https://www.courts.ca.gov/1042.htm

- U.S. Department of Labor: https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications/qdro-fact-sheet

Legal Aid Organizations

- Legal Aid Society of San Diego: https://www.lassd.org/get-legal-help/family-law/divorce-and-legal-separation/

- Bay Area Legal Aid: https://www.baylegal.org/what-we-do/family-law/divorce-and-legal-separation

Online Resources

- Nolo: https://www.nolo.com/legal-encyclopedia/qdro-qualified-domestic-relations-order.html

- Rocket Lawyer: https://www.rocketlawyer.com/family-law/divorce/qualified-domestic-relations-order-qdro

It’s important to note that QDRO forms are also available in different languages. For example, the California Courts website provides QDRO forms in Spanish, Chinese, and Vietnamese.

FAQ Summary

What are the key benefits of using free printable QDRO forms?

Free printable QDRO forms offer several advantages, including cost savings, convenience, and accessibility. They allow you to complete and file the QDRO without incurring attorney fees, saving you a substantial amount of money. Additionally, these forms are readily available online, eliminating the need for time-consuming and potentially expensive visits to legal offices.

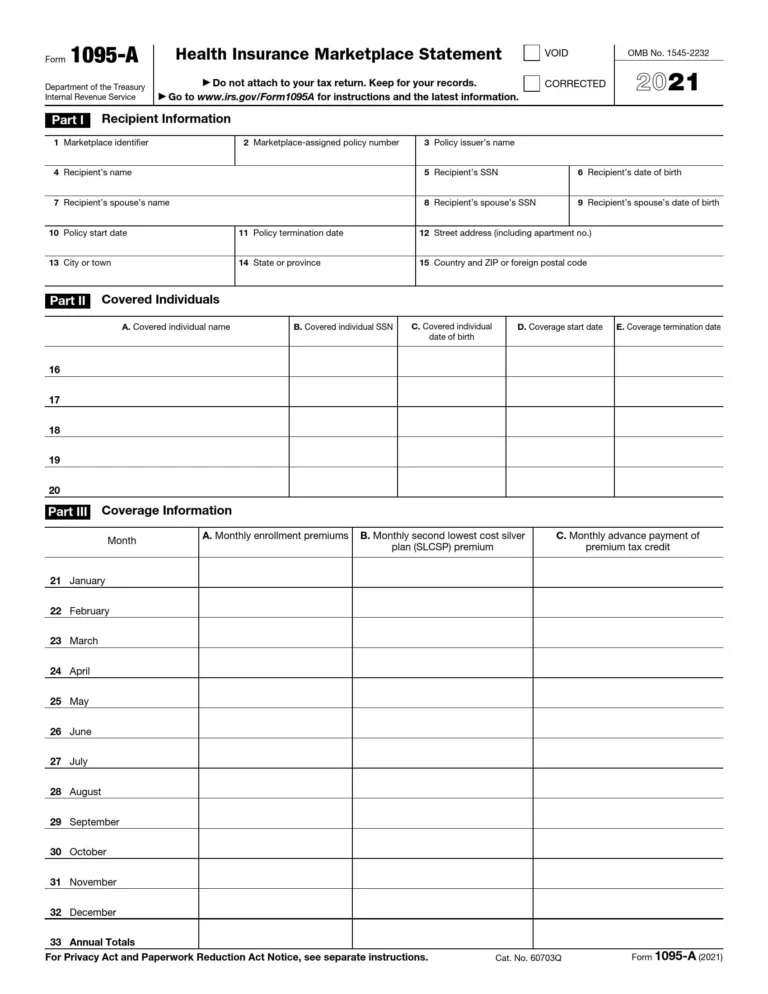

What are the different types of free printable QDRO forms available?

There are various types of free printable QDRO forms available, each designed for specific retirement account types. Some common forms include the Domestic Relations Order for Division of Retirement Benefits, the Order for Division of Retirement Benefits, and the Judgment for Division of Retirement Benefits. Selecting the appropriate form is crucial to ensure that the QDRO is legally compliant and enforceable.

What are some tips for completing QDRO forms accurately?

To ensure accuracy when completing QDRO forms, it is essential to provide precise and complete information. Carefully review the instructions provided with the form and consult with a legal professional if you have any questions or uncertainties. Additionally, double-check all entries for errors before submitting the form to the court.