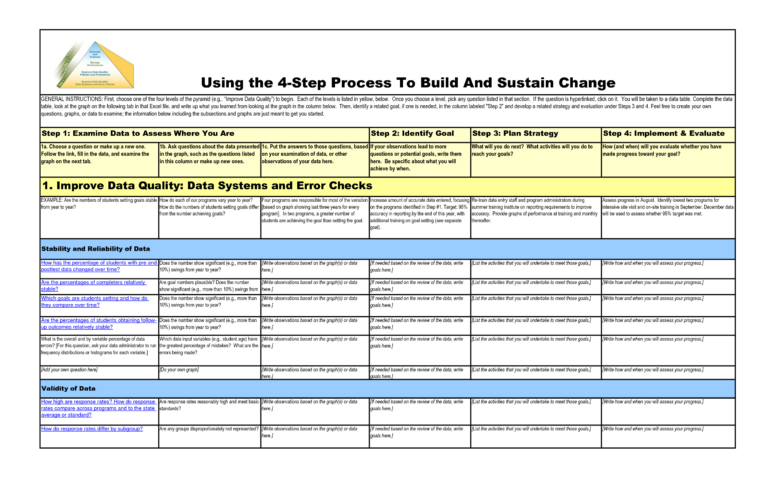

Free Printable Mileage Log For Taxes: Your Guide to Accurate Record-Keeping

Navigating the complexities of tax season can be daunting, but keeping track of your mileage doesn’t have to be. Utilizing a free printable mileage log is a smart move for individuals and businesses alike, providing a comprehensive and convenient way to document your travel expenses for tax purposes.

In this guide, we’ll delve into the importance of mileage tracking, the benefits of using a free printable mileage log, and provide step-by-step instructions on how to use one effectively. Additionally, we’ll explore advanced mileage tracking techniques and common mistakes to avoid, ensuring the accuracy and validity of your mileage claims.

Free Printable Mileage Log For Taxes

Roadmen, if you’re clocking up the miles for work, you need to keep a bangin’ mileage log. It’s the cheesiest way to track your expenses and smash the taxman when it comes to claiming back dough.

We’ve got your back with a free printable mileage log that’s as slick as a whistle. It’s a doddle to use, so you can focus on the graft, not the paperwork.

What’s Inside This Mileage Log?

- Sections for your basic deets, like name, address, and car info.

- Columns to track your journeys, including date, start and end mileage, purpose, and notes.

- Space for your signature and the date you filled it in.

It’s the perfect way to stay on top of your mileage expenses and make tax time a breeze.

How to Use This Mileage Log

- Print out the log and keep it in your car.

- Every time you make a work-related journey, jot down the details in the log.

- Keep the log up to date, so you’ve got a solid record of your mileage.

- When tax time rolls around, simply hand over the log to your accountant or use it to claim your expenses online.

Easy as pie, innit?

Why Keep a Mileage Log?

Keeping a mileage log is a no-brainer because:

- It helps you track your expenses and claim back the dough you’re owed.

- It’s a legit way to reduce your tax bill.

- It’s a simple and effective way to stay organized.

So, what are you waiting for? Grab our free printable mileage log today and start saving money on your taxes.

FAQs

What is a free printable mileage log?

A free printable mileage log is a document that allows you to record your mileage for tax purposes. It typically includes fields for the date, time, starting and ending odometer readings, purpose of the trip, and any other relevant information.

Why should I use a free printable mileage log?

Using a free printable mileage log can help you save money on taxes by providing documentation to support your mileage deductions. It also helps you keep track of your business travel expenses for reimbursement purposes.

How do I use a free printable mileage log?

To use a free printable mileage log, simply fill out the fields for each trip you take. Be sure to include the date, time, starting and ending odometer readings, purpose of the trip, and any other relevant information.

What are some common mistakes to avoid when using a mileage log?

Some common mistakes to avoid when using a mileage log include:

– Not recording your mileage regularly

– Not including all of the required information

– Making errors in your calculations

– Using a mileage log that is not accepted by the IRS