Free Printable Bill Planner: Take Control of Your Finances

Managing your finances can be a daunting task, but it doesn’t have to be. With the help of a free printable bill planner, you can simplify your financial life, stay organized, and achieve your financial goals.

In this comprehensive guide, we will delve into the world of free printable bill planners, exploring their types, benefits, and how to use them effectively. Whether you’re a seasoned budgeter or just starting out, you’ll find valuable insights and practical tips to help you get the most out of your financial planning.

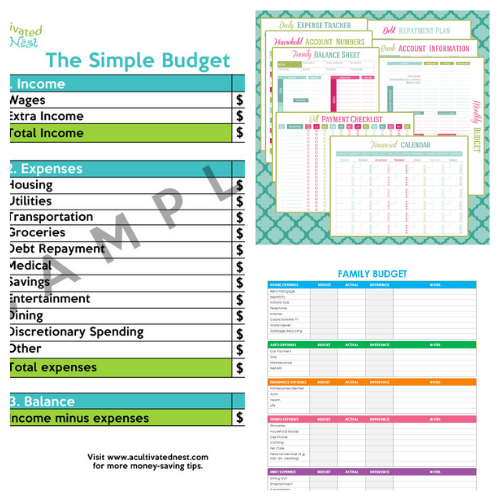

Customization of Free Printable Bill Planners

Free printable bill planners offer a flexible and adaptable solution for managing finances. They allow individuals to tailor the planner to their specific needs and preferences, ensuring a personalized budgeting experience.

There are several ways to customize a free printable bill planner:

Adding Notes

Notes provide an excellent way to capture additional information or reminders. These notes can be used to track irregular expenses, record payment due dates, or simply jot down any relevant details.

Creating Custom Categories

Pre-defined categories in bill planners may not always align with individual spending habits. Creating custom categories allows users to organize expenses in a way that makes sense to them. This ensures a more tailored and effective budgeting system.

Using Color Coding

Color coding is a visual way to differentiate between different expense categories. This technique can enhance the planner’s readability and make it easier to identify areas where spending needs to be adjusted.

Integration with Other Financial Tools

Free printable bill planners can be seamlessly integrated with other financial tools to create a comprehensive financial management system. This integration enhances your ability to track expenses, manage budgets, and plan for the future.

By combining the bill planner with budgeting apps, expense trackers, and financial software, you gain a holistic view of your financial situation. This integration streamlines your financial management process, saving you time and effort.

Integration with Budgeting Apps

Integrating the bill planner with budgeting apps allows you to automatically import your bills into the app. This eliminates the need for manual entry, reducing the risk of errors. The app can then categorize your bills, track your spending, and provide insights into your financial habits.

Integration with Expense Trackers

Expense trackers can be integrated with the bill planner to provide a detailed breakdown of your expenses. This integration helps you identify areas where you can cut back on spending and optimize your budget. The expense tracker can also generate reports and charts to visualize your spending patterns.

Integration with Financial Software

Financial software offers a wide range of features, including investment tracking, retirement planning, and tax preparation. By integrating the bill planner with financial software, you can access all your financial information in one place. This integration provides a comprehensive view of your financial situation, enabling you to make informed decisions.

Best Practices for Using a Free Printable Bill Planner

To maximize the effectiveness of your free printable bill planner, adopt these best practices for staying organized, tracking expenses meticulously, and reviewing progress consistently.

Consistency and discipline are paramount in using the bill planner. Regular use allows you to monitor your financial situation effectively and make informed decisions.

Record Expenses Diligently

Ensure that you record all expenses, regardless of how small or seemingly insignificant, to maintain an accurate picture of your financial situation.

- Note down every purchase, including regular bills, variable expenses, and unexpected costs.

- Keep receipts or take digital notes for future reference and verification.

Review Progress Regularly

Regularly review your bill planner to identify patterns, track progress towards financial goals, and make necessary adjustments.

- Compare actual expenses to budgeted amounts to identify areas of overspending.

- Adjust your budget and spending habits based on insights gained from reviewing your progress.

Seek Professional Help When Needed

If you encounter difficulties in managing your finances effectively, consider seeking professional guidance from a financial advisor or credit counselor.

- They can provide personalized advice and support to help you achieve your financial goals.

- Remember, you’re not alone, and seeking help is a sign of strength and a commitment to improving your financial well-being.

Conclusion

Innit, using a free printable bill planner is like having a money manager in your pocket, helping you stay on top of your dough and avoid nasty surprises. It’s a simple yet powerful tool that can make a massive difference to your financial well-being.

So, if you’re not already using one, grab a free printable bill planner today and start taking control of your finances. You’ll be glad you did.

Questions and Answers

What is the difference between a free printable bill planner and a digital one?

Free printable bill planners are physical planners that you can print and use offline, while digital bill planners are software or apps that you can use on your computer or mobile device. Both types have their advantages and disadvantages, but free printable bill planners offer the benefits of being tangible, customizable, and cost-free.

How do I choose the right free printable bill planner for my needs?

Consider your financial goals, budgeting style, and personal preferences when selecting a free printable bill planner. Different planners offer varying features, such as debt tracking, savings sections, and expense categorization. Choose one that aligns with your specific needs and provides the functionality you require.

Can I customize my free printable bill planner?

Yes, one of the key benefits of free printable bill planners is their customizability. You can add notes, create custom categories, and use color coding to personalize your planner and make it work for you. This flexibility allows you to tailor the planner to your unique financial situation and preferences.

How do I integrate my free printable bill planner with other financial tools?

Many free printable bill planners can be integrated with budgeting apps, expense trackers, and financial software. By connecting your planner to these tools, you can create a comprehensive financial management system that provides a holistic view of your finances. This integration streamlines your financial tracking and analysis, making it easier to stay on top of your money.

What are some best practices for using a free printable bill planner?

To get the most out of your free printable bill planner, stay organized by regularly updating it with your expenses and income. Review your progress periodically to identify areas where you can adjust your spending or increase savings. Consistency and discipline are key to making the most of your bill planner and achieving your financial goals.