Free 1099 Printable Form: A Comprehensive Guide

Navigating the complexities of 1099 forms can be daunting, but it doesn’t have to be. This comprehensive guide will provide you with all the essential information you need to understand, complete, and file 1099 forms with ease. Whether you’re a freelancer, contractor, or business owner, this guide will empower you to manage your tax obligations efficiently.

In this guide, we’ll delve into the different types of 1099 forms, their uses, and where to find free printable options. We’ll walk you through the process of completing the form step-by-step, highlighting common errors to avoid. Additionally, we’ll discuss the tax implications of receiving a 1099 form and provide guidance on how to report 1099 income on your tax returns.

Definition and Overview

Blud, a 1099 form is a way for the taxman to know how much cheddar you’ve been raking in. It’s like a secret handshake between you and the government, letting them know you’re not dodging your dues.

There’s a whole fam of 1099 forms, each one with its own special purpose. The most common ones are:

- 1099-MISC: For any old odd jobs you’ve been doing, like freelance writing or dog walking.

- 1099-NEC: For self-employed peeps who’ve been grinding in the gig economy.

- 1099-DIV: For any dividends you’ve been collecting from your investments.

- 1099-INT: For the interest you’ve been stashing away in your bank account.

Printable Form Options

Blud, need a 1099 form? We got you covered. Check out these safe sites to print one for free. You can choose from different formats like PDF, DOCX, and XLSX, so you’re sorted whatever you need it for.

Make sure you pick the right form for the type of bread you’re getting paid for. There’s different ones for self-employment, contract work, and more.

Reputable Sources

- Internal Revenue Service (IRS): https://www.irs.gov/forms-pubs/about-form-1099-misc

- Adobe Acrobat: https://www.adobe.com/acrobat/online/free-printable-1099-forms.html

- The Balance Small Business: https://www.thebalancesmb.com/free-1099-printable-forms-4058680

- LegalNature: https://www.legalnature.com/documents/1099-form

- Rocket Lawyer: https://www.rocketlawyer.com/article/what-is-a-1099-form-and-how-do-i-get-one

File Formats

- PDF: Best for printing and sharing.

- DOCX: Can be edited in Microsoft Word.

- XLSX: For use in Microsoft Excel.

Selecting the Right Form

- 1099-MISC: For self-employment income.

- 1099-NEC: For nonemployee compensation.

- 1099-K: For payments from payment card transactions.

- 1099-INT: For interest income.

- 1099-DIV: For dividend income.

Completing the Form

Filling out a 1099 form can seem like a daunting task, but it’s actually quite straightforward. Here’s a step-by-step guide to help you complete the form accurately and avoid any potential errors.

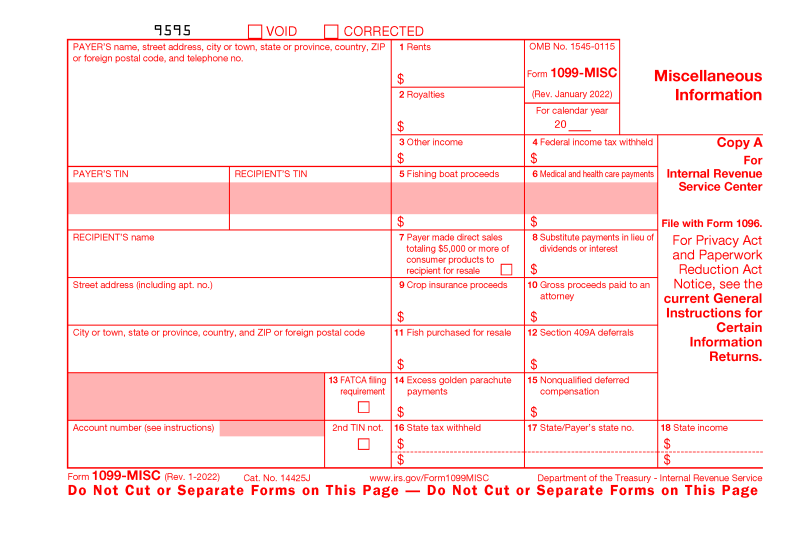

The 1099 form is divided into several sections, each of which requires specific information. Let’s go through each section and explain what information you need to provide:

Payer Information

- Payer’s name: This is the name of the person or business that paid you.

- Payer’s address: This is the address of the payer.

- Payer’s TIN: This is the payer’s Taxpayer Identification Number (TIN), which is usually their Social Security number or Employer Identification Number (EIN).

Recipient Information

- Recipient’s name: This is your name as it appears on your tax return.

- Recipient’s address: This is your address as it appears on your tax return.

- Recipient’s TIN: This is your Social Security number or EIN.

Income Information

- Box 1: Income: This is the total amount of income you received from the payer.

- Box 2: Federal income tax withheld: This is the amount of federal income tax that was withheld from your income.

- Box 3: Social Security tax withheld: This is the amount of Social Security tax that was withheld from your income.

- Box 4: Medicare tax withheld: This is the amount of Medicare tax that was withheld from your income.

- Box 5: Nonemployee compensation: This is the amount of nonemployee compensation you received from the payer.

- Box 6: State income tax: This is the amount of state income tax that was withheld from your income.

Common Errors to Avoid

Here are some common errors to avoid when filling out a 1099 form:

- Using the wrong form: There are different types of 1099 forms for different types of income. Make sure you’re using the correct form for your situation.

- Entering incorrect information: Double-check all of the information you enter on the form to make sure it’s accurate.

- Missing information: Don’t leave any fields blank. If you don’t have the information, contact the payer and request it.

- Filing late: The deadline for filing your 1099 forms is April 15th. Don’t wait until the last minute to file your forms.

Filing and Deadlines

Filing 1099 forms on time is crucial to avoid penalties and ensure timely tax refunds.

Deadlines

The filing deadlines vary depending on the type of income earned:

| Income Type | Deadline |

|---|---|

| Nonemployee compensation (Form 1099-NEC) | January 31st |

| Self-employment income (Form 1099-SE) | April 15th |

| Dividends and distributions (Form 1099-DIV) | April 15th |

| Interest income (Form 1099-INT) | April 15th |

| Proceeds from broker and barter exchange transactions (Form 1099-B) | February 28th |

Assistance

If you need assistance with filing your 1099 forms, consider the following resources:

- IRS website

- Tax professionals

- Online tax preparation software

Tax Implications

Receiving a 1099 form means you’re responsible for paying taxes on your income. It’s crucial to understand the difference between independent contractors and employees, as this affects your tax obligations.

As an independent contractor, you’re self-employed and responsible for paying self-employment taxes (Social Security and Medicare). You’ll need to file Schedule SE with your tax return to report this income.

If you’re an employee, your employer will withhold taxes from your paycheck. You’ll receive a W-2 form from your employer, which you’ll use to file your tax return.

Reporting 1099 Income

When reporting 1099 income on your tax return, you’ll need to include it on Schedule C (Form 1040). This form is used to report income from self-employment.

You’ll also need to pay estimated taxes throughout the year if you expect to owe more than $1,000 in taxes. Estimated taxes can be paid online or by mail.

Using HTML Tables

HTML tables are a powerful tool for organizing and presenting data in a clear and concise manner. They can be used to compare different types of information, display filing deadlines, and much more.

In this section, we will show you how to create two HTML tables that will help you to better understand 1099 forms.

Table 1: Types of 1099 Forms

The following table compares the different types of 1099 forms, their uses, and the income they report:

| Form | Use | Income Reported |

|---|---|---|

| 1099-NEC | Nonemployee compensation | Payments for services performed as a nonemployee |

| 1099-MISC | Miscellaneous income | Income from sources other than wages, salaries, or tips |

| 1099-K | Merchant card and third party network transactions | Payments received through credit cards and other third-party payment networks |

| 1099-S | Proceeds from real estate transactions | Proceeds from the sale or exchange of real estate |

| 1099-DIV | Dividends and distributions | Dividends and distributions from stocks and mutual funds |

| 1099-INT | Interest income | Interest earned on savings accounts, bonds, and other investments |

| 1099-B | Proceeds from broker and barter exchange transactions | Proceeds from the sale or exchange of stocks, bonds, and other securities |

| 1099-R | Distributions from pensions, annuities, retirement or profit-sharing plans, IRAs, and insurance contracts | Distributions from retirement accounts and insurance contracts |

Table 2: Filing Deadlines for 1099 Forms

The following table displays the filing deadlines for various income categories:

| Income Category | Filing Deadline |

|---|---|

| Wages, salaries, and tips | April 15 |

| Self-employment income | April 15 |

| Capital gains and losses | April 15 |

| Interest and dividends | April 15 |

| Other income | April 15 |

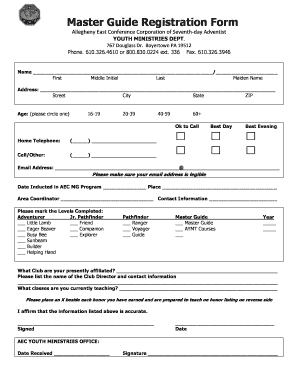

Sample Documents

Here, you’ll find examples and templates of 1099 forms for your reference.

These documents can guide you in understanding the structure and content of a 1099 form.

Sample 1099 Form

View and download a sample 1099 form to see how it’s structured and what information it contains.

Downloadable Template

Customize and use a downloadable 1099 template for your own purposes. This template can save you time and ensure accuracy when completing your 1099 forms.

FAQs

Where can I find free printable 1099 forms?

Numerous reputable websites offer free printable 1099 forms, including the IRS website, tax software providers, and online accounting platforms.

What file formats are available for printable 1099 forms?

Printable 1099 forms are typically available in PDF, DOCX, and XLSX formats, allowing you to choose the format that best suits your needs.

How do I select the appropriate 1099 form based on my income type?

There are different types of 1099 forms, each designed for specific types of income. Refer to the IRS website or consult with a tax professional to determine the correct form for your income.

What are some common errors to avoid when filling out a 1099 form?

Common errors include incorrect taxpayer information, missing or incomplete data, and mathematical errors. Double-check all information carefully before submitting the form.

What are the tax implications of receiving a 1099 form?

Receiving a 1099 form means you are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. You must report 1099 income on your tax return.