Form 3575 Printable: A Comprehensive Guide to Filing and Understanding

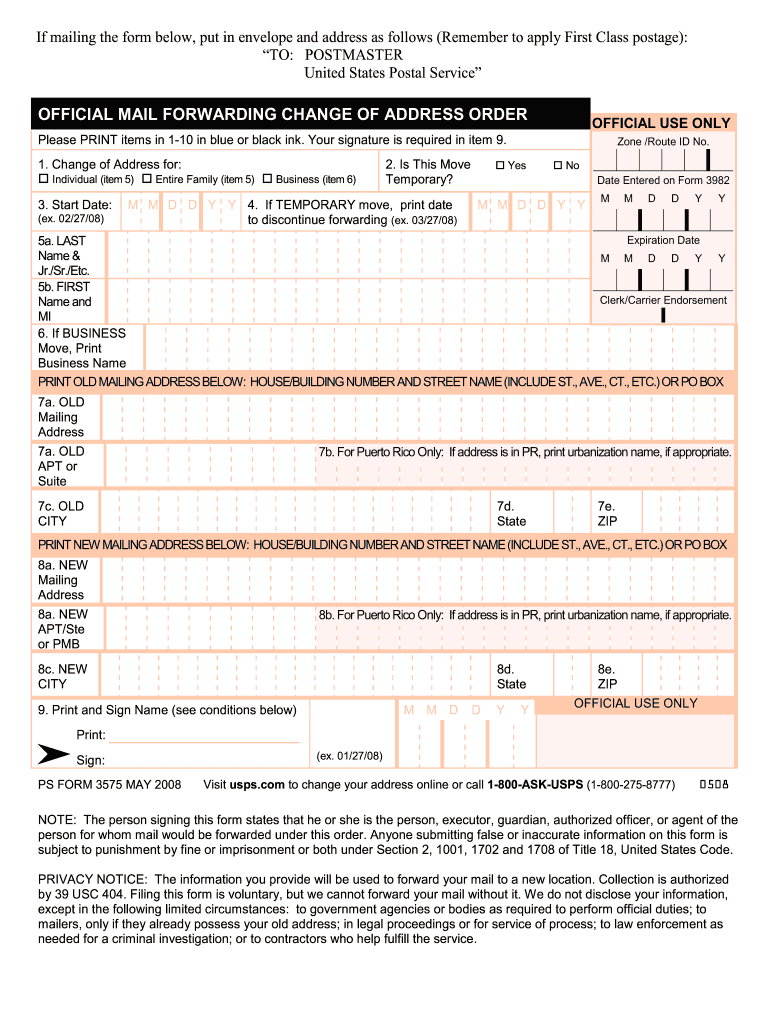

Form 3575, the Application for Change of Address, is a crucial document for individuals seeking to update their official address with the United States Postal Service (USPS). This form plays a pivotal role in ensuring the timely and accurate delivery of mail and packages, streamlining communication and safeguarding the integrity of correspondence.

Navigating the process of completing and filing Form 3575 can be daunting, but with the right guidance, it becomes a straightforward task. This comprehensive guide will provide you with a step-by-step walkthrough, highlighting common errors to avoid and troubleshooting tips to address any challenges that may arise. Additionally, we’ll explore the various filing methods and deadlines, empowering you to complete this essential task with confidence and ease.

Introduction to Form 3575

Form 3575 is a document designed by Her Majesty’s Revenue and Customs (HMRC), the UK’s tax authority, to enable individuals to register for Self Assessment. Self Assessment is a system where individuals are responsible for calculating and paying their own taxes, including Income Tax, National Insurance, and Capital Gains Tax.

Individuals who are required to complete Form 3575 include those who are self-employed, have income from property or investments, or have other sources of taxable income that are not covered by the Pay As You Earn (PAYE) system. The form can be accessed and obtained from the HMRC website or by contacting the HMRC helpline.

How to Obtain Form 3575

Individuals can obtain Form 3575 in the following ways:

- Online: Form 3575 can be downloaded from the HMRC website.

- By post: Individuals can request a copy of Form 3575 by writing to HMRC at the following address: HM Revenue and Customs, BX9 1AS, United Kingdom.

- By phone: Individuals can call the HMRC helpline at 0300 200 3310 to request a copy of Form 3575.

Completing Form 3575

Filling out Form 3575 is a breeze, mate. Just follow these steps and you’ll be done in no time.

Personal Information

Start by filling in your personal deets, like your name, addy, and contact info. Make sure it’s all up to date, yeah?

Employment Information

Now, let’s talk about your job. Give us the lowdown on your employer, your job title, and your salary. Don’t forget to include any other income you might have, like from investments or benefits.

Financial Information

Time to spill the beans on your dough. List your assets, like your savings, investments, and property. Don’t forget about your debts, too, like your mortgage, car loan, and credit card bills.

Additional Information

Any other info that might be relevant to your application, chuck it in here. This could include things like your education, work experience, or any special circumstances.

Review and Submit

Once you’re done, give it a once-over to make sure everything’s ship-shape. Then, sign and date the form and hit that submit button. Easy peasy, lemon squeezy!

Filing Form 3575

Yo, listen up, filing Form 3575 ain’t rocket science, but you gotta know your options. You can file it online, through the post, or in person. Deadlines and stuff vary, so make sure you check those out before you start.

Online

If you’re feeling tech-savvy, you can file Form 3575 online. It’s quick, easy, and you can do it from the comfort of your own gaff. Just head over to the HMRC website and follow the instructions. You’ll need to have a Government Gateway account to do this, so if you don’t have one, you’ll need to set one up first.

By Mail

If you’re not into the whole online thing, you can always file Form 3575 by post. Just download the form from the HMRC website, fill it in, and send it to the address on the form. Make sure you include all the necessary documents and evidence, and keep a copy for your records.

In Person

If you’re not sure how to fill in Form 3575 or you want some help, you can file it in person at your local HMRC office. Just make an appointment beforehand so you don’t have to wait around. You’ll need to bring all the necessary documents and evidence with you, and the HMRC staff will help you fill in the form and submit it.

Common Errors and Troubleshooting

Submitting an accurate Form 3575 is essential to avoid delays or rejections. Let’s delve into common errors and provide tips to steer clear of them.

Incorrect Personal Information

Mistakes in personal details can derail your application. Double-check your name, address, and contact information to ensure they match your official documents.

Missing or Incomplete Sections

Leaving sections blank or incomplete can raise red flags. Carefully review the form and fill in all required fields. If a section is not applicable, indicate “N/A” or “Not Applicable”.

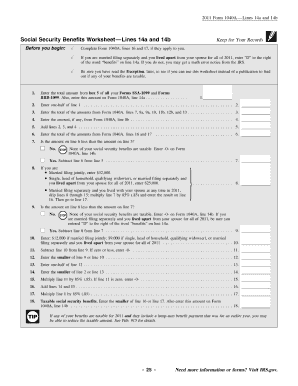

Incorrect Tax Year

Mistaking the tax year can lead to confusion and potential penalties. Ensure you’re using the correct tax year for the income you’re reporting.

Math Errors

Miscalculations can delay your refund or result in additional taxes. Use a calculator or double-check your arithmetic to avoid any math blunders.

Incorrect Filing Status

Choosing the wrong filing status can impact your tax liability. Carefully consider your marital status, dependents, and other factors to determine your correct filing status.

Troubleshooting Tips

If you encounter any issues while filing Form 3575, here are some troubleshooting tips:

- Refer to the instructions: The IRS provides detailed instructions for completing Form 3575. Utilize them to clarify any uncertainties.

- Contact the IRS: If you’re still stuck, don’t hesitate to reach out to the IRS for assistance. They can provide guidance and resolve any queries.

- Use tax software: Tax software can simplify the filing process, reduce errors, and ensure accuracy.

Additional Resources

If you need more help with Form 3575, here are some useful resources:

Online Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-3575

- Tax Foundation: https://taxfoundation.org/publications/understanding-form-3575-extension-application-individual-income-tax-return/

- Nolo: https://www.nolo.com/legal-encyclopedia/how-file-irs-form-3575-request-extension-time-file-taxes.html

Contact Information

If you have any questions or need assistance, you can contact the IRS at 1-800-829-1040.

Answers to Common Questions

What is Form 3575 used for?

Form 3575 is used to notify the USPS of a change of address for an individual or household.

Where can I obtain Form 3575?

Form 3575 can be downloaded from the USPS website, local post offices, or ordered by phone.

Is there a fee to file Form 3575?

No, there is no fee to file Form 3575.

How long does it take for my change of address to be processed?

The USPS typically processes change of address requests within 7-10 business days.

What should I do if I make a mistake on Form 3575?

If you make a mistake on Form 3575, you can cross out the error and write the correct information next to it. You can also request a new form from the USPS.