Financial Power of Attorney Ohio Printable Form: A Comprehensive Guide

Empowering someone to manage your financial affairs can provide peace of mind and ensure your wishes are respected in case of incapacity. In Ohio, a Financial Power of Attorney (FPOA) grants legal authority to a trusted agent to handle your financial matters. Understanding the legal implications, types of powers, and considerations involved in creating an FPOA is crucial for effective planning.

This guide provides a printable form for an FPOA in Ohio, along with clear instructions on completing and executing it. It also explores the importance of choosing a reliable agent, the potential risks and benefits of granting different powers, and the procedures for revoking or modifying an FPOA. By understanding these aspects, you can create a comprehensive and effective FPOA that protects your interests and ensures your financial well-being.

Understanding Financial Power of Attorney in Ohio

A Financial Power of Attorney (FPOA) in Ohio is a legal document that allows you to appoint someone you trust to manage your financial affairs if you become unable to do so yourself. This could be due to illness, injury, or other circumstances that prevent you from making sound financial decisions.

The person you appoint as your agent under a Financial Power of Attorney has the legal authority to act on your behalf in financial matters. This includes managing your bank accounts, paying your bills, investing your money, and making other financial decisions.

There are two main types of Financial Power of Attorney in Ohio:

* Durable Power of Attorney: This type of FPOA remains in effect even if you become incapacitated.

* Springing Power of Attorney: This type of FPOA only becomes effective if you become incapacitated.

It’s important to carefully consider who you appoint as your agent under a Financial Power of Attorney. This person should be someone you trust implicitly and who is capable of handling your financial affairs responsibly.

There are several situations where a Financial Power of Attorney may be necessary, such as:

* If you are going out of town for an extended period of time and need someone to manage your finances while you are away.

* If you are ill or injured and unable to make financial decisions for yourself.

* If you are elderly or have a disability that makes it difficult for you to manage your finances.

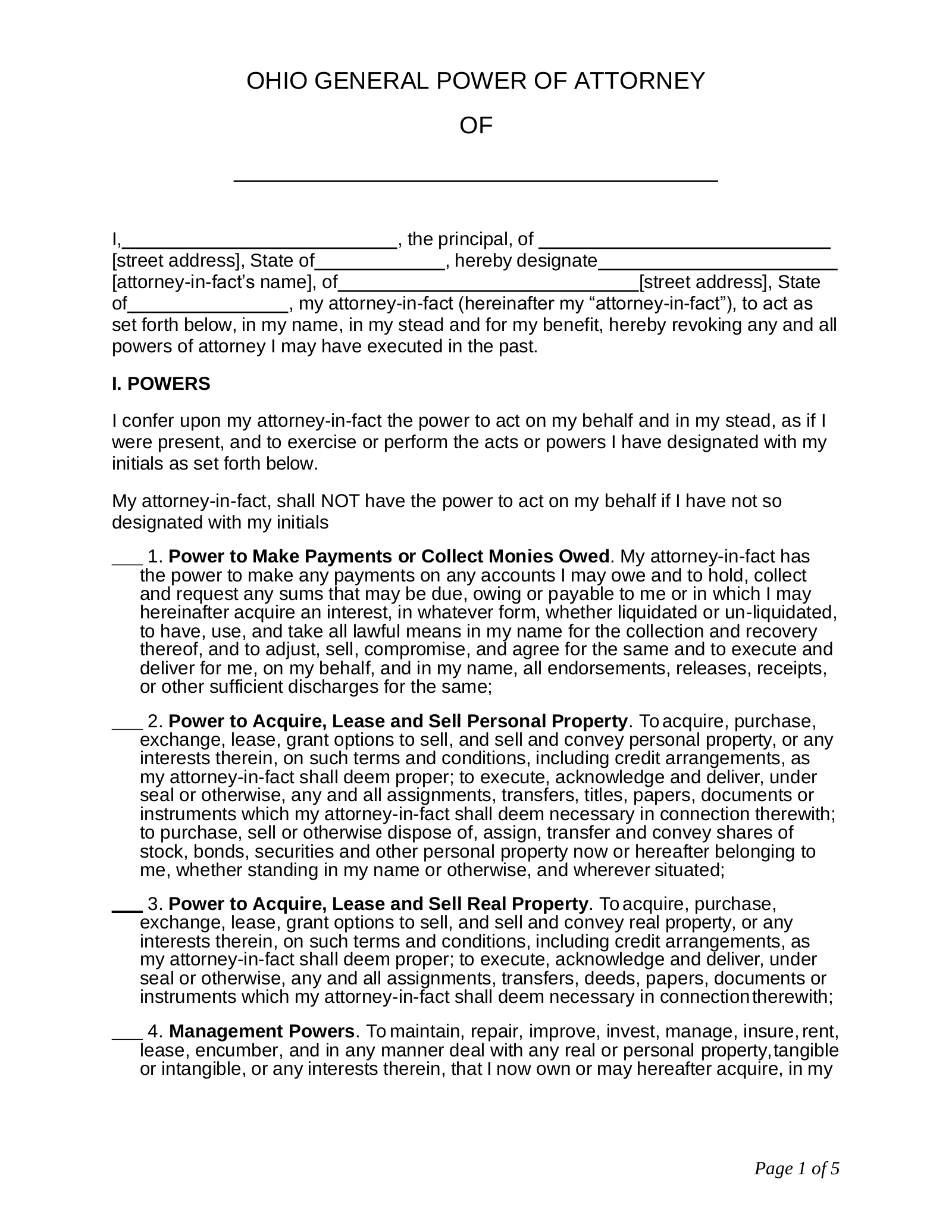

Printable Form for Financial Power of Attorney in Ohio

If you’re in Ohio and need a Financial Power of Attorney (FPOA) form, we’ve got you covered. This legal document lets you appoint someone you trust to handle your financial affairs if you become unable to do so yourself.

Our printable FPOA form includes all the necessary legal provisions and disclosures required by Ohio law. It’s easy to complete and execute, so you can have peace of mind knowing your financial affairs are taken care of.

How to Complete the Form

- Fill in the blanks with your personal information and the name of your agent (the person you’re giving power to).

- Choose the powers you want to grant your agent. These can include managing your bank accounts, paying your bills, or selling your property.

- Sign and date the form in front of a notary public.

How to Execute the Form

- Once you’ve completed and signed the form, give it to your agent.

- Your agent can start acting on your behalf immediately, or they can wait until you become unable to manage your finances yourself.

- If you ever want to revoke the FPOA, you can do so by writing a letter to your agent and signing it in front of a notary public.

Considerations When Creating a Financial Power of Attorney

When creating a Financial Power of Attorney (FPOA), it’s crucial to be mindful of the following considerations:

Choosing a Trustworthy and Capable Agent

Your agent is the person you empower to make financial decisions on your behalf. It’s paramount to choose someone you trust implicitly, who is responsible, organized, and has good judgment. Consider their financial literacy, availability, and willingness to take on this responsibility.

Broad or Limited Powers

The FPOA can grant your agent either broad or limited powers. Broad powers allow them to make a wide range of decisions, while limited powers restrict their authority to specific tasks or accounts. Weigh the pros and cons carefully. Broad powers offer flexibility, but they also increase the risk of misuse. Limited powers provide more control, but they may limit your agent’s ability to respond effectively to unforeseen circumstances.

Creating a Comprehensive and Effective FPOA

To ensure your FPOA is effective, make sure it is:

- Clear and unambiguous: The document should clearly Artikel the agent’s powers, duties, and limitations.

- Durable: The FPOA should remain valid even if you become incapacitated.

- Revocable: You should have the ability to revoke the FPOA at any time, unless you are legally incapacitated.

- Witnessed and notarized: In most states, the FPOA must be signed in the presence of two witnesses and notarized to be legally valid.

Revoking or Modifying a Financial Power of Attorney

Innit, revoking or changing a Financial Power of Attorney (FPOA) in Ohio is peng, but you gotta know the drill.

To revoke an FPOA, you need to write a notice of revocation and sign it in front of a notary public. You can also destroy the original FPOA document, which is a sick way to say “peace out” to your old agent.

Modifying an FPOA is a bit trickier. You can’t just scribble out the bits you don’t like; you need to create a new FPOA document with the changes you want. Make sure you sign the new FPOA in front of a notary public, too.

Legal Consequences of Revoking or Modifying an FPOA

Revoking or modifying an FPOA has some serious legal consequences, so don’t be a mug about it.

- Revoking an FPOA: If you revoke an FPOA, your agent’s authority to act on your behalf ends immediately. Any actions they take after the revocation are invalid.

- Modifying an FPOA: If you modify an FPOA, your agent’s authority to act on your behalf changes according to the changes you make. Any actions they take after the modification that are consistent with the new FPOA are valid.

Protecting Against Unauthorized Revocation or Modification

Don’t let some geezer revoke or modify your FPOA without your say-so. Here’s how to protect yourself:

- Keep your FPOA safe: Store your FPOA in a secure place where no one else can get their mitts on it.

- Tell your agent you’re revoking or modifying your FPOA: If you’re revoking or modifying your FPOA, let your agent know right away. This will help prevent them from acting on your behalf without your permission.

- Get a new FPOA: If you’re worried about someone revoking or modifying your FPOA without your consent, you can get a new FPOA. This will cancel out the old FPOA and give you peace of mind.

Answers to Common Questions

What is the purpose of a Financial Power of Attorney?

An FPOA allows you to designate a trusted individual to manage your financial affairs if you become unable to do so yourself due to incapacity or absence.

What types of financial powers can be granted through an FPOA?

FPOAs can grant broad powers, such as managing bank accounts, investing assets, and paying bills, or limited powers for specific tasks.

How do I choose a trustworthy and capable agent?

Consider their trustworthiness, financial literacy, availability, and willingness to fulfill the responsibilities of an agent.

What are the risks of granting broad powers in an FPOA?

While broad powers provide flexibility, they also increase the risk of potential misuse or abuse by the agent.

How can I protect against unauthorized revocation or modification of an FPOA?

Keep the original FPOA in a secure location and consider registering it with the county recorder’s office.