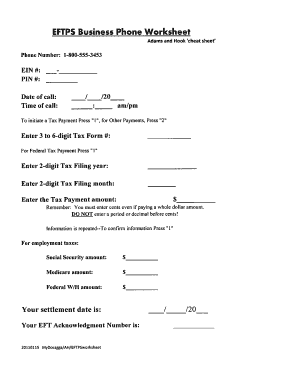

Master EFTPS with Our Comprehensive Printable Worksheet Guide

In the realm of electronic funds transfer, EFTPS (Electronic Federal Tax Payment System) reigns supreme. Navigating the intricacies of EFTPS can be daunting, but with our EFTPS Printable Worksheet, you’ll transform tax payments into a breeze. Dive into this comprehensive guide to unlock the power of printable worksheets and streamline your EFTPS experience.

Our meticulously crafted EFTPS Printable Worksheet serves as your indispensable companion, providing a clear roadmap through the EFTPS landscape. Whether you’re a seasoned tax professional or a novice just starting out, this guide empowers you with the knowledge and tools to conquer EFTPS with confidence.

Overview of EFTPS Printable Worksheet

An EFTPS Printable Worksheet is a valuable tool that allows individuals to record and track their EFTPS payments easily. It provides a convenient way to keep a physical record of transactions, making it easier to manage and reconcile payments.

The worksheet is designed to be printed and filled out manually, offering a simple and accessible method for individuals to maintain accurate payment records. It is commonly used by businesses, organizations, and individuals who make regular EFTPS payments and want to keep track of their transactions.

Benefits of using an EFTPS Printable Worksheet include:

- Simplified record-keeping: The worksheet provides a structured format for recording payment details, making it easier to track and manage payments.

- Improved accuracy: By manually filling out the worksheet, individuals can reduce the risk of errors and ensure the accuracy of their payment records.

- Convenient reconciliation: The worksheet allows for easy reconciliation of EFTPS payments with bank statements or other financial records.

- Physical documentation: The printed worksheet serves as a physical record of payments, providing a tangible backup in case of electronic records being lost or compromised.

Types of EFTPS Printable Worksheets

Bruv, let’s get this bread with EFTPS printable worksheets. They come in all shapes and sizes, innit? From tax forms to payment vouchers, there’s a worksheet for every skint. Check out the table below for the lowdown on each type.

Types of Worksheets

Here’s the tea on the different types of EFTPS printable worksheets:

| Worksheet Type | What It’s For | Features |

|---|---|---|

| Form 941 | Quarterly Federal Tax Return |

|

| Form 940 | Annual Federal Unemployment Tax Return |

|

| Form 944 | Employer’s Annual Federal Tax Return |

|

| Payment Voucher | Electronic Funds Transfer Request |

|

So there you have it, the lowdown on EFTPS printable worksheets. Use ’em wisely, and you’ll be a tax wizard in no time.

How to Use an EFTPS Printable Worksheet

The EFTPS Printable Worksheet is a convenient tool for tracking your tax payments. Using it is straightforward and efficient, allowing you to manage your tax obligations smoothly.

Steps Involved

- Download the Worksheet: Head over to the EFTPS website and download the printable worksheet in the format that suits you best (PDF or Excel).

- Fill in Your Information: Start by entering your personal details, including your name, address, and taxpayer identification number (TIN).

- Enter Payment Details: Specify the amount you’re paying, the payment date, and the tax type (e.g., income tax, estimated tax).

- Choose Your Payment Method: Indicate how you plan to make the payment, whether it’s through your bank account or a debit card.

- Submit the Worksheet: Once you’ve filled out the worksheet, submit it securely through the EFTPS website.

Tips and Best Practices

- Keep a Copy: Make sure to retain a copy of the completed worksheet for your records.

- File Early: Submit your worksheet well before the payment deadline to avoid any late fees or penalties.

- Verify Details: Double-check all the information you enter to ensure accuracy.

- Use Online Tools: The EFTPS website provides helpful tools and resources to guide you through the process.

- Contact Support: If you encounter any difficulties, don’t hesitate to reach out to the EFTPS support team for assistance.

Design Elements of an EFTPS Printable Worksheet

An effective EFTPS Printable Worksheet should be well-designed to make it easy to understand and use. Key design elements include layout, typography, and visual cues.

Layout

The layout of the worksheet should be clear and concise, with ample white space and logical organization. The most important information should be placed prominently, and the worksheet should be easy to navigate.

Typography

The typography of the worksheet should be legible and easy to read. The font should be large enough to be easily readable, and the text should be well-spaced.

Visual Cues

Visual cues can be used to make the worksheet more visually appealing and easier to understand. These cues can include color, icons, and charts.

Examples of Well-Designed Worksheets

Some examples of well-designed EFTPS Printable Worksheets include:

- The IRS Form 941 Worksheet

- The EFTPS Business Tax Deposit Worksheet

- The State of California EFTPS Worksheet

These worksheets are all well-organized and easy to use, and they provide clear instructions on how to complete the form.

Customization and Automation

EFTPS Printable Worksheets offer various customization options to suit individual needs. Users can modify the layout, fields, and calculations to align with specific requirements. Additionally, automation tools can streamline the generation and distribution of worksheets, saving time and effort.

Customizable Features

- Layout: Adjust the worksheet’s overall structure, including margins, font sizes, and column widths.

- Fields: Add, remove, or modify data fields to capture specific information.

- Calculations: Automate calculations based on user-defined formulas, reducing manual errors.

- Branding: Incorporate company logos, colors, and branding elements for a professional touch.

Automation Methods

Automate EFTPS Printable Worksheet generation and distribution using various methods:

- Data Integration: Link worksheets to data sources, such as spreadsheets or databases, for automatic population.

- Workflow Tools: Utilize workflow automation tools to trigger worksheet generation and distribution based on predefined rules.

- API Integration: Integrate with EFTPS APIs to automate the transfer of data from worksheets to the EFTPS system.

Case Studies

Example 1: A financial institution customized EFTPS Printable Worksheets to include specific fields for tax-related information, streamlining tax filing for clients.

Example 2: A payroll company automated the generation and distribution of EFTPS Printable Worksheets for multiple clients, saving hours of manual effort.

Questions and Answers

What is the purpose of an EFTPS Printable Worksheet?

An EFTPS Printable Worksheet is a customizable document that provides a structured and organized approach to preparing and submitting electronic tax payments through the EFTPS system.

How can I use an EFTPS Printable Worksheet?

Simply download the worksheet, fill in the required information, and print it out. You can then use the printed worksheet to manually enter your payment details into the EFTPS system.

What are the benefits of using an EFTPS Printable Worksheet?

Using an EFTPS Printable Worksheet offers several benefits, including improved accuracy, reduced errors, simplified record-keeping, and enhanced efficiency in the EFTPS payment process.