Durable Power of Attorney Printable Form: Protect Your Interests and Empower Your Trusted Agent

In the tapestry of life, unexpected events can arise, challenging our ability to make decisions that impact our well-being. A Durable Power of Attorney (POA) serves as a crucial tool, empowering a trusted individual to act on our behalf when we are unable to do so, ensuring our wishes are respected and our interests are protected.

This comprehensive guide will delve into the world of Durable POAs, exploring their types, benefits, and the essential steps involved in creating a printable form. We will also address common considerations and provide a sample form for your reference, empowering you to safeguard your future and ensure peace of mind.

Definition of Durable Power of Attorney (POA)

Imagine you’re in a sticky situation, mate, where you can’t make decisions for yourself, like if you’re ill or away. That’s where a Durable Power of Attorney (POA) comes in handy. It’s like having a trusty sidekick who can step in and make choices on your behalf, ensuring your wishes are respected.

A POA is a legal document where you give someone you trust (called an “agent” or “attorney-in-fact”) the authority to act on your behalf in various matters, such as managing your finances, making medical decisions, or handling legal affairs.

When a POA Comes in Clutch

POA can be a lifesaver in many scenarios, such as:

- When you’re away: If you’re travelling or on a business trip, a POA can give your agent the power to handle your bills, collect your mail, or make decisions about your property.

- During an illness or injury: If you’re unable to make decisions for yourself due to illness or injury, your agent can step in to ensure your wishes are carried out regarding medical treatment, finances, or other matters.

- For long-term care: If you need long-term care in a nursing home or assisted living facility, a POA can give your agent the authority to make decisions about your care, including medical treatment and financial arrangements.

Types of Durable POA

Innit bruv, let’s get into the nitty-gritty of durable POAs. There are three main types that you need to know about, each with its own bits and bobs.

Picture this, fam. Your POA is like a superpower that you give to someone to handle your affairs when you can’t. But not all POAs are created equal. Let’s break it down:

Financial POA

This one’s all about the dosh, mate. It gives your agent the power to manage your money, pay your bills, and make investments. They can even buy or sell property on your behalf.

Just remember, this type of POA only covers financial matters. If you want someone to make medical decisions for you, you’ll need a different type of POA.

Medical POA

This one’s a bit more serious, innit? It gives your agent the power to make medical decisions for you if you’re unable to do so yourself. This includes everything from consenting to treatments to choosing a care home.

Medical POAs are crucial if you want to make sure your wishes are respected when you’re not able to speak for yourself. Just be careful who you choose as your agent – you want someone you trust implicitly.

General POA

This one’s the broadest type of POA. It gives your agent the power to do pretty much anything you could do yourself, including managing your finances, making medical decisions, and even signing legal documents.

General POAs are useful if you want to give someone complete control over your affairs. However, they’re also the riskiest type of POA, so it’s important to choose your agent very carefully.

Benefits of Using a Durable POA

Having a durable power of attorney (POA) offers numerous advantages that can provide peace of mind and ensure your wishes are respected, even if you become incapacitated.

A durable POA allows you to appoint someone you trust to make decisions on your behalf, ensuring that your financial and healthcare needs are met according to your wishes.

Peace of Mind

Knowing that your affairs are in order and that someone you trust has the authority to make decisions on your behalf can provide immense peace of mind, especially during times of illness or incapacity.

Ensuring Your Wishes Are Respected

A durable POA ensures that your wishes are respected, even if you are unable to communicate them yourself. Your agent will have the legal authority to make decisions that align with your values and preferences.

Avoiding Conservatorship or Guardianship

A durable POA can help you avoid the need for conservatorship or guardianship proceedings, which can be costly and time-consuming. By appointing an agent through a POA, you retain control over your affairs and prevent the need for court intervention.

Continuity of Care

In the event of your incapacity, a durable POA ensures continuity of care for your financial and healthcare needs. Your agent can access your accounts, pay bills, and make medical decisions, ensuring that your affairs are managed smoothly.

How to Create a Durable POA Printable Form

Creating a durable power of attorney (POA) printable form is crucial for ensuring your wishes are respected in case you become incapacitated. Follow these steps to create a valid and effective durable POA:

Gather Necessary Information

Before you begin, gather the following information:

– Your full name, address, and contact information

– The name and contact information of your chosen agent

– The specific powers you want to grant your agent

– The effective date and duration of the POA

Choose an Agent

Your agent should be someone you trust implicitly and who is capable of making decisions on your behalf. Consider their:

– Trustworthiness and reliability

– Financial literacy and experience

– Ability to communicate effectively

– Availability and willingness to act

Complete the Form

Once you have gathered the necessary information and chosen an agent, you can complete the durable POA printable form.

– Fill in the blanks with the information you gathered.

– Be clear and specific about the powers you are granting your agent.

– Sign and date the form in front of two witnesses.

– Have the witnesses sign and date the form as well.

Notarization

In most cases, it is recommended to have your durable POA notarized. This adds an extra layer of authenticity and can help prevent disputes.

Considerations When Creating a Durable POA

Creating a durable power of attorney (POA) is a serious decision that requires careful consideration. Several important factors must be taken into account to ensure the POA is valid, effective, and meets your needs.

Here are some key considerations to keep in mind when creating a durable POA:

Choosing a Trustworthy Agent

The agent you choose to act on your behalf under the POA is crucial. This person should be someone you trust implicitly, who understands your wishes and values, and who is capable of making sound decisions on your behalf. Consider their:

- Character and trustworthiness

- Financial literacy and experience

- Understanding of your wishes and goals

- Availability and willingness to serve

Understanding the Legal Implications

It’s essential to fully understand the legal implications of creating a durable POA. This includes:

- The scope of the agent’s authority

- The agent’s duties and responsibilities

- Your rights and protections under the POA

- The potential consequences of misusing the POA

Reviewing the Document Carefully

Once you have drafted a durable POA, it’s crucial to review the document carefully to ensure that it accurately reflects your wishes and intentions. Pay particular attention to:

- The agent’s powers and limitations

- The effective date and duration of the POA

- Any specific instructions or conditions

- The signatures and notarization requirements

By considering these factors carefully, you can create a durable POA that is valid, effective, and tailored to your specific needs.

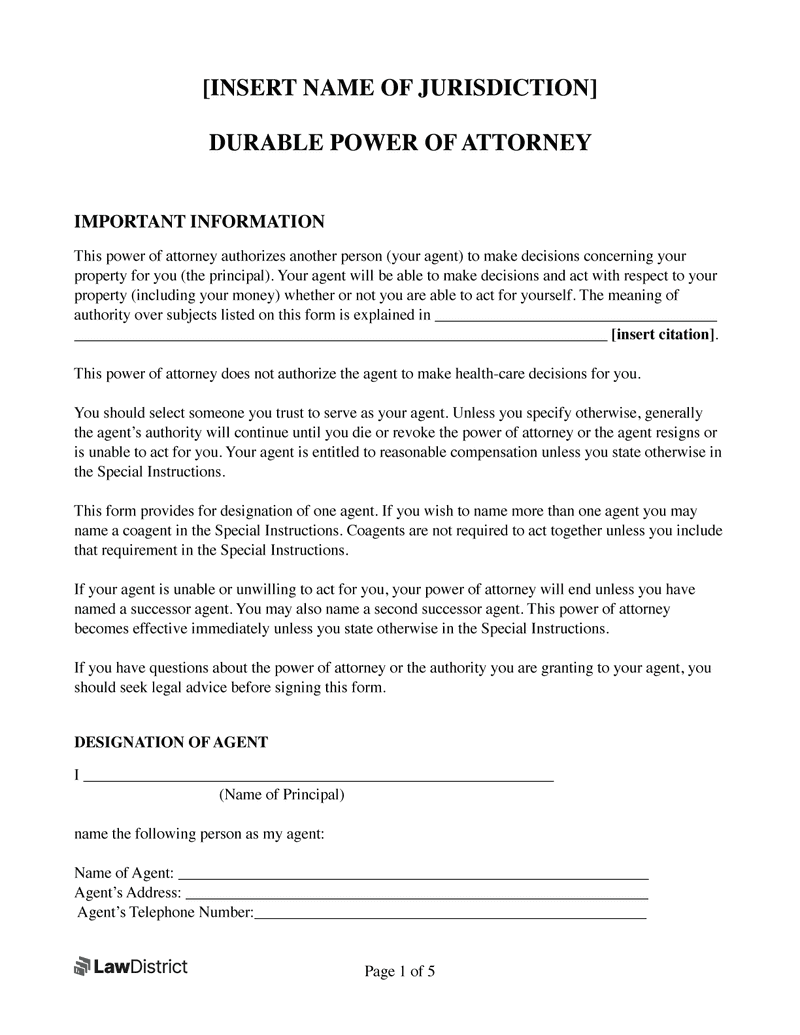

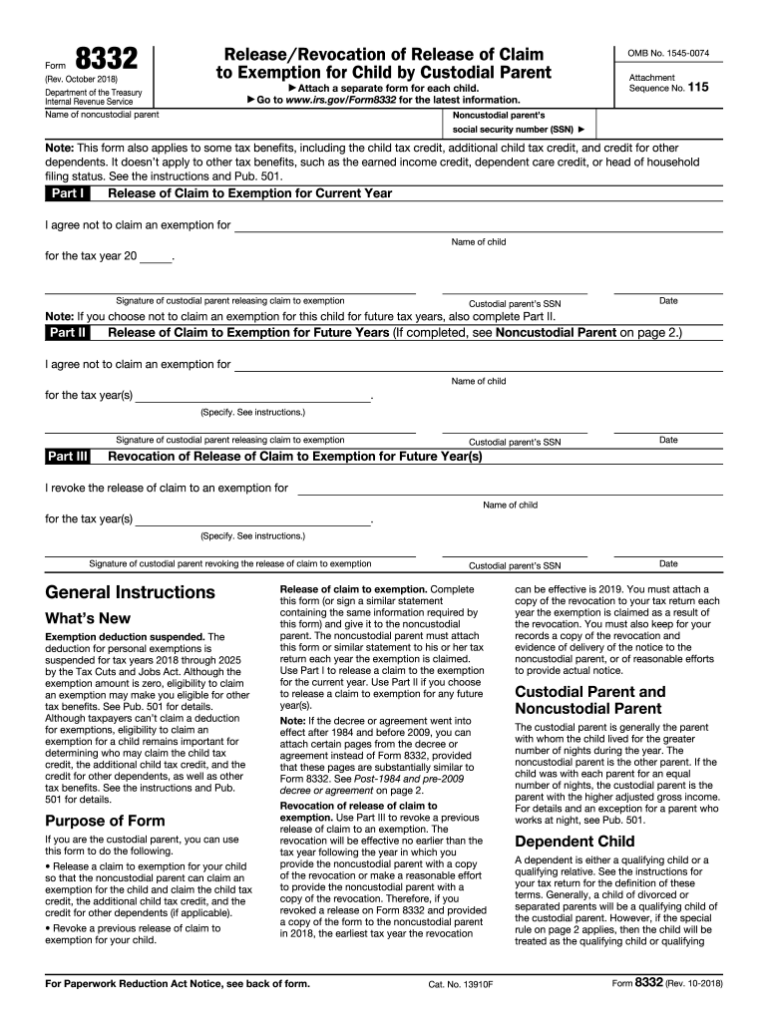

Sample Durable POA Printable Form

Here’s a sample durable power of attorney printable form for your reference:

Key Sections and Clauses of the Form

Parties Involved

- Principal: The person granting the power of attorney.

- Agent: The person receiving the power of attorney.

Powers Granted

- Specific powers: List the specific tasks or decisions that the agent is authorized to make on behalf of the principal.

- General powers: Grant the agent broad powers to make decisions on behalf of the principal, such as managing finances, healthcare, and property.

Duration and Termination

- Effective date: The date when the power of attorney becomes effective.

- Expiration date: The date when the power of attorney expires.

- Revocation: The conditions under which the principal can revoke the power of attorney.

Signatures and Notarization

- Principal’s signature: The principal must sign the form in the presence of a notary public.

- Notary’s signature: The notary public must witness the principal’s signature and verify their identity.

Additional Provisions

- Durable clause: This clause ensures that the power of attorney remains valid even if the principal becomes incapacitated.

- Bonding requirement: The form may include a requirement for the agent to obtain a bond to protect the principal’s assets.

Additional Resources

Individuals seeking further information about durable powers of attorney can access various resources for guidance and support.

These resources include websites, articles, and organizations that provide comprehensive information on durable POAs, their types, benefits, and the process of creating one.

Websites

- Citizens Advice: Provides clear and concise information on durable POAs, including their types and how to create one.

- Age UK: Offers guidance on durable POAs specifically tailored for seniors, addressing their unique needs and concerns.

- GOV.UK: The official government website provides detailed information on durable POAs, including legal requirements and how to register them.

Articles

- Which?: Provides an in-depth guide to durable POAs, covering their benefits, limitations, and how to choose the right type.

- Money Advice Service: Offers practical advice on creating and using durable POAs, including tips on choosing an attorney and dealing with potential conflicts.

Organizations

- Alzheimer’s Society: Provides support and guidance to individuals with dementia and their families on creating and using durable POAs.

- Headway: Offers legal advice and support to individuals with brain injuries and their families on durable POAs, including how to create and use them.

FAQs

What is the difference between a general and a limited POA?

A general POA grants broad authority to the agent to act on your behalf in all matters, while a limited POA restricts the agent’s authority to specific tasks or areas, such as managing finances or making healthcare decisions.

Can I revoke a Durable POA once it is created?

Yes, you can revoke a Durable POA at any time as long as you have the capacity to do so. You can do this by destroying the original document, creating a new POA that revokes the previous one, or informing your agent and witnesses of your decision.

What happens if my agent becomes incapacitated or unwilling to act?

If your agent becomes incapacitated or unwilling to act, you can appoint a successor agent in the Durable POA document. This ensures that your wishes will continue to be carried out even if your primary agent is unable to do so.