Disability Tax Credit Printable Form: A Guide to Accessibility and Convenience

Navigating the complexities of tax forms can be daunting, especially when dealing with matters of disability. The Disability Tax Credit (DTC) printable form offers a simplified and accessible solution, empowering individuals to claim their rightful tax benefits. In this comprehensive guide, we will delve into the intricacies of the DTC printable form, providing a step-by-step roadmap to its completion and submission.

The DTC program has a rich history of providing financial relief to individuals with disabilities. Understanding its eligibility criteria and requirements is crucial for successful claims. This guide will provide clear and concise explanations, ensuring that you meet all the necessary conditions.

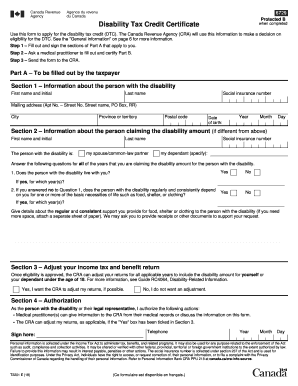

Disability Tax Credit Printable Form Overview

The Disability Tax Credit (DTC) is a tax credit that helps people with disabilities offset the extra costs they may incur as a result of their impairment. The DTC is a non-refundable tax credit that can be claimed on your personal income tax return.

The DTC was introduced in 1998 and has been expanded over the years to include more people with disabilities. The DTC is available to people of all ages who have a severe and prolonged impairment that limits their ability to perform daily activities.

Eligibility Criteria

To be eligible for the DTC, you must meet the following criteria:

- You must have a severe and prolonged impairment that limits your ability to perform daily activities.

- Your impairment must have lasted, or is expected to last, for a continuous period of at least 12 months.

- You must be able to certify that your impairment meets the criteria set out in the Income Tax Act.

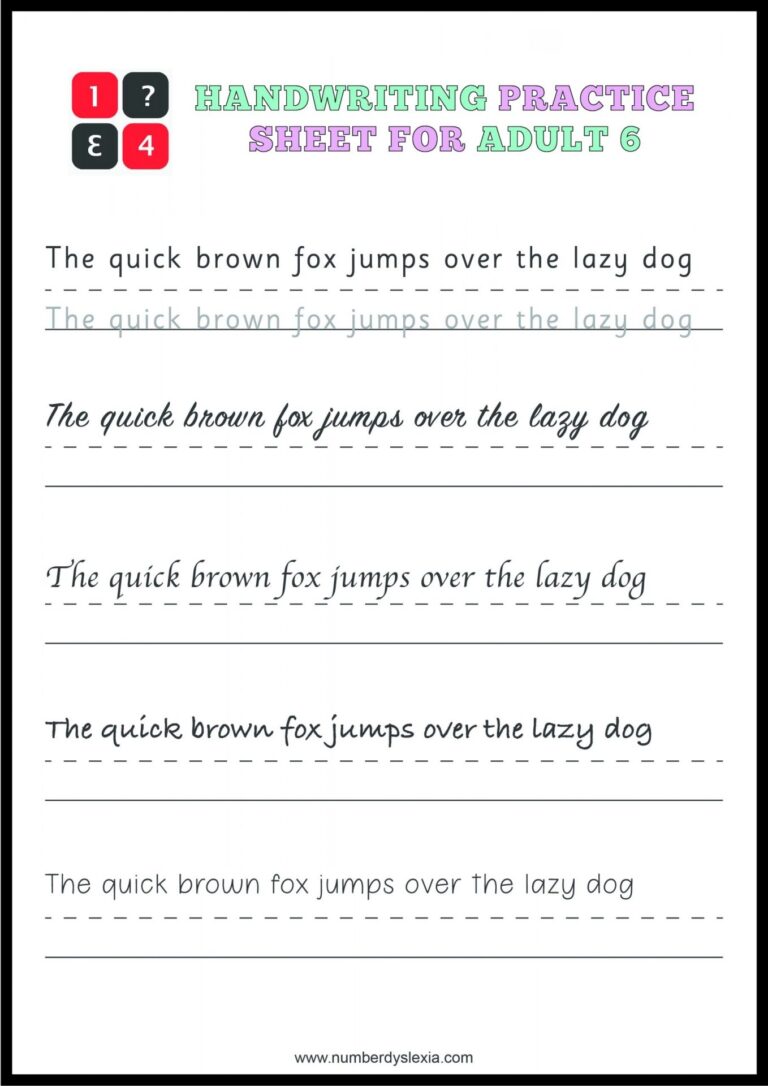

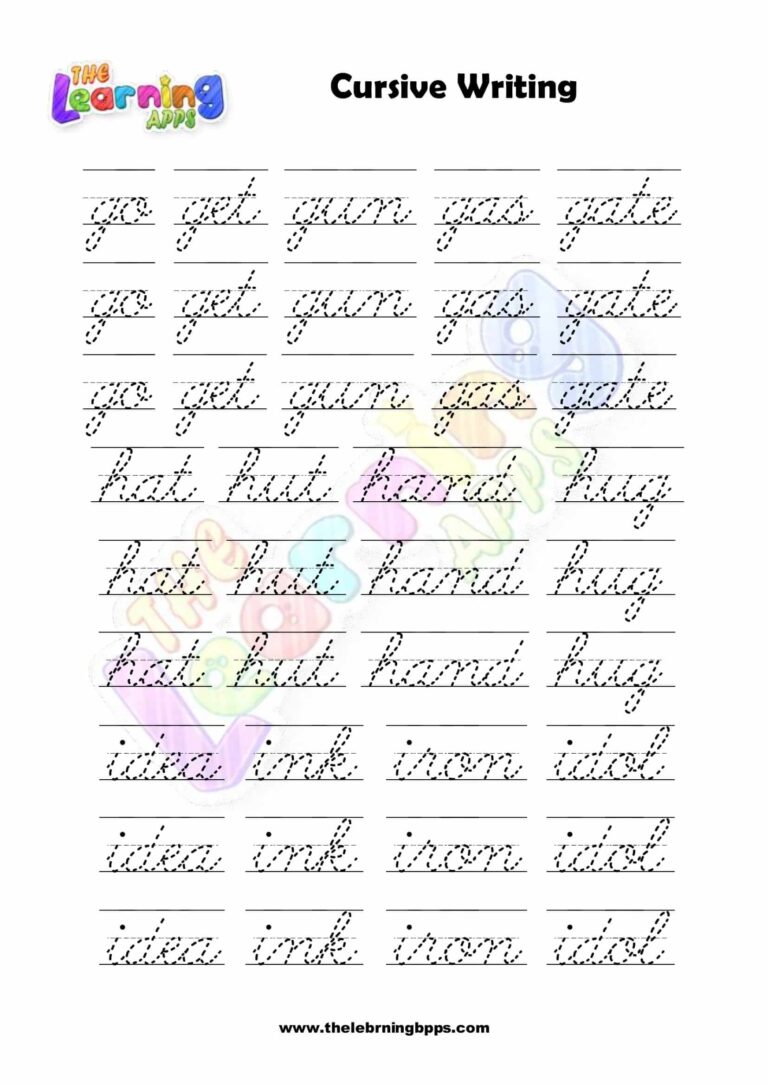

Completing the DTC Printable Form

Completing the Disability Tax Credit (DTC) Printable Form can seem daunting, but with a little guidance, you can do it. Here’s a step-by-step guide to help you fill out the form accurately and efficiently.

Section A: Personal Information

This section asks for basic personal information, including your name, address, and Social Insurance Number (SIN). Make sure to fill out this section completely and accurately.

Section B: Eligibility

In this section, you’ll need to provide information about your disability. You’ll need to describe your impairment and how it affects your ability to work. You’ll also need to provide medical documentation from a qualified healthcare professional to support your claim.

Section C: Income

This section asks for information about your income. You’ll need to provide your income from all sources, including employment, self-employment, and investments.

Section D: Expenses

In this section, you’ll need to list any expenses you’ve incurred as a result of your disability. This could include expenses for medical treatments, assistive devices, or transportation.

Section E: Declaration

This section is where you’ll sign and date the form. You’ll also need to provide the name and contact information of a witness.

Submitting the DTC Printable Form

Submitting your completed DTC printable form is crucial to claim your disability tax credit. There are several ways to submit the form, and each method has its own deadlines and requirements.

Online Submission

- You can submit your DTC printable form online through the Canada Revenue Agency (CRA) My Account portal.

- You’ll need to create a CRA My Account if you don’t have one.

- Once you’re logged in, you can upload your completed form and supporting documents.

- The deadline for online submission is the same as for mail-in submission.

Mail-in Submission

- You can mail your completed DTC printable form to the CRA’s Disability Tax Credit Unit.

- The address is: Disability Tax Credit Unit, Canada Revenue Agency, Ottawa, ON K1A 0L5.

- Make sure to include all required supporting documentation with your form.

- The deadline for mail-in submission is April 30 of the year following the year in which you became eligible for the DTC.

Importance of Deadlines and Supporting Documentation

It’s essential to meet the submission deadlines for your DTC printable form. If you miss the deadline, your application may be delayed or rejected.

Providing supporting documentation is also crucial. This documentation helps the CRA verify your eligibility for the DTC. Some common types of supporting documentation include:

- Medical records

- Prescriptions

- Letters from healthcare professionals

Potential Delays or Issues

There may be some delays or issues during the submission process. These could include:

- Technical problems with the online submission portal

- Mail delays

- Incomplete or missing supporting documentation

If you experience any delays or issues, contact the CRA for assistance.

Benefits of Using the DTC Printable Form

The DTC printable form offers numerous advantages compared to other methods. It’s a user-friendly and efficient way to claim your tax credit.

The printable form is convenient and accessible. You can fill it out at your own pace and submit it whenever you’re ready. This saves you time and effort, as you don’t have to wait for an appointment or deal with long phone queues.

Time-Saving

Filling out the printable form online or downloading and printing it to complete offline can save you significant time. You can work on it whenever it’s convenient for you, without having to schedule an appointment or wait for a response.

Effortless Completion

The printable form is designed to be straightforward and easy to understand. It provides clear instructions and examples, making it simple to complete even for those who are not familiar with tax forms.

Accessibility and Convenience

The DTC printable form is accessible 24/7, allowing you to work on it at your convenience. You can access the form online or download it to your computer or mobile device, giving you the flexibility to complete it whenever and wherever you want.

Common Challenges and Solutions

Completing the DTC printable form can be challenging, especially for those unfamiliar with tax jargon or with disabilities that affect their cognitive abilities. Here are some common challenges and practical solutions to help you overcome them:

Understanding the Form’s Terminology

The DTC printable form uses specific tax-related terminology that may be unfamiliar to some individuals. To address this, consider the following:

– Familiarize yourself with key terms by reading the form’s instructions or consulting online resources.

– Seek assistance from a tax professional or disability advocate who can explain the terms and provide guidance.

– Utilize online tools or dictionaries that define tax-related jargon in a simplified manner.

Gathering Supporting Documentation

The DTC printable form requires supporting documentation to verify the applicant’s disability and related expenses. This can be a time-consuming process, particularly for those with complex medical conditions. To streamline this process, consider the following:

– Start gathering documentation early on to avoid last-minute stress.

– Keep organized records of all relevant medical reports, receipts, and other supporting documents.

– Contact healthcare providers and service providers to request copies of necessary documentation.

– Consider using a digital document management system to store and organize your documents securely.

Completing the Form Accurately

Completing the DTC printable form accurately is crucial to ensure a successful application. To minimize errors, consider the following:

– Read the form’s instructions carefully and follow them precisely.

– Use clear and concise language when providing information.

– Seek assistance from a tax professional or disability advocate to review your completed form before submitting it.

– Utilize online tools or software that can help you complete the form accurately and efficiently.

Meeting Deadlines

The DTC printable form has specific submission deadlines that must be met to be considered for the tax year. To avoid missing these deadlines, consider the following:

– Mark the submission deadlines on your calendar and set reminders to start working on the form well in advance.

– Break down the form into smaller sections and work on them gradually to avoid feeling overwhelmed.

– Seek assistance from a tax professional or disability advocate who can help you meet the deadlines.

Additional Information and Resources

Get the lowdown on the Disability Tax Credit (DTC) with these top-notch resources. From official websites to helpful orgs, we’ve got you covered.

Plus, check out real-life stories from peeps who’ve nailed the DTC claim. It’s like a cheat code for getting the support you deserve.

Websites and Resources

- HM Revenue & Customs (HMRC): https://www.gov.uk/disability-tax-credit

- Citizens Advice: https://www.citizensadvice.org.uk/benefits/disability-benefits/disability-tax-credit/

- Scope: https://www.scope.org.uk/advice-and-support/money-matters/disability-tax-credit/

Contact Details

- HMRC Disability Tax Credit helpline: 0345 302 1444

- Citizens Advice helpline: 03444 111 444

- Scope helpline: 0808 800 3333

Success Stories

“The DTC has made a massive difference to my life. I’m able to cover the extra costs of my disability and live more independently.” – Sarah, DTC claimant

“I was so relieved when I finally got approved for the DTC. It’s a huge weight off my mind, knowing that I have the financial support I need.” – James, DTC claimant

Answers to Common Questions

What are the eligibility criteria for claiming the DTC?

To be eligible for the DTC, you must meet specific criteria related to your physical or mental impairment. These criteria are Artikeld in the guide and can be further explored on the official government website.

Can I submit the DTC printable form online?

Currently, the DTC printable form must be submitted by mail or fax. However, you can download the form online and fill it out electronically before printing and mailing it.

What supporting documentation is required when submitting the DTC printable form?

Depending on your specific situation, you may need to provide medical certificates, letters from healthcare professionals, or other documents that support your claim. The guide will provide detailed information on the required documentation.