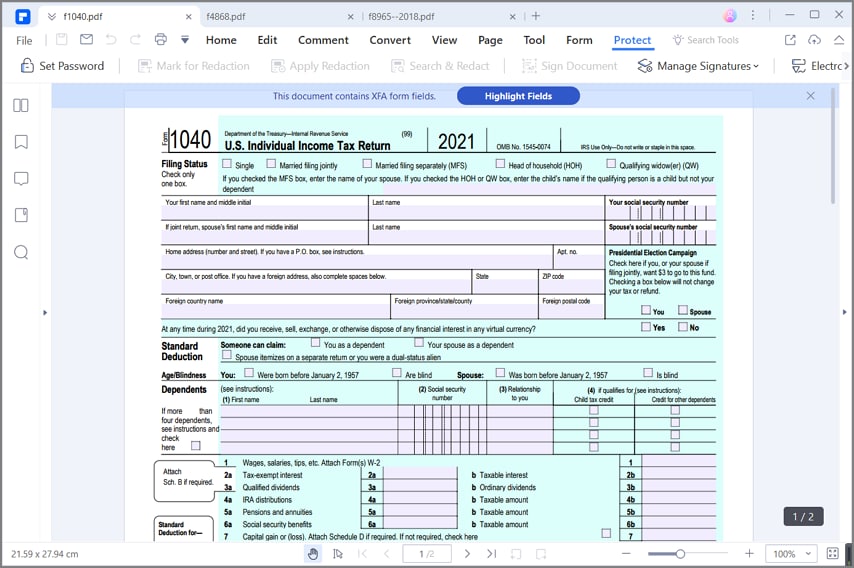

Can I Print My Own Tax Forms?

The Internal Revenue Service (IRS) offers a variety of tax forms that you can download and print for free. This can be a convenient option if you don’t want to pay a tax preparer or if you want to file your taxes yourself. However, there are some things you should keep in mind before you print your own tax forms.

First, you need to make sure that you have the right software to print the forms. The IRS provides a free software program called Free File Fillable Forms that you can use to print most tax forms. You can also use commercial software programs like TurboTax or H&R Block to print tax forms.

Introduction

Self-printing tax forms have become increasingly popular in recent years, as people look for ways to save money and time during tax season. There are several potential benefits to printing your own tax forms, including:

- Convenience: You can print your tax forms at home or at a local library or office supply store, which can save you a trip to the post office.

- Cost savings: Printing your own tax forms can save you money on postage and other fees.

- Accuracy: You can be sure that your tax forms are filled out correctly when you print them yourself.

Determining Eligibility

Blud, if you’re gassed about printing your own tax forms, you need to check if you’re even in the game. Here’s the lowdown on who’s got the green light to print their own tax forms:

You’re all good to go if you’re a UK resident and you’re self-employed, a sole trader, or a partner in a partnership. But if you’re an employee, you’re not in the club. Sorry, mate.

Types of Tax Forms

When it comes to printing your own tax forms, there are a few different types you might need to get your hands on:

- Self Assessment tax return (SA100)

- Partnership tax return (SA800)

- Corporation tax return (CT600)

Software and Resources

To print your own tax forms, you’ll need some software to help you out. Here are a few options:

- HMRC’s online tax return service

- Commercial software, like QuickBooks or Sage

- Free software, like TaxCalc

Step-by-Step Guide to Printing Tax Forms

Innit, printing tax forms can be a bit of a chore, but it doesn’t have to be a nightmare. Here’s a guide to help you sort it out, blud.

First off, you need to get your bits and bobs together. That means gathering all the info you need, like your National Insurance number and your P60.

Choosing the Right Software

Next up, you need to pick the right software. There’s a bunch of free and paid options out there, but we recommend using HMRC’s own software, which you can find on their website. It’s free, easy to use, and it’ll make sure you’re filling out the right forms.

Printing the Forms

Once you’ve got your software sorted, it’s time to print the forms. Make sure you’ve got a decent printer and plenty of ink. You don’t want to run out halfway through and have to start all over again.

Troubleshooting Tips

If you’re having any trouble printing your forms, here are a few things you can try:

- Check that your printer is connected to your computer and turned on.

- Make sure you’ve selected the right printer in the software.

- Try restarting your computer and printer.

- If you’re still having problems, you can contact HMRC for help.

Advantages and Disadvantages of Printing Tax Forms

Printing tax forms has both advantages and disadvantages. Understanding these factors can help you decide whether it’s the best option for you.

One of the main advantages of printing tax forms is that it can save you time and money. If you don’t have access to a computer or printer, you can still file your taxes by printing out the forms and filling them out by hand. This can be a much faster and cheaper option than hiring a tax preparer.

However, there are also some potential risks associated with printing tax forms. If you make a mistake on your forms, it could delay your refund or even result in penalties. Additionally, if you lose your printed forms, you could be at risk of identity theft.

Advantages of Printing Tax Forms

- Save time and money

- Don’t need a computer or printer

- Can file taxes by hand

Disadvantages of Printing Tax Forms

- Risk of making mistakes

- Could delay refund or result in penalties

- Risk of identity theft if forms are lost

Conclusion

Ultimately, the decision of whether or not to print tax forms is a personal one. Weigh the advantages and disadvantages carefully before making a decision.

Security Considerations

Printing tax forms involves handling sensitive personal information, so it’s crucial to prioritize security. By following best practices, you can protect yourself from fraud and identity theft.

Secure Printing

- Use a secure printer that is not accessible to unauthorized individuals.

- Print tax forms on high-quality paper that is difficult to copy or alter.

- Consider using a shredder to destroy any discarded tax forms or drafts.

Secure Storage

- Store tax forms in a secure location, such as a locked cabinet or safe.

- Avoid storing tax forms digitally unless you have a secure password-protected system.

- Dispose of tax forms properly by shredding or burning them.

Avoiding Fraud

- Be wary of phishing scams that attempt to trick you into providing personal information.

- Never share your tax forms with anyone unless necessary.

- Report any suspicious activity or fraud attempts to the appropriate authorities.

Alternative Options to Printing Tax Forms

Innit, there are bare other ways to sort out your tax forms besides printing ’em off. Let’s chat about ’em, blud.

E-filing

E-filing is peng ’cause it’s quick, safe, and the taxman gets your forms lickety-split. No more waiting for the post to come through, fam. Plus, you can do it all from the comfort of your own gaff. But, it can be a bit more tricky if you’ve got a complicated tax situation.

Using a Tax Preparation Service

If you’re not feeling confident doing your taxes yourself, you can always get a tax preparation service to sort it out for you. They’ll make sure your forms are filled out correctly and that you’re getting all the tax breaks you’re entitled to. But, it can be a bit pricey, so bear that in mind.

Conclusion

Innit, bruv, we’ve been chattin’ ’bout printing your own tax forms, and it’s been right mint. We’ve covered the nitty-gritty, from who can do it to how to do it step-by-step. Now, let’s wrap things up with a quick recap.

Printing your own tax forms can be a right result if you’re eligible and you’re down with the advantages. You can save some dosh and dodge the hassle of mailing them in. But remember, there are some security risks to watch out for, so make sure you’re keeping your info safe.

If you’re keen to learn more about this malarkey, check out these bits:

- HM Revenue & Customs (HMRC): https://www.gov.uk/printing-tax-returns

- GOV.UK: https://www.gov.uk/self-assessment-tax-returns

- MoneySavingExpert: https://www.moneysavingexpert.com/tax/how-to-get-a-tax-refund/

FAQs

Can I print my own tax forms?

Yes, you can print your own tax forms from the IRS website.

What software do I need to print tax forms?

You can use the free software program Free File Fillable Forms from the IRS website or commercial software programs like TurboTax or H&R Block.

How do I fill out tax forms?

The IRS website provides instructions on how to fill out tax forms.

Where do I mail my tax forms?

You can mail your tax forms to the IRS address listed on the forms.