Budget Printable Worksheet: Your Guide to Financial Control

In today’s fast-paced world, managing personal finances can be a daunting task. With numerous expenses and financial obligations, it’s easy to lose track of where your money goes. That’s where budget printable worksheets come into play. These powerful tools offer a simple and effective way to take control of your finances, track your spending, and achieve your financial goals.

Budget printable worksheets are customizable templates that help you create a structured plan for your income and expenses. They provide a clear overview of your financial situation, enabling you to make informed decisions about how you spend your money. Whether you’re a seasoned financial planner or just starting your journey towards financial freedom, budget printable worksheets can empower you to take charge of your finances and achieve your financial aspirations.

Understanding Budget Printable Worksheets

Budget printable worksheets are downloadable templates that provide a structured format for tracking your income, expenses, and savings. They’re designed to help you create a realistic budget, stick to it, and achieve your financial goals.

Using budget printable worksheets offers several benefits, including:

Tracking Your Finances

- Gaining a clear understanding of your income and expenses

- Identifying areas where you can save money

- Making informed decisions about your spending

Creating a Realistic Budget

- Allocating your income to different categories

- Setting financial goals and tracking your progress

- Avoiding overspending and debt

Sticking to Your Budget

- Monitoring your expenses and comparing them to your budget

- Making adjustments as needed

- Staying on track towards your financial goals

Types of Budget Printable Worksheets

Budget printable worksheets come in various formats, each tailored to different needs and preferences. Understanding the types available can help you choose the most suitable one for your budgeting journey.

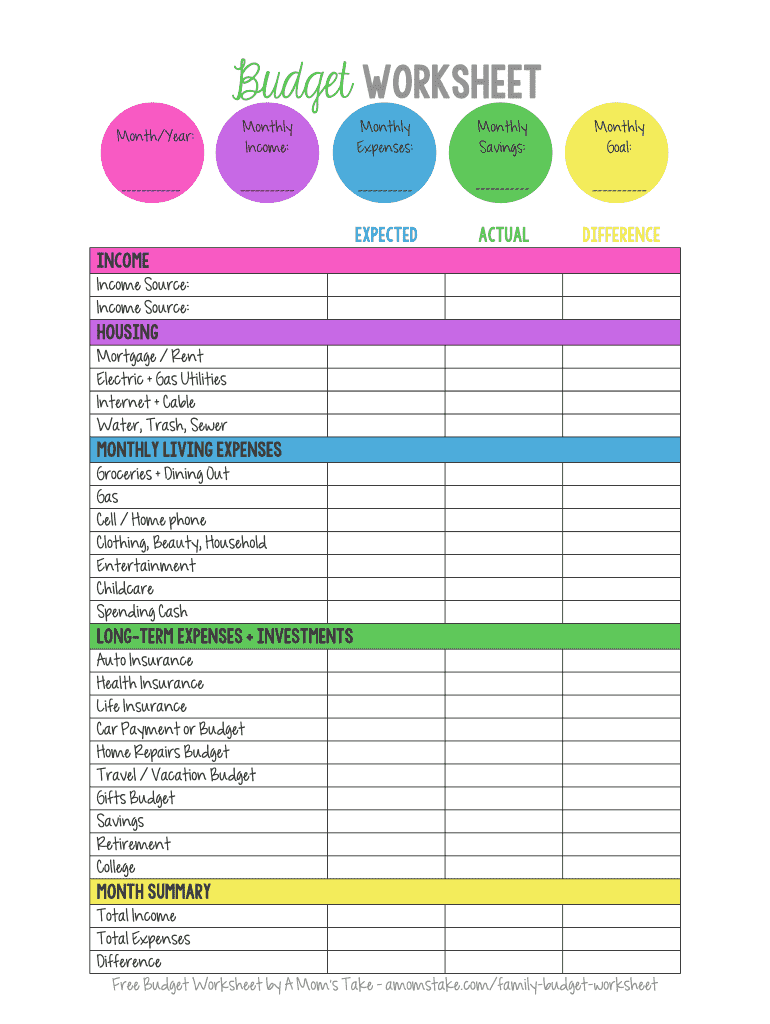

Monthly Budget Worksheets

Monthly budget worksheets are designed to track your income and expenses over a month. They typically include sections for:

- Income sources (e.g., salary, investments, etc.)

- Fixed expenses (e.g., rent, mortgage, car payment, etc.)

- Variable expenses (e.g., groceries, entertainment, dining out, etc.)

- Savings goals

Monthly budget worksheets help you stay on top of your cash flow and identify areas where you can save or adjust your spending.

Weekly Budget Worksheets

Weekly budget worksheets provide a more granular view of your spending habits. They break down your expenses into weekly intervals, allowing you to track your progress and make adjustments as needed. Weekly budget worksheets can be helpful for:

- Monitoring daily spending habits

- Staying within specific spending limits

- Identifying impulsive purchases or unnecessary expenses

Yearly Budget Worksheets

Yearly budget worksheets provide a comprehensive overview of your financial situation over a year. They include sections for:

- Annual income

- Major expenses (e.g., vacations, home repairs, etc.)

- Savings and investment goals

- Debt repayment plan

Yearly budget worksheets help you plan for the long term and make informed financial decisions.

Specific Categories Budget Worksheets

Specific categories budget worksheets focus on tracking expenses in particular areas, such as:

- Groceries

- Entertainment

- Travel

- Personal care

These worksheets help you identify areas where you overspend or underspend, allowing you to make adjustments and optimize your budget accordingly.

Creating a Budget Printable Worksheet

Creating a budget printable worksheet is a crucial step towards managing your finances effectively. It provides a clear and organized overview of your income and expenses, helping you make informed financial decisions. Here’s a comprehensive guide to create your own personalized budget printable worksheet:

### Setting Up Categories

– Categorize your expenses into fixed (e.g., rent, loan payments) and variable (e.g., groceries, entertainment).

– Create a separate category for savings and emergency funds.

### Tracking Expenses

– Record all your expenses meticulously, whether it’s a coffee purchase or a car payment.

– Use a dedicated expense tracker app or simply jot down expenses in a notebook.

### Monitoring Progress

– Regularly review your budget to track your spending patterns and identify areas where you can save.

– Compare your actual expenses to your budgeted amounts and make adjustments as needed.

– Use the worksheet to set financial goals and monitor your progress towards achieving them.

Using Budget Printable Worksheets Effectively

Utilizing budget printable worksheets effectively can empower you to take control of your finances and achieve your financial goals. Here’s how you can maximize their usage:

Tracking Expenses

- Record every transaction: Note down every penny you spend, no matter how small. This includes cash, card payments, and online purchases.

- Categorize expenses: Group similar expenses together, such as groceries, entertainment, and transportation.

- Use a dedicated tracker: Whether it’s a spreadsheet, app, or printable worksheet, choose a system that makes tracking expenses convenient and consistent.

Analyzing Spending Patterns

- Identify areas of overspending: Review your expense categories to pinpoint where you’re spending more than you intended.

- Spot trends and patterns: Analyze your expenses over time to identify recurring spending habits and potential areas for savings.

- Set realistic goals: Based on your analysis, establish achievable financial goals that you can work towards.

Making Adjustments

- Adjust your budget: Revise your budget based on your spending analysis. Reduce expenses in overspending categories and allocate funds to more important areas.

- Find ways to save: Explore cost-saving measures such as negotiating bills, using coupons, and cutting back on non-essential expenses.

- Monitor your progress: Regularly review your budget and track your expenses to ensure you’re staying on track and making necessary adjustments.

Benefits of Using Budget Printable Worksheets

Budget printable worksheets are incredibly handy tools that can help you manage your finances effectively. They offer a range of advantages, making them an essential resource for anyone looking to improve their financial well-being.

One of the key benefits of using budget printable worksheets is that they provide a clear and organized overview of your financial situation. By tracking your income, expenses, and savings, you can easily see where your money is going and identify areas where you can cut back or save more.

Financial Planning

Budget printable worksheets are an invaluable tool for financial planning. They help you create a roadmap for your financial future by setting realistic goals and developing a plan to achieve them. By tracking your progress over time, you can stay on top of your financial goals and make adjustments as needed.

Saving Money

Budget printable worksheets can also help you save money by identifying areas where you can reduce your expenses. By tracking your spending, you can see where your money is going and make informed decisions about where to cut back. This can help you free up more money to save for your future goals.

Achieving Financial Goals

Ultimately, budget printable worksheets can help you achieve your financial goals. By providing a clear roadmap and helping you track your progress, they can keep you motivated and on track. Whether you’re saving for a down payment on a house, a new car, or a dream vacation, budget printable worksheets can help you make your dreams a reality.

Design Considerations for Budget Printable Worksheets

When designing budget printable worksheets, visual appeal and functionality should be top priorities. By incorporating visually appealing elements and organizing the worksheet effectively, you can create a user-friendly and engaging experience that encourages regular use and accurate budgeting.

Consider the following tips to enhance the design of your budget printable worksheets:

Colors

- Use a color scheme that is both visually appealing and easy to read. Avoid using too many colors or bright colors that can be distracting.

- Consider using color-coding to differentiate different categories of expenses or income. This can help you quickly identify where your money is going and where you can make adjustments.

Fonts

- Choose a font that is easy to read and visually appealing. Avoid using fonts that are too small or too stylized.

- Use bold or italics to highlight important information, such as category headings or totals.

Layout

- Organize the worksheet in a logical way that makes it easy to find the information you need.

- Use headings and subheadings to break up the content and make it more readable.

- Include space for notes or additional information, such as reminders or financial goals.

Examples of Budget Printable Worksheets

Budget printable worksheets come in various formats, catering to different needs and preferences. Here are some popular templates to get you started:

Personal Budget Worksheets

- Monthly Budget Planner: Track income, expenses, and savings for a specific month.

- Yearly Budget Overview: Get a comprehensive view of your financial plan for the entire year.

- Expense Tracker: Log every purchase to identify spending patterns and areas for improvement.

Business Budget Worksheets

- Project Budget Template: Allocate funds for specific projects, including materials, labour, and overhead costs.

- Cash Flow Statement: Monitor the flow of money in and out of your business.

- Profit and Loss Statement: Determine your business’s profitability by tracking revenue and expenses.

Specific Purpose Budget Worksheets

- Wedding Budget Planner: Plan your dream wedding within your financial means.

- Travel Budget Calculator: Estimate expenses for your next adventure, including flights, accommodation, and activities.

- Debt Repayment Tracker: Create a plan to pay off debt faster and save money on interest.

FAQs

What are the benefits of using budget printable worksheets?

Budget printable worksheets offer numerous benefits, including helping you track your expenses, identify areas where you can save money, create a realistic budget, and stay on top of your financial goals.

How do I create a budget printable worksheet?

Creating a budget printable worksheet is easy. Start by listing your income and expenses, then categorize them into different groups (e.g., housing, food, transportation). Finally, track your spending and make adjustments as needed.

What types of budget printable worksheets are available?

There are various types of budget printable worksheets available, including monthly, weekly, and yearly worksheets. Each type has its own unique features and benefits, so choose the one that best suits your needs.

How often should I update my budget printable worksheet?

It’s recommended to update your budget printable worksheet regularly, at least once a month. This will help you stay on top of your finances and make necessary adjustments to your budget.